Official Texas Motor Vehicle Bill of Sale Document

Key takeaways

When filling out and using the Texas Motor Vehicle Bill of Sale form, it is important to keep several key points in mind.

- The form serves as a legal document that proves the sale and transfer of ownership of a motor vehicle.

- Both the buyer and seller must complete and sign the form for it to be valid.

- Accurate information about the vehicle, including the Vehicle Identification Number (VIN), make, model, and year, must be provided.

- The sale price should be clearly stated to avoid any future disputes.

- It is advisable to keep a copy of the completed Bill of Sale for personal records.

- The form is not mandatory for all vehicle sales in Texas, but it is highly recommended for documentation purposes.

- Filling out the form correctly can help streamline the vehicle registration process with the Texas Department of Motor Vehicles.

By following these guidelines, both parties can ensure a smooth transaction and protect their interests during the sale of a motor vehicle.

Common mistakes

Filling out the Texas Motor Vehicle Bill of Sale form may seem straightforward, but many individuals make common mistakes that can lead to complications down the line. One frequent error is neglecting to include all necessary information about the vehicle. Buyers and sellers must ensure that details such as the Vehicle Identification Number (VIN), make, model, and year are accurately recorded. Missing even one of these elements can create confusion and potentially invalidate the sale.

Another mistake often seen is the failure to provide complete personal information for both the buyer and the seller. This includes names, addresses, and contact numbers. Incomplete or incorrect information can hinder communication and may cause issues if legal disputes arise later. It’s essential to double-check that all names are spelled correctly and that addresses are current.

Many people also overlook the importance of signatures. Both the buyer and seller must sign the form to validate the transaction. Without these signatures, the document may not hold up in legal situations. Additionally, some individuals forget to date the form. A date is crucial as it establishes when the transaction took place, which can be important for tax purposes and vehicle registration.

Another common pitfall is not providing a sales price. While it might seem trivial, including the purchase price is essential for tax calculations and future reference. Leaving this section blank can lead to misunderstandings and complications with the Texas Department of Motor Vehicles.

People sometimes make the mistake of not keeping a copy of the completed Bill of Sale. After signing, both parties should retain a copy for their records. This document serves as proof of the transaction and can be invaluable if any disputes arise later regarding ownership or payment.

Finally, some individuals fail to understand the implications of the Bill of Sale. This document is not just a simple receipt; it is a legal record of the transaction. Misunderstanding its importance can lead to issues with title transfers or liability for the vehicle after the sale. It’s crucial for both parties to understand their rights and responsibilities as outlined in the Bill of Sale.

Misconceptions

When it comes to the Texas Motor Vehicle Bill of Sale form, many people hold misconceptions that can lead to confusion or even legal issues. Let's clear up some of these misunderstandings.

- It’s only necessary for private sales. While it's true that a Bill of Sale is crucial for private transactions, it can also be beneficial in dealer sales. It serves as a record of the transaction, regardless of who is selling the vehicle.

- It doesn’t need to be notarized. A common belief is that notarization is optional. In Texas, notarization is not required for the Bill of Sale to be valid, but having it notarized can provide additional protection and authenticity.

- It’s the same as a title transfer. Many assume that the Bill of Sale and the title transfer are interchangeable. In reality, the Bill of Sale documents the sale, while the title transfer is the legal process that officially changes ownership in the state’s records.

- All information is optional. Some people think they can skip important details. In fact, including specific information such as the vehicle identification number (VIN), sale price, and buyer/seller information is crucial for the document's validity.

- It’s only for cars. A misconception exists that this form is limited to automobiles. The Bill of Sale can be used for a variety of motor vehicles, including trucks, motorcycles, and even trailers.

- It’s not legally binding. Some individuals believe that the Bill of Sale is merely a formality. However, it is a legally binding document that can be used in court to prove ownership and the terms of the sale.

- Once signed, it’s final and cannot be changed. Many think that once the Bill of Sale is signed, it cannot be altered. While it is a formal agreement, both parties can agree to amend the document if necessary, provided both sign the changes.

- It’s only needed for high-value transactions. Some people think that a Bill of Sale is only necessary for expensive vehicles. However, even for lower-value transactions, having a Bill of Sale can protect both the buyer and the seller in case of disputes.

Understanding these misconceptions can help you navigate the process of buying or selling a vehicle in Texas more effectively. Always ensure that you have the right documentation in place to protect your interests.

Dos and Don'ts

When filling out the Texas Motor Vehicle Bill of Sale form, it is essential to follow certain guidelines to ensure the document is completed correctly. Here are five things to do and five things to avoid:

- Do provide accurate vehicle information, including the make, model, year, and VIN.

- Do include the names and addresses of both the buyer and the seller.

- Do specify the sale price clearly to avoid any misunderstandings.

- Do sign and date the form to validate the transaction.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; incomplete forms may lead to issues later.

- Don't use abbreviations or shorthand that could cause confusion.

- Don't forget to check for spelling errors in names and addresses.

- Don't alter the form after it has been signed by both parties.

- Don't submit the form without ensuring all required fields are filled out correctly.

