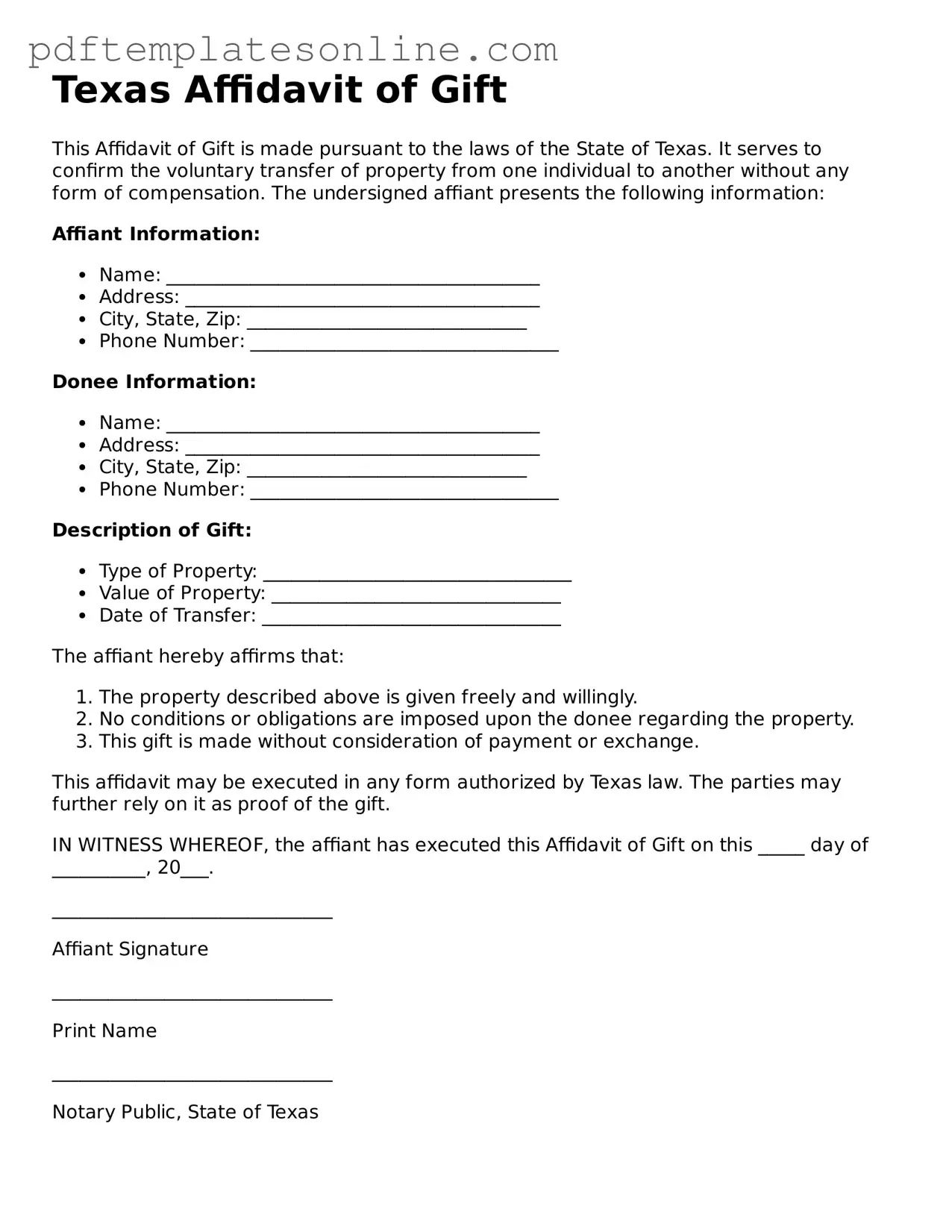

Official Texas Affidavit of Gift Document

Key takeaways

Filling out and using the Texas Affidavit of Gift form is an important process for individuals looking to transfer property or assets without a sale. Here are some key takeaways to consider:

- The Texas Affidavit of Gift form is used to document the transfer of property as a gift, which can have significant tax implications.

- Ensure that both the donor and the recipient understand the terms of the gift before completing the form.

- Accurate details about the property, including its description and value, must be provided to avoid future disputes.

- The form must be signed in front of a notary public to be legally binding.

- Consider consulting with a tax professional to understand any potential tax consequences associated with the gift.

- After completing the form, it should be filed with the appropriate county clerk's office to ensure proper documentation.

- Keep a copy of the signed affidavit for personal records, as it may be needed for future reference.

- Be aware that gifting property may impact the recipient’s tax situation, especially concerning property taxes and potential capital gains taxes in the future.

