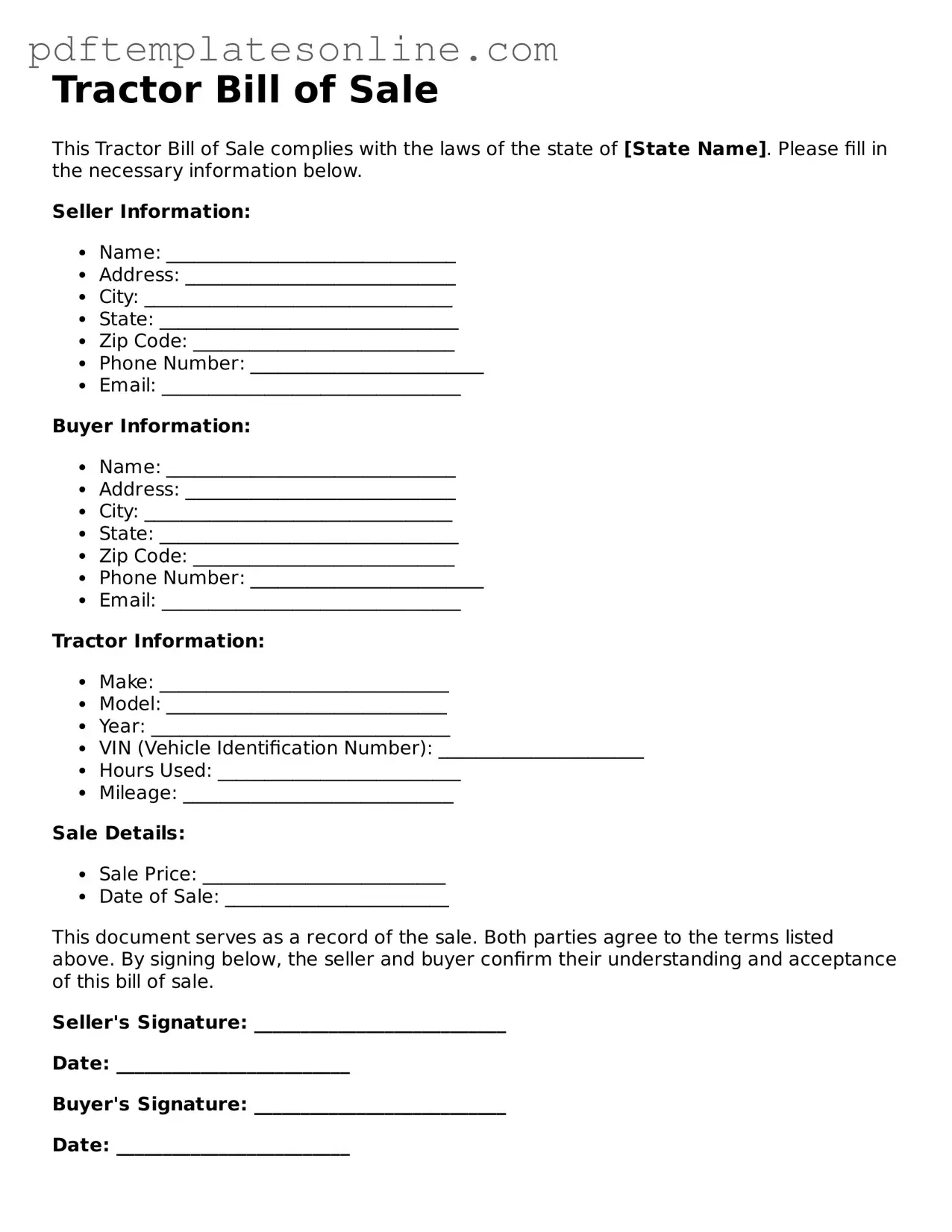

Fillable Tractor Bill of Sale Document

Key takeaways

When filling out and using the Tractor Bill of Sale form, there are several important points to consider. These takeaways can help ensure a smooth transaction.

- Accurate Information: Ensure all details about the tractor, including make, model, year, and VIN, are correct.

- Seller and Buyer Details: Include full names and addresses of both the seller and the buyer to establish clear ownership transfer.

- Purchase Price: Clearly state the agreed purchase price to avoid disputes later on.

- Condition of the Tractor: Describe the condition of the tractor, including any known issues, to inform the buyer.

- Signatures: Both parties must sign the document to validate the sale. This step is crucial for legal recognition.

- Date of Sale: Include the date of the transaction to document when the ownership transfer occurs.

- Payment Method: Specify how the payment will be made, whether by cash, check, or another method.

- Bill of Sale Copies: Provide copies of the signed bill of sale to both the buyer and the seller for their records.

- State Requirements: Check local laws to ensure compliance with any specific requirements for vehicle sales in your state.

By following these key takeaways, both buyers and sellers can facilitate a more effective and legally sound transaction.

Tractor Bill of Sale Forms for Particular States

Common mistakes

Completing a Tractor Bill of Sale form is a crucial step in the process of buying or selling a tractor. However, many individuals overlook important details that can lead to complications down the road. Here are eight common mistakes to avoid when filling out this form.

One of the most frequent errors is failing to provide complete information. Sellers often neglect to include essential details such as the tractor's make, model, and year. Omitting this information can create confusion and may lead to disputes regarding the tractor's identity.

Another mistake involves not accurately recording the Vehicle Identification Number (VIN). This unique identifier is critical for tracking ownership and registration. Double-checking the VIN against the tractor's documentation ensures that the correct number is recorded, preventing potential legal issues.

