Blank Wh 58 Form

Key takeaways

When dealing with the WH-58 form, it's essential to understand its purpose and implications. Here are some key takeaways to keep in mind:

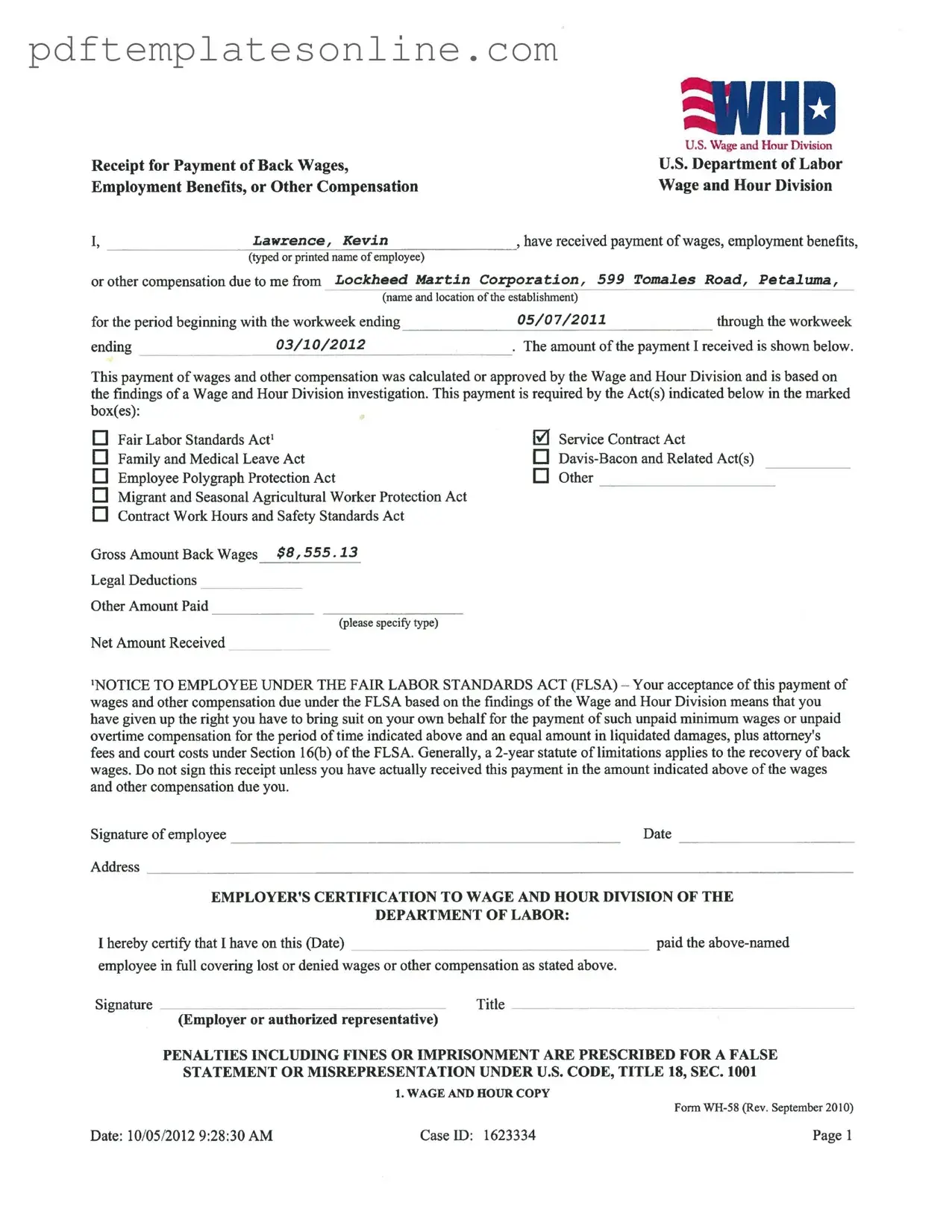

- Purpose of the Form: The WH-58 form is used to acknowledge receipt of back wages or other compensation determined by the Wage and Hour Division.

- Employer Information: The form must include the employer's name and location, ensuring that the employee knows who is responsible for the payment.

- Payment Period: Clearly state the workweek periods for which the back wages are being paid. This helps establish the timeframe of the compensation.

- Amount Received: The form requires the employee to indicate the gross amount of back wages received, along with any legal deductions.

- Legal Implications: Signing the WH-58 means the employee waives the right to sue for unpaid minimum wages or overtime for the specified period.

- Statute of Limitations: Generally, there is a two-year limit to recover back wages, so it’s crucial to act within this timeframe.

- Signature Requirement: Employees must sign the form only after confirming they have received the stated payment amount.

- Employer Certification: Employers must certify that they have paid the employee as indicated on the form, ensuring accountability.

Understanding these points can help ensure that both employees and employers handle the WH-58 form correctly and effectively.

Common mistakes

Completing the WH-58 form accurately is crucial for employees seeking to claim back wages or other compensation. However, several common mistakes can hinder this process. Understanding these pitfalls can help ensure that the form is filled out correctly and that employees receive the benefits they are entitled to.

