Fillable Vehicle Repayment Agreement Document

Key takeaways

When filling out and using the Vehicle Repayment Agreement form, keep these key takeaways in mind:

- Ensure all parties involved are clearly identified, including names and contact information.

- Clearly outline the terms of the repayment, including the total amount owed and the payment schedule.

- Be specific about the vehicle details, such as make, model, year, and VIN.

- Include any applicable interest rates and fees associated with the repayment.

- Signatures from all parties are essential to make the agreement legally binding.

- Keep a copy of the completed form for your records and provide copies to all parties involved.

- Review the agreement periodically to ensure all terms are being met and to address any changes that may arise.

Common mistakes

When filling out the Vehicle Repayment Agreement form, many people inadvertently make mistakes that can lead to complications down the road. One common error is failing to provide accurate personal information. This includes not only your name and address but also your contact details. If any of this information is incorrect, it can cause delays in processing your agreement and may even lead to misunderstandings with the lender.

Another frequent mistake is neglecting to read the terms and conditions carefully. Many individuals skim through this section, assuming they understand everything. However, overlooking important details—such as interest rates, payment schedules, or penalties for late payments—can have serious financial implications. It’s crucial to grasp these terms fully to avoid surprises later on.

Additionally, some people forget to include all necessary documentation. The Vehicle Repayment Agreement often requires supporting documents like proof of income or identification. Failing to attach these documents can result in the rejection of your application or significant delays. Always double-check the requirements and ensure you have everything ready before submission.

Finally, a common oversight is not signing the agreement. It may seem trivial, but an unsigned document is not legally binding. This simple mistake can invalidate the entire agreement, leaving you without any legal recourse. Take a moment to review the form and ensure all required signatures are in place before you submit it.

Misconceptions

Understanding the Vehicle Repayment Agreement form is crucial for both lenders and borrowers. However, several misconceptions can lead to confusion. Here are nine common misconceptions about this form:

- The form is only for car loans. Many believe the Vehicle Repayment Agreement is exclusively for car loans, but it can apply to any vehicle financing arrangement, including motorcycles and trucks.

- It is not legally binding. Some individuals think that the agreement is merely a suggestion. In reality, once signed, it becomes a legally binding contract between the parties involved.

- Only lenders need to sign the form. A common misconception is that only the lender's signature is necessary. Both parties must sign to validate the agreement.

- All terms are negotiable. While many terms can be negotiated, certain legal requirements must be met, and some terms may be non-negotiable based on state laws.

- The form is the same in every state. Some assume that the Vehicle Repayment Agreement is uniform across the United States. However, variations exist based on state laws and regulations.

- It does not need to be notarized. Many people think notarization is unnecessary. Depending on the state, notarization may be required for the agreement to be enforceable.

- It only covers repayment terms. While repayment terms are a significant part of the agreement, it can also include clauses regarding default, late fees, and other important conditions.

- Once signed, the terms cannot be changed. Some believe that after signing, the terms are set in stone. In fact, parties can modify the agreement if both agree to the changes in writing.

- The form is not necessary if there is a verbal agreement. Many think a verbal agreement suffices. However, having a written Vehicle Repayment Agreement is essential for clarity and legal protection.

Addressing these misconceptions can help individuals navigate the complexities of vehicle financing more effectively.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it is crucial to follow certain guidelines to ensure accuracy and compliance. Here are five essential dos and don'ts:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do double-check all numbers and signatures before submission.

- Don't leave any required fields blank.

- Don't use abbreviations or unclear terms that could lead to confusion.

Check out Popular Documents

Da - Supports logistical decision-making and planning efforts.

Lady Bird Deed Form - This deed simplifies the process of transferring property upon death, avoiding probate and potential delays.

The Investment Letter of Intent form is a preliminary document that outlines the initial terms and conditions under which an investor expresses interest in a potential investment opportunity. This form serves as a foundation for negotiations between the parties involved, facilitating clarity and setting expectations. To proceed effectively, consider filling out the form by clicking the button below or accessing it directly at https://pdftemplates.info/investment-letter-of-intent-form/.

Prenup Agreement - This legal document helps protect assets owned prior to marriage.

