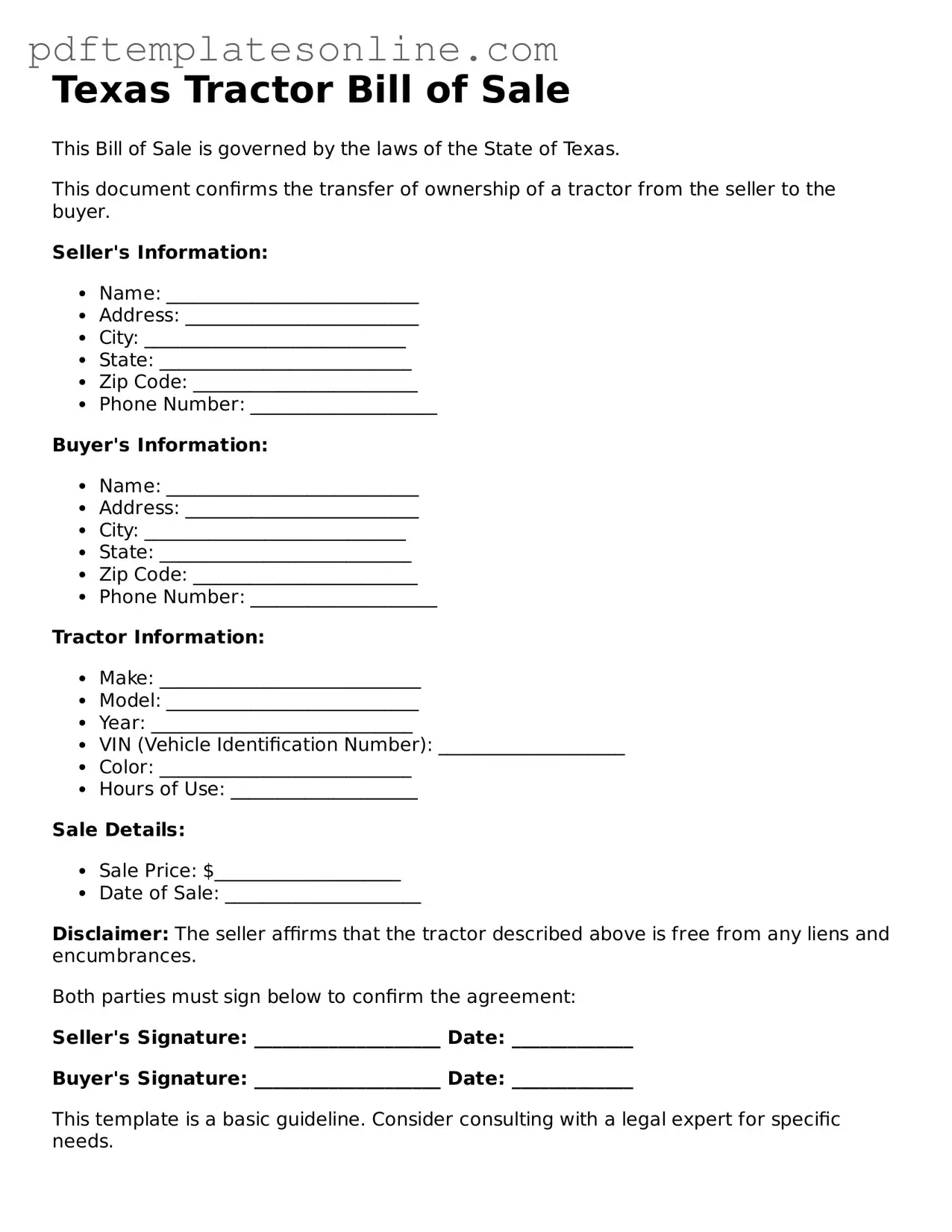

Official Texas Tractor Bill of Sale Document

Key takeaways

When filling out and using the Texas Tractor Bill of Sale form, keep these key takeaways in mind:

- Accurate Information: Ensure that all details about the tractor, including make, model, year, and VIN, are correct.

- Seller and Buyer Details: Include full names and addresses of both the seller and buyer to avoid any future disputes.

- Date of Sale: Clearly state the date when the transaction takes place; this is important for record-keeping.

- Purchase Price: Clearly indicate the agreed-upon price for the tractor to establish a clear understanding between parties.

- Signatures Required: Both the seller and buyer must sign the document for it to be legally binding.

- Notarization: While not required, having the document notarized can add an extra layer of authenticity and protection.

- Record Keeping: Keep a copy of the completed bill of sale for your records, as it serves as proof of ownership transfer.

- State Requirements: Familiarize yourself with any specific Texas state requirements regarding the sale of agricultural equipment.

- Tax Implications: Be aware of any tax obligations that may arise from the sale, such as sales tax or property tax considerations.

By following these guidelines, you can ensure a smooth and legally compliant transaction.

Common mistakes

When completing the Texas Tractor Bill of Sale form, many individuals make common mistakes that can lead to complications. One frequent error is failing to provide accurate information about the tractor. This includes details such as the make, model, year, and Vehicle Identification Number (VIN). Inaccurate information can create confusion and may affect the transfer of ownership.

Another mistake is neglecting to include the sale price. This is crucial for both the buyer and seller, as it establishes the value of the transaction. Omitting this information can lead to misunderstandings and disputes later on.

