Official Texas Bill of Sale Document

Key takeaways

When filling out and using the Texas Bill of Sale form, there are several important points to consider to ensure the transaction is smooth and legally sound.

- Accurate Information: Ensure all details, including the names of the buyer and seller, are correct. Mistakes can lead to complications in ownership transfer.

- Item Description: Provide a thorough description of the item being sold. Include details such as make, model, year, and any unique identifiers like VIN for vehicles.

- Consideration Amount: Clearly state the purchase price. This amount is essential for both parties and may be required for tax purposes.

- Signatures Required: Both the buyer and seller must sign the document. This step is crucial for validating the transaction and protecting both parties' interests.

- Keep Copies: After completing the form, make copies for both the buyer and seller. These copies serve as proof of the transaction and can be useful for future reference.

Common mistakes

Filling out the Texas Bill of Sale form can be straightforward, but there are common mistakes that individuals often make. One frequent error is not including all necessary information. Buyers and sellers should provide their full names, addresses, and contact details. Omitting any of this information can lead to confusion later on.

Another mistake is failing to accurately describe the item being sold. It’s essential to include details such as the make, model, year, and Vehicle Identification Number (VIN) for vehicles. For other items, a clear description helps avoid disputes about what was sold.

Many people forget to check the date on the form. The date of the transaction is crucial for record-keeping and legal purposes. Without the correct date, it may be difficult to establish when the sale took place.

Some individuals neglect to sign the document. Both the buyer and seller must sign the Bill of Sale for it to be valid. A missing signature can render the document ineffective and complicate future claims.

Using incorrect or outdated forms is another common mistake. It’s important to ensure that you are using the most current version of the Texas Bill of Sale form. Using an old version may lead to issues with compliance.

People sometimes do not include the purchase price. This amount should be clearly stated to avoid any misunderstandings. Leaving this blank can raise questions about the legitimacy of the sale.

Another oversight is not keeping a copy of the completed Bill of Sale. Both parties should retain a copy for their records. This document serves as proof of the transaction and can be important in case of future disputes.

Some individuals fail to check for spelling errors or incorrect information. Typos can lead to confusion or misinterpretation. Double-checking the information helps ensure clarity and accuracy.

Another mistake involves not having witnesses or notarization when required. While not always necessary, having a witness or notary can add an extra layer of security to the transaction.

Lastly, individuals may not understand the implications of the Bill of Sale. It is important to recognize that this document is not just a receipt; it can have legal consequences. Understanding its significance can help both parties navigate the sale more effectively.

Misconceptions

When it comes to the Texas Bill of Sale form, several misconceptions can lead to confusion. Here are eight common misunderstandings about this important document:

- It is only necessary for vehicle sales. Many people believe that a Bill of Sale is only required for the sale of vehicles. In reality, it can be used for various transactions, including boats, trailers, and personal property.

- It must be notarized. Some think that a Bill of Sale must be notarized to be valid. While notarization can add an extra layer of authenticity, it is not a legal requirement in Texas.

- It is not legally binding. There is a misconception that a Bill of Sale is just a simple receipt and holds no legal weight. In fact, it serves as a legal document that can protect both the buyer and seller in case of disputes.

- Only the seller needs to sign it. Many assume that only the seller's signature is required. However, both parties should sign the Bill of Sale to acknowledge the transaction.

- It is not needed for gifts. Some believe that a Bill of Sale is unnecessary for gifting property. Yet, having a Bill of Sale can clarify the transfer of ownership and avoid future disputes.

- It can be handwritten and is still valid. While a Bill of Sale can be handwritten, it is essential to ensure that it includes all necessary information. A well-structured form is often more effective and less likely to lead to misunderstandings.

- It does not need to include the purchase price. Some people think that the purchase price is optional. Including the price is crucial, as it establishes the value of the transaction and can be important for tax purposes.

- It is only for private sales. Many believe that a Bill of Sale is only relevant for private transactions. However, it can also be useful in sales involving dealers or businesses to document the sale officially.

Understanding these misconceptions can help ensure that you use the Texas Bill of Sale form correctly and effectively. Always consider consulting with a legal professional if you have questions about your specific situation.

Dos and Don'ts

When filling out the Texas Bill of Sale form, there are important guidelines to follow. Here are some things you should and shouldn't do:

- Do: Provide accurate information about the buyer and seller.

- Do: Include a detailed description of the item being sold.

- Do: Sign and date the document to make it valid.

- Do: Keep a copy of the Bill of Sale for your records.

- Don't: Leave any sections blank; complete all required fields.

- Don't: Use vague language; be specific about the item.

- Don't: Forget to check for spelling errors or inaccuracies.

- Don't: Sign the form without reviewing it thoroughly.

Browse Popular Bill of Sale Forms for US States

Bill of Sale Auto Template - A Bill of Sale can also outline any post-sale obligations, such as maintenance or repair responsibilities.

Sample of Car Bill of Sale - Details the sale agreement between a buyer and a seller.

