Fillable Transfer-on-Death Deed Document

Key takeaways

When dealing with a Transfer-on-Death Deed form, it is essential to understand its implications and requirements. Here are key takeaways to guide you through the process:

- Purpose of the Deed: A Transfer-on-Death Deed allows you to designate a beneficiary who will receive your property automatically upon your death, avoiding probate.

- Eligibility: Not all states recognize Transfer-on-Death Deeds. Check your state's laws to confirm if this option is available.

- Filling Out the Form: Complete the form accurately. Include your name, the property description, and the beneficiary’s information.

- Signature Requirement: The deed must be signed by you, the property owner, to be valid. Some states may also require notarization.

- Recording the Deed: Submit the completed deed to the appropriate local government office, usually the county recorder, to ensure it is legally recognized.

- Revocation: You can revoke the deed at any time before your death. Follow your state’s procedure for revocation to ensure it is properly documented.

- Tax Implications: Be aware that transferring property through this deed may have tax consequences for your beneficiary. Consulting a tax professional is advisable.

- Communication: Discuss your intentions with your beneficiary. Clear communication can prevent misunderstandings and ensure your wishes are honored.

Taking these steps seriously can simplify the transfer of your property and provide peace of mind for you and your loved ones. Act promptly to ensure your wishes are documented correctly.

Transfer-on-Death Deed Forms for Particular States

Common mistakes

Filling out a Transfer-on-Death Deed form can be a straightforward process, but mistakes can lead to complications down the line. One common error is failing to include a legal description of the property. Instead of simply listing the address, it’s crucial to provide a detailed description, such as the lot number and block number. This ensures that there is no ambiguity about which property is being transferred.

Another frequent mistake involves not signing the deed correctly. All required parties must sign the document in the appropriate places. If the deed is not signed properly, it may not be recognized as valid. Moreover, some individuals forget to have the deed notarized. Notarization is often a requirement for the deed to be legally enforceable. Without it, the transfer may face challenges in probate court.

People also sometimes overlook the need to update the deed after major life events. For example, if the property owner gets married, divorced, or passes away, the deed may need to be revised to reflect these changes. Failure to do so can lead to disputes among heirs or unintended beneficiaries.

Finally, misunderstanding the implications of the Transfer-on-Death Deed can cause issues. Some individuals assume that this deed avoids all probate processes, but that is not always the case. While it does allow for the direct transfer of property, any debts associated with the property must still be addressed. Being clear on these details can prevent future legal complications.

Misconceptions

Understanding the Transfer-on-Death Deed can be challenging due to several misconceptions. Below is a list of common misunderstandings, along with clarifications to help clear the confusion.

- It is the same as a will. A Transfer-on-Death Deed operates independently of a will. It allows for the direct transfer of property upon death, bypassing probate.

- It can be used for any type of property. This deed is typically limited to real estate. Other types of assets, like bank accounts or personal property, require different estate planning tools.

- It requires the consent of all heirs. Only the property owner needs to sign the deed. Heirs do not need to approve it beforehand.

- It is irrevocable once signed. The property owner can revoke or change the deed at any time before death, as long as they follow the proper legal procedures.

- It eliminates all estate taxes. While a Transfer-on-Death Deed can simplify the transfer process, it does not eliminate potential estate taxes that may apply.

- It automatically applies to all properties owned. Each property must have its own separate Transfer-on-Death Deed. A single deed does not cover multiple properties.

- It is only for wealthy individuals. This deed can benefit anyone who owns real estate and wants to simplify the transfer process for their heirs.

- It is only valid in certain states. While laws vary by state, many states do recognize Transfer-on-Death Deeds. It’s essential to check local laws for specific requirements.

- It can be used to transfer property to multiple beneficiaries. A Transfer-on-Death Deed typically designates one beneficiary. However, multiple beneficiaries can be named, but this must be done carefully to ensure clarity.

- It requires a lawyer to complete. While it is advisable to consult a lawyer for legal advice, individuals can fill out and file a Transfer-on-Death Deed on their own if they understand the process.

By addressing these misconceptions, individuals can make more informed decisions regarding their estate planning and the use of Transfer-on-Death Deeds.

Dos and Don'ts

When filling out the Transfer-on-Death Deed form, it's important to follow specific guidelines to ensure accuracy and legality. Below is a list of things you should and shouldn't do.

- Do ensure you have the correct property description.

- Do include the full names of all beneficiaries.

- Do sign the deed in the presence of a notary.

- Do keep a copy of the completed deed for your records.

- Don't leave out any required information.

- Don't forget to check state-specific requirements.

- Don't assume the deed is valid without proper notarization.

Follow these guidelines closely to avoid complications in the future. Properly completing the form will help ensure a smooth transfer of property upon death.

Browse Common Types of Transfer-on-Death Deed Templates

Iowa Quit Claim Deed - Parties involved should ensure they have a clear understanding of property boundaries.

