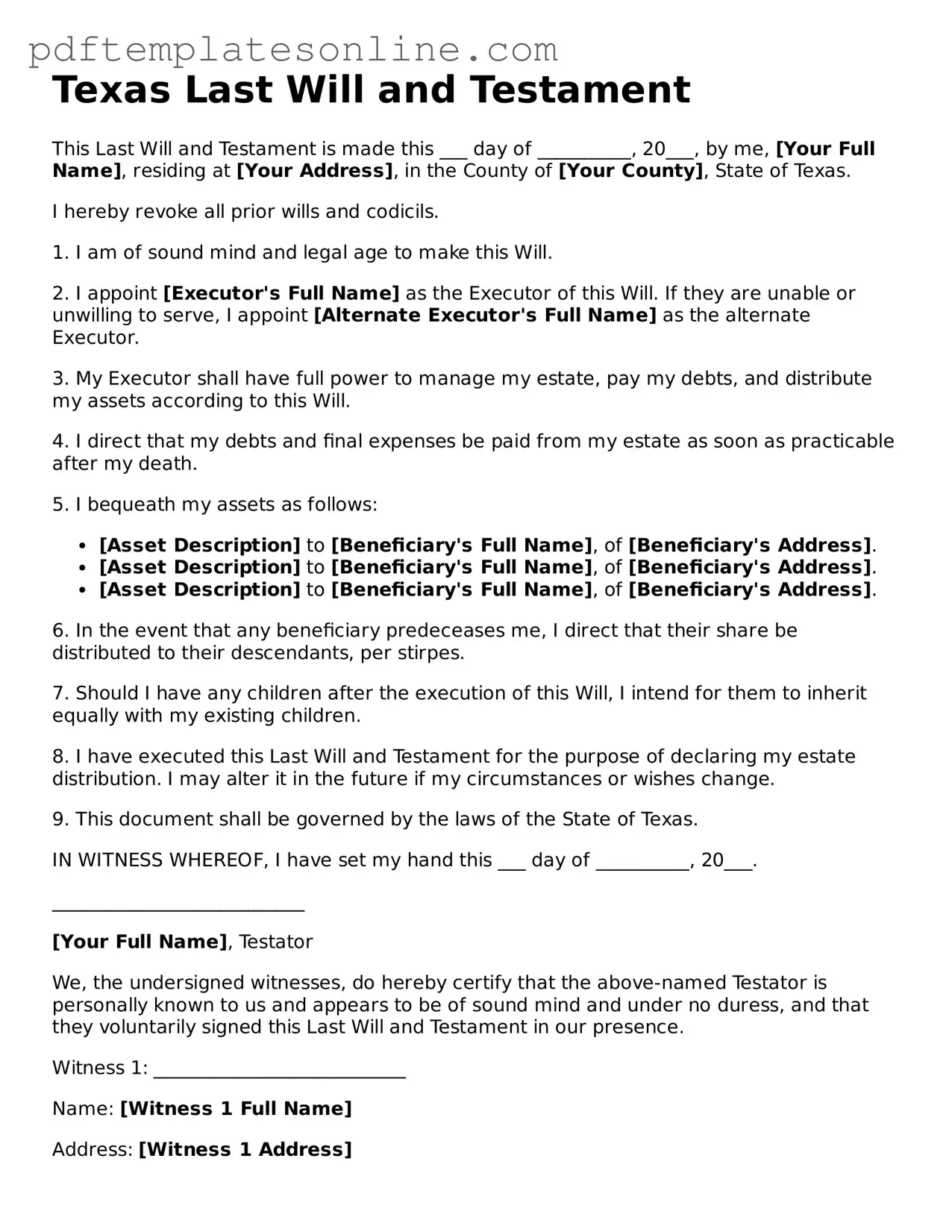

Official Texas Last Will and Testament Document

Key takeaways

When filling out and using the Texas Last Will and Testament form, it's important to keep several key points in mind. Here are some essential takeaways:

- The form must be signed in front of two witnesses. These witnesses should not be beneficiaries of the will.

- Clear language is crucial. Use simple and direct terms to express your wishes regarding the distribution of your assets.

- Specify an executor. This person will be responsible for carrying out your wishes as stated in the will.

- Consider including a clause for guardianship if you have minor children. This will ensure their care is managed according to your wishes.

- Review the will regularly. Life changes, such as marriage or the birth of a child, may require updates to your will.

- Keep the original will in a safe place. Inform your executor and trusted family members where it can be found.

- Understand that a will only takes effect upon your death. It does not manage your assets while you are still alive.

- Consult with a legal professional if you have complex assets or specific concerns. Their guidance can help ensure your will is valid and effective.

Common mistakes

Creating a Last Will and Testament in Texas is an important step in ensuring that your wishes are honored after your passing. However, many individuals make common mistakes that can lead to complications or even invalidate the will. Understanding these pitfalls can help you navigate the process more effectively.

One frequent mistake is failing to properly sign the document. In Texas, a will must be signed by the testator, the person making the will. If the will is not signed, it will not be considered valid. Additionally, if the signature is placed in an unusual location or is missing altogether, it can create confusion about the testator's intentions.

