Official Texas Operating Agreement Document

Key takeaways

When filling out and utilizing the Texas Operating Agreement form, several important considerations emerge. Understanding these can help ensure compliance and clarity among business partners.

- Define Roles and Responsibilities: Clearly outline the roles of each member in the agreement. This helps prevent misunderstandings and sets expectations for contributions and decision-making.

- Establish Profit Distribution: Specify how profits and losses will be shared among members. This provision is crucial for financial transparency and fairness within the business.

- Include Dispute Resolution Mechanisms: Having a plan for resolving disputes can save time and resources. Consider including mediation or arbitration procedures to handle conflicts that may arise.

- Regular Updates: Review and update the agreement regularly to reflect changes in membership or business operations. This ensures that the document remains relevant and legally sound.

Common mistakes

Filling out a Texas Operating Agreement form can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One frequent error is neglecting to include all members' names and addresses. This information is crucial for establishing clear ownership and responsibilities within the company. Omitting even one member can create confusion and disputes later.

Another mistake often seen is failing to define the roles and responsibilities of each member. Clarity is key in any business operation. Without clearly outlined duties, members may have differing expectations, leading to misunderstandings and potential conflicts. It is essential to specify who handles what to ensure smooth operations.

Many individuals also overlook the importance of detailing the decision-making process. An Operating Agreement should specify how decisions will be made—whether by majority vote, unanimous consent, or another method. Without this information, important decisions may become contentious, causing delays and frustration.

Additionally, some people forget to address how profits and losses will be distributed among members. This can lead to disputes when it comes time to share earnings. Clearly stating the distribution method in the agreement helps prevent misunderstandings and ensures all members are on the same page.

Another common oversight is not including a buy-sell agreement. This clause is vital for outlining what happens if a member wants to leave the business or if a triggering event occurs, such as death or incapacity. Without this provision, the remaining members may face challenges in managing the ownership transition smoothly.

Finally, failing to update the Operating Agreement can create problems as the business evolves. Changes in membership, roles, or business structure should be reflected in the agreement. Regular reviews and updates help maintain clarity and relevance, ensuring the document continues to serve its purpose effectively.

Misconceptions

The Texas Operating Agreement form is often misunderstood, leading to confusion among business owners and stakeholders. Below are four common misconceptions, along with clarifications to help dispel them.

- Misconception 1: The Operating Agreement is not necessary for a Texas LLC.

- Misconception 2: The Operating Agreement is a public document.

- Misconception 3: All Operating Agreements are the same.

- Misconception 4: The Operating Agreement cannot be changed once established.

Many believe that an Operating Agreement is optional for forming an LLC in Texas. While it is true that the state does not require an Operating Agreement to establish an LLC, having one is highly advisable. This document outlines the management structure and operational procedures, providing clarity and protection for all members involved.

Some individuals think that the Operating Agreement must be filed with the state and thus becomes a public record. In reality, this agreement is a private document. It is maintained internally by the LLC and only shared among members or as required in specific legal circumstances.

There is a belief that Operating Agreements are standardized and do not require customization. This is misleading. Each LLC has unique needs and circumstances that should be reflected in its Operating Agreement. Tailoring the document to the specific goals and operations of the business is crucial for effective governance.

Some assume that once an Operating Agreement is signed, it is set in stone. In fact, amendments can be made to the agreement as long as all members consent to the changes. This flexibility allows the LLC to adapt to new circumstances or to reflect changes in membership or business strategy.

Dos and Don'ts

When filling out the Texas Operating Agreement form, it's essential to keep certain practices in mind. Here are four key dos and don'ts:

- Do provide accurate and complete information to avoid future complications.

- Do have all members review the agreement before finalizing it.

- Don't leave any sections blank; incomplete forms can lead to delays.

- Don't rush through the process; take your time to ensure everything is correct.

Browse Popular Operating Agreement Forms for US States

How to Make an Operating Agreement - It serves as a reference for all members to understand their obligations.

Ohio Llc Operating Agreement - This form helps to specify management authority and limitations.

