Official Texas Lady Bird Deed Document

Key takeaways

Here are some important points to consider when filling out and using the Texas Lady Bird Deed form:

- The Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining certain rights.

- It is often used to avoid probate, simplifying the transfer process upon the owner's death.

- The property owner can continue to live in the property and manage it as usual during their lifetime.

- To complete the form, accurate property descriptions are necessary to avoid any confusion later.

- Both the grantor (the person transferring the property) and the beneficiaries must be clearly identified on the deed.

- It is recommended to have the deed notarized to ensure its validity.

- After filling out the form, it must be filed with the county clerk in the county where the property is located.

- The deed becomes effective immediately upon recording, but the grantor retains control until their passing.

- Beneficiaries should understand that they receive the property with a "step-up" in basis for tax purposes.

- Consulting with a legal professional can help clarify any specific questions or concerns regarding the deed.

Common mistakes

Filling out a Texas Lady Bird Deed form can be a straightforward process, but many individuals make common mistakes that can lead to complications. One frequent error is failing to include the full legal names of all parties involved. This can create confusion and may result in legal disputes later on. It is essential to ensure that the names match those on official identification documents.

Another mistake is neglecting to provide accurate property descriptions. A vague or incorrect description can lead to challenges in identifying the property in question. It is crucial to include the complete legal description of the property as recorded in public records.

Some individuals forget to sign the document. A Lady Bird Deed must be signed by the grantor, and without a signature, the deed is not valid. Additionally, witnesses may be required, depending on the circumstances. Omitting this step can invalidate the entire process.

Another common issue arises when individuals do not properly date the form. The date of signing is important for establishing the timeline of the transfer. Without a date, it may be difficult to determine when the deed was executed, which can lead to legal complications.

Many people also fail to have the deed notarized. Notarization serves to verify the identities of the signers and adds an additional layer of authenticity. Without notarization, the deed may not be accepted by title companies or courts.

Additionally, some individuals overlook the importance of recording the deed with the county clerk’s office. Recording provides public notice of the property transfer and protects the rights of the new owner. Failing to record the deed can lead to issues with future property transactions.

Another mistake is not understanding the implications of the Lady Bird Deed itself. This type of deed allows for certain rights to remain with the grantor, and misinterpretation of these rights can lead to confusion or unintended consequences. It is important to fully understand the legal effects before completing the form.

People sometimes neglect to consider tax implications when filling out the deed. Transferring property can have consequences for property taxes, and it is wise to consult a tax professional to understand these effects. Ignoring this aspect may result in unexpected financial burdens.

Another frequent error is not including any specific terms or conditions regarding the transfer. While the Lady Bird Deed is generally straightforward, adding specific instructions can help clarify the grantor's intentions and prevent future disputes.

Finally, individuals may fail to communicate with family members or other stakeholders about the deed. Transparency is key in estate planning. Not discussing the deed can lead to misunderstandings and potential conflicts among heirs. Open dialogue can help ensure that everyone is on the same page.

Misconceptions

The Texas Lady Bird Deed, also known as an enhanced life estate deed, is a valuable tool for property owners in Texas. However, several misconceptions surround its use and implications. Here are five common misunderstandings:

-

It only applies to residential property.

Many believe that the Lady Bird Deed is limited to residential properties. In reality, it can be used for various types of real estate, including commercial properties and vacant land.

-

It avoids all taxes.

Some people think that using a Lady Bird Deed completely avoids taxes. While it can help avoid probate, it does not exempt the property from property taxes or capital gains taxes upon sale.

-

It automatically transfers ownership upon death.

There is a misconception that the property automatically transfers to the designated beneficiaries upon the owner's death. While the deed does facilitate this transfer, it is essential that the deed is properly executed and recorded to ensure its effectiveness.

-

It cannot be revoked.

Some believe that once a Lady Bird Deed is executed, it cannot be changed. In fact, the grantor retains the right to revoke or modify the deed at any time during their lifetime.

-

It is only beneficial for elderly individuals.

This deed is often thought to be a tool exclusively for seniors. However, anyone who wishes to manage their property and plan for the future can benefit from a Lady Bird Deed, regardless of age.

Understanding these misconceptions can help individuals make informed decisions about their estate planning and property management strategies.

Dos and Don'ts

When filling out the Texas Lady Bird Deed form, it is important to follow specific guidelines to ensure accuracy and compliance. Here are eight things you should and shouldn't do:

- Do make sure to include the full legal names of all parties involved.

- Do clearly describe the property being transferred.

- Do check for any existing liens or encumbrances on the property.

- Do ensure that the form is signed in front of a notary public.

- Don't leave any sections of the form blank.

- Don't use abbreviations or nicknames for the parties involved.

