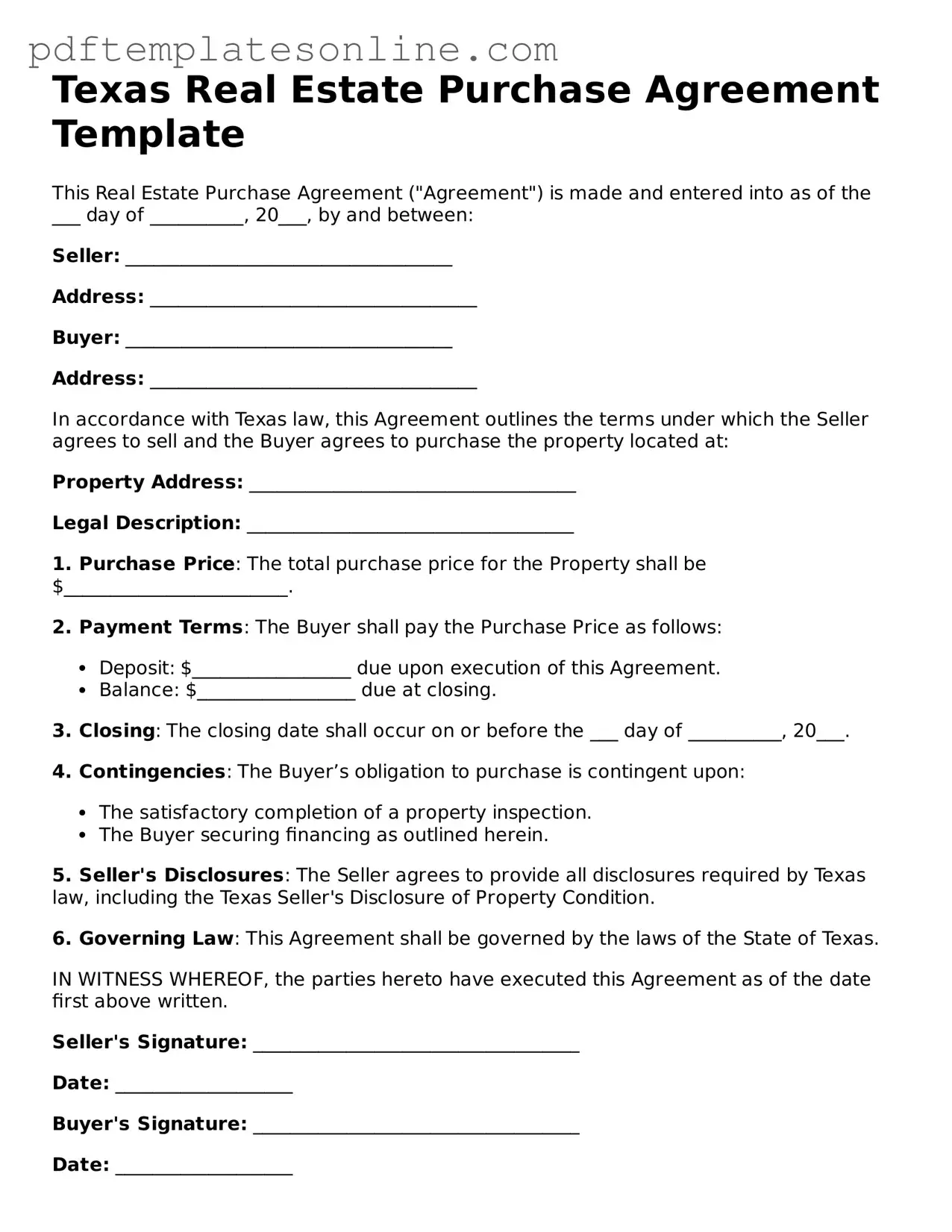

Official Texas Real Estate Purchase Agreement Document

Key takeaways

Ensure all parties involved are clearly identified. This includes the buyer, seller, and any agents. Accurate names and contact information are essential.

Specify the property details. Include the address, legal description, and any relevant property features to avoid confusion later.

Outline the purchase price and payment terms. Clearly state the total amount, any deposits, and how the payment will be structured.

Include contingencies. Common contingencies involve financing, inspections, and appraisals. These protect the buyer and seller by allowing them to back out under certain conditions.

Review the closing timeline. Set a clear date for closing and ensure both parties understand the timeline for inspections, financing, and other key steps.

Consider legal review. Having a real estate attorney review the agreement can help catch any potential issues and ensure that all terms are fair and enforceable.

