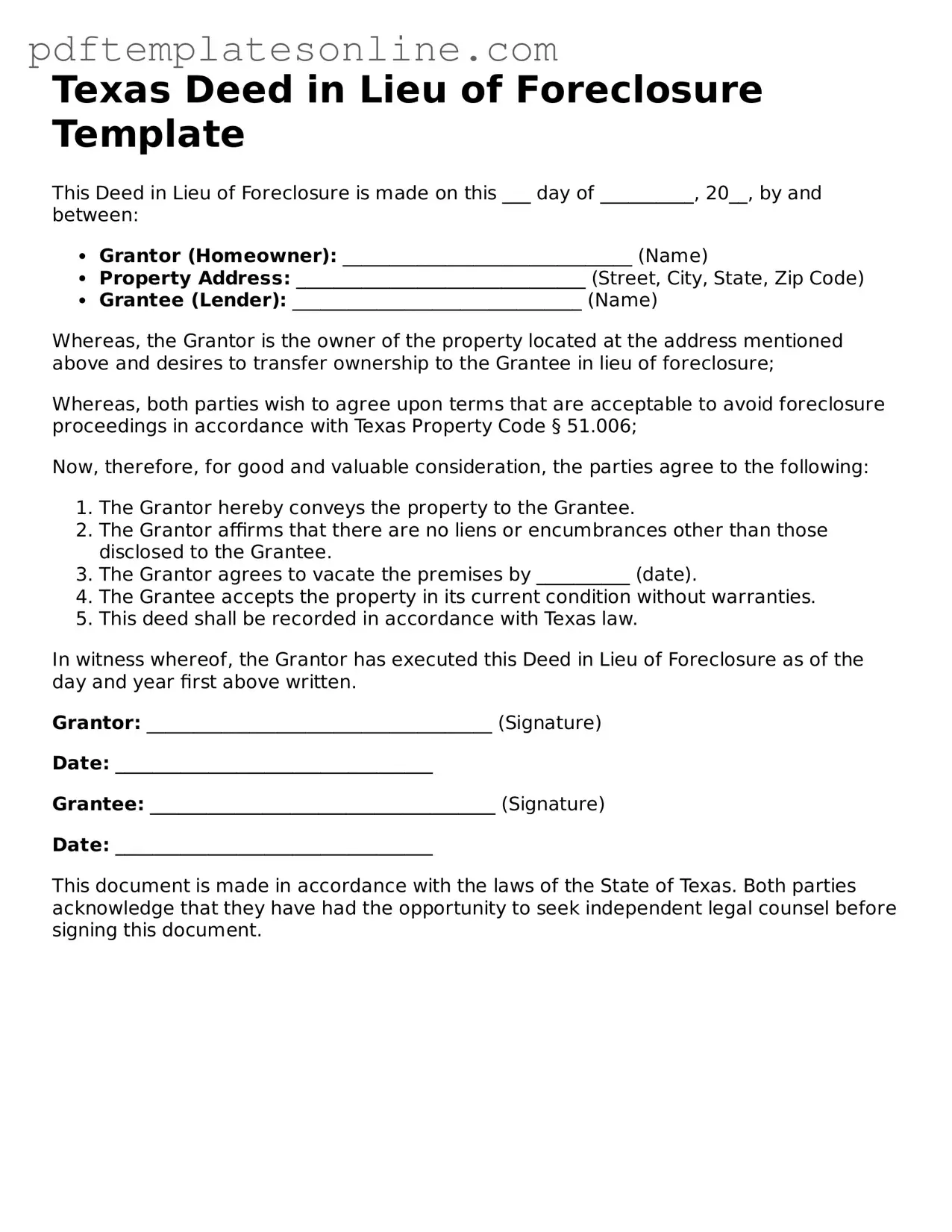

Official Texas Deed in Lieu of Foreclosure Document

Key takeaways

Filling out and using the Texas Deed in Lieu of Foreclosure form is an important step for homeowners facing foreclosure. Here are some key takeaways to keep in mind:

- Understanding the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender, thereby avoiding the foreclosure process.

- Eligibility Criteria: Homeowners must be in default on their mortgage payments and should have a clear understanding of their financial situation before considering this option.

- Consulting Professionals: It is advisable to seek guidance from a real estate attorney or a housing counselor to fully understand the implications of signing the deed.

- Reviewing the Mortgage Terms: Homeowners should review their mortgage agreement to understand any clauses related to foreclosure and the deed in lieu process.

- Property Condition: The property should be in good condition, as lenders may require it to be free of significant damage before accepting the deed.

- Potential Tax Implications: Homeowners should be aware that transferring the property may have tax consequences, including potential liability for canceled debt income.

- Documentation Requirements: Proper documentation must be completed and submitted to the lender, including the deed itself and any necessary disclosures.

- Impact on Credit Score: While a deed in lieu of foreclosure is less damaging than a foreclosure, it can still negatively affect a homeowner's credit score.

By understanding these key points, homeowners can make more informed decisions regarding their financial futures and property ownership.

Common mistakes

Filling out a Texas Deed in Lieu of Foreclosure form can be a complex process, and several common mistakes may hinder the effectiveness of this legal document. One frequent error occurs when individuals fail to provide accurate property descriptions. A precise description of the property is essential, as it helps to identify the specific parcel of land involved in the transaction. Omitting details or using vague language can lead to confusion and potential legal disputes in the future.

