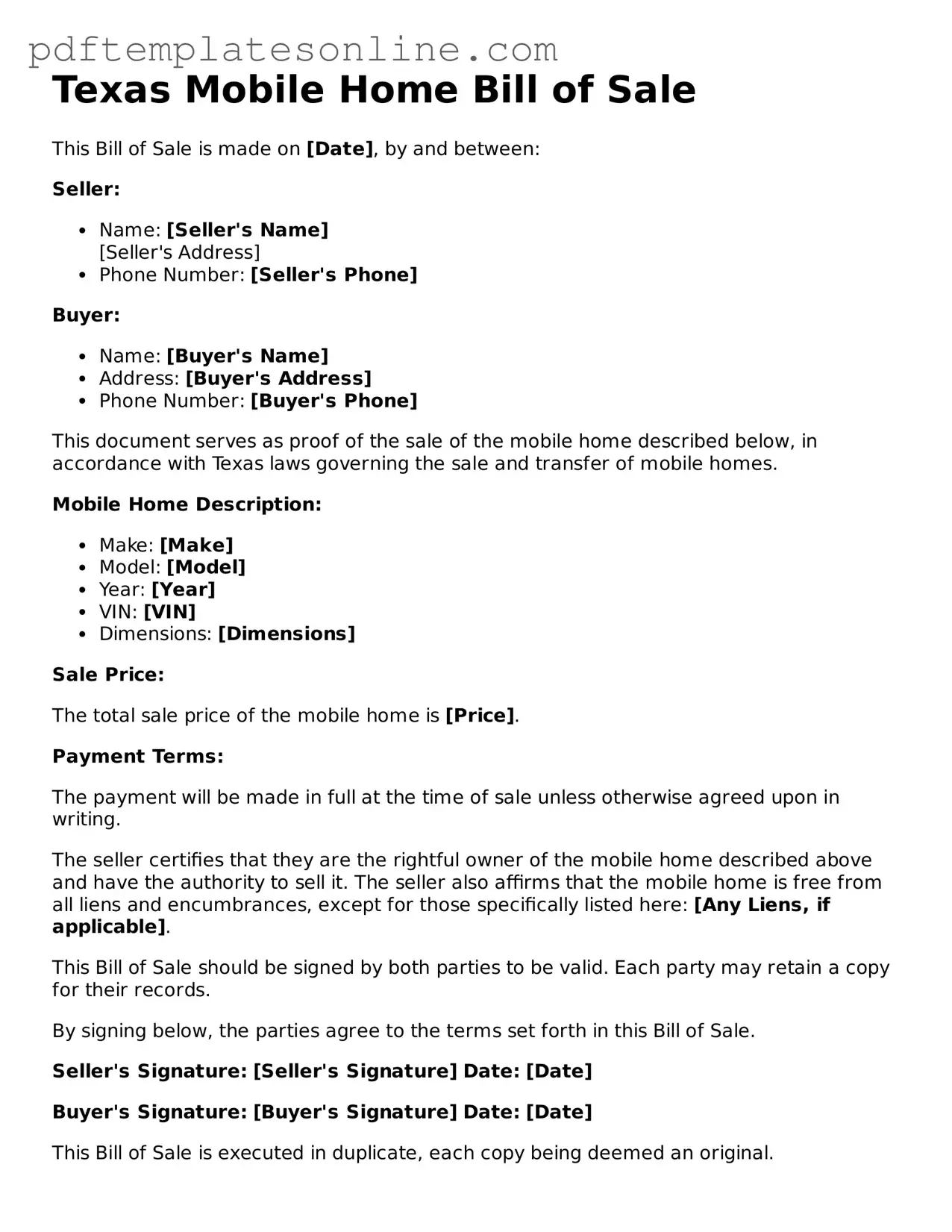

Official Texas Mobile Home Bill of Sale Document

Key takeaways

When dealing with the Texas Mobile Home Bill of Sale form, it is essential to understand its significance and how to fill it out correctly. Here are some key takeaways to consider:

- Accurate Information: Ensure that all information provided in the form is accurate. This includes the names of the buyer and seller, the mobile home’s identification number, and the sale price.

- Signatures Required: Both the buyer and seller must sign the document. Without these signatures, the bill of sale may not be considered valid.

- Notarization: While notarization is not always mandatory, having the document notarized can provide an extra layer of protection and authenticity, especially in disputes.

- Transfer of Ownership: The bill of sale serves as proof of the transfer of ownership. It is crucial for the buyer to retain this document for future reference.

