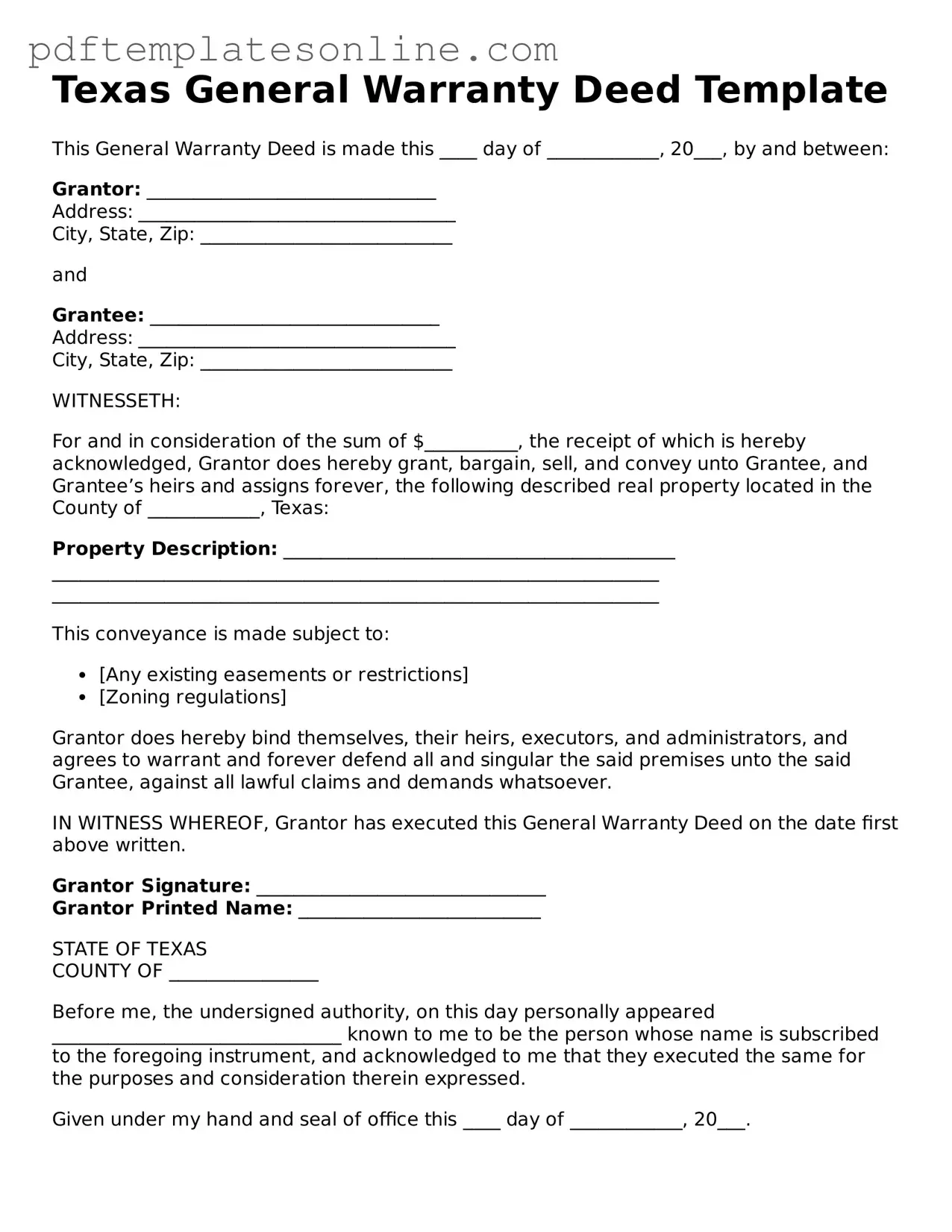

Official Texas Deed Document

Key takeaways

Filling out and using the Texas Deed form can be a straightforward process, but attention to detail is crucial. Here are some key takeaways to keep in mind:

- Ensure accurate information: All parties involved in the transaction must have their names spelled correctly, and the property description should be precise to avoid future disputes.

- Consider the type of deed: Different types of deeds, such as warranty deeds and quitclaim deeds, serve different purposes. Understanding which one is appropriate for your situation is essential.

- Signatures are vital: The deed must be signed by the grantor (the person transferring the property). Notarization is also required to validate the document legally.

- File with the county: After completing the deed, it must be filed with the county clerk’s office in the county where the property is located. This step ensures the deed is part of the public record.

Common mistakes

Filling out a Texas Deed form can seem straightforward, but many people encounter common pitfalls that can lead to complications down the line. One frequent mistake is failing to include the correct legal description of the property. The legal description must be precise, detailing the boundaries and location of the property. Omitting this information or using an inaccurate description can create confusion and disputes in the future.

Another mistake involves incorrect or incomplete names of the parties involved. It is crucial to ensure that the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property) are spelled correctly and match their official identification. Any discrepancies can lead to legal challenges that may delay or invalidate the transfer.