Detailed Guide for Writing Texas Operating Agreement

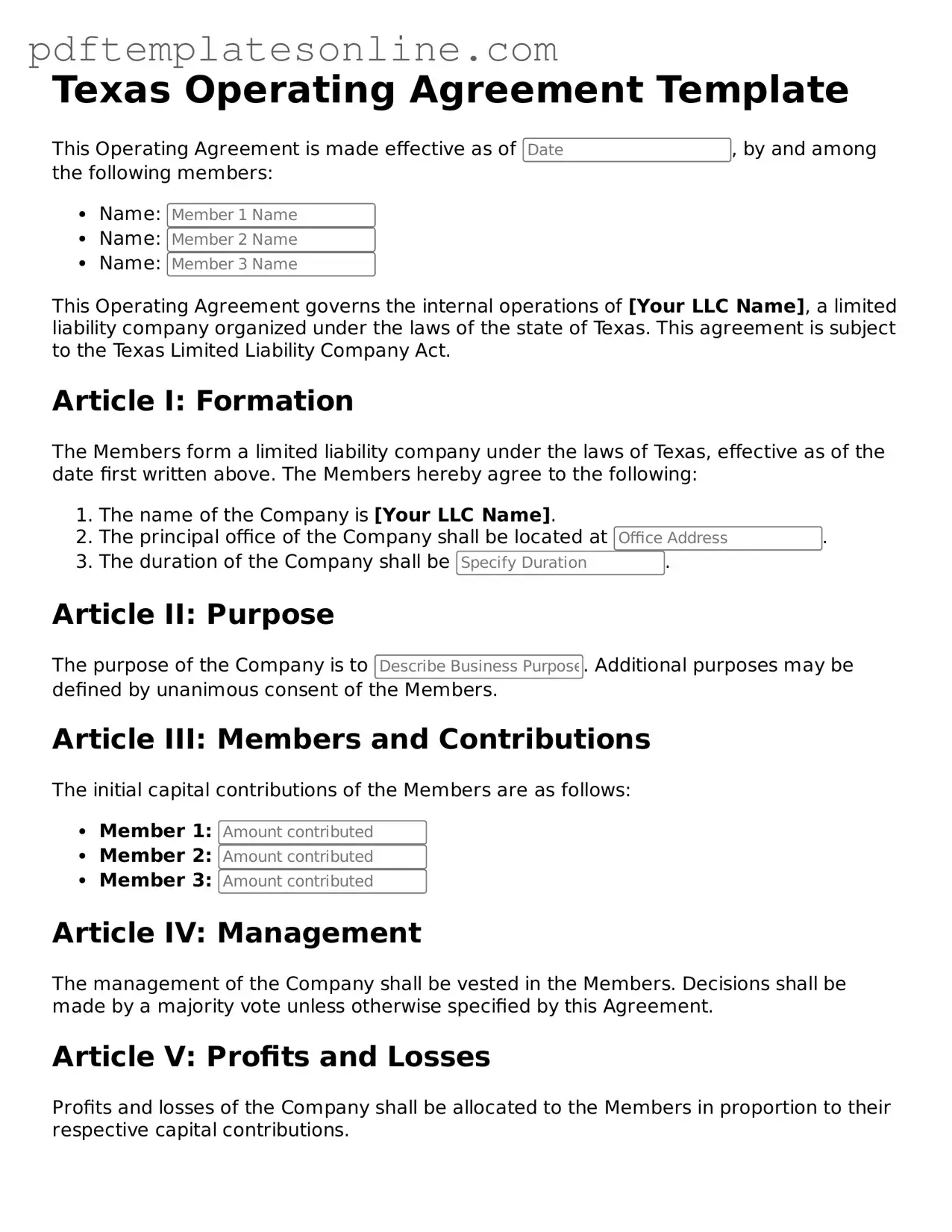

Completing the Texas Operating Agreement form is an important step for any business owner looking to establish clear guidelines for their company. This process requires careful attention to detail to ensure that all necessary information is accurately provided. Follow the steps below to fill out the form correctly.

- Begin by entering the name of your limited liability company (LLC) at the top of the form.

- Provide the principal office address of the LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members of the LLC. Include each member's percentage of ownership.

- Outline the purpose of the LLC. Describe what business activities the company will engage in.

- Specify the duration of the LLC. Indicate whether it is intended to exist for a specific period or indefinitely.

- Detail the management structure of the LLC. Indicate whether it will be member-managed or manager-managed.

- Include provisions for adding or removing members. Clearly state the process for changes in membership.

- Address how profits and losses will be distributed among members. Specify the method of distribution.

- Provide information on how decisions will be made within the LLC. Outline voting rights and procedures.

- Sign and date the form. Ensure that all members sign if required, confirming their agreement to the terms outlined.

Once the form is filled out, review it carefully to ensure accuracy. It may be beneficial to consult with a legal professional to confirm that all necessary details are included. After verifying the information, proceed to submit the form according to the specified instructions.