For accurate documentation of firearm transactions, utilizing a legally recognized form is essential. The complete Firearm Bill of Sale process ensures both parties are protected and the transfer adheres to California regulations.

Detailed Guide for Writing Transfer-on-Death Deed

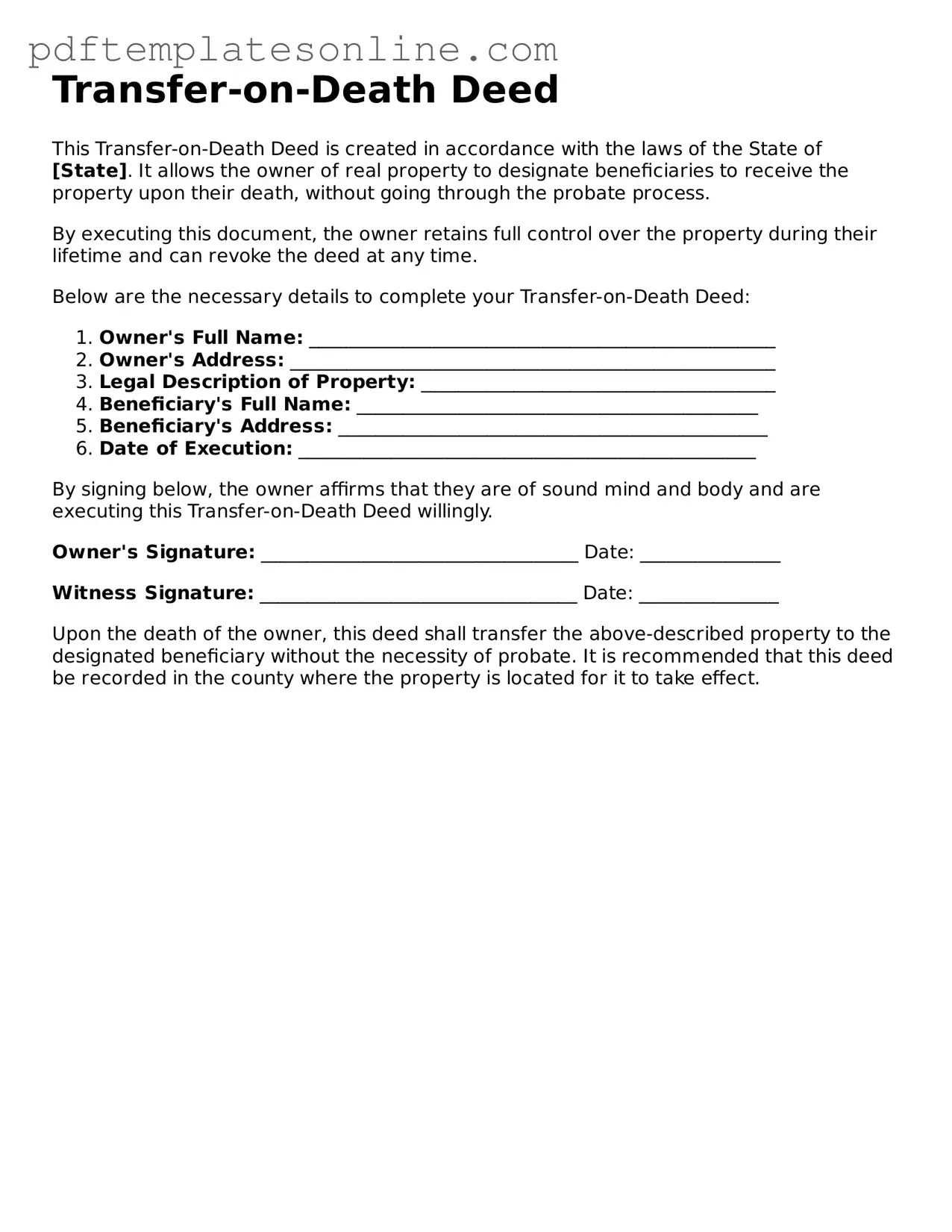

Once you have the Transfer-on-Death Deed form ready, you can begin filling it out. Ensure you have all necessary information at hand to complete the form accurately. Follow these steps carefully to ensure clarity and correctness.

- Start by entering your full name in the designated field at the top of the form.

- Provide your current address, including city, state, and ZIP code.

- Identify the property you wish to transfer. Include the full legal description of the property, which can usually be found on your property deed.

- List the names of the beneficiaries who will receive the property upon your death. Include their full names and addresses.

- Indicate the relationship of each beneficiary to you, such as spouse, child, friend, etc.

- Sign the form in the designated area. Make sure to date your signature.

- Have the form notarized. A notary public will verify your identity and witness your signature.

- Finally, file the completed deed with your local county recorder's office. Ensure you keep a copy for your records.