Blank Sample Tax Return Transcript Form

Key takeaways

When filling out and using the Sample Tax Return Transcript form, several key points should be considered to ensure accuracy and effective use.

- Understand the Purpose: This form provides a summary of your tax return data, including income, deductions, and credits. It is essential for verifying income when applying for loans or financial aid.

- Check for Accuracy: Ensure all personal information, such as your Social Security Number (SSN) and income details, are correct. Mistakes can lead to complications or delays in processing.

- Review the Tax Period: The transcript reflects the tax period ending on December 31, 2017. Be aware of the specific tax year you are referencing, as this will impact any claims or applications you are making.

- Utilize for Financial Applications: Lenders often require this document to assess your financial situation. Use it to provide proof of income and tax compliance when necessary.

Common mistakes

Filling out the Sample Tax Return Transcript form can be a straightforward process, but there are common mistakes that individuals often make. These errors can lead to delays or complications in processing. Understanding these pitfalls can help ensure a smoother experience.

One frequent mistake is incorrectly entering personal information. This includes the Social Security Number (SSN) and names. Even a small typo can cause significant issues. Always double-check this information to ensure it matches the official documents.

Another common error involves misreporting income. Taxpayers sometimes forget to include all sources of income or misclassify them. For example, business income from a side hustle should be reported accurately. It's essential to gather all relevant documents before filling out the form.

Many people also overlook the importance of tax credits and deductions. Missing out on credits can lead to a higher tax liability. For instance, if you qualify for the Earned Income Credit, ensure it is included. Review eligibility requirements to maximize your benefits.

Additionally, failing to sign the form is a common oversight. A signature is necessary for the submission to be valid. Without it, the form may be rejected or delayed. Always remember to sign and date the document before sending it in.

Another mistake involves not keeping copies of submitted forms. Having a record of what was submitted can be invaluable if questions arise later. It’s a good practice to maintain copies for personal records.

Some individuals also make the mistake of not using the latest version of the form. Tax forms can change from year to year, and using an outdated version may result in errors. Always check for the most current form before starting.

Another pitfall is ignoring deadlines. Late submissions can incur penalties and interest. Mark important dates on your calendar to ensure timely filing. Being proactive can save you from unnecessary stress.

Finally, not seeking help when needed can lead to mistakes. If you’re unsure about certain entries or calculations, consider consulting a tax professional. They can provide guidance and help avoid costly errors.

By being aware of these common mistakes, individuals can fill out the Sample Tax Return Transcript form more accurately and efficiently. Taking the time to review and double-check information can make a significant difference in the overall experience.

Misconceptions

Misconceptions about the Sample Tax Return Transcript can lead to confusion and errors in understanding one's tax situation. Here are five common misconceptions:

- Misconception 1: The Sample Tax Return Transcript shows current account activity.

- Misconception 2: The transcript includes all income sources.

- Misconception 3: The transcript is the same as a full tax return.

- Misconception 4: You can use the transcript to file your taxes.

- Misconception 5: The information on the transcript is always up to date.

This form only reflects the amounts as reported on the tax return and any adjustments made. It does not provide information about subsequent activities or changes to the account.

While it summarizes various income categories, it may not include every income source. For example, if you had income that wasn't reported on the main tax return, it won't show up here.

The Sample Tax Return Transcript is a summary document. It does not contain all the details of the original return, such as supporting schedules or additional documentation.

This document is not intended for filing. It serves as a record of what has been reported to the IRS and should not be submitted as a tax return.

The transcript reflects information as of the date it was issued. If you have made changes or corrections after that date, those updates will not be reflected in the transcript.

Dos and Don'ts

When filling out the Sample Tax Return Transcript form, consider the following do's and don'ts:

- Ensure all personal information, such as your name and Social Security Number (SSN), is accurate.

- Double-check the tax period you are requesting to ensure it matches your records.

- Use the correct form number (1040) as indicated on the transcript.

- Keep a copy of the completed form for your records.

- Submit the form before the deadline to avoid delays in processing.

- Review the instructions provided with the form for any specific requirements.

- Contact the IRS directly if you have questions about the form or your tax situation.

However, avoid these common mistakes:

- Do not leave any required fields blank.

- Avoid using outdated forms or incorrect versions.

- Do not provide inaccurate information, as this can lead to complications.

- Do not forget to sign and date the form before submission.

- Avoid submitting the form without verifying all calculations and entries.

- Do not assume that the IRS will correct any mistakes for you.

- Do not ignore any requests for additional information from the IRS.

Other PDF Forms

Blank Bill of Lading - This form is often required for businesses involved in shipping.

Types of Medicine - An organized sheet contributes to efficient health care delivery systems.

Detailed Guide for Writing Sample Tax Return Transcript