Example of a Bill of Sale for a Car - Imparts legal validity to the sale being conducted.

Georgia Dmv Bill of Sale - A Bill of Sale offers a streamlined approach to documenting sales.

Detailed Guide for Writing Texas Bill of Sale

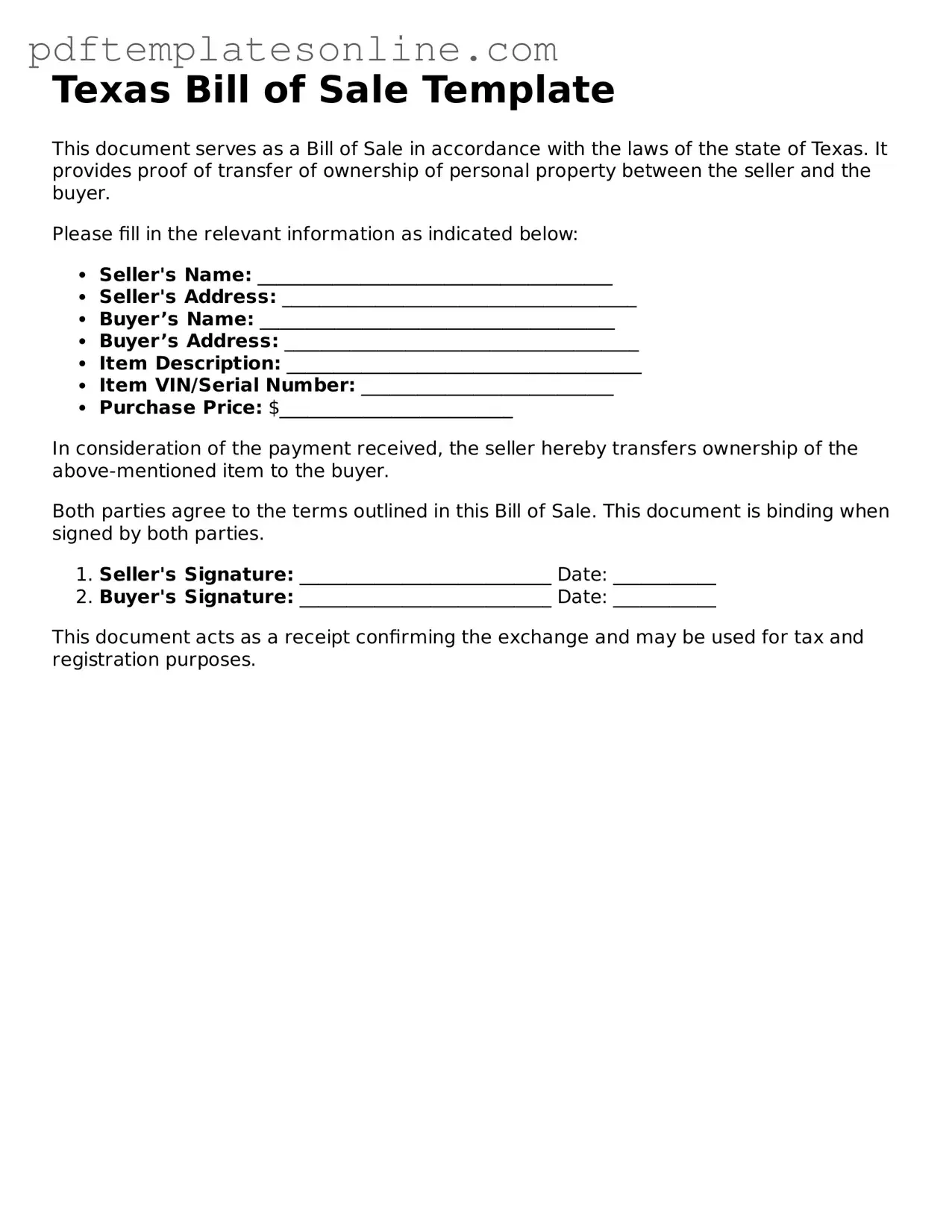

Once you have the Texas Bill of Sale form, you can proceed to fill it out with the necessary details. Ensure that all information is accurate and complete to avoid any potential issues in the future. Follow the steps outlined below to successfully complete the form.

- Begin by entering the date of the transaction at the top of the form.

- Provide the full name and address of the seller. This should include the street address, city, state, and zip code.

- Next, fill in the buyer's full name and address, ensuring that it matches their identification.

- Clearly describe the item being sold. Include details such as make, model, year, color, and Vehicle Identification Number (VIN) if applicable.

- Indicate the purchase price of the item in numerical format. Make sure this is the agreed amount between the buyer and seller.

- Both the seller and buyer should sign and date the form. Signatures must be written in the designated areas.

- If there are any additional terms or conditions, include them in the space provided, if applicable.

After completing the form, ensure that both parties retain a copy for their records. This document serves as proof of the transaction and may be necessary for future reference.