Another common error involves not having the required witnesses. Texas law mandates that a will must be witnessed by at least two individuals who are at least 14 years old. If the witnesses do not meet these criteria or if their signatures are missing, the will may be challenged in court.

Some individuals also overlook the importance of clearly identifying beneficiaries. Vague language can lead to disputes among family members. It is essential to specify who receives what, and to include full names and relationships to avoid any ambiguity.

Moreover, failing to update the will after significant life events is a mistake that can have serious repercussions. Changes such as marriage, divorce, or the birth of a child should prompt a review and potential revision of the will. If the will does not reflect current circumstances, it may not serve its intended purpose.

Another issue arises when individuals do not consider the implications of their choices regarding guardianship for minor children. Failing to name a guardian can lead to uncertainty about who will care for the children in the event of the parents' death. It is crucial to designate a trustworthy individual to assume this responsibility.

Some people mistakenly believe that a handwritten will, or holographic will, is always valid. While Texas does recognize holographic wills, they must meet specific criteria. If the document is not entirely in the testator's handwriting or lacks proper signatures, it may not be enforceable.

Additionally, neglecting to include a self-proving affidavit can complicate the probate process. This affidavit, signed by the witnesses, can expedite the validation of the will and reduce the need for witnesses to appear in court.

Finally, individuals often fail to store the will in a safe and accessible location. A will that cannot be found after the testator's death can lead to significant delays and complications in the probate process. It is advisable to keep the will in a secure place and inform trusted family members or an attorney about its location.

Misconceptions

- All wills must be notarized to be valid. While having a will notarized can add an extra layer of authenticity, it is not a requirement for a will to be legally valid in Texas. A handwritten will, also known as a holographic will, can be valid without notarization if it meets certain criteria.

- Only lawyers can create a valid will. Many individuals successfully draft their own wills without legal assistance. Texas law allows for individuals to prepare their own Last Will and Testament, provided they follow the state’s guidelines.

- Once a will is created, it cannot be changed. This is a common misconception. In Texas, individuals can revise or revoke their wills at any time as long as they are of sound mind. It is essential to follow the proper procedures for making changes to ensure the will remains valid.

- A will can dictate what happens to my body after I die. While a will can express your wishes regarding funeral arrangements, it is not legally binding. It is advisable to communicate your desires to family members or create a separate document for such instructions.

- All assets must go through probate. Not all assets are subject to probate in Texas. Certain assets, such as those held in a living trust or designated beneficiaries on accounts, can pass outside of probate, simplifying the transfer process.

- My spouse automatically inherits everything. This is not necessarily true. While Texas law provides for community property rights, individual wills can override these rights. It is essential to specify your wishes in your will to ensure they are honored.

- Having a will means my estate will avoid taxes. A will does not exempt an estate from taxes. Estate taxes depend on various factors, including the total value of the estate and applicable tax laws at the time of death.

- Only wealthy individuals need a will. Every adult should consider having a will, regardless of their financial situation. A will ensures that your wishes are followed regarding asset distribution and guardianship of minor children.

Dos and Don'ts

When filling out the Texas Last Will and Testament form, it is important to follow specific guidelines to ensure that your wishes are clearly expressed. Here are five things you should and shouldn't do:

- Do ensure that you are of sound mind and at least 18 years old when completing the form.

- Do clearly identify yourself, including your full name and address, to avoid any confusion.

- Do specify your beneficiaries clearly, stating who will receive your assets.

- Do sign the document in the presence of at least two witnesses, who should also sign the form.

- Do keep the will in a safe place and inform your loved ones about its location.

- Don't use vague language that may lead to misunderstandings regarding your wishes.

- Don't attempt to fill out the form under duress or without proper understanding.

- Don't forget to date the will; this helps establish its validity.

- Don't leave out any important details about your assets or debts.

- Don't forget to review and update your will as your circumstances change.

Browse Popular Last Will and Testament Forms for US States

Ohio Will Template - Important for anyone with assets, regardless of size or type.

California Holographic Will - A crucial document in estate planning to minimize confusion and conflict.

Free Ny Will Template - A crucial document that helps in structuring how assets are divided among beneficiaries.

Is It Legal to Write Your Own Will - Serves to affirm relationships and commitments through planned distribution after death.

Detailed Guide for Writing Texas Last Will and Testament

Once you have your Texas Last Will and Testament form ready, it's time to fill it out carefully. Each section requires specific information about your assets, beneficiaries, and executor. Take your time to ensure accuracy, as this document will guide the distribution of your estate.

- Begin with your full name and address at the top of the form. Make sure to use your legal name as it appears on official documents.

- Specify the date on which you are creating this will. This is important for establishing the will's validity.

- Clearly state that this document is your Last Will and Testament. A simple declaration at the beginning suffices.

- List your beneficiaries. Include their full names and relationships to you. Be specific about what each person will inherit.

- Designate an executor. This person will be responsible for carrying out your wishes. Include their full name and contact information.

- Outline how you want your debts and taxes to be handled. Specify if you want them paid from your estate before distribution to beneficiaries.

- Include any special instructions. This could involve guardianship for minor children or specific bequests of personal property.

- Sign and date the document in the presence of at least two witnesses. They should also sign the will, confirming that they witnessed your signature.

- Make copies of the signed will for your records and for your executor. Store the original in a safe place.