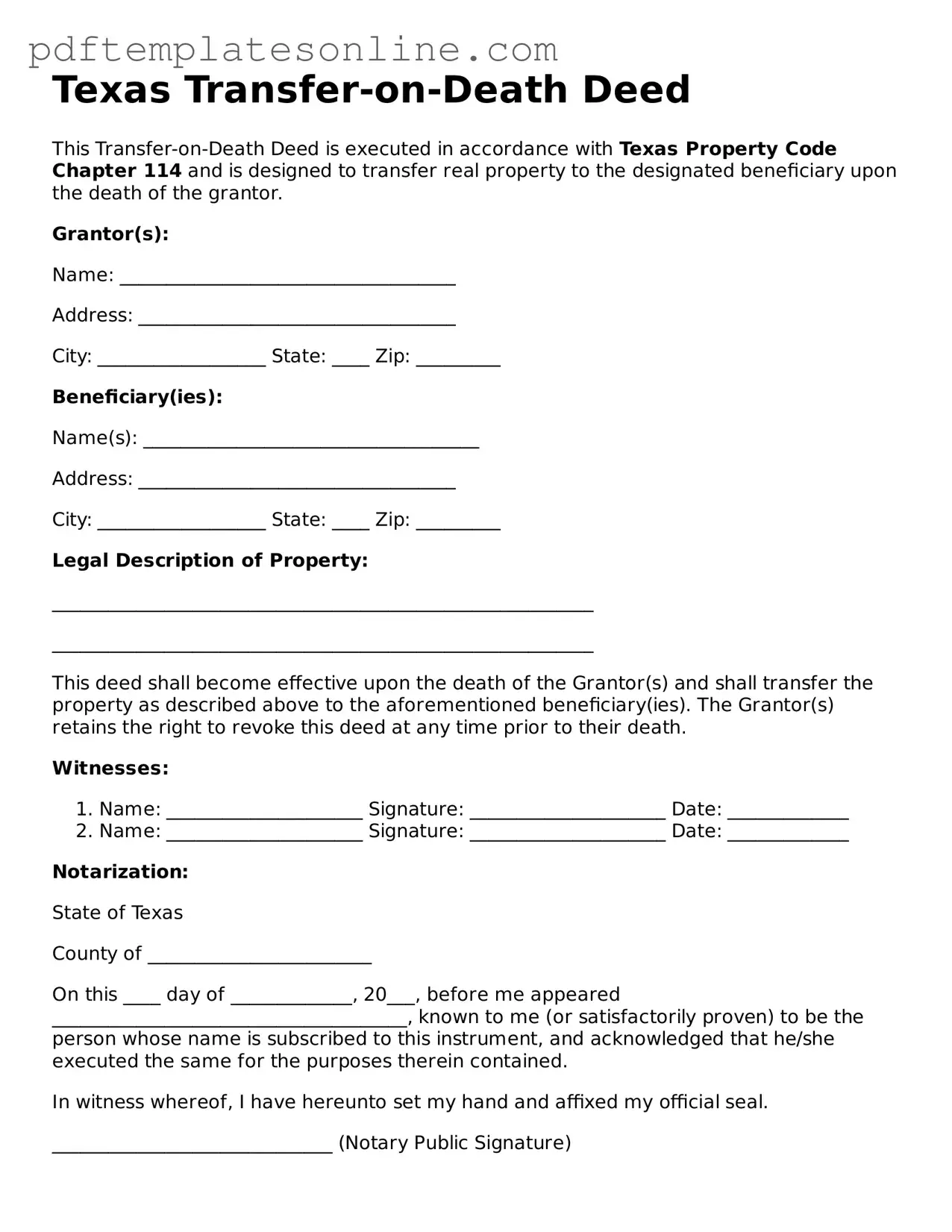

Official Texas Transfer-on-Death Deed Document

Key takeaways

A Texas Transfer-on-Death Deed allows property owners to designate a beneficiary to receive their real estate upon death, avoiding probate.

The form must be filled out accurately and completely to ensure that the transfer is valid and legally binding.

It is essential to include the legal description of the property, which can typically be found on the property’s deed or tax records.

Both the property owner and the beneficiary must be clearly identified, including full names and addresses.

The deed must be signed by the property owner in the presence of a notary public to be considered valid.

After signing, the deed must be filed with the county clerk in the county where the property is located to ensure the transfer is recognized.

Beneficiaries should be aware that they will inherit the property subject to any existing liens or debts associated with it.

Common mistakes

Filling out the Texas Transfer-on-Death Deed form can be a straightforward process, but many individuals make critical mistakes that can lead to complications later on. One common error is failing to include the legal description of the property. This description must be precise and should typically be taken from the property’s deed. Without it, the deed may not be enforceable, and the intended transfer could be challenged.

Another frequent mistake is neglecting to sign the deed in front of a notary public. While it may seem minor, the requirement for notarization is essential for the deed to be valid. If the signature is not notarized, the deed may be deemed invalid, preventing the intended beneficiary from receiving the property upon the owner’s death.

