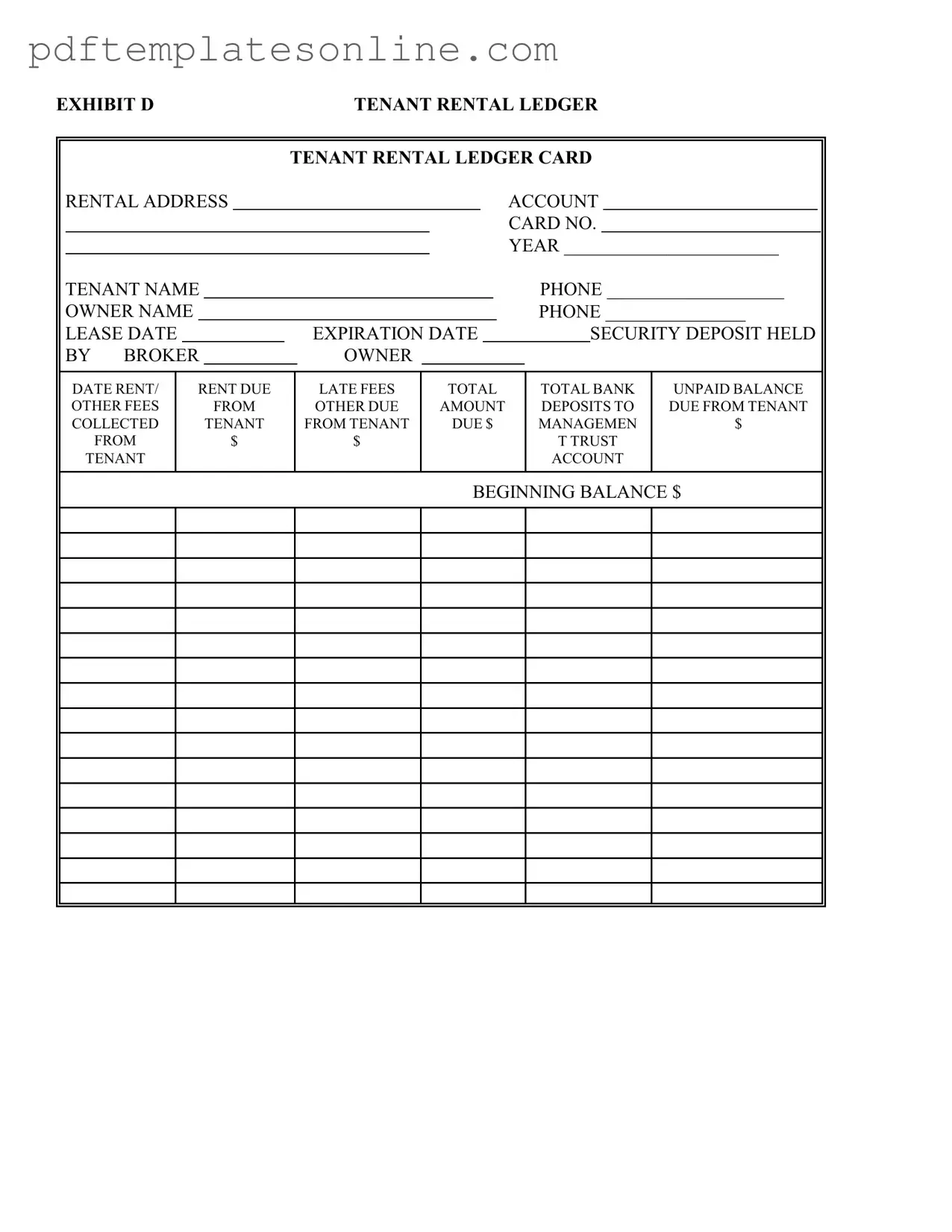

Blank Tenant Ledger Card Form

Key takeaways

Filling out and using the Tenant Ledger Card form is an essential task for property management. Here are some key takeaways to consider:

- Accurate Information: Ensure that all tenant and owner information is filled out accurately. This includes names, phone numbers, and addresses.

- Lease Dates: Clearly note the lease start and expiration dates. This helps in tracking the duration of the rental agreement.

- Security Deposit: Record the amount of the security deposit held. This is crucial for both parties in case of disputes.

- Payment Tracking: Document rent and any other fees collected from the tenant. This helps in maintaining a clear financial record.

- Late Fees: If applicable, include any late fees charged. This ensures transparency about additional costs incurred by the tenant.

- Total Amount Due: Calculate and display the total amount due from the tenant. This should include rent, fees, and any other charges.

- Unpaid Balances: Keep track of any unpaid balances. This information is vital for managing accounts and following up with tenants.

- Bank Deposits: Record any deposits made to the management trust account. This helps in reconciling financial records and ensuring proper accounting.