- Don't forget to file the completed deed with the county clerk.

- Don't ignore state-specific requirements that may apply.

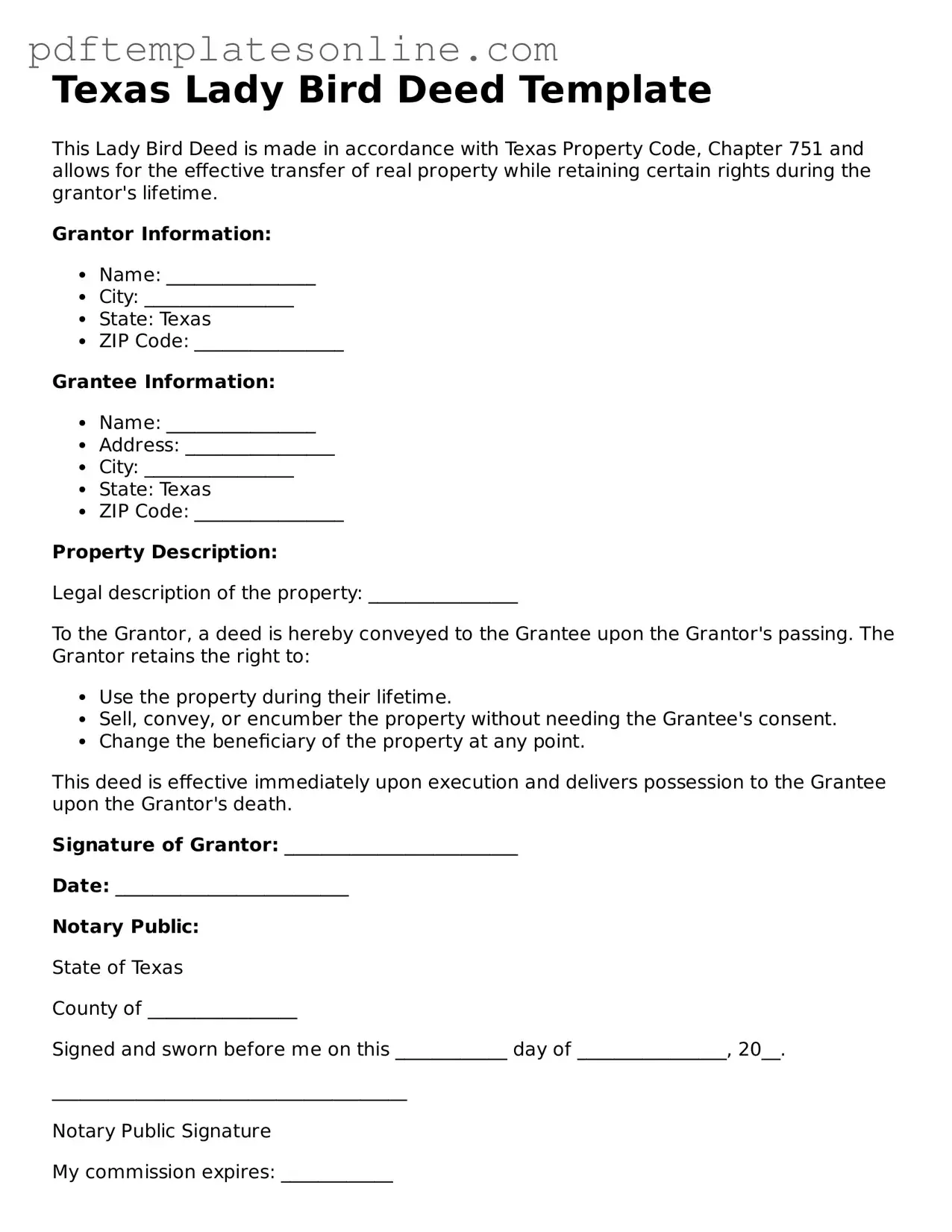

Detailed Guide for Writing Texas Lady Bird Deed

After obtaining the Texas Lady Bird Deed form, you will need to carefully fill it out to ensure all necessary information is accurately provided. The next steps will guide you through the process of completing the form correctly.

- Begin by entering the date at the top of the form.

- Provide the name and address of the grantor, which is the person transferring the property.

- List the name and address of the grantee, who will receive the property.

- Clearly describe the property being transferred. Include the legal description and address of the property.

- Indicate any specific conditions or instructions regarding the transfer, if applicable.

- Sign the form in the designated area. Ensure that the signature matches the name of the grantor.

- Have the form notarized. A notary public must witness the signing of the document.

- Make copies of the completed and notarized form for your records.

- File the original deed with the county clerk’s office in the county where the property is located.