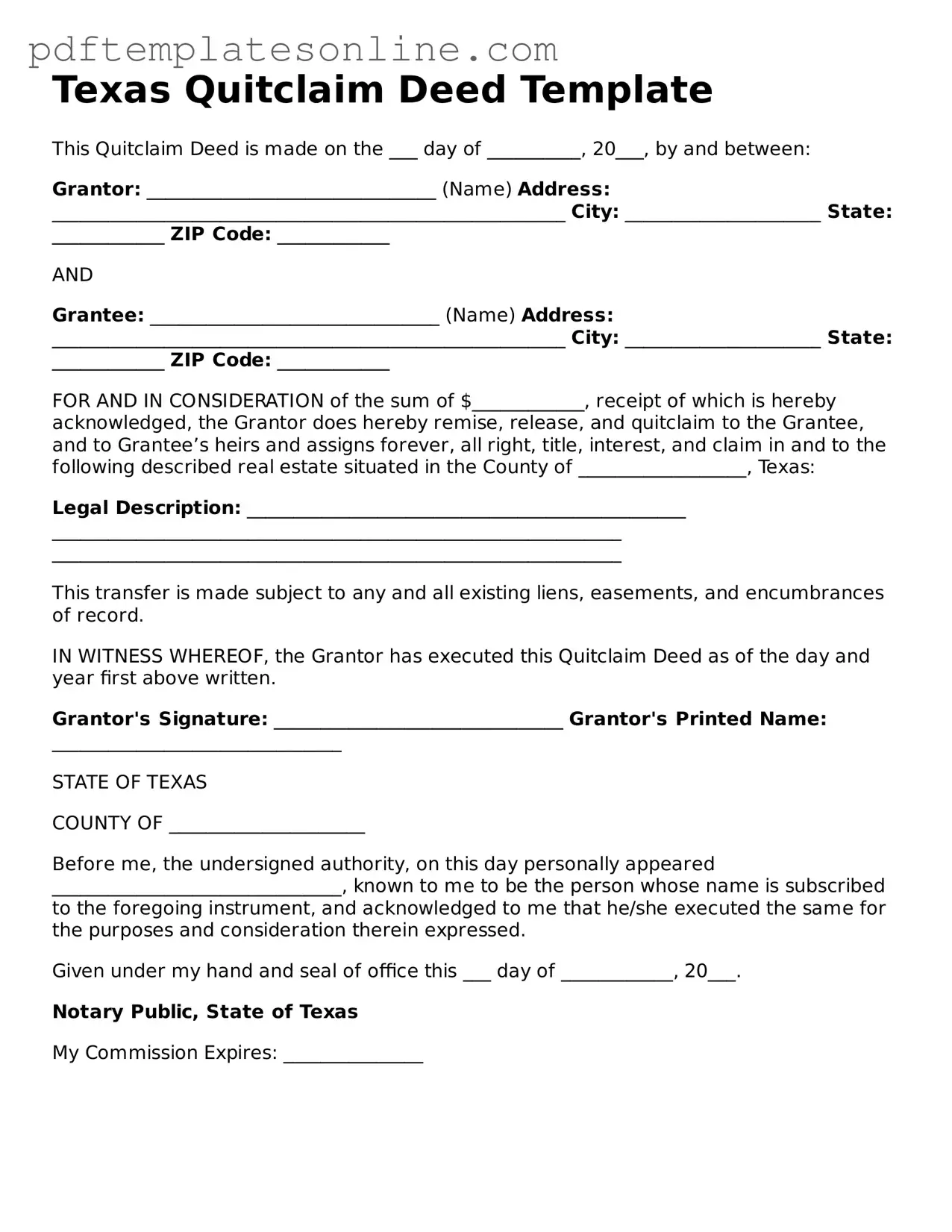

Official Texas Quitclaim Deed Document

Key takeaways

Filling out and using a Texas Quitclaim Deed form can be a straightforward process, but it is essential to understand the key elements involved. Here are some important takeaways to consider:

- Understanding the Purpose: A Quitclaim Deed is primarily used to transfer ownership of property without guaranteeing that the title is clear. This means the grantor (the person transferring the property) does not promise that they own the property free of any claims.

- Accurate Information is Crucial: Ensure that all information on the form is accurate. This includes the names of the grantor and grantee, the legal description of the property, and any other relevant details. Mistakes can lead to complications down the line.

- Notarization Requirements: In Texas, a Quitclaim Deed must be signed in the presence of a notary public. This step is vital to validate the document and ensure its acceptance in legal matters.

- Recording the Deed: After the Quitclaim Deed is completed and notarized, it should be filed with the county clerk's office in the county where the property is located. This recording protects the grantee's interest in the property and provides public notice of the ownership transfer.

Common mistakes

When filling out a Texas Quitclaim Deed form, many individuals unknowingly make mistakes that can lead to complications down the line. One common error is failing to include the correct legal description of the property. This description should be precise and detailed, typically found in the original deed. Omitting or inaccurately describing the property can create ambiguity and may result in disputes over ownership.

Another frequent mistake involves not properly identifying the grantor and grantee. The grantor is the person transferring the property, while the grantee is the recipient. It's crucial to ensure that full names are used and that they match the names on the original deed. Missing or incorrect names can lead to confusion or even invalidate the deed.