One frequent error occurs when individuals fail to provide their full legal name. The form requires the typed or printed name of the employee, and any discrepancies can lead to delays or rejections. It is essential to match the name exactly as it appears on official documents to avoid complications.

Another mistake is neglecting to specify the name and location of the establishment. This section must be completed with precision. Omitting this information can create confusion about the source of the wages, which may result in the claim being dismissed.

Additionally, many individuals overlook the importance of accurately stating the workweek period. The form requests specific dates, and failing to include the correct range can lead to misunderstandings regarding the compensation owed. Employees should double-check these dates against their employment records.

Inaccuracies in the reported payment amounts are also common. Employees must ensure that the gross amount, legal deductions, and net amount received are correctly calculated and clearly stated. Mistakes in these figures can lead to disputes about the actual compensation received.

Moreover, some individuals sign the receipt without having received the payment indicated on the form. This is a critical mistake, as it can waive the right to pursue further claims for unpaid wages. Employees should only sign the document if they have indeed received the specified amount.

Another issue arises when employees fail to read the notice to employees section carefully. This section outlines the implications of accepting the payment, including the waiver of the right to sue for unpaid wages. Understanding these consequences is vital before signing the form.

Lastly, employers also make mistakes when certifying the form. It is essential that they provide accurate information regarding the payment made to the employee. Any false statements can lead to severe penalties, including fines or imprisonment. Employers should ensure that all details are correct before signing and submitting the form.

Misconceptions

- Misconception 1: The WH-58 form is only for employees who have been denied wages.

- Misconception 2: Signing the WH-58 means you cannot pursue further legal action.

- Misconception 3: The amount listed on the WH-58 is the final amount owed.

- Misconception 4: The WH-58 form is only relevant to the Fair Labor Standards Act (FLSA).

- Misconception 5: You must sign the WH-58 immediately upon receiving it.

This form is not limited to cases of wage denial. It also serves as a receipt for payments made to employees as a result of investigations by the Wage and Hour Division. Employees may receive back wages or compensation for various reasons, and the WH-58 helps document these transactions.

While signing the form does indicate acceptance of the payment, it does not necessarily preclude all future legal actions. However, it does mean that you are waiving your right to sue for the specific wages and damages covered by that payment. Understanding this limitation is crucial before signing.

The amount shown on the WH-58 reflects what has been paid, not necessarily what may still be owed. If there are ongoing disputes or additional claims, the employee may still have avenues to pursue further compensation.

Although the FLSA is a significant aspect of the WH-58, the form also relates to other laws, such as the Family and Medical Leave Act and the Davis-Bacon Act. Each of these laws may impact the compensation and rights of employees in different ways.

It is essential to review the form carefully before signing. Employees should ensure that they have indeed received the payment indicated and understand the implications of signing. Rushing to sign could lead to misunderstandings about their rights and the compensation received.

Dos and Don'ts

When filling out the WH-58 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do ensure that all information is accurate and complete.

- Do use clear and legible handwriting or type the information.

- Do double-check the dates to confirm they align with the work period.

- Do keep a copy of the completed form for your records.

- Don't sign the form unless you have received the payment indicated.

- Don't leave any sections blank; fill in all required fields.

- Don't provide false information, as it may lead to penalties.

- Don't ignore the instructions regarding legal deductions and net amounts.

Other PDF Forms

Check Netspend Balance Free - It’s vital to report lost or stolen cards to limit liability for charges.

Florida Immunization Records - The form is divided into parts that simplify the documentation of completed immunizations.

For couples seeking to formalize their decision to separate while remaining legally married, the California Marital Separation Agreement form is essential. This legal document meticulously outlines the division of assets, debts, and various financial responsibilities, in addition to any arrangements regarding child custody and support. Those navigating this challenging process may find valuable resources, such as California PDF Forms, to assist in drafting a clear and fair agreement.

Private Party Test Drive Agreement - Your signature confirms acceptance of the terms listed.

Detailed Guide for Writing Wh 58

After you have received your payment for back wages or other compensation, you will need to fill out the WH-58 form. This form serves as a receipt for the payment you received, ensuring that both you and your employer have a record of the transaction. Follow these steps to complete the form accurately.

- Start by entering your full name in the designated area. Make sure it is typed or printed clearly.

- Next, provide the name and address of your employer. In this case, it would be "Lockheed Martin Corporation, 599 Tomales Road, Petaluma."

- Indicate the period for which you are receiving payment. Fill in the start and end dates of the workweeks, such as "beginning with the workweek ending 05/07/2011 through the workweek ending 03/10/2012."

- Write down the gross amount of back wages you received. For example, "$0,555.13."

- If there were any legal deductions or other amounts paid, specify those in the appropriate sections.

- Carefully read the notice regarding your rights under the Fair Labor Standards Act (FLSA). Understand the implications of accepting this payment.

- Sign and date the form to confirm that you have received the payment as indicated.

- Have your employer or an authorized representative fill out their certification section, including the date and their signature.

Once you have completed the form, keep a copy for your records. Your employer will also submit a copy to the Wage and Hour Division. This documentation is important for both parties to ensure clarity regarding the payment received.