Many people also forget to sign the document. A signature is essential for validating the sale. Without it, the form may not hold up in legal situations. Both the buyer and seller should ensure they sign the form before finalizing the transaction.

Some individuals fail to date the form correctly. The date of the sale is important for record-keeping and tax purposes. If the date is missing or incorrect, it can lead to issues with the registration of the tractor.

Another common mistake is not providing the correct address for both the buyer and seller. This information is vital for identification and contact purposes. Incorrect addresses can complicate future communications or legal matters.

Inaccurate or incomplete information regarding the payment method can also be problematic. Whether payment is made in cash, check, or another form, it should be clearly stated. This helps prevent misunderstandings about the transaction.

Some people overlook the need for a witness or notary. While not always required, having a witness can add an extra layer of security to the sale. It may be beneficial in case of disputes regarding the transaction.

Additionally, individuals sometimes forget to keep a copy of the completed form. Retaining a copy is essential for both parties. It serves as proof of the transaction and can be useful for future reference.

Failing to check for typos or errors before submission is another mistake. Simple mistakes can lead to significant issues. Taking the time to review the document can save both parties from potential headaches later on.

Lastly, people may not understand the importance of local laws and regulations. Each county may have specific requirements for the sale of a tractor. Familiarizing oneself with these regulations can ensure a smooth transaction.

Misconceptions

The Texas Tractor Bill of Sale form is an essential document for anyone buying or selling a tractor in Texas. However, several misconceptions surround this form. Let's clarify some of these misunderstandings.

- 1. A bill of sale is not necessary for tractor transactions. Many people believe that a verbal agreement is sufficient. In reality, having a written bill of sale protects both the buyer and seller by providing clear evidence of the transaction.

- 2. The form is only for new tractors. Some think that the bill of sale applies only to new purchases. In truth, it is equally important for used tractors, ensuring proper documentation regardless of the tractor's age.

- 3. You don't need to include the tractor's VIN. It's a common misconception that the Vehicle Identification Number (VIN) is optional. Including the VIN is crucial as it uniquely identifies the tractor and helps prevent disputes.

- 4. The bill of sale is only for private sales. Some assume that this form is unnecessary for sales through dealerships. However, even dealerships should provide a bill of sale for transparency and record-keeping.

- 5. You can fill out the form after the sale. Many people think it can be completed at any time. Ideally, the bill of sale should be filled out and signed at the time of the transaction to avoid confusion later on.

- 6. The buyer doesn't need a copy of the bill of sale. This is a significant error. Both parties should retain a copy for their records, as it serves as proof of ownership and the terms of the sale.

- 7. The bill of sale doesn't need to be notarized. While notarization is not always required, having the document notarized can add an extra layer of legitimacy and protection for both parties.

- 8. You can use any bill of sale template. Some people think any generic template will suffice. However, using the specific Texas Tractor Bill of Sale form ensures compliance with state laws and requirements.

- 9. The form is only important for tax purposes. While the bill of sale can be used for tax documentation, its importance extends far beyond that. It serves as a legal record of ownership and can be vital in case of disputes.

Understanding these misconceptions can help you navigate the process of buying or selling a tractor in Texas with confidence. Always ensure that you have the correct documentation to protect your interests.

Dos and Don'ts

When filling out the Texas Tractor Bill of Sale form, it is important to follow specific guidelines to ensure the document is valid and serves its purpose effectively. Below is a list of things to do and avoid during the process.

- Do provide accurate information about the tractor, including make, model, year, and VIN.

- Do include the purchase price clearly to avoid any disputes later.

- Do sign and date the form to validate the transaction.

- Do have both the buyer and seller retain a copy of the completed bill of sale.

- Do check for any additional requirements specific to your county or municipality.

- Don't leave any sections blank; fill in all required fields.

- Don't falsify information about the tractor or the transaction.

- Don't forget to include the buyer's and seller's contact information.

- Don't overlook the importance of having witnesses if required by local laws.

Adhering to these guidelines will help ensure a smooth transaction and protect the interests of both parties involved.

Browse Popular Tractor Bill of Sale Forms for US States

Do Tractors Need to Be Registered - Can be customized to meet the specific needs of the transaction.

Understanding the nuances of a California Non-compete Agreement form is essential for businesses and employees alike, especially when considering its general lack of enforceability under California law. Those seeking to draft or review such agreements can benefit from resources like California PDF Forms, which provide valuable insights and templates to navigate this complex landscape effectively.

Tractor Bill of Sale Word Template - Promotes adherence to agricultural best practices in transactions.

Detailed Guide for Writing Texas Tractor Bill of Sale

After gathering all necessary information, you are ready to fill out the Texas Tractor Bill of Sale form. This document will help facilitate the transfer of ownership of the tractor, ensuring that both the buyer and seller have a clear record of the transaction.

- Begin by entering the date of the sale at the top of the form.

- Fill in the seller's full name and address. Ensure that the information is accurate and up-to-date.

- Next, provide the buyer's full name and address. Double-check for any spelling errors.

- In the designated section, describe the tractor. Include details such as the make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price of the tractor clearly. This amount should reflect the agreed-upon price between the buyer and seller.

- Both the buyer and seller should sign and date the form at the bottom. This step is crucial for the validity of the document.

- Make a copy of the completed form for your records. This will serve as proof of the transaction.