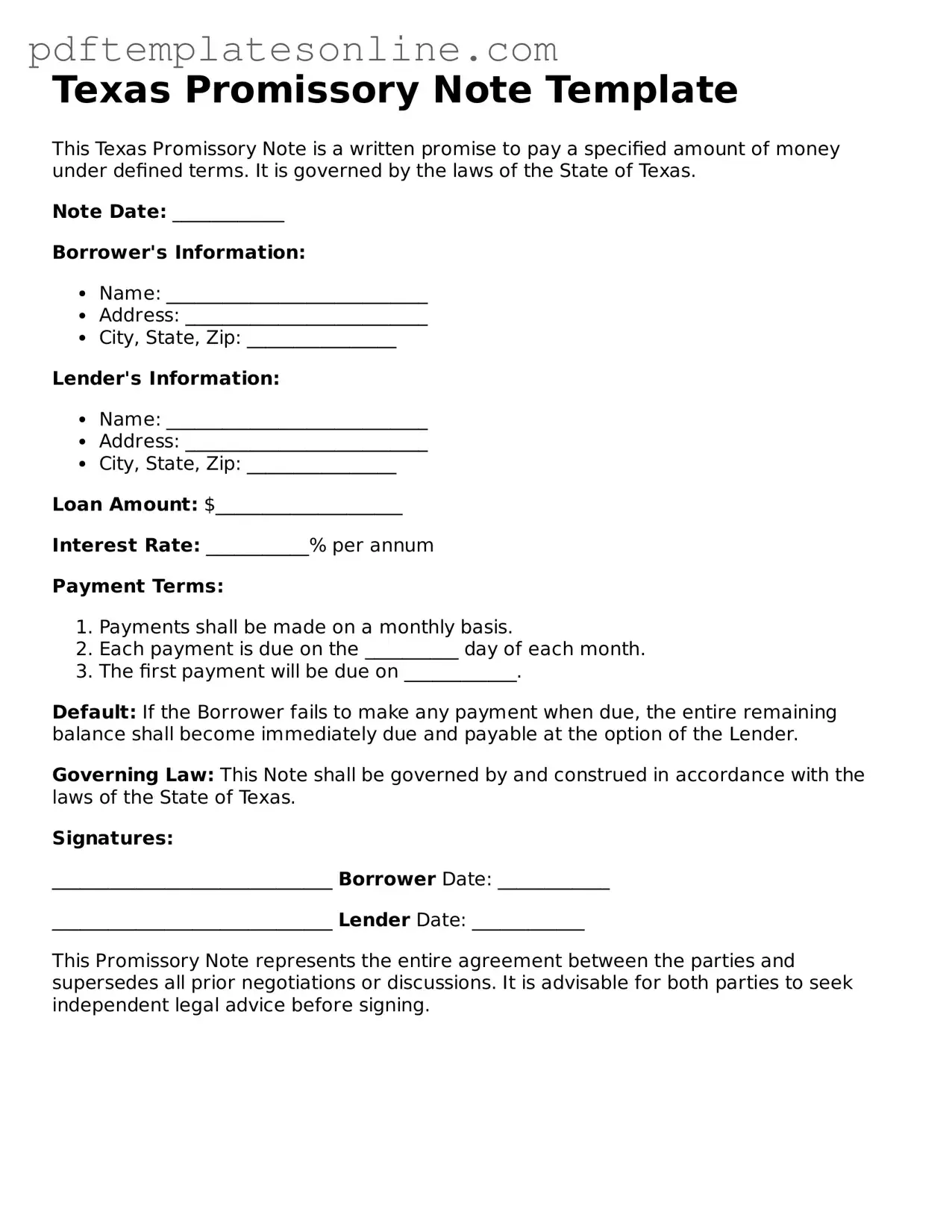

Official Texas Promissory Note Document

Key takeaways

When filling out and using the Texas Promissory Note form, consider the following key takeaways:

- Understand the Purpose: A promissory note is a legal document that outlines a promise to pay a specific amount of money to a lender.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures everyone knows who is involved in the agreement.

- Specify the Loan Amount: Clearly indicate the total amount of money being borrowed. This is crucial for clarity and enforcement.

- Include Interest Rate: If applicable, state the interest rate. This informs the borrower of the cost of borrowing the money.

- Outline Payment Terms: Describe how and when payments will be made. Include due dates and acceptable payment methods.

- State Consequences of Default: Explain what happens if the borrower fails to make payments. This can include late fees or legal action.

- Signatures Required: Both the borrower and lender must sign the document. This makes the agreement legally binding.

- Keep Copies: Both parties should keep a signed copy of the promissory note for their records. This helps in case of disputes.

