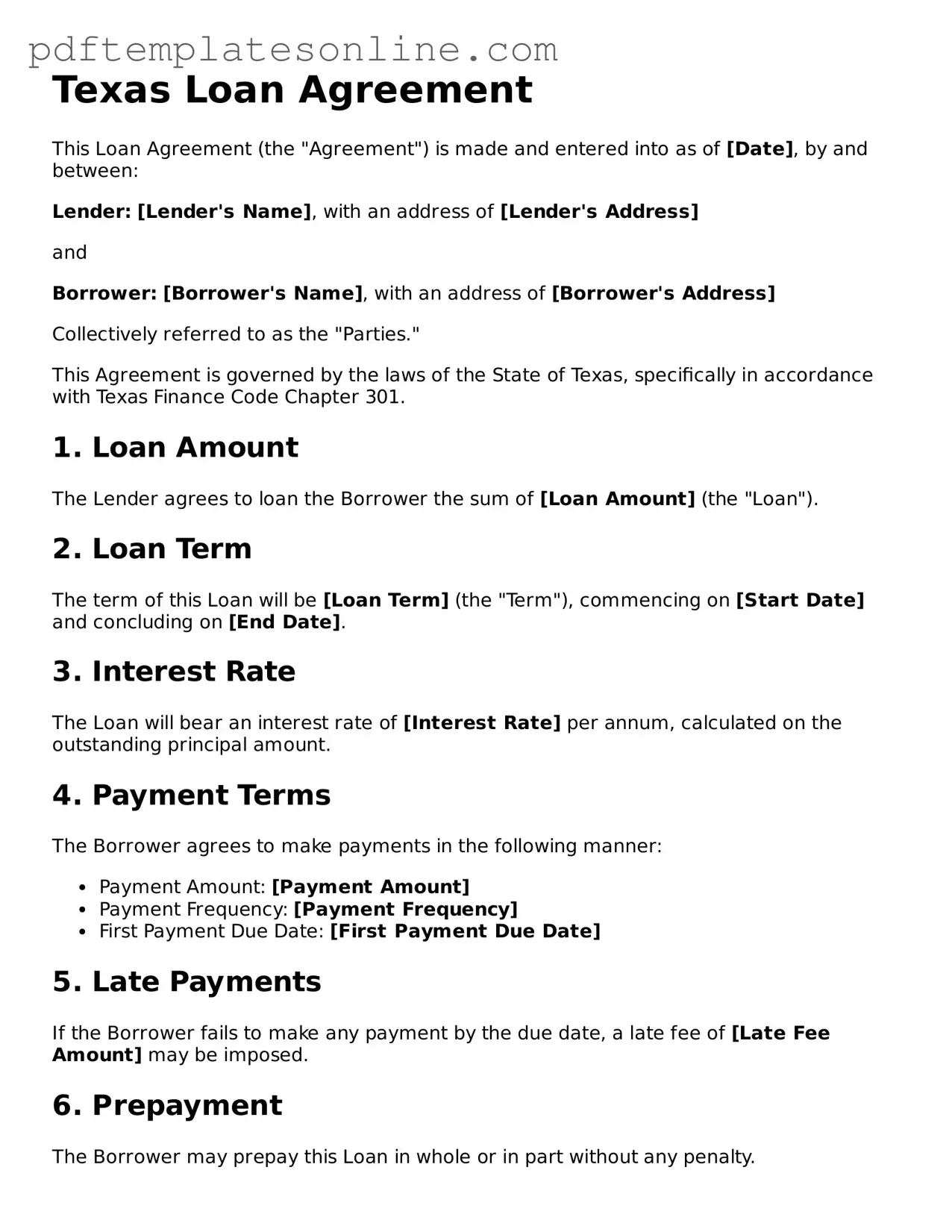

Official Texas Loan Agreement Document

Key takeaways

When filling out and using the Texas Loan Agreement form, there are several important points to keep in mind. Here are the key takeaways:

- Ensure all parties involved are clearly identified, including names and addresses.

- Specify the loan amount in clear terms to avoid confusion later.

- Include the interest rate and how it will be calculated.

- Outline the repayment schedule, detailing when payments are due.

- State the consequences of late payments or defaults on the loan.

- Include any collateral that may secure the loan, if applicable.

- Make sure to sign and date the agreement to make it legally binding.

- Consider having the agreement notarized for added protection.

- Keep a copy of the signed agreement for your records.

These takeaways will help ensure that the loan agreement is clear and enforceable, protecting the interests of all parties involved.

