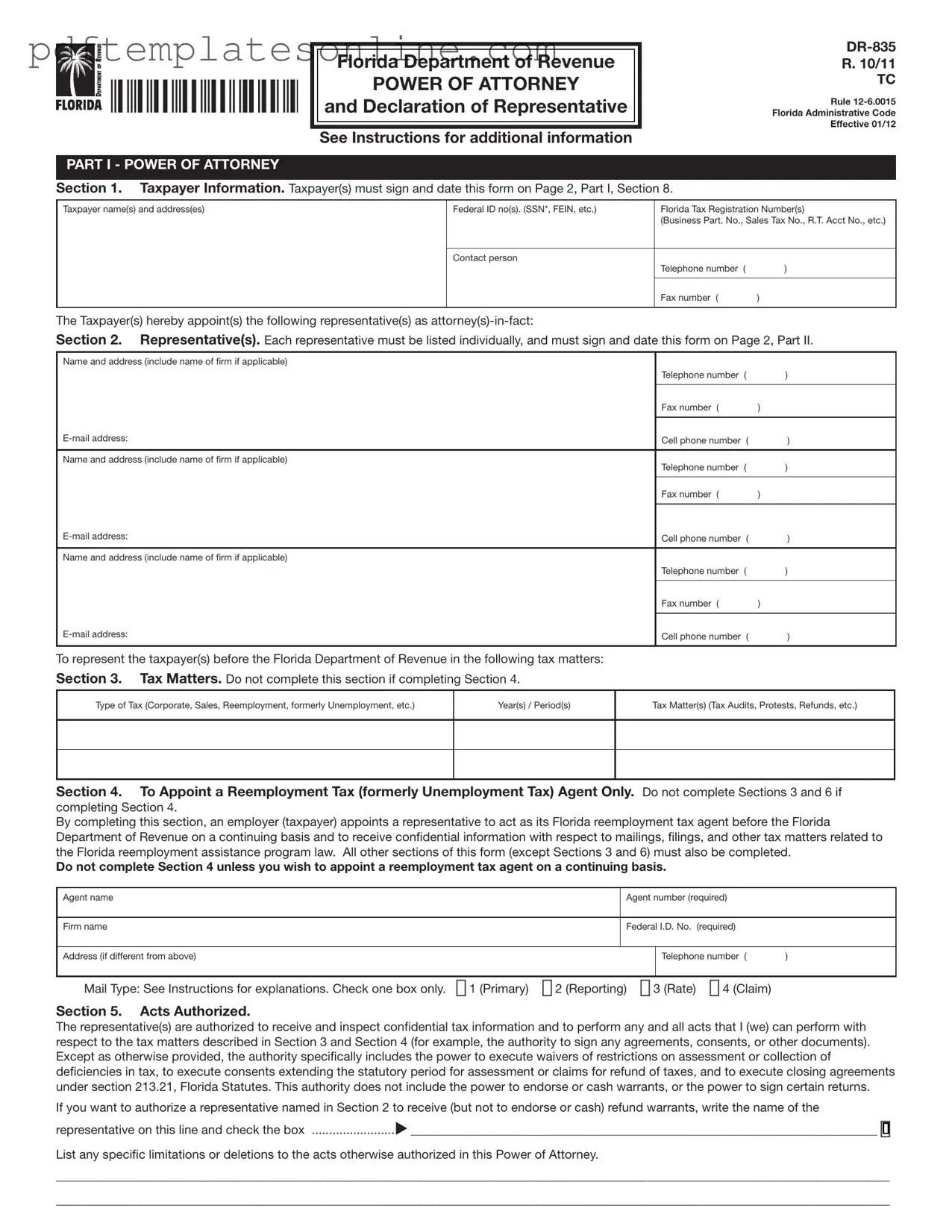

Blank Tax POA dr 835 Form

Key takeaways

Filling out the Tax POA DR 835 form is an important step for anyone needing to authorize someone to act on their behalf regarding tax matters. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Tax POA DR 835 form allows you to designate someone to handle your tax issues with the IRS or state tax authority.

- Choose Your Representative Wisely: Select someone you trust, as they will have access to sensitive financial information.

- Complete All Required Fields: Make sure to fill in all necessary information accurately to avoid delays in processing.

- Sign and Date the Form: Your signature is required to validate the form. Ensure it is dated correctly.

- Keep a Copy: Always retain a copy of the completed form for your records. This is essential for future reference.

- Submit to the Correct Agency: Send the form to the appropriate tax authority, whether federal or state, based on your needs.

- Monitor the Status: After submission, check the status of your authorization to ensure it has been processed.