Common mistakes

When filling out the Texas Promissory Note form, many individuals overlook critical details that can lead to complications later on. One common mistake is failing to include all necessary parties. The borrower and lender must be clearly identified. Omitting one of these parties can create confusion about who is responsible for repayment.

Another frequent error is not specifying the loan amount accurately. It is essential to write the amount in both numerical and written form. If there is a discrepancy between the two, it may lead to disputes regarding the actual amount owed. Always double-check these figures to avoid any potential misunderstandings.

People often neglect to include the interest rate. If the rate is not clearly stated, it can result in ambiguity regarding repayment terms. This omission can lead to disputes and may even affect the enforceability of the note. Make sure to specify whether the interest is fixed or variable.

Additionally, many individuals forget to outline the repayment schedule. It is crucial to detail when payments are due and the method of payment. Without a clear repayment schedule, both parties may have different expectations, leading to frustration and potential legal issues.

Finally, not signing the document correctly is a common mistake. The note must be signed by both the borrower and lender. If either party fails to sign, the document may not hold up in court. Always ensure that all signatures are present and that they match the names printed in the document.

Misconceptions

When it comes to the Texas Promissory Note form, many people hold misconceptions that can lead to confusion or poor decisions. Here are six common misunderstandings:

- It must be notarized. While notarization can add an extra layer of security and authenticity, it is not a legal requirement for a promissory note to be valid in Texas.

- Only banks can issue promissory notes. This is not true. Anyone can create a promissory note as long as they meet the necessary legal requirements, including clear terms and conditions.

- Promissory notes are only for large loans. Many people believe that promissory notes are only used for significant amounts of money. In reality, they can be used for any amount, big or small.

- Once signed, a promissory note cannot be changed. While it’s best to have all terms agreed upon before signing, parties can amend the note later if both agree to the changes and document them properly.

- Promissory notes are the same as contracts. Although they share similarities, a promissory note specifically focuses on the promise to repay a loan, while contracts can cover a broader range of agreements.

- Defaulting on a promissory note has no consequences. In fact, failing to repay a promissory note can lead to serious repercussions, including legal action and damage to one’s credit score.

Understanding these misconceptions can help individuals navigate the world of promissory notes with greater confidence and clarity.

Dos and Don'ts

When filling out the Texas Promissory Note form, it's important to follow some guidelines to ensure everything is completed correctly. Here are seven things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate information for all parties involved.

- Do clearly state the loan amount and interest rate.

- Do include the repayment schedule and due dates.

- Don't leave any sections blank unless instructed.

- Don't use vague language that could lead to confusion.

- Don't forget to sign and date the document.

Browse Popular Promissory Note Forms for US States

Ohio Promissory Note Requirements - Promissory notes can influence credit scores, reflecting borrower reliability.

To effectively analyze your company’s financial performance, it is crucial to utilize the Profit and Loss form, which serves as a comprehensive summary of revenues, costs, and expenses over a designated time frame. This financial statement not only highlights your organization's profitability but also provides valuable insights into its overall health. To gain insights into your financial position, consider filling out the Profit And Loss form by clicking the button below.

Promissory Note for Personal Loan - An asset for lending decisions, providing formal acknowledgment of debts.

Promissory Note Template California Word - Interest calculations should be understood thoroughly to ensure fair agreements.

Notarized Promissory Note - Often, it is used in conjunction with a loan agreement for further clarity.

Detailed Guide for Writing Texas Promissory Note

After obtaining the Texas Promissory Note form, the next step involves filling it out accurately to ensure all necessary details are included. This document is crucial for outlining the terms of a loan agreement between the lender and borrower. Following the completion of the form, it will need to be signed and dated by both parties to make it legally binding.

- Begin by entering the date at the top of the form. This date should reflect when the note is being created.

- In the first blank, write the name of the borrower. This is the individual or entity that is receiving the loan.

- Next, provide the address of the borrower. This helps identify the borrower and ensures proper communication.

- In the following section, enter the name of the lender. This is the individual or entity providing the loan.

- Then, include the lender's address. This information is important for any correspondence related to the loan.

- Specify the principal amount of the loan in the designated space. This is the total amount borrowed and should be clearly stated.

- Indicate the interest rate, if applicable. This should be expressed as a percentage and clearly defined.

- Fill in the repayment terms. This includes how long the borrower has to repay the loan and the schedule for payments (e.g., monthly, quarterly).

- Next, outline any late fees or penalties for missed payments. This section is important for establishing the consequences of late payment.

- Finally, both the borrower and lender should sign and date the form at the bottom. This signifies their agreement to the terms outlined in the note.