Common mistakes

Filling out the Texas Real Estate Purchase Agreement form can be daunting. One common mistake is failing to include all necessary parties. Ensure that all buyers and sellers are listed correctly. If a spouse or co-owner is not included, it can lead to complications down the line. Always double-check that every person involved in the transaction is accounted for.

Another frequent error is neglecting to specify the property details accurately. This includes the address, legal description, and any relevant features of the property. Missing or incorrect information can cause confusion and may even delay the closing process. Take the time to verify these details before submitting the agreement.

Many people also overlook the importance of the earnest money deposit. This deposit shows the seller that the buyer is serious about the purchase. Failing to specify the amount or the terms surrounding the deposit can create misunderstandings. Make sure to clearly outline how much earnest money is being offered and the conditions for its return.

Additionally, buyers and sellers sometimes forget to address contingencies. These are conditions that must be met for the sale to proceed. Common contingencies include financing, inspections, and appraisals. Not including these can lead to unexpected issues later. Clearly state any contingencies to protect your interests.

Lastly, neglecting to review the entire agreement before signing is a significant mistake. It’s essential to read through the document carefully. This includes understanding all terms and conditions. If something is unclear, seek clarification before proceeding. Taking the time to review can prevent costly errors and ensure a smoother transaction.

Misconceptions

- Misconception 1: The Texas Real Estate Purchase Agreement is the same as a lease agreement.

- Misconception 2: You don’t need a real estate agent to use the form.

- Misconception 3: The form is only for residential properties.

- Misconception 4: Once signed, the agreement cannot be changed.

- Misconception 5: The purchase agreement guarantees the sale will go through.

- Misconception 6: Only the buyer needs to sign the agreement.

- Misconception 7: The purchase price is the only important detail in the agreement.

- Misconception 8: You can use the same form for every transaction.

- Misconception 9: The Texas Real Estate Purchase Agreement is a simple document that requires no legal knowledge.

This is not true. A purchase agreement is a legal document that outlines the terms for buying a property, while a lease agreement is for renting a property.

While it's possible to fill out the form without an agent, having one can help ensure all details are correctly addressed and the process runs smoothly.

This agreement can be used for both residential and commercial real estate transactions in Texas.

Parties can negotiate changes to the agreement before closing. Amendments can be made as long as both parties agree.

The agreement is a step toward closing, but it does not guarantee that the sale will be completed. Contingencies may affect the outcome.

Both the buyer and the seller must sign the purchase agreement for it to be legally binding.

While the price is crucial, other terms like contingencies, closing dates, and repairs are equally important and should be carefully reviewed.

Each transaction may have unique circumstances. It's essential to customize the agreement to fit the specific situation.

While the form is user-friendly, understanding its implications and details is important. Consulting a professional can help avoid potential issues.

Dos and Don'ts

When filling out the Texas Real Estate Purchase Agreement form, there are important guidelines to follow. Here are five things you should and shouldn't do:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate information about the property and the parties involved.

- Do ensure all necessary signatures are obtained.

- Don't leave any blank spaces; fill in all required fields.

- Don't rush through the process; take your time to avoid mistakes.

Browse Popular Real Estate Purchase Agreement Forms for US States

How to Make a Purchase Agreement - The agreement typically validates the buyer's earnest money deposit.

Simple Real Estate Sales Contract - The agreement should clearly define the property being sold to avoid disputes.

Real Estate Contract Georgia - Included in the agreement are critical dates, ensuring both parties are aware of key milestones in the sale process.

Purchase Agreement for a House - A Real Estate Purchase Agreement outlines the terms for buying a property.

Detailed Guide for Writing Texas Real Estate Purchase Agreement

After obtaining the Texas Real Estate Purchase Agreement form, it is important to complete it accurately to facilitate the transaction process. The following steps outline how to fill out the form correctly.

- Begin by entering the date at the top of the form.

- Identify the parties involved. Fill in the full legal names of the buyer(s) and seller(s).

- Provide the property address, including street number, street name, city, and zip code.

- Specify the purchase price. Clearly state the amount being offered for the property.

- Detail the earnest money deposit. Indicate the amount and the name of the title company or bank where it will be held.

- Outline the financing terms. Indicate whether the buyer will use a loan, cash, or other means to purchase the property.

- Include any contingencies. Specify conditions that must be met for the sale to proceed, such as inspections or financing approval.

- Set the closing date. Provide a proposed date for the closing of the sale.

- List any personal property included in the sale, such as appliances or fixtures.

- Have all parties sign and date the agreement at the designated lines.

After completing the form, it is advisable to review it for accuracy and completeness before submitting it to the appropriate parties involved in the transaction.