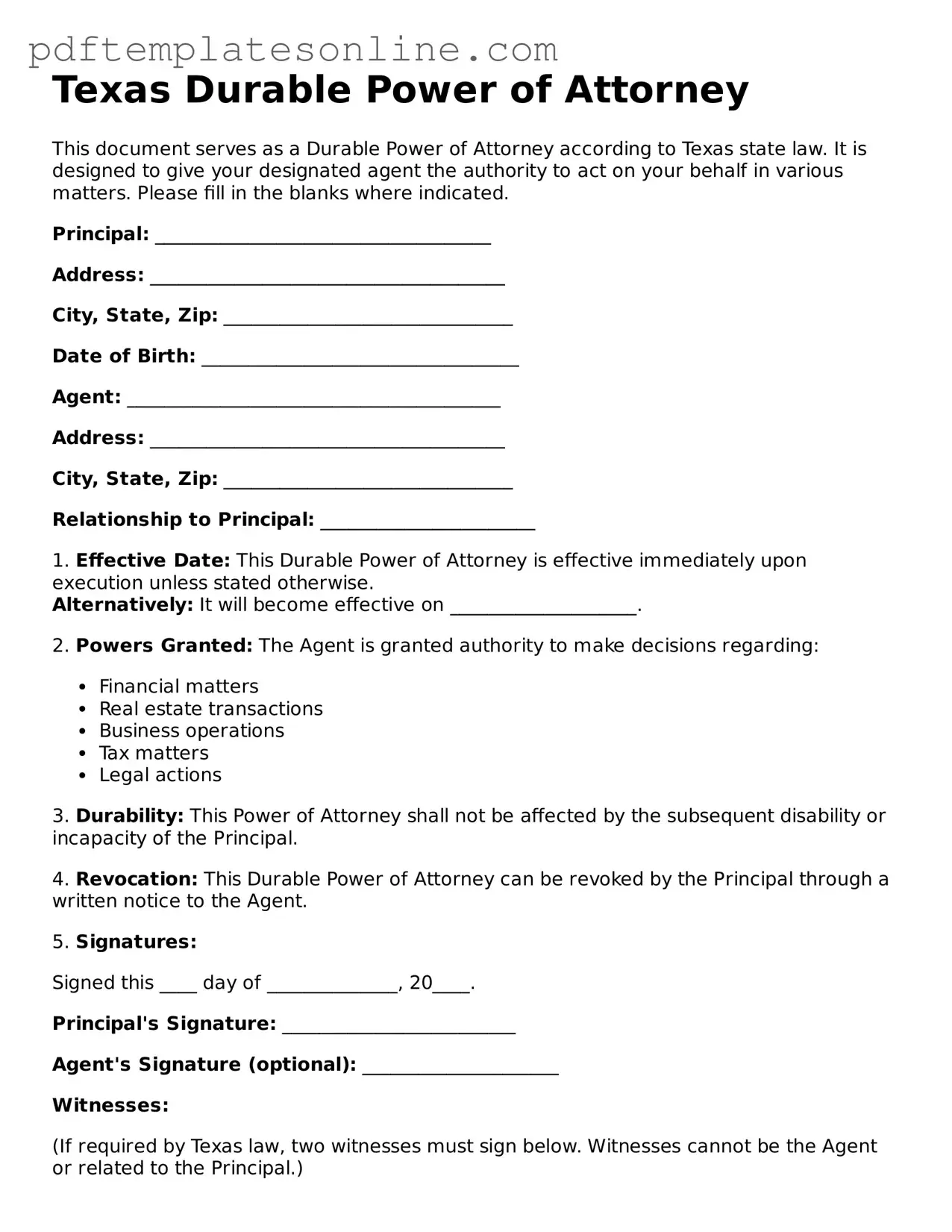

Official Texas Durable Power of Attorney Document

Key takeaways

When considering a Texas Durable Power of Attorney (DPOA), it is essential to understand its purpose and the implications of filling it out correctly. Here are some key takeaways to keep in mind:

- Authority Granted: The DPOA allows you to appoint someone to make financial and legal decisions on your behalf. This person, known as your agent, can manage your affairs if you become incapacitated.

- Durability Feature: Unlike a regular power of attorney, a durable power of attorney remains effective even if you become mentally incapacitated. This ensures that your financial matters can continue to be handled without interruption.

- Specific Instructions: It is important to be clear about the powers you are granting. You can specify what decisions your agent can make, such as handling bank transactions, selling property, or managing investments.

- Revocation: You have the right to revoke the DPOA at any time, as long as you are mentally competent. It is crucial to inform your agent and any relevant institutions when you decide to revoke the document.

Common mistakes

Filling out a Texas Durable Power of Attorney form can be a straightforward process, but many individuals encounter common mistakes that can lead to complications down the line. One frequent error is not specifying the powers granted. The form allows you to designate specific powers to your agent, but failing to do so can result in your agent lacking the authority to make necessary decisions on your behalf.