- Local Regulations: Be aware of any local regulations or additional requirements that may apply to mobile home sales in your area. These can vary significantly across different jurisdictions.

- Record Keeping: Both parties should keep a copy of the completed bill of sale for their records. This can be helpful for tax purposes or in case of future legal issues.

Understanding these key points can help facilitate a smooth transaction when buying or selling a mobile home in Texas.

Common mistakes

Filling out the Texas Mobile Home Bill of Sale form can be straightforward, but mistakes often occur. One common error is failing to include all necessary information about the mobile home. This includes not only the make and model but also the Vehicle Identification Number (VIN). Omitting these details can lead to complications in the transfer of ownership.

Another frequent mistake is neglecting to provide accurate buyer and seller information. Both parties must be clearly identified, including their full names and addresses. If this information is incomplete or incorrect, it could create issues later when trying to register the mobile home or resolve disputes.

Additionally, some individuals forget to sign the form. A signature is crucial for validating the transaction. Without it, the document may not be considered legally binding. Both the seller and buyer should ensure that they sign and date the form appropriately.

Finally, people often overlook the importance of keeping a copy of the completed Bill of Sale. After filling out the form, it is essential to retain a copy for personal records. This document serves as proof of the transaction and can be invaluable in the future, especially if any questions arise regarding ownership or the terms of the sale.

Misconceptions

Many people have misunderstandings about the Texas Mobile Home Bill of Sale form. Here are some common misconceptions:

- It’s not necessary for mobile home sales. Some believe that a bill of sale is optional. However, it serves as a legal record of the transaction and protects both the buyer and seller.

- Any bill of sale will suffice. Not all bills of sale are created equal. The Texas Mobile Home Bill of Sale form includes specific information required by state law, making it essential to use the correct version.

- Only the seller needs to sign it. This is incorrect. Both the buyer and seller should sign the document to ensure that both parties agree to the terms of the sale.

- It’s only for new mobile homes. This form can be used for both new and used mobile homes. It applies to any transfer of ownership.

- The form is not needed for cash transactions. Even if the sale is conducted in cash, a bill of sale is still important. It documents the transfer and can help avoid disputes later.

- Once signed, the form doesn’t need to be filed. While the bill of sale does not need to be filed with the state, it should be kept in a safe place by both parties for their records.

Dos and Don'ts

When filling out the Texas Mobile Home Bill of Sale form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are four key actions to take and avoid:

- Do: Provide accurate information about the mobile home, including the make, model, year, and Vehicle Identification Number (VIN).

- Do: Include the full names and addresses of both the buyer and the seller to avoid any future disputes.

- Do: Sign and date the form in the appropriate sections to validate the transaction.

- Do: Keep a copy of the completed Bill of Sale for your records.

- Don't: Leave any sections blank; incomplete information can lead to complications later.

- Don't: Use white-out or erase any mistakes; instead, cross out the error and write the correct information clearly.

- Don't: Forget to check for any additional requirements specific to your county or municipality.

- Don't: Rush the process; take your time to ensure all details are correct before submitting the form.

Browse Popular Mobile Home Bill of Sale Forms for US States

Bill of Sale for Car Georgia Template - Helps clarify the agreed terms of the mobile home sale.

Completing the Employment Application PDF form is crucial for candidates, as it not only consolidates essential information required by employers but also enhances the chances of securing an interview. For those looking to streamline their application process, a convenient option can be found at https://mypdfform.com/blank-employment-application-pdf, which provides a blank application to fill out with your details.

Dmv Family Transfer - The Mobile Home Bill of Sale is a document used to transfer ownership of a mobile home from one party to another.

Detailed Guide for Writing Texas Mobile Home Bill of Sale

After obtaining the Texas Mobile Home Bill of Sale form, you will need to complete it accurately to ensure a smooth transaction. This document serves as proof of the sale and transfer of ownership of a mobile home. Follow the steps below to fill out the form correctly.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller. Ensure that all information is correct and up-to-date.

- Next, fill in the buyer's full name and address in the designated section.

- Describe the mobile home in detail. Include the make, model, year, and vehicle identification number (VIN).

- Specify the sale price of the mobile home. This amount should reflect the agreed-upon price between the buyer and seller.

- Indicate whether there are any liens on the mobile home. If there are, provide details about the lienholder.

- Both the buyer and seller should sign and date the form at the bottom. Ensure that signatures are legible.

- Finally, make copies of the completed form for both parties for their records.