By following these takeaways, property managers can maintain a clear and organized tenant ledger, which ultimately benefits both tenants and landlords.

Common mistakes

Filling out the Tenant Ledger Card form can seem straightforward, but many people make common mistakes that can lead to confusion or disputes later on. One frequent error is neglecting to include the tenant's name clearly. This section is crucial as it identifies who the ledger pertains to. Without a clear name, it can be challenging to track payments or address issues that arise.

Another mistake often made involves the lease dates. People sometimes forget to fill in the lease date and expiration date. These dates are essential for understanding the timeline of the rental agreement. If these fields are left blank, it can create ambiguity about the terms of the lease, leading to potential misunderstandings between tenants and owners.

In addition, errors can occur in the financial sections of the form. For instance, tenants might miscalculate the total amount due. This includes rent, late fees, and any other charges. If the calculations are incorrect, it can lead to disputes over what is owed. Double-checking these figures is a simple way to avoid complications.

Another common oversight is failing to record payments received accurately. When payments are not documented properly, it can create confusion about what has been paid and what remains outstanding. Keeping a detailed record of each transaction helps maintain clarity and can prevent disputes.

Lastly, some individuals overlook the importance of the security deposit section. Not specifying the amount held can lead to misunderstandings about what the tenant is entitled to at the end of their lease. It is vital to document this accurately to ensure both parties are aware of the terms regarding the security deposit.

Misconceptions

When it comes to the Tenant Ledger Card form, there are several misconceptions that can lead to confusion. Understanding these can help tenants and landlords alike manage their rental agreements more effectively.

- Misconception 1: The Tenant Ledger Card is only for landlords.

- Misconception 2: The form is only about rent payments.

- Misconception 3: Once filled out, the information is set in stone.

- Misconception 4: The Tenant Ledger Card is not legally binding.

This is not true. While landlords often use the form to track payments, tenants can also benefit from reviewing it. It provides a clear record of what has been paid and what is still owed, helping to avoid misunderstandings.

Many believe that the Tenant Ledger Card only tracks rent. In reality, it includes other fees, such as late fees or additional charges. This comprehensive view helps both parties stay informed about the financial aspects of the rental agreement.

Some think that once the Tenant Ledger Card is completed, it cannot be changed. However, updates can and should be made to reflect new payments or any adjustments. Keeping it current is essential for accurate record-keeping.

While the form itself may not serve as a contract, it is an important record that can be used in disputes. It provides evidence of payment history and outstanding balances, which can be crucial in legal situations.

Dos and Don'ts

When filling out the Tenant Ledger Card form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are eight things you should and shouldn't do:

- Do use clear and legible handwriting or type the information to avoid confusion.

- Don't leave any sections blank. Fill in all required fields to ensure completeness.

- Do double-check the tenant's name and rental address for accuracy.

- Don't forget to include the correct lease dates. This information is crucial for tracking the rental period.

- Do accurately record all fees collected, including rent and any late fees.

- Don't mix up the amounts due and paid. Keep these figures separate for clarity.

- Do maintain a copy of the completed form for your records.

- Don't use shorthand or abbreviations that may not be understood by others reviewing the document.

Other PDF Forms

Roof Inspection Report Template - Inspect for cracking in the roof deck structure.

To aid your application process, it's essential to familiarize yourself with the Employment Application PDF form, which can be accessed at mypdfform.com/blank-employment-application-pdf/. This form serves as a crucial resource for employers to gather necessary information from candidates, including personal details, work history, education, and references. Ensuring that this form is filled out accurately is important for all job seekers, as it helps in evaluating their qualifications and fit for the roles available.

District of Columbia Lease Agreement - Tenants will receive notice if the landlord intends to apply the deposit to unpaid rent.

Detailed Guide for Writing Tenant Ledger Card

Filling out the Tenant Ledger Card form is a straightforward process that requires specific information about the tenant and their rental situation. Once completed, this form helps track rental payments, fees, and any outstanding balances. Follow the steps below to ensure accurate and thorough completion of the form.

- Start by entering the rental address in the designated space at the top of the form.

- Write the account card number next to the rental address.

- Fill in the year for which you are completing the ledger.

- Provide the tenant's name and phone number in the appropriate fields.

- Next, enter the owner's name and phone number.

- Indicate the lease date and the expiration date of the lease agreement.

- Document the security deposit amount held by the broker or owner.

- Record the date of the rent or other fees collected from the tenant.

- Enter the rent due from the tenant in the specified space, using a dollar amount.

- If applicable, list any late fees charged to the tenant.

- Include any other fees due from the tenant in the designated area.

- Calculate the total amount due by adding the rent, late fees, and other fees.

- Document the total bank unpaid balance in the appropriate section.

- Finally, record any deposits to management trust account and the beginning balance for the account.