Another common mistake is neglecting to sign the document in the presence of a notary public. In Texas, a Durable Power of Attorney must be notarized to be valid. Without this step, the document may not hold up in legal situations, potentially causing delays in decision-making when it is most needed.

Some individuals forget to date the form. A date is essential as it establishes when the document becomes effective. If the date is missing, it could lead to confusion regarding the validity of the powers granted, especially if there are multiple versions of the document in circulation.

Additionally, people often overlook the importance of choosing the right agent. Selecting someone who is not trustworthy or lacks the ability to handle financial matters can lead to significant issues. It is crucial to choose an agent who understands your wishes and can act in your best interest.

Another mistake is failing to discuss the arrangement with the chosen agent beforehand. Open communication ensures that the agent is aware of their responsibilities and is willing to accept the role. Without this conversation, the agent may feel unprepared or unwilling to act when the time comes.

Some individuals mistakenly believe that a Durable Power of Attorney remains effective indefinitely. However, if the principal becomes incapacitated, the document may need to be updated or replaced to reflect current wishes and circumstances. Regularly reviewing and updating the document is essential to ensure it aligns with your intentions.

People also sometimes forget to include alternate agents. Life is unpredictable, and the primary agent may not always be available to act. By designating alternate agents, you can ensure that someone is always ready to step in and make decisions on your behalf.

Finally, many individuals do not seek legal advice when completing the form. While it is possible to fill out the document independently, consulting with a legal professional can help clarify any uncertainties and ensure that all necessary steps are taken. This can prevent future complications and provide peace of mind.

Misconceptions

When it comes to the Texas Durable Power of Attorney (DPOA), many people hold misconceptions that can lead to confusion and mismanagement of important decisions. Here are five common misunderstandings:

- Misconception 1: A Durable Power of Attorney is only for elderly individuals.

- Misconception 2: A Durable Power of Attorney gives unlimited power to the agent.

- Misconception 3: A Durable Power of Attorney automatically goes into effect.

- Misconception 4: Once created, a Durable Power of Attorney cannot be changed.

- Misconception 5: A Durable Power of Attorney is the same as a Living Will.

This is not true. While many people associate DPOAs with aging, anyone can benefit from having one. Accidents or sudden illnesses can happen at any age, making it crucial for all adults to consider this legal tool.

While a DPOA does grant significant authority, it does not mean the agent can do anything they want. The document specifies what powers the agent has, and these can be tailored to fit the principal's wishes.

This is misleading. A DPOA can be set up to take effect immediately or only upon the principal’s incapacitation. It’s important to clarify when the powers begin to avoid confusion later on.

This is false. A principal can revoke or amend a DPOA at any time, as long as they are mentally competent. Regularly reviewing this document ensures it remains aligned with current wishes.

These are distinctly different documents. A DPOA allows someone to make financial and legal decisions on your behalf, while a Living Will outlines your wishes regarding medical treatment in the event you cannot communicate them.

Dos and Don'ts

When filling out the Texas Durable Power of Attorney form, it is essential to approach the process with care. Here’s a list of things you should and shouldn’t do to ensure that your document is completed correctly and serves its intended purpose.

- Do read the entire form carefully before starting.

- Do clearly identify the person you are appointing as your agent.

- Do specify the powers you want to grant to your agent.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless specified.

- Don't appoint someone who may have a conflict of interest.

- Don't forget to date the form when signing it.

- Don't assume that verbal agreements will be honored; everything must be in writing.

- Don't overlook state-specific requirements that may apply.

By following these guidelines, you can help ensure that your Durable Power of Attorney is both effective and legally sound.

Browse Popular Durable Power of Attorney Forms for US States

Financial Power of Attorney Georgia - Choosing a successor agent in case your primary agent is unable to serve can provide additional security.

Durable Power of Attorney California - The authority granted can be immediate or effective only upon a certain event, like incapacity.

Detailed Guide for Writing Texas Durable Power of Attorney

Filling out the Texas Durable Power of Attorney form is a straightforward process. Once completed, the form allows you to designate someone to make decisions on your behalf regarding financial matters if you become unable to do so. Follow these steps to ensure the form is filled out correctly.

- Obtain the Texas Durable Power of Attorney form. You can find it online or request a copy from a legal office.

- Read the form carefully to understand the sections that require your information.

- In the first section, provide your full name and address. This identifies you as the principal.

- Next, designate your agent by entering their full name and address. This person will act on your behalf.

- Specify the powers you wish to grant your agent. You may choose general powers or limit them to specific actions.

- Include any special instructions or limitations regarding your agent’s authority, if applicable.

- Sign and date the form in the designated area. Ensure your signature matches the name provided at the top.

- Have the form notarized. This step is crucial for the document to be legally valid in Texas.

- Provide copies of the completed form to your agent and any relevant institutions or individuals.