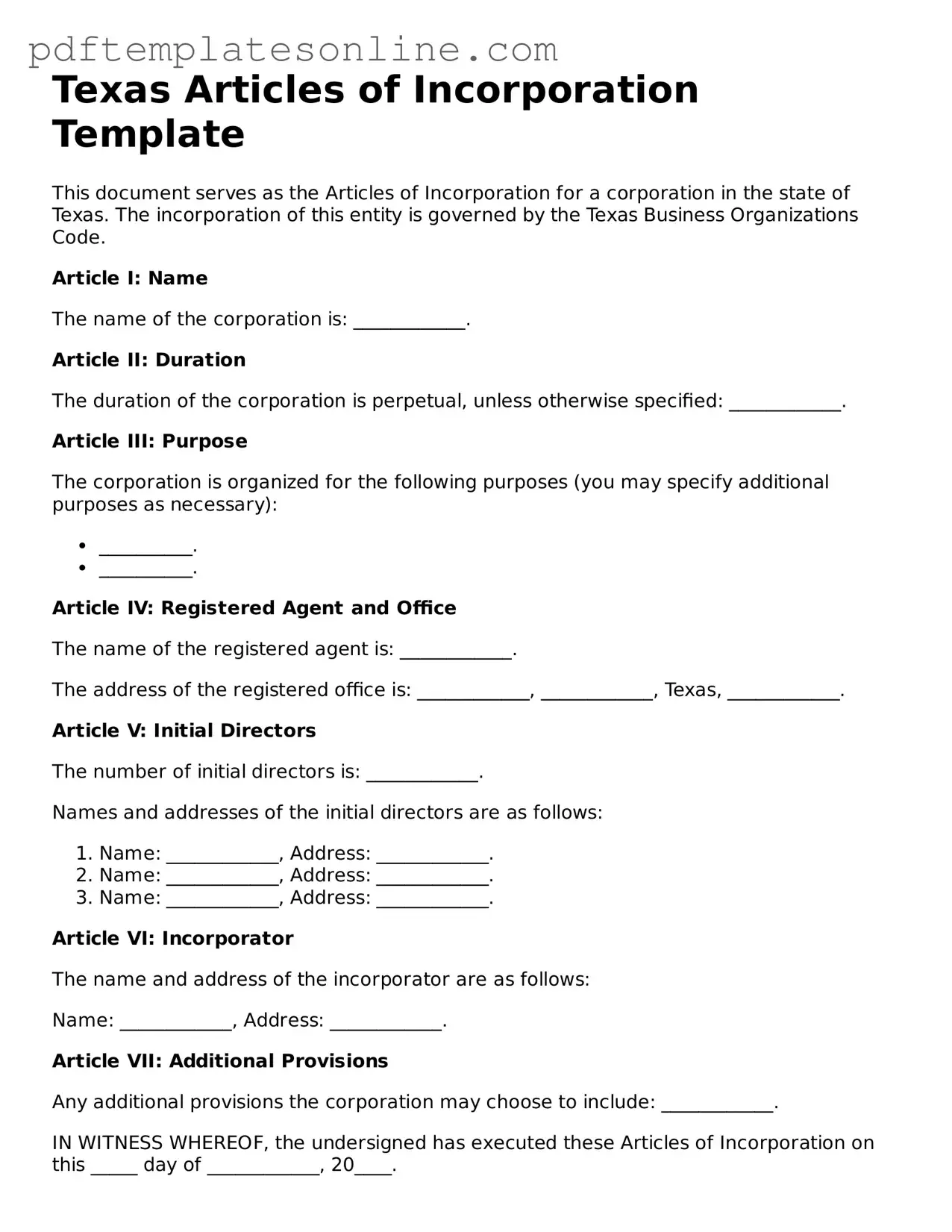

Official Texas Articles of Incorporation Document

Key takeaways

When filling out and using the Texas Articles of Incorporation form, it's essential to keep several key points in mind. Here are some important takeaways to guide you through the process:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation. They establish your business as a legal entity in Texas.

- Choose the Right Name: Your corporation's name must be unique and not already in use by another entity in Texas. It should also include a designation like "Corporation," "Incorporated," or "Company."

- Designate a Registered Agent: You must appoint a registered agent who will receive legal documents on behalf of your corporation. This agent must have a physical address in Texas.

- Specify the Purpose: Clearly state the purpose of your corporation. While you can be broad, including a specific business purpose can be beneficial.

- Provide Incorporator Information: Include the name and address of the person or people filing the Articles. This is typically the person who will oversee the formation of the corporation.

- File with the Secretary of State: After completing the form, submit it to the Texas Secretary of State along with the required filing fee. Ensure you keep a copy for your records.

- Consider Additional Documents: Depending on your business type, you may need to file additional documents, such as bylaws or initial reports, to complete your incorporation process.

By keeping these points in mind, you can navigate the process of filling out and using the Texas Articles of Incorporation with confidence.

Common mistakes

Filing the Texas Articles of Incorporation can be a straightforward process, but many individuals make common mistakes that can lead to delays or complications. One frequent error is not providing a clear and specific name for the corporation. The name must be distinguishable from other registered entities in Texas. If the name is too similar to an existing business, the application may be rejected.

Another mistake involves failing to include the correct purpose of the corporation. The purpose statement should be concise yet descriptive enough to inform the state and the public about the business activities. Vague or overly broad statements can lead to confusion and potential legal issues down the line.