Browse Popular Motor Vehicle Bill of Sale Forms for US States

Trailer Bill of Sale Georgia - It can also be beneficial for insurance purposes, as proof of ownership often requires documentation.

Car Bill of Sale Printable - The form can help define any conditions that may affect the sale price or transaction.

Dmv Statement of Facts - The Bill of Sale often includes the Vehicle Identification Number (VIN) for identification.

Ohio Vehicle Bill of Sale - Recommended for all private vehicle sales to ensure clarity.

Detailed Guide for Writing Texas Motor Vehicle Bill of Sale

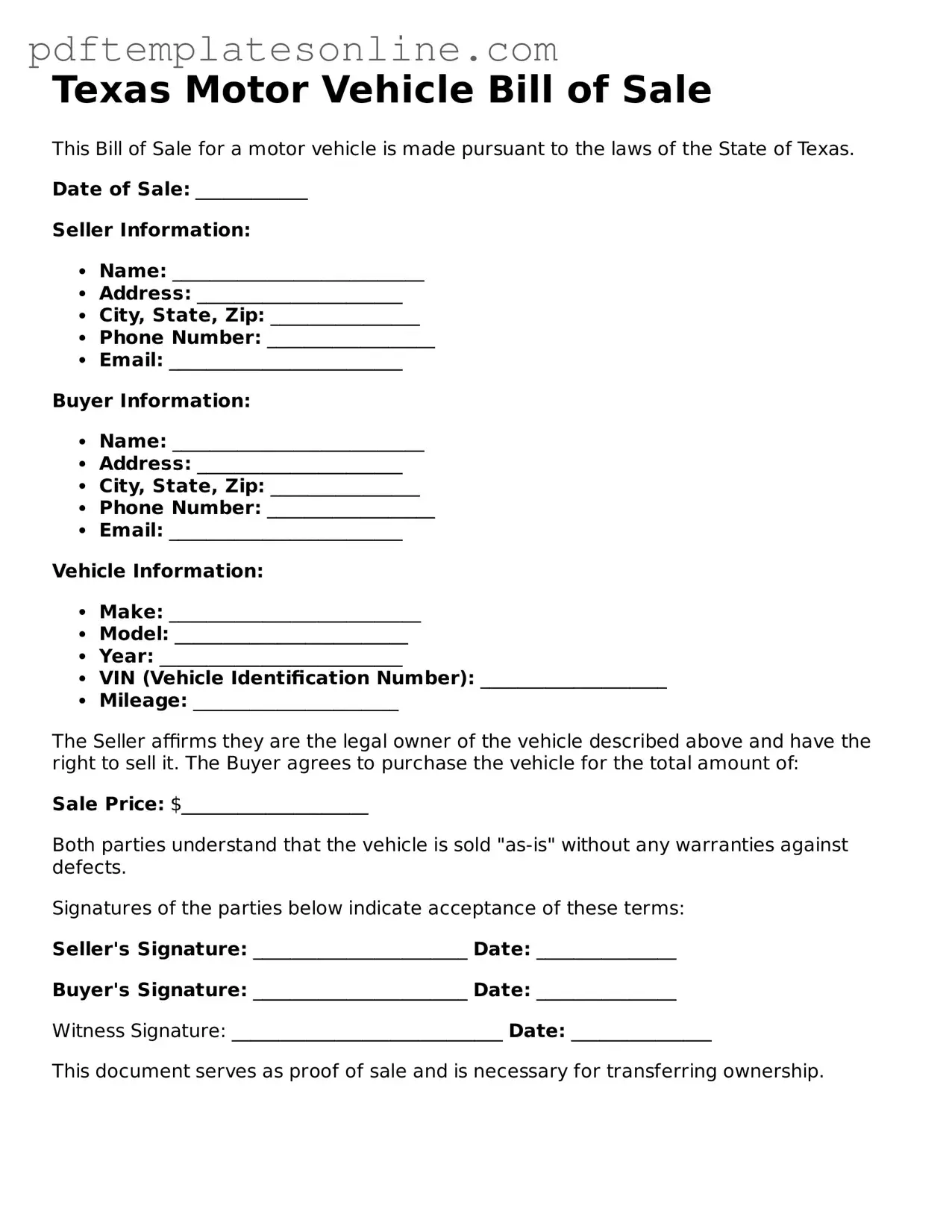

After obtaining the Texas Motor Vehicle Bill of Sale form, you’ll need to fill it out accurately to ensure a smooth transfer of ownership. This document will be important for both the buyer and seller, so taking the time to complete it correctly is essential.

- Start by entering the date of the sale at the top of the form.

- Provide the name and address of the seller. Make sure to include the seller's full name and current address.

- Next, fill in the buyer's name and address. Similar to the seller's information, include the full name and current address of the buyer.

- In the vehicle description section, include the make, model, year, and Vehicle Identification Number (VIN) of the vehicle being sold.

- Indicate the sale price of the vehicle. This should reflect the agreed-upon amount between the buyer and seller.

- Both parties should sign and date the form. The seller's signature confirms the sale, while the buyer's signature acknowledges the purchase.

- Finally, make copies of the completed form for both the buyer and seller. This ensures that each party has a record of the transaction.