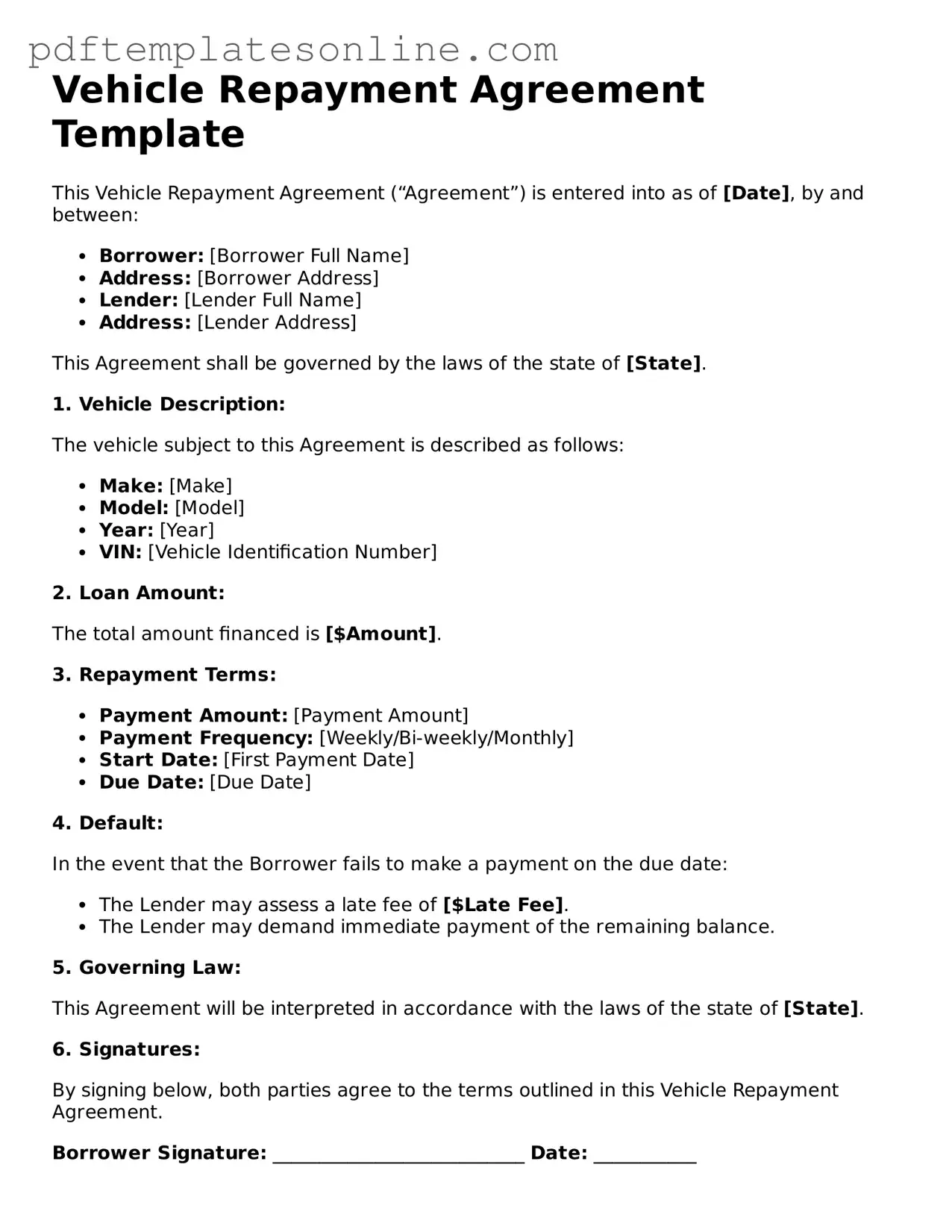

Detailed Guide for Writing Vehicle Repayment Agreement

After you have gathered all necessary information, you are ready to fill out the Vehicle Repayment Agreement form. This document is important for outlining the terms of repayment for a vehicle loan. It ensures that both parties are clear on their responsibilities moving forward.

- Begin by entering your personal information at the top of the form. Include your full name, address, and contact details.

- Next, provide the details of the vehicle. This includes the make, model, year, and Vehicle Identification Number (VIN).

- In the designated section, state the total amount borrowed for the vehicle. Be precise to avoid any misunderstandings.

- Specify the repayment terms. Indicate the amount of each payment, the frequency (monthly, bi-weekly, etc.), and the due date for the first payment.

- Include any interest rate information if applicable. Clearly state how interest will be calculated over the term of the loan.

- Read through the agreement carefully. Ensure that all information is accurate and reflects your understanding of the terms.

- Sign and date the form at the bottom. If there is a co-signer, they should also sign in the designated area.

- Finally, make a copy of the completed form for your records before submitting it to the lender.