Additionally, many people forget to sign the Quitclaim Deed. A signature from the grantor is essential for the deed to be legally binding. Without this signature, the document is incomplete and cannot be recorded. In some cases, witnesses or notarization may also be required, depending on local regulations, so it’s wise to check those requirements.

Another pitfall is neglecting to consider tax implications. While a Quitclaim Deed transfers property without warranties, it can still trigger tax consequences. Individuals should be aware of potential property taxes or transfer taxes that may apply when transferring ownership. Consulting a tax professional can help clarify these issues.

People often overlook the importance of recording the Quitclaim Deed with the county clerk’s office. Recording the deed is a critical step in making the transfer official and public. Failing to record can lead to challenges in proving ownership in the future, especially if disputes arise.

Lastly, some individuals do not seek legal advice when completing the Quitclaim Deed. While the form may seem straightforward, the implications of transferring property can be significant. Consulting with a real estate attorney or a knowledgeable professional can help avoid costly mistakes and ensure the process goes smoothly.

Misconceptions

Understanding the Texas Quitclaim Deed form is essential for anyone involved in property transactions. Unfortunately, several misconceptions can lead to confusion. Here are nine common misconceptions about this legal document:

-

A Quitclaim Deed transfers ownership of property.

This is partially true. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor holds clear title. The recipient may not receive full ownership rights.

-

A Quitclaim Deed is the same as a Warranty Deed.

This misconception is widespread. Unlike a Warranty Deed, which guarantees that the title is clear and free of liens, a Quitclaim Deed offers no such assurances.

-

You cannot use a Quitclaim Deed for property sales.

This is incorrect. While Quitclaim Deeds are often used among family members or in informal transactions, they can also be used in sales. However, buyers should be cautious.

-

A Quitclaim Deed eliminates mortgage obligations.

This is a misconception. Transferring property via a Quitclaim Deed does not remove any existing mortgage obligations. The original borrower remains responsible for the mortgage.

-

You do not need to file a Quitclaim Deed.

This is misleading. To make the transfer official and public, it is necessary to file the Quitclaim Deed with the county clerk's office. Failure to do so may lead to disputes.

-

A Quitclaim Deed can be revoked.

This is not accurate. Once a Quitclaim Deed is executed and filed, it cannot be revoked unilaterally. The grantor would need to execute a new deed to change ownership.

-

All Quitclaim Deeds are the same.

This is a misconception. While the basic format may be similar, specific requirements can vary by county or situation. It is essential to ensure compliance with local regulations.

-

You must be an attorney to prepare a Quitclaim Deed.

This is not true. While having legal assistance can be beneficial, individuals can prepare a Quitclaim Deed themselves, provided they follow the correct procedures and guidelines.

-

A Quitclaim Deed is only for transferring property between family members.

This is incorrect. Although Quitclaim Deeds are commonly used among family members, they can be used in various situations, including transferring property between unrelated parties.

Being informed about these misconceptions can help individuals make better decisions regarding property transactions in Texas. It is always advisable to seek guidance when dealing with legal documents to ensure a clear understanding of the implications involved.

Dos and Don'ts

When filling out the Texas Quitclaim Deed form, it is important to follow certain guidelines to ensure accuracy and legality. Here are nine things you should and shouldn't do:

- Do provide the full legal names of all parties involved in the transaction.

- Do include a complete description of the property being transferred.

- Do ensure that the form is signed in front of a notary public.

- Do check for any specific local requirements that may apply.

- Do keep a copy of the completed deed for your records.

- Don't leave any blank spaces on the form; fill in all required fields.

- Don't use incorrect or abbreviated names for the parties involved.

- Don't forget to date the document upon signing.

- Don't submit the deed without verifying that all information is accurate.

Browse Popular Quitclaim Deed Forms for US States

Printable Quit Claim Deed Form - Quitclaim Deeds are typically recorded with the county office to ensure public notice.

Quick Claim Deeds Ohio - It’s particularly useful in situations involving foreclosures or bank transfers.

Quit Claim Deed Form Georgia - Some states require specific language to be included in a Quitclaim Deed.

Detailed Guide for Writing Texas Quitclaim Deed

Once you have obtained the Texas Quitclaim Deed form, the next step is to carefully fill it out to ensure that the transfer of property rights is accurately documented. This process involves providing specific information about the parties involved and the property in question. Following these steps will help you complete the form correctly.

- Obtain the Form: Get a copy of the Texas Quitclaim Deed form. You can find it online or at your local county clerk's office.

- Identify the Grantor: In the designated space, write the full name of the person transferring the property. Ensure that the name is spelled correctly and matches official documents.

- Identify the Grantee: Next, enter the full name of the person receiving the property. Again, accuracy is key, so double-check the spelling.

- Provide the Property Description: Clearly describe the property being transferred. Include the address, legal description, and any relevant details that define the property boundaries.

- Include Consideration: State the amount of consideration, or payment, for the property. If the transfer is a gift, you can indicate that by writing "for love and affection."

- Sign the Document: The grantor must sign the Quitclaim Deed in the presence of a notary public. This step is crucial for the document's validity.

- Notarization: Have the notary public complete the notarization section. This confirms that the signature is genuine and that the grantor signed willingly.

- File the Deed: Finally, take the completed and notarized Quitclaim Deed to the county clerk's office where the property is located. File it to officially record the transfer.