Official Texas Horse Bill of Sale Document

Key takeaways

When dealing with the Texas Horse Bill of Sale form, several key points are essential for ensuring a smooth transaction. Understanding these elements can help both buyers and sellers navigate the process effectively.

- Identification of Parties: Clearly identify both the seller and the buyer. Include full names and contact information to avoid any ambiguity.

- Horse Description: Provide a detailed description of the horse being sold. This should include the horse's breed, age, color, and any identifying marks or registration numbers.

- Purchase Price: Clearly state the agreed-upon purchase price. This ensures both parties have a mutual understanding of the financial terms.

- Signatures: Both parties must sign the bill of sale. This step is crucial, as it signifies agreement to the terms outlined in the document.

- Record Keeping: Keep a copy of the completed bill of sale for your records. This document serves as proof of the transaction and can be useful for future reference.

Common mistakes

When completing the Texas Horse Bill of Sale form, individuals often overlook critical details that can lead to complications. One common mistake is failing to include accurate identification information for both the buyer and the seller. This includes full names, addresses, and contact information. Inaccurate or incomplete information can create issues later, especially if disputes arise.

Another frequent error is neglecting to provide a clear description of the horse being sold. This should encompass not only the horse's name but also its breed, age, color, and any identifying marks. A vague description may lead to misunderstandings about the horse's identity, which could complicate ownership verification.

People also sometimes forget to specify the terms of the sale. This includes the purchase price and any payment arrangements. Without these details, the agreement lacks clarity, which can result in disputes over what was agreed upon. It’s essential to document all financial terms clearly to avoid future disagreements.

Additionally, some individuals fail to include the date of the sale. This date is crucial for establishing the timeline of ownership transfer. Without it, the record may not hold up in legal situations, particularly if questions about ownership arise later.

Another mistake is not having the document signed by both parties. A bill of sale is only valid when it is signed, so both the buyer and seller must provide their signatures. Without this step, the transaction may not be legally enforceable, leading to potential issues down the line.

Finally, individuals often neglect to keep a copy of the completed form. Retaining a copy ensures that both parties have a record of the transaction. This can be vital for future reference, especially if any disputes or questions about the sale come up later.

Misconceptions

The Texas Horse Bill of Sale form is an important document for anyone buying or selling a horse in Texas. However, several misconceptions surround its use and requirements. Here are five common misunderstandings:

- 1. A Bill of Sale is not necessary for horse transactions. Many believe that a verbal agreement suffices. However, having a written Bill of Sale protects both parties and provides clear evidence of the transaction.

- 2. The form is only needed for registered horses. Some think that only horses with registration papers require a Bill of Sale. In reality, all horse sales benefit from a Bill of Sale, regardless of registration status.

- 3. The seller is responsible for all liabilities after the sale. There is a misconception that once the horse is sold, the seller retains all liability. In fact, the Bill of Sale can include clauses that transfer certain liabilities to the buyer.

- 4. The Bill of Sale must be notarized. While notarization adds an extra layer of authenticity, it is not a legal requirement for the Bill of Sale in Texas. Both parties can sign the document without a notary present.

- 5. The form is the same for all livestock transactions. Some individuals assume that the Bill of Sale form for horses is interchangeable with those for other livestock. Each type of animal may have specific requirements, so using the correct form is crucial.

Understanding these misconceptions can help buyers and sellers navigate the horse transaction process more effectively and ensure that their rights are protected.

Dos and Don'ts

When filling out the Texas Horse Bill of Sale form, there are several important actions to take and avoid. Below is a list of dos and don'ts to ensure the process is smooth and effective.

- Do provide accurate information about the horse, including its breed, age, and registration number.

- Do include the names and contact information of both the buyer and seller.

- Do clearly state the sale price and any terms of payment.

- Do have both parties sign and date the document to validate the sale.

- Don't leave any fields blank; incomplete forms can lead to confusion.

- Don't use vague descriptions; specificity helps avoid disputes later.

- Don't forget to keep a copy of the signed bill of sale for your records.

- Don't rush through the process; take your time to review all details carefully.

Browse Popular Horse Bill of Sale Forms for US States

Horse Bill of Sale Template - The form often includes a description of the horse, including breed and color.

The Washington Employment Verification form is a vital resource for employers seeking to verify an employee's job status and salary information, which can be particularly important in scenarios such as loan approvals and rental applications. By utilizing this form, both parties can ensure clarity and trust in their professional relationship. To learn more about how to properly complete this essential document, you can access the Employment Verification form here.

