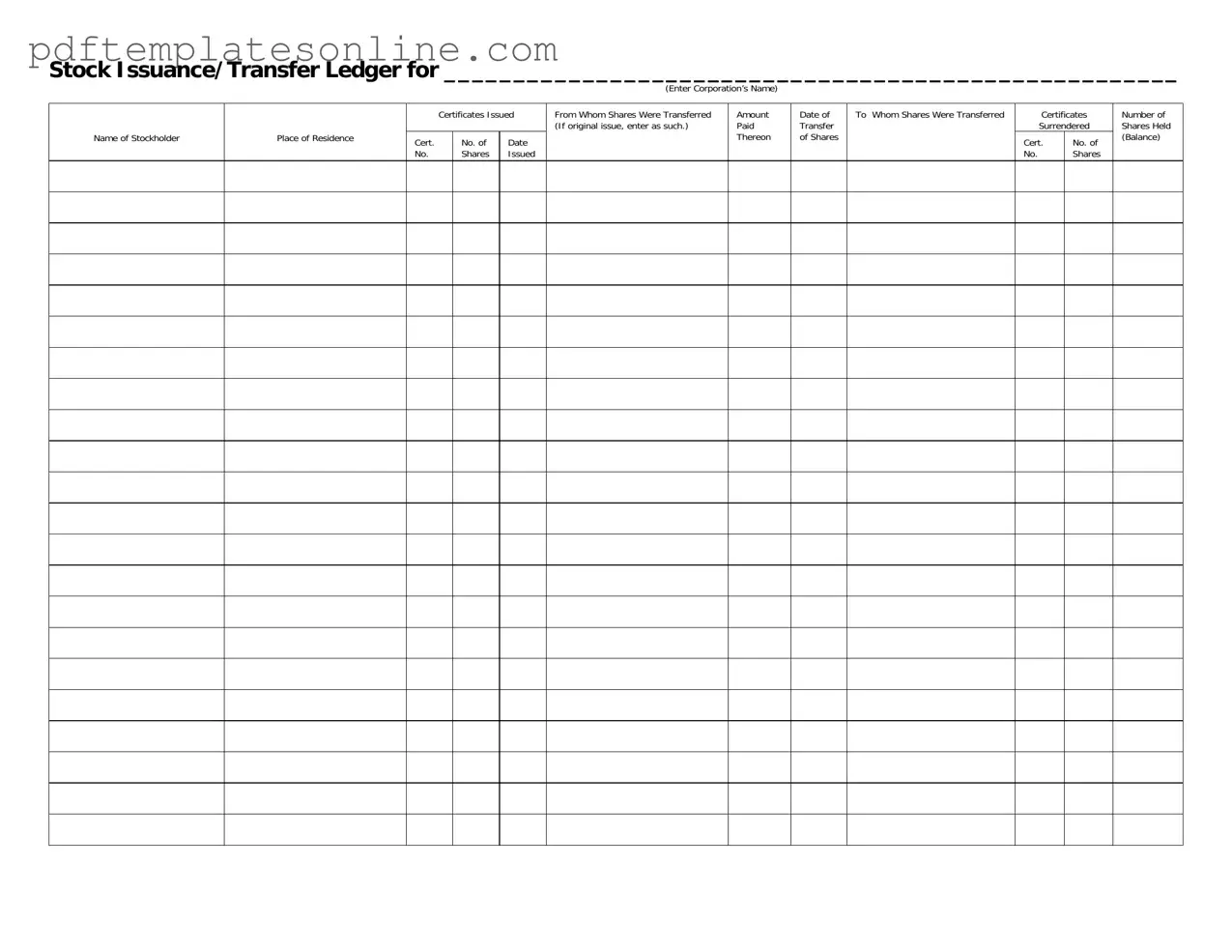

Blank Stock Transfer Ledger Form

Key takeaways

Filling out and using the Stock Transfer Ledger form is a crucial step for any corporation dealing with stock transfers. Here are some key takeaways to keep in mind:

- Identify the Corporation: Begin by clearly entering the name of the corporation at the top of the form. This identifies the entity involved in the stock transfer.

- Accurate Stockholder Information: Ensure that the name and place of residence of the stockholder are accurately recorded. This information is vital for maintaining clear records.

- Certificates Issued: Document the certificates issued to the stockholder. This includes the certificate number and the date it was issued, which helps track ownership history.

- Details of Shares Transferred: When shares are transferred, note from whom the shares were transferred. If it’s the original issue, indicate that clearly.

- Payment Information: Record the amount paid for the shares. This information is important for financial records and may be required for tax purposes.

- Date of Transfer: Always include the date when the shares were transferred. This establishes a timeline for ownership changes.

- Recipient Information: Clearly specify to whom the shares were transferred. This ensures that the new owner's details are properly documented.

- Certificates Surrendered: If applicable, indicate the certificate numbers of any shares that were surrendered during the transfer process.

- Balance of Shares: Finally, calculate and record the number of shares held after the transfer. This helps maintain an accurate account of ownership.

By following these guidelines, you can effectively manage stock transfers and maintain accurate records for your corporation.

Common mistakes

Filling out the Stock Transfer Ledger form can seem straightforward, but many individuals make common mistakes that can lead to complications. One prevalent error is failing to enter the corporation's name correctly. This information is crucial, as it identifies the entity involved in the stock transfer. A misspelled name or incorrect designation can create confusion and may even invalidate the transfer.

