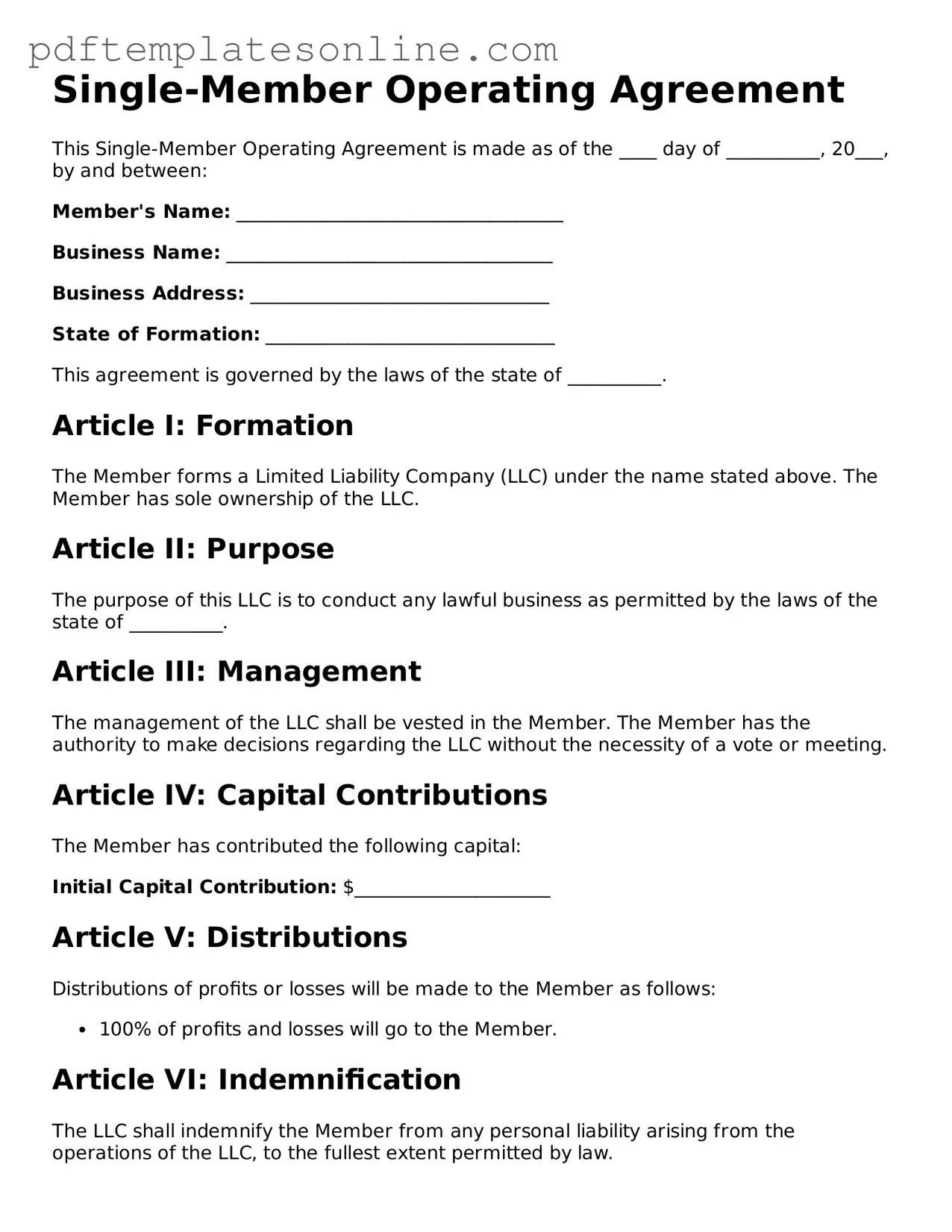

Fillable Single-Member Operating Agreement Document

Key takeaways

When filling out and using the Single-Member Operating Agreement form, consider the following key takeaways:

- Clearly identify the owner. This establishes who has full control over the business.

- Specify the business name. Ensure it matches the name registered with the state.

- Outline the purpose of the business. This provides clarity on the business's operations and goals.

- Detail the initial capital contribution. Document how much money or assets you are investing in the business.

- Include provisions for profit distribution. State how profits will be allocated to you as the owner.

- Establish a process for amendments. Describe how changes to the agreement can be made in the future.

- Consider liability limitations. Address how the agreement protects your personal assets from business liabilities.

- Sign and date the agreement. This finalizes the document and makes it legally binding.

Using this form correctly can help ensure that your business operates smoothly and legally.