Many applicants overlook the importance of appointing a registered agent. This person or business must have a physical address in Texas and be available during business hours. Failing to designate a registered agent can result in the rejection of the application, as well as complications in receiving legal documents.

Inaccurate information about the incorporators is another common issue. The Articles of Incorporation require the names and addresses of the incorporators. If this information is incomplete or incorrect, it can lead to delays in processing. Double-checking these details is crucial to ensure a smooth filing process.

Some individuals mistakenly believe that all signatures are optional. However, the Articles of Incorporation must be signed by the incorporators. Without the required signatures, the application cannot be processed, and the corporation will not be legally recognized.

Finally, many people fail to pay the necessary filing fees. The Texas Secretary of State requires a fee to process the Articles of Incorporation. Not including the correct payment can result in the application being returned or delayed. It’s essential to verify the current fee structure before submitting the form.

Misconceptions

Many people have misunderstandings about the Texas Articles of Incorporation form. Here are ten common misconceptions, along with clarifications to help you navigate the process more effectively.

-

Misconception 1: The Articles of Incorporation are only for large businesses.

This is not true. Any business, regardless of size, can benefit from incorporating. Small businesses often use this form to protect personal assets.

-

Misconception 2: You can fill out the form without any legal help.

While it is possible to complete the form on your own, consulting with a legal professional can help ensure that all requirements are met and reduce the chance of errors.

-

Misconception 3: The form is the same for all states.

Each state has its own requirements and forms. The Texas Articles of Incorporation are specific to Texas and may differ significantly from those in other states.

-

Misconception 4: Filing the Articles of Incorporation guarantees approval.

Submitting the form does not automatically mean it will be approved. The Texas Secretary of State reviews each application for compliance with state laws.

-

Misconception 5: You need a physical office in Texas to incorporate.

This is incorrect. You can incorporate in Texas even if your business operates elsewhere, as long as you have a registered agent in Texas.

-

Misconception 6: The Articles of Incorporation can be changed easily after filing.

While amendments are possible, they require additional paperwork and filing fees. It is better to ensure accuracy from the start.

-

Misconception 7: Incorporation eliminates all personal liability.

Incorporation provides a layer of protection, but it does not completely shield owners from liability in all situations, such as personal guarantees or illegal activities.

-

Misconception 8: You must have a board of directors before filing.

While having a board is important for governance, you can designate directors in the Articles of Incorporation and appoint them later.

-

Misconception 9: The Articles of Incorporation are only required for for-profit businesses.

This is false. Nonprofit organizations also need to file Articles of Incorporation to gain legal recognition and tax-exempt status.

-

Misconception 10: You can use a generic template for the Articles of Incorporation.

Using a generic template may not meet specific Texas requirements. It is essential to use the official form provided by the Texas Secretary of State.

Dos and Don'ts

When filling out the Texas Articles of Incorporation form, it's essential to be mindful of certain practices to ensure a smooth process. Here’s a helpful list of things to do and avoid:

- Do read the instructions carefully before starting. Understanding the requirements will save time and reduce errors.

- Do provide accurate and complete information. Double-check names, addresses, and other details to avoid complications.

- Do include the purpose of your corporation. A clear statement helps clarify your business intentions.

- Do designate a registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Don't leave any sections blank. If a section does not apply, write "N/A" to indicate that it has been considered.

- Don't use abbreviations or informal language. Stick to formal business terminology to maintain professionalism.

- Don't forget to sign and date the form. An unsigned form will be considered incomplete and may delay processing.

By following these guidelines, you can navigate the process more effectively and help ensure your incorporation goes smoothly.

Browse Popular Articles of Incorporation Forms for US States

Pa Articles of Amendment - Can include provisions for changing the articles in the future.

Ohio Business Forms - The document may include certain requirements for meetings and voting rights.

By utilizing the California Small Estate Affidavit, individuals can streamline the distribution of estates valued below the designated limit, thus avoiding the complexities of probate court. This efficient process not only facilitates the timely transfer of assets to heirs but also makes legal procedures simpler. For those seeking to access this essential document, resources such as California PDF Forms provide valuable assistance.

Ga Corporation - Can provide for the designation of an advisory board.

Detailed Guide for Writing Texas Articles of Incorporation

After obtaining the Texas Articles of Incorporation form, it is essential to complete it accurately to ensure your business is legally recognized. Follow these steps to fill out the form effectively.

- Begin by providing the name of your corporation. Ensure it complies with Texas naming requirements, such as including “Corporation,” “Incorporated,” or an abbreviation.

- Next, enter the duration of the corporation. Most corporations are set up to exist perpetually unless specified otherwise.

- Indicate the purpose of the corporation. Be clear and concise, stating the primary business activities.

- List the address of the corporation's registered office in Texas. This must be a physical address, not a P.O. Box.

- Provide the name and address of the registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Identify the number of shares the corporation is authorized to issue. Specify the classes of shares if applicable.

- Include the names and addresses of the initial directors. This information is crucial for the governance of the corporation.

- Finally, sign and date the form. Ensure that the person signing has the authority to do so on behalf of the corporation.

Once the form is completed, it must be submitted to the Texas Secretary of State along with the required filing fee. Ensure that all information is accurate to avoid delays in processing.