Detailed Guide for Writing Texas Horse Bill of Sale

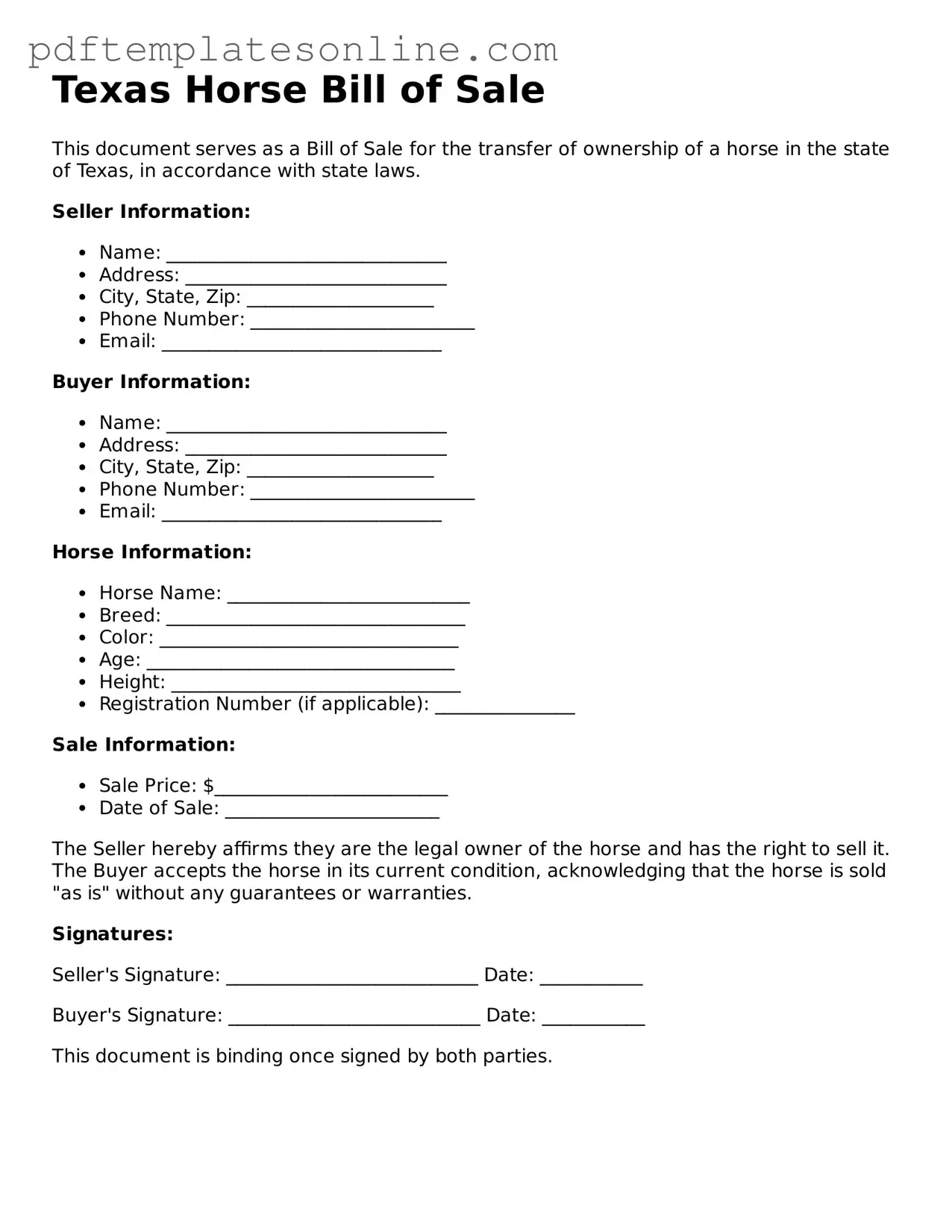

Filling out the Texas Horse Bill of Sale form is a straightforward process that requires careful attention to detail. Once completed, this form serves as a crucial document for the transfer of ownership of a horse. Below are the steps to ensure the form is filled out correctly.

- Obtain the Form: Start by downloading or printing the Texas Horse Bill of Sale form from a reliable source.

- Seller Information: Enter the seller's full name, address, and contact information in the designated fields.

- Buyer Information: Fill in the buyer's full name, address, and contact details just as you did for the seller.

- Horse Description: Provide a detailed description of the horse. Include its name, breed, age, color, and any identifying marks or registration numbers.

- Sale Price: Clearly state the agreed-upon sale price for the horse. Make sure this amount is accurate and legible.

- Date of Sale: Write the date on which the sale is taking place. This is important for record-keeping purposes.

- Signatures: Both the seller and buyer must sign the form. Ensure that each party includes the date of their signature.

- Witness (if required): If a witness is needed, have them sign and provide their contact information as well.

Once the form is filled out, it’s advisable to keep a copy for your records. Both parties should retain their copies for future reference, ensuring a smooth transition of ownership.