Many people also overlook the importance of clearly identifying beneficiaries. It is not enough to simply name someone; the deed should specify whether the beneficiaries are individuals, entities, or a trust. Ambiguity can lead to disputes among potential heirs, complicating the transfer process and potentially resulting in costly legal battles.

Additionally, individuals often forget to review the deed for accuracy before submitting it. Simple typographical errors or omissions can have significant consequences. For instance, misspelling a beneficiary’s name or incorrectly entering the property address can create confusion and may even invalidate the deed.

Finally, some people fail to record the deed with the county clerk’s office after it has been properly filled out and signed. Recording the deed is a crucial step in ensuring that the transfer is recognized legally. Without this step, the deed may not have the intended effect, leaving the property in limbo and potentially subject to claims from other parties.

Misconceptions

Understanding the Texas Transfer-on-Death Deed can be challenging, and several misconceptions often arise. Here are five common misunderstandings about this legal tool:

-

It automatically transfers property upon death.

While the Transfer-on-Death Deed allows for the property to be transferred upon the owner's death, it does not take effect until that time. The owner retains full control of the property during their lifetime.

-

It replaces a will.

This deed does not replace a will. Instead, it functions as an additional tool for transferring property outside of probate. A will can still be necessary for other assets or specific instructions.

-

All properties can be transferred using this deed.

Not all properties qualify for a Transfer-on-Death Deed. Certain types of properties, such as those held in a trust or properties with existing liens, may not be eligible for this transfer method.

-

It requires court approval.

The Transfer-on-Death Deed does not require court approval to be effective. It simply needs to be properly executed and recorded to ensure that the property transfers according to the owner's wishes.

-

It can be revoked easily.

While it is possible to revoke a Transfer-on-Death Deed, the process must be done correctly. A new deed must be executed and recorded to ensure the revocation is valid.

By understanding these misconceptions, individuals can better navigate the complexities of property transfer in Texas.

Dos and Don'ts

When filling out the Texas Transfer-on-Death Deed form, it's crucial to approach the task with care and attention to detail. Here are ten essential do's and don'ts to guide you through the process.

- Do ensure that you understand the purpose of the Transfer-on-Death Deed. It allows property to transfer directly to beneficiaries upon your death.

- Do clearly identify the property involved. Include the legal description and address to avoid any confusion.

- Do list all beneficiaries accurately. Make sure their names are spelled correctly and that their relationship to you is clear.

- Do sign the deed in front of a notary public. This step is crucial for the deed to be valid.

- Do file the completed deed with the county clerk's office where the property is located. This ensures that the deed is recorded and recognized.

- Don't use vague language when describing the property. Precision is key to avoid disputes later.

- Don't forget to check state laws regarding Transfer-on-Death Deeds. Requirements can vary, and staying informed is essential.

- Don't neglect to inform your beneficiaries about the deed. Transparency can prevent misunderstandings in the future.

- Don't attempt to change the deed after it has been filed without proper procedures. This can complicate the transfer process.

- Don't overlook the importance of seeking legal advice if you're unsure about any aspect of the process. A little guidance can go a long way.

By following these guidelines, you can navigate the Transfer-on-Death Deed process with greater confidence and clarity.

Browse Popular Transfer-on-Death Deed Forms for US States

How to Avoid Probate in Pa - It can be revoked or modified at any time by the property owner before their death.

For those needing to take action against troubling behavior, a Florida Cease and Desist Letter is an essential resource. This document not only demands the cessation of the infringing activity but also provides individuals with a clear framework to communicate their rights. To simplify the process of creating this important letter, various resources are available, including Florida PDF Forms, which offer templates and guidance to ensure proper usage and understanding of this legal instrument.

Transfer on Death Deed California Common Questions - Can apply to single-family homes, condos, or land parcels.

Detailed Guide for Writing Texas Transfer-on-Death Deed

Filling out the Texas Transfer-on-Death Deed form is an important step in planning for the future. After completing the form, it needs to be filed with the county clerk in the county where the property is located. This ensures that your intentions regarding the transfer of your property are clear and legally recognized.

- Begin by downloading the Texas Transfer-on-Death Deed form from a reliable source.

- Fill in your name as the grantor (the person transferring the property).

- Provide your address, including city, state, and zip code.

- Identify the property being transferred. Include a legal description of the property, which can usually be found on your property tax statement or deed.

- Enter the name of the beneficiary (the person who will receive the property upon your death).

- Include the beneficiary's address, ensuring it is complete and accurate.

- Specify whether the beneficiary is a single person or multiple individuals. If there are multiple beneficiaries, clearly indicate how the property should be divided among them.

- Sign the form in the presence of a notary public to validate your signature.

- Have the notary public sign and stamp the form, confirming the notarization.

- Make copies of the completed and notarized form for your records.

- File the original form with the county clerk’s office in the county where the property is located. Check for any filing fees that may apply.