Another frequent mistake involves the inaccurate recording of stockholder information. It's essential to provide the full name and place of residence of the stockholder. Omitting details or using nicknames can lead to issues in verifying ownership and could complicate future transactions.

People often overlook the certificates issued section. This part requires careful attention to detail. Each certificate number must match the corresponding shares. A mismatch can raise red flags during audits or when the stock is sold. Ensuring that all numbers are accurate is vital for a smooth transfer process.

Additionally, many individuals forget to include the date of transfer. This date is significant as it marks when the ownership officially changes hands. Without it, there could be disputes about the timing of the transfer, which may affect taxation or shareholder rights.

Another common error is not specifying from whom the shares were transferred. This section should clearly indicate the previous owner. Failing to do so can lead to confusion and potential legal issues, especially if the shares were originally issued to multiple parties.

When it comes to the amount paid for the shares, many people neglect to fill in this section. This information is critical for accounting purposes and can impact how the transaction is treated for tax purposes. Accurately reporting the amount ensures compliance with financial regulations.

Finally, individuals often forget to indicate the number of shares held after the transfer. This balance is essential for maintaining accurate records of ownership. Without it, future transactions may become complicated, and the stockholder's rights could be called into question.

Misconceptions

Misconceptions about the Stock Transfer Ledger form can lead to confusion and improper handling of stock transfers. Here are ten common misconceptions explained:

- It is only for new stock issuances. Many believe the Stock Transfer Ledger is solely for issuing new shares. In reality, it also tracks the transfer of existing shares between stockholders.

- Only corporations need to use it. While corporations commonly use this form, any entity that issues stock, including limited liability companies, may require a Stock Transfer Ledger.

- It is not legally required. Some think the form is optional. However, maintaining accurate records of stock transfers is essential for compliance with state laws and regulations.

- All information is confidential. While certain details may be private, the ledger must be accurate and accessible for legal verification and shareholder inquiries.

- It can be completed at any time. Some assume they can fill it out whenever. In fact, it should be updated immediately following any stock transfer to ensure accuracy.

- Only the original stockholder needs to sign. Many believe only the original stockholder's signature is necessary. However, both the transferor and transferee typically need to provide signatures.

- It is the same as a stock certificate. Some confuse the Stock Transfer Ledger with stock certificates. The ledger is a record of ownership, while certificates are physical proof of ownership.

- It does not need to be updated if shares are sold. Some think the ledger remains unchanged after a sale. In reality, each transaction must be recorded to reflect current ownership accurately.

- It is only relevant during audits. Many believe the ledger is only necessary during audits. However, regular updates are crucial for ongoing corporate governance and shareholder communication.

- Electronic records are not acceptable. Some assume only paper forms are valid. In fact, electronic records can be maintained, provided they meet legal standards for accuracy and accessibility.

Dos and Don'ts

When filling out the Stock Transfer Ledger form, attention to detail is crucial. Here are seven important dos and don'ts to keep in mind:

- Do ensure you enter the correct name of the corporation at the top of the form.

- Do provide accurate information about the stockholder, including their full name and place of residence.

- Do carefully record the certificate numbers and the number of shares issued.

- Do indicate the amount paid for the shares clearly and accurately.

- Don't leave any fields blank; all sections must be completed to avoid processing delays.

- Don't forget to include the date of transfer for each transaction.

- Don't mix up the details of the transferor and transferee; clarity is key.

Other PDF Forms

Panel Schedule - Assists in planning electrical upgrades and expansions as needed.

Alabama Public Title Portal - Double-check that all fields on the application are filled before sending it to the Department of Revenue.

The California Prenuptial Agreement form is a legal document designed to detail how a couple wishes to divide their assets and responsibilities should their marriage end. It provides a clear agreement on financial matters, safeguarding both parties' interests. Couples can access resources like California PDF Forms to create these terms before marriage, ensuring a measure of security and clarity for their future.

Free Printable Cash Drawer Count Sheet Pdf - The form can help in correlating cash receipts with register sales, ensuring accuracy.

Detailed Guide for Writing Stock Transfer Ledger

After completing the Stock Transfer Ledger form, you will have a clear record of stock transfers and issuances for your corporation. This is important for maintaining accurate ownership records and ensuring compliance with regulations. Follow these steps to fill out the form correctly.

- Enter the corporation’s name at the top of the form.

- In the section labeled "Name of Stockholder," write the full name of the stockholder involved in the transfer.

- Fill in the "Place of Residence" for the stockholder.

- In the "Certificates Issued" section, indicate how many certificates are being issued.

- Write the "Cert. No." for each certificate issued, along with the corresponding "Date" of issuance.

- In the "No. of Shares Issued" section, specify the number of shares being issued.

- For the "From Whom Shares Were Transferred," provide the name of the individual or entity transferring the shares. If this is the original issue, simply state "original issue."

- Indicate the "Amount Paid Thereon" for the shares being transferred.

- Fill in the "Date of Transfer of Shares" to document when the transfer took place.

- In the "To Whom Shares Were Transferred" section, write the name of the individual or entity receiving the shares.

- List any "Certificates Surrendered" and their corresponding "Cert. No." if applicable.

- Finally, indicate the "No. of Shares" for the certificates surrendered and the "Number of Shares Held (Balance)" after the transfer.