People also often forget to include the sale price. This information is vital for both parties, as it establishes the terms of the transaction. Without a clear sale price, misunderstandings can arise, leading to disputes later on.

In addition, some individuals fail to sign the document. Both the buyer and seller must sign the Tractor Bill of Sale to validate the transaction. Neglecting this step can render the document ineffective and may complicate future ownership claims.

Another common oversight is not including the date of the sale. This detail is important for establishing the timeline of ownership transfer. Without a date, it may be difficult to resolve any disputes that arise after the sale.

People sometimes make the mistake of not keeping copies of the completed form. Both parties should retain a copy for their records. This documentation serves as proof of the transaction and can be invaluable in case of future disputes.

Additionally, some individuals overlook the importance of notarization. While not always required, having the bill of sale notarized can add an extra layer of security to the transaction. This can be particularly important in cases of high-value sales.

Lastly, many people fail to check for state-specific requirements. Each state may have different regulations regarding the sale of agricultural equipment. It’s essential to research these requirements to ensure compliance and avoid potential legal issues.

Misconceptions

When it comes to the Tractor Bill of Sale form, several misconceptions can lead to confusion for buyers and sellers alike. Understanding these myths can help ensure a smoother transaction.

- It’s not necessary for private sales. Many believe that a bill of sale is only required for dealership transactions. In reality, having a bill of sale for private sales is crucial. It serves as proof of the transaction and can protect both parties.

- All states require the same information. Some people think that a Tractor Bill of Sale form is uniform across the country. However, each state has its own requirements regarding what must be included, such as signatures, vehicle identification numbers, and buyer and seller information.

- It’s only for tractors. While the name suggests otherwise, a Tractor Bill of Sale can be used for various types of agricultural equipment. If it’s a piece of machinery being sold, a bill of sale is often recommended.

- It doesn't need to be notarized. Many assume that notarization is unnecessary for a bill of sale. In some states, having the document notarized adds an extra layer of legitimacy and can be beneficial, especially if disputes arise later.

- It’s a one-size-fits-all document. Some individuals think they can use a generic bill of sale template without any modifications. Customizing the document to reflect the specific details of the transaction is important for clarity and legal standing.

- Only the seller needs a copy. There’s a common belief that only the seller should keep a copy of the bill of sale. In fact, both the buyer and seller should retain copies for their records, as this document can be essential for future reference.

- It’s not legally binding. Some people mistakenly believe that a bill of sale is just a formality and carries no legal weight. In truth, a properly completed bill of sale is a legal document that can be enforced in court if necessary.

By dispelling these misconceptions, individuals can navigate the process of buying or selling a tractor with greater confidence and clarity.

Dos and Don'ts

When filling out a Tractor Bill of Sale form, it's important to ensure accuracy and clarity. Here’s a list of things you should and shouldn’t do:

- Do provide accurate information about the tractor, including make, model, year, and VIN.

- Do include the sale price to establish the value of the transaction.

- Do have both the buyer and seller sign the document to validate the sale.

- Do date the bill of sale to reflect when the transaction occurred.

- Do keep a copy of the signed bill of sale for your records.

- Don't leave any fields blank; incomplete information can lead to disputes.

- Don't use vague language; be clear about the terms of the sale.

- Don't forget to check for any local requirements that may need to be included.

- Don't sign the document without reading it thoroughly to ensure all details are correct.

Browse Common Types of Tractor Bill of Sale Templates

Simple Bill of Sale for Trailer - This form can help buyers and sellers resolve disputes over the sale of the trailer.

Equine Bill of Sale - For horses with specific training or qualities, these details can be included in the form.

The Emotional Support Animal Letter is essential for those who require assistance from their ESA, as it provides the official documentation needed to validate their situation and can often be found at mypdfform.com/blank-emotional-support-animal-letter. This letter, issued by a qualified mental health professional, plays a crucial role in ensuring individuals can access the mental health benefits that these animals offer, allowing for enhanced well-being and stability.

Selling Limited Edition Prints - It acts as a legal record of ownership and can be important for tax purposes.

Detailed Guide for Writing Tractor Bill of Sale

Completing a Tractor Bill of Sale form is an essential step in the transfer of ownership for a tractor. This document serves as a record of the sale and provides legal protection for both the buyer and the seller. Once you have filled out the form, ensure that both parties keep a copy for their records.

- Obtain the form: Start by acquiring the Tractor Bill of Sale form from a reliable source, such as a legal website or local government office.

- Fill in the date: Write the date of the sale at the top of the form. This establishes when the transaction took place.

- Provide seller information: Enter the full name, address, and contact information of the seller. This identifies who is selling the tractor.

- Provide buyer information: Next, fill in the buyer’s full name, address, and contact information. This identifies who is purchasing the tractor.

- Describe the tractor: Include detailed information about the tractor. This should cover the make, model, year, and Vehicle Identification Number (VIN).

- State the purchase price: Clearly write the amount the buyer is paying for the tractor. This is crucial for the transaction record.

- Include payment method: Specify how the payment will be made (e.g., cash, check, bank transfer).

- Sign the document: Both the buyer and seller must sign the form. This signifies agreement to the terms of the sale.

- Date the signatures: After signing, both parties should date their signatures to confirm when the agreement was made.

- Make copies: Finally, make copies of the completed form for both the buyer and seller to retain for their records.