Common mistakes

Filling out a Single-Member Operating Agreement form can be a straightforward process, but many people encounter common pitfalls. One frequent mistake is overlooking the specific details of the member's information. It’s essential to provide accurate and complete details, including the member’s name and address. Missing or incorrect information can lead to confusion and complications later on.

Another common error is failing to outline the business purpose clearly. This section is crucial as it defines what the business will do. A vague or overly broad description can create issues with compliance and may affect the business's legal standing. Taking the time to articulate the business purpose ensures clarity and sets the right expectations.

People often neglect to specify how profits and losses will be distributed. Without clear guidelines, disputes may arise among stakeholders, even if there’s only one member. Clearly stating the distribution method in the agreement can prevent misunderstandings and provide a solid foundation for financial management.

Additionally, many individuals forget to address the management structure of the business. Even as a single-member entity, it’s important to clarify how decisions will be made and who will have authority over various aspects of the business. This can help streamline operations and avoid potential conflicts in the future.

Lastly, failing to sign and date the document is a mistake that can render the agreement ineffective. It’s vital to ensure that the form is properly executed. A signed and dated agreement serves as a legal record of the member’s intentions and can be crucial in the event of disputes or legal challenges.

Misconceptions

Understanding the Single-Member Operating Agreement is essential for anyone involved in a single-member limited liability company (LLC). However, several misconceptions can cloud this understanding. Below are ten common misconceptions, along with clarifications for each.

-

It is unnecessary for single-member LLCs.

Many believe that a formal operating agreement is not needed for single-member LLCs. In reality, having an operating agreement can help clarify the structure and operations of the business, even for a single owner.

-

It must be filed with the state.

Some think that the operating agreement needs to be submitted to the state. This is not true; it is an internal document that does not require state filing.

-

It is the same as the Articles of Organization.

People often confuse the operating agreement with the Articles of Organization. While the Articles of Organization establish the LLC, the operating agreement outlines how the LLC will operate.

-

It has to be complicated.

There is a misconception that operating agreements must be lengthy and complex. In fact, a straightforward document that covers essential aspects can be sufficient.

-

It cannot be amended.

Some believe that once an operating agreement is created, it cannot be changed. However, it is possible to amend the agreement as the needs of the business evolve.

-

All single-member LLCs have the same operating agreement.

This misconception suggests that a one-size-fits-all approach applies. In reality, each operating agreement can be tailored to fit the specific needs and preferences of the owner.

-

It is only for legal protection.

While an operating agreement does provide legal protection, its purpose extends beyond that. It also helps in defining roles, responsibilities, and operational procedures.

-

It is only relevant during disputes.

Some people think that the operating agreement is only necessary when conflicts arise. In truth, it serves as a guide for daily operations and decision-making.

-

It can be verbal.

There is a belief that a verbal agreement suffices. However, having a written document is crucial for clarity and enforceability.

-

It is not important if the owner is the only member.

Finally, some owners may think that being the sole member eliminates the need for an operating agreement. This is misleading, as it still provides structure and clarity for the business.

Addressing these misconceptions can lead to a better understanding of the importance and function of a Single-Member Operating Agreement in managing an LLC effectively.

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, it’s important to follow certain guidelines to ensure accuracy and compliance. Here are some dos and don’ts to keep in mind:

- Do provide accurate and complete information about your business.

- Do include your name and contact information clearly.

- Don't leave any sections blank; if a section doesn’t apply, indicate that.

- Don't use ambiguous language that could lead to misunderstandings.

Browse Common Types of Single-Member Operating Agreement Templates

What Does an Operating Agreement Look Like for an Llc - Includes provisions for member meetings and records.

Detailed Guide for Writing Single-Member Operating Agreement

Completing the Single-Member Operating Agreement form is a straightforward process that requires careful attention to detail. This document serves to outline the operational structure of a single-member limited liability company (LLC). By following these steps, you can ensure that your form is filled out accurately and comprehensively.

- Begin by entering the name of your LLC in the designated field. Ensure that the name complies with state regulations.

- Next, provide the principal address of your LLC. This should be a physical address where the business operates.

- Identify the sole member of the LLC. Include the full legal name and any relevant contact information.

- Outline the purpose of the LLC. Describe the nature of the business activities that the LLC will engage in.

- Specify the duration of the LLC. Indicate whether it is intended to exist indefinitely or for a specific period.

- Detail the management structure. Indicate that the single member will manage the LLC and describe any powers or limitations.

- Include provisions for the distribution of profits and losses. Clearly state how profits will be allocated to the member.

- Provide any additional clauses that may be relevant, such as dispute resolution procedures or amendment processes.

- Finally, sign and date the document. Make sure to include the member's printed name beneath the signature.