Common mistakes

When completing the Texas Loan Agreement form, individuals often overlook crucial details that can lead to complications. One common mistake is failing to provide accurate personal information. This includes names, addresses, and Social Security numbers. Inaccurate information can delay processing and may even result in the rejection of the loan application.

Another frequent error is neglecting to read the terms and conditions thoroughly. Borrowers may skim through the fine print, missing essential clauses regarding interest rates, repayment schedules, and penalties for late payments. Understanding these details is vital to avoid unexpected surprises later on.

Additionally, many people forget to include all required documentation. Lenders typically ask for proof of income, employment verification, and other financial statements. Omitting these documents can slow down the approval process or lead to outright denial of the loan.

Some applicants also miscalculate their financial capabilities. They may overestimate their ability to repay the loan, which can result in financial strain. It is important to assess one’s budget realistically before committing to a loan agreement.

Finally, individuals sometimes fail to sign and date the form correctly. A missing signature or incorrect date can render the agreement invalid. Ensuring that every required section is completed accurately is essential for the legal enforceability of the loan agreement.

Misconceptions

When dealing with the Texas Loan Agreement form, several misconceptions can lead to confusion. Here are eight common misunderstandings:

- All loan agreements are the same. Each loan agreement can vary significantly based on the terms, conditions, and parties involved. It's essential to read each agreement carefully.

- Verbal agreements are sufficient. A written loan agreement is crucial. Verbal agreements can be difficult to enforce and often lead to disputes.

- Only lenders need to understand the agreement. Borrowers should also be well-informed. Knowing your rights and obligations helps prevent future issues.

- Loan agreements are only for large amounts. Even small loans should have a written agreement. This protects both parties, regardless of the amount involved.

- Signing a loan agreement means you can't negotiate. Many terms can be negotiated before signing. Don't hesitate to ask for changes that better suit your needs.

- Loan agreements are permanent. Some agreements can be modified or refinanced. Understanding the process can provide flexibility in your financial planning.

- All loan agreements include the same fees. Fees can vary widely. Always review the agreement for any hidden costs or charges.

- Once signed, you can't back out. There may be options to rescind an agreement under specific circumstances. Knowing these can offer peace of mind.

Understanding these misconceptions can help you navigate the Texas Loan Agreement form more effectively. Always seek clarification on any terms that seem unclear.

Dos and Don'ts

When filling out the Texas Loan Agreement form, it is important to approach the task carefully. Here are some key dos and don'ts to keep in mind.

- Do read the entire form thoroughly before starting to fill it out.

- Do provide accurate and complete information to avoid delays.

- Do double-check all figures and calculations for correctness.

- Do sign and date the form in the designated areas.

- Don't leave any required fields blank; this can lead to rejection.

- Don't use white-out or other correction methods on the form.

- Don't rush through the process; take your time to ensure everything is correct.

Following these guidelines will help ensure a smoother experience when completing the Texas Loan Agreement form.

Browse Popular Loan Agreement Forms for US States

Loan Agreement Template Georgia - Can provide tabs for additional borrower or lender information.

The Emotional Support Animal Letter is a document that certifies an individual's need for an emotional support animal (ESA). This letter typically comes from a licensed mental health professional and serves to help individuals manage their mental health challenges. By clarifying the importance of ESAs, this letter enables individuals to live more comfortably while receiving the support they require, and you can find a template for this letter at https://mypdfform.com/blank-emotional-support-animal-letter/.

Detailed Guide for Writing Texas Loan Agreement

Filling out the Texas Loan Agreement form is a straightforward process. By carefully following these steps, you can ensure that all necessary information is provided accurately. This will help facilitate the loan process smoothly and efficiently.

- Read the Instructions: Begin by reviewing any instructions provided with the form. This will give you a clear understanding of what information is required.

- Enter Borrower Information: Fill in the borrower's full name, address, and contact information. Make sure this information is accurate and up-to-date.

- Provide Lender Information: Next, enter the lender's name, address, and contact details. This is crucial for communication regarding the loan.

- Specify Loan Amount: Clearly state the total amount of the loan being requested. Double-check this figure for accuracy.

- Detail Loan Terms: Outline the terms of the loan, including the interest rate, repayment schedule, and any fees associated with the loan.

- Sign and Date: Both the borrower and lender must sign and date the agreement. This signifies that both parties agree to the terms outlined in the document.

- Make Copies: After completing the form, make copies for both the borrower and lender. This ensures that each party has a record of the agreement.

Once the form is filled out and signed, you can proceed with the next steps in the loan process, such as submitting the agreement to the lender or discussing any additional requirements.