Understanding these points can help facilitate a smooth transfer of property while ensuring compliance with Texas laws.

Common mistakes

Filling out the Texas Affidavit of Gift form can seem straightforward, but many people make common mistakes that can lead to delays or complications. Understanding these pitfalls can help ensure that the process goes smoothly.

One frequent error is incomplete information. Many individuals forget to fill out all required fields, such as the full names and addresses of both the donor and the recipient. Omitting any detail can result in the form being rejected or returned for corrections.

Another mistake is failing to sign the affidavit. While it may seem obvious, some people neglect to provide their signature or the date, which is crucial for the document's validity. A missing signature can invalidate the entire affidavit.

People often overlook the notarization requirement. The affidavit must be notarized to be legally binding. Skipping this step can lead to issues, especially if the document is needed for legal or financial transactions later on.

Providing incorrect or outdated information is another common error. For instance, using an old address or misspelling names can create confusion. It's essential to double-check all entries before submitting the form.

Some individuals misunderstand the gift value declaration. Accurately assessing the fair market value of the gift is important. Underestimating or overestimating can have tax implications, so it's wise to consult a professional if unsure.

Another mistake is not keeping a copy of the completed form. It’s advisable to retain a copy for personal records. This can be useful if questions arise later regarding the gift or its value.

Many people also forget to review the entire document before submission. Taking the time to read through the affidavit can help catch errors or omissions that might otherwise go unnoticed.

Some individuals fail to consider the tax implications of gifting. It's important to be aware of the annual gift tax exclusion and how it applies to your situation. Consulting with a tax advisor can provide clarity on this matter.

Finally, a lack of understanding about the purpose of the affidavit can lead to mistakes. Knowing that this document serves to formalize the gift can help individuals approach the process with the seriousness it deserves.

By being aware of these common mistakes, individuals can fill out the Texas Affidavit of Gift form correctly and avoid potential complications down the road.

Misconceptions

The Texas Affidavit of Gift form is often misunderstood. Here are five common misconceptions about this important document:

- It is only for real estate transactions. Many people believe that the Affidavit of Gift is only applicable when transferring real estate. In reality, this form can be used for various types of gifts, including personal property like vehicles, jewelry, and other assets.

- It requires a notary public. Some individuals think that the Affidavit must be notarized to be valid. While notarization can add a layer of authenticity, it is not a strict requirement for the document to be effective.

- It is only needed for large gifts. Another misconception is that the Affidavit of Gift is necessary only for substantial gifts. However, regardless of the value, if you are transferring ownership of an item as a gift, this form can help clarify the intent and avoid potential disputes.

- It exempts the giver from tax obligations. Many people assume that using the Affidavit of Gift eliminates any tax responsibilities. While gifts below a certain value may not incur taxes, it’s essential to understand the IRS rules regarding gift taxes to ensure compliance.

- It is a legally binding contract. Some believe that the Affidavit of Gift serves as a binding contract between the giver and receiver. In truth, it is more of a declaration of intent rather than a contract that enforces obligations.

Understanding these misconceptions can help individuals navigate the gifting process more effectively and avoid potential pitfalls.

Dos and Don'ts

When filling out the Texas Affidavit of Gift form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are some important dos and don'ts to consider:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information about the donor and the recipient.

- Do include a description of the property being gifted.

- Do sign and date the affidavit in the appropriate sections.

- Do consult with a legal professional if you have questions about the form.

- Don't leave any required fields blank; incomplete forms may be rejected.

- Don't use whiteout or correction fluid to alter the form.

- Don't forget to provide identification if required by the form.

- Don't submit the affidavit without keeping a copy for your records.

Detailed Guide for Writing Texas Affidavit of Gift

After completing the Texas Affidavit of Gift form, the next step involves ensuring that all information is accurate and submitting it to the appropriate authorities. This form is crucial for documenting the transfer of property or assets as a gift, and it may require additional steps depending on the type of gift and the recipient's situation.

- Obtain a copy of the Texas Affidavit of Gift form. This can typically be found on the Texas Secretary of State's website or at a local county office.

- Begin by filling out the donor's information. This includes the full name, address, and contact details of the person giving the gift.

- Next, provide the recipient's information. Include the full name, address, and contact details of the person receiving the gift.

- In the designated section, describe the gift being transferred. Be specific about the type of property or asset, including any identifying details like serial numbers or property descriptions.

- Indicate the date of the gift. This is the date when the gift was officially given to the recipient.

- Sign the form in the presence of a notary public. The notary will verify your identity and witness your signature.

- Ensure that the notary public completes their section of the form, including their signature and seal.

- Make copies of the completed and notarized form for your records and for the recipient.

- Submit the form to the appropriate office, if required, or provide a copy to the recipient for their records.