Another mistake often made is not obtaining the necessary signatures. All parties involved in the transaction must sign the deed for it to be valid. This includes not only the borrower but also any co-owners or other interested parties. Neglecting to gather these signatures can render the deed ineffective, leaving the borrower still responsible for the mortgage.

People may also overlook the importance of reviewing the terms of the deed. It is critical to understand what rights are being given up and what obligations remain after the deed is executed. A lack of comprehension regarding these terms can result in unexpected consequences, such as continued liability for certain debts or tax implications.

Another common error is failing to record the deed with the appropriate county office. Recording the deed is a crucial step that provides public notice of the transfer of ownership. Without this step, the deed may not be enforceable against third parties, which can lead to complications in future property transactions.

Additionally, individuals sometimes do not seek legal advice before completing the form. Consulting with a legal expert can provide valuable insights and help avoid pitfalls. Without professional guidance, borrowers may inadvertently make decisions that could adversely affect their financial situation or future property rights.

Lastly, some individuals may rush through the process, leading to mistakes in the completion of the form itself. It is essential to take the time to carefully read and fill out each section accurately. Errors such as misspellings, incorrect dates, or incomplete information can invalidate the deed or delay the foreclosure process. Taking a methodical approach ensures that all necessary details are correctly captured, ultimately facilitating a smoother transition.

Misconceptions

Understanding the Texas Deed in Lieu of Foreclosure can be challenging. Many people hold misconceptions about this legal document. Here are ten common misunderstandings, along with clarifications to help you navigate this process more effectively.

- It automatically cancels the mortgage debt. Many believe that signing a deed in lieu of foreclosure eliminates all mortgage obligations. In reality, it may not discharge any secondary liens or debts associated with the property.

- It is the same as a short sale. A deed in lieu of foreclosure is different from a short sale. In a short sale, the lender agrees to accept less than the full mortgage amount, while a deed in lieu transfers ownership back to the lender without a sale.

- It guarantees a quick resolution. While it may expedite the process compared to foreclosure, there are still necessary evaluations and approvals from the lender that can take time.

- All lenders accept deeds in lieu of foreclosure. Not every lender offers this option. It is essential to check with your lender to see if they accept a deed in lieu as a solution.

- It has no impact on your credit score. A deed in lieu of foreclosure can affect your credit score, although it may be less damaging than a full foreclosure. The impact varies based on individual circumstances.

- It is a straightforward process. While it may seem simple, the deed in lieu process involves several steps, including negotiations and paperwork that can be complex.

- Once signed, it cannot be revoked. Some think that once they sign the deed in lieu, they cannot change their mind. However, there may be opportunities to negotiate or withdraw under certain conditions before finalization.

- It is only for homeowners in financial distress. While many people facing financial difficulties consider this option, it can also be suitable for those looking to avoid the lengthy foreclosure process.

- It absolves you of all liability. Signing a deed in lieu does not necessarily release you from all liabilities. You may still be responsible for any deficiencies or other obligations tied to the mortgage.

- Legal assistance is not necessary. Many people think they can handle the deed in lieu process on their own. However, consulting with a legal expert can provide valuable guidance and help avoid pitfalls.

By addressing these misconceptions, you can better understand the Texas Deed in Lieu of Foreclosure and make informed decisions about your property and financial future.

Dos and Don'ts

When filling out the Texas Deed in Lieu of Foreclosure form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here are eight things to keep in mind:

- Do ensure that all information is accurate and complete.

- Do include the correct legal description of the property.

- Do sign the document in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to avoid errors.

- Don't leave any fields blank; fill in all required information.

- Don't forget to check for any specific lender requirements.

- Don't submit the form without reviewing it thoroughly.

Browse Popular Deed in Lieu of Foreclosure Forms for US States

Will I Owe Money After a Deed in Lieu of Foreclosure - Obtaining legal advice can help protect your interests during the process.

Deed in Lieu of Foreclosure Pa - Before proceeding, reviewing the implications of this deed on one’s credit rating is essential.

When dealing with the ownership and registration of vehicles, it's essential to use the proper legal documentation to avoid complications. One such important document is the California Motor Vehicle Power of Attorney form, which allows a specified individual to act on behalf of the vehicle owner. This is particularly useful for those who are unable to attend to these matters in person. For ease of access to this and other related documents, you might consider using California PDF Forms, which offer editable templates that can simplify the process.

California Pre-foreclosure Property Transfer - The agreement may also include stipulations regarding any remaining debts or liabilities tied to the property.

Detailed Guide for Writing Texas Deed in Lieu of Foreclosure

Once the Texas Deed in Lieu of Foreclosure form is completed, it will be submitted to the lender for review. This process can help facilitate the transfer of property and may lead to a resolution of the mortgage default. It is important to ensure that all information is accurate and complete to avoid delays.

- Obtain the Texas Deed in Lieu of Foreclosure form from a reliable source or your lender.

- Fill in the Grantor section with your full legal name as the property owner.

- In the Grantee section, write the name of the lender or the entity that will receive the property.

- Provide the property address, including the city, state, and ZIP code.

- Include the legal description of the property. This can often be found on your property deed or tax documents.

- Indicate the date of the transfer.

- Sign the form in the designated area. Ensure that your signature matches the name provided as the Grantor.

- Have the form notarized. A notary public must witness your signature to validate the document.

- Make copies of the completed and notarized form for your records.

- Submit the original form to your lender, following any specific instructions they provide.