By following these steps, you can effectively use the Tax POA DR 835 form to manage your tax affairs with confidence.

Common mistakes

Filling out the Tax Power of Attorney (POA) DR 835 form can be a straightforward process, but many individuals encounter common pitfalls that can lead to delays or complications. One prevalent mistake is failing to provide complete information. When filling out the form, it is essential to include all required details, such as the taxpayer's name, address, and Social Security number. Missing any of this information can result in the form being rejected.

Another frequent error is not signing the form correctly. The taxpayer must sign the document to authorize the representative. If the signature is missing or does not match the name provided, the IRS may not accept the form. It is also important to ensure that the representative’s information is accurate. Incorrect details about the representative can lead to issues in communication and representation.

Many people overlook the importance of checking the expiration date of the form. The Tax POA DR 835 form must be current and valid. Using an outdated version can lead to rejection, so it is advisable to download the latest form from the official IRS website. Additionally, individuals often forget to specify the tax matters for which they are granting power of attorney. Clearly defining the scope of authority is crucial to avoid confusion or limitations in representation.

Another mistake involves not understanding the limitations of the power granted. Some individuals mistakenly believe that the power of attorney allows their representative to make decisions beyond tax matters. This misunderstanding can lead to unintended consequences. Furthermore, failing to provide a clear expiration date for the power of attorney can result in prolonged authority that may not be desired.

Lastly, individuals often neglect to keep a copy of the completed form for their records. Retaining a copy is essential for future reference and can help clarify any disputes that may arise later. By being mindful of these common mistakes, taxpayers can ensure that their Tax POA DR 835 form is filled out correctly and efficiently, facilitating a smoother process in managing their tax matters.

Misconceptions

Understanding the Tax POA DR 835 form can be challenging. Here are five common misconceptions about this form:

-

The Tax POA DR 835 form is only for tax professionals.

This form can be used by anyone who wants to authorize someone else to represent them before the tax authorities. It is not limited to tax professionals.

-

Filing the Tax POA DR 835 form means I can’t talk to the tax authorities myself.

Submitting this form does not prevent you from communicating with the tax authorities. You can still engage directly if you choose to do so.

-

Once I file the Tax POA DR 835 form, it cannot be revoked.

You can revoke the authorization at any time by submitting a written notice to the tax authorities. This gives you control over who represents you.

-

All tax issues require a Tax POA DR 835 form.

Not all tax matters need representation. You may only need this form for specific issues where you want someone else to act on your behalf.

-

The Tax POA DR 835 form is the same in every state.

This form may vary by state. It’s important to check the specific requirements for your state to ensure compliance.

Dos and Don'ts

When completing the Tax POA DR 835 form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are four important dos and don'ts to keep in mind:

- Do provide accurate information.

- Do ensure all signatures are properly dated.

- Don't leave any required fields blank.

- Don't submit the form without reviewing it for errors.

Other PDF Forms

Imm 5645 - Section D involves the applicant’s certification of the accuracy of the provided information.

In situations where a vehicle owner is unable to attend to the necessary paperwork, they can utilize the California Motor Vehicle Power of Attorney form to designate someone else with the authority to manage their vehicle's registration and ownership issues. This convenient document helps facilitate smooth transactions and ensures important matters are addressed without delay. For those seeking resources to navigate this process, California PDF Forms can provide the proper templates and guidance.

Asylum Form - Applications submitted on time can lead to interviews with asylum officers to assess the claims.

6 Team Single Elimination Bracket With Consolation - The ultimate goal is to emerge as the proud consolation champion!

Detailed Guide for Writing Tax POA dr 835

Once you have the Tax POA DR 835 form ready, the next steps involve accurately filling it out to ensure your tax matters are handled appropriately. This process requires careful attention to detail, as each section must be completed correctly to avoid delays or complications.

- Begin by downloading the Tax POA DR 835 form from the appropriate tax authority website.

- Read the instructions provided with the form to understand the requirements for completion.

- In the first section, enter your personal information, including your name, address, and Social Security number.

- Next, provide the information of the person or entity you are granting power of attorney to, including their name and address.

- Specify the type of tax matters the power of attorney covers by checking the relevant boxes.

- Indicate the tax years or periods that the power of attorney will apply to, if applicable.

- Sign and date the form at the bottom to confirm your consent.

- If required, have the designated representative sign the form as well.

- Make a copy of the completed form for your records before submission.

- Submit the form to the appropriate tax authority, either by mail or electronically, as instructed.

After submitting the form, it may take some time for the tax authority to process your request. You can check the status of your submission by contacting them directly if needed.