Many individuals also overlook the importance of including the date of execution. This date is essential as it indicates when the deed was signed and can impact the legal standing of the document. Without this date, the deed may be questioned, especially in cases where timing is critical for tax purposes or other legal considerations.

Another common error is not having the deed properly notarized. In Texas, a deed must be acknowledged by a notary public to be legally effective. Failing to do so can result in the deed being deemed invalid, which could cause significant issues for both the grantor and the grantee.

People often forget to include any necessary signatures. Both parties must sign the deed for it to be valid. In some cases, additional signatures may be required, such as those of spouses or co-owners. Neglecting this step can lead to disputes over ownership and the validity of the transaction.

Additionally, some individuals do not consider the implications of property taxes when filling out the deed. Transferring property can trigger reassessments or changes in tax liability. Understanding these implications is vital for making informed decisions about the transfer and ensuring that all tax obligations are met.

Another mistake is failing to file the deed with the appropriate county clerk's office. Once the deed is completed and signed, it must be recorded to provide public notice of the transfer. If this step is overlooked, the deed may not be enforceable against third parties, which could lead to complications in the future.

Lastly, many people underestimate the importance of seeking legal advice. While it is possible to fill out a deed form independently, consulting with a legal professional can help ensure that all aspects of the deed are correctly handled. This can save time, money, and stress by preventing mistakes that could have been easily avoided.

Misconceptions

Understanding the Texas Deed form can be challenging, especially with the various misconceptions surrounding it. Here are eight common misunderstandings, along with clarifications to help you navigate this important legal document.

-

All deeds are the same.

Many people believe that all deeds serve the same purpose. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each with unique features and implications.

-

A deed is the same as a title.

While a deed transfers ownership of property, it is not the same as a title. The title is the legal concept of ownership, whereas a deed is the physical document that conveys that ownership.

-

Only a lawyer can prepare a deed.

Although having a lawyer can be helpful, it is not mandatory. Many people successfully prepare their own deeds using templates and resources available online.

-

Once a deed is signed, it cannot be changed.

Deeds can be amended or revoked, but the process can be complex. It often requires additional legal documentation to ensure the changes are valid.

-

All deeds must be notarized.

In Texas, while notarization is common and often recommended, it is not always required for the deed to be valid. However, notarization can help prevent disputes in the future.

-

Deeds do not need to be recorded.

Recording a deed with the county clerk is essential to protect your ownership rights. Failing to record can lead to complications if disputes arise.

-

There are no fees associated with filing a deed.

There are typically fees for recording a deed, which can vary by county. It's important to check local regulations to understand the costs involved.

-

Anyone can sign a deed.

Only individuals with legal authority to convey the property can sign a deed. This usually includes the current property owner or authorized representatives.

By addressing these misconceptions, individuals can approach the Texas Deed form with greater confidence and clarity. Understanding the nuances of property transfer is crucial for anyone involved in real estate transactions.

Dos and Don'ts

When filling out the Texas Deed form, it’s essential to follow certain guidelines to ensure the document is completed correctly. Below are some important dos and don’ts to keep in mind.

- Do use clear and legible handwriting or type the information.

- Do include the full legal names of all parties involved.

- Do accurately describe the property being transferred, including its legal description.

- Do sign the deed in the presence of a notary public.

- Don't leave any required fields blank; this could lead to delays or issues.

- Don't use abbreviations for names or property descriptions.

- Don't forget to date the document; an undated deed may not be valid.

- Don't submit the deed without making copies for your records.

Browse Popular Deed Forms for US States

Release of Dower Rights Ohio Form - A legal document that transfers property ownership.

Nys Deed Form - Once a deed is filed, it becomes a public record, accessible for verification by interested parties.

For those seeking to document their firearm transactions, the guide to the California Firearm Bill of Sale is invaluable. This essential resource provides clarity on the legal requirements and ensures compliance with state laws. You can find it here with the Firearm Bill of Sale information.

Quick Claim Deeds Georgia - Legal requirements may vary by state or jurisdiction.

Detailed Guide for Writing Texas Deed

Once you have obtained the Texas Deed form, it is important to fill it out accurately to ensure that the transfer of property is legally recognized. After completing the form, it will need to be signed and possibly notarized before being filed with the appropriate county office.

- Begin by entering the date at the top of the form.

- Identify the grantor, or the person transferring the property. Provide their full name and address.

- Next, identify the grantee, or the person receiving the property. Include their full name and address as well.

- Describe the property being transferred. This typically includes the legal description, which can often be found in previous deeds or property records.

- Indicate the consideration, or the amount being paid for the property, if applicable. If the transfer is a gift, you can state that as well.

- Include any additional terms or conditions of the transfer, if necessary.

- Sign the form where indicated. If there are multiple grantors, all must sign.

- Have the signatures notarized, if required by local laws.

- File the completed deed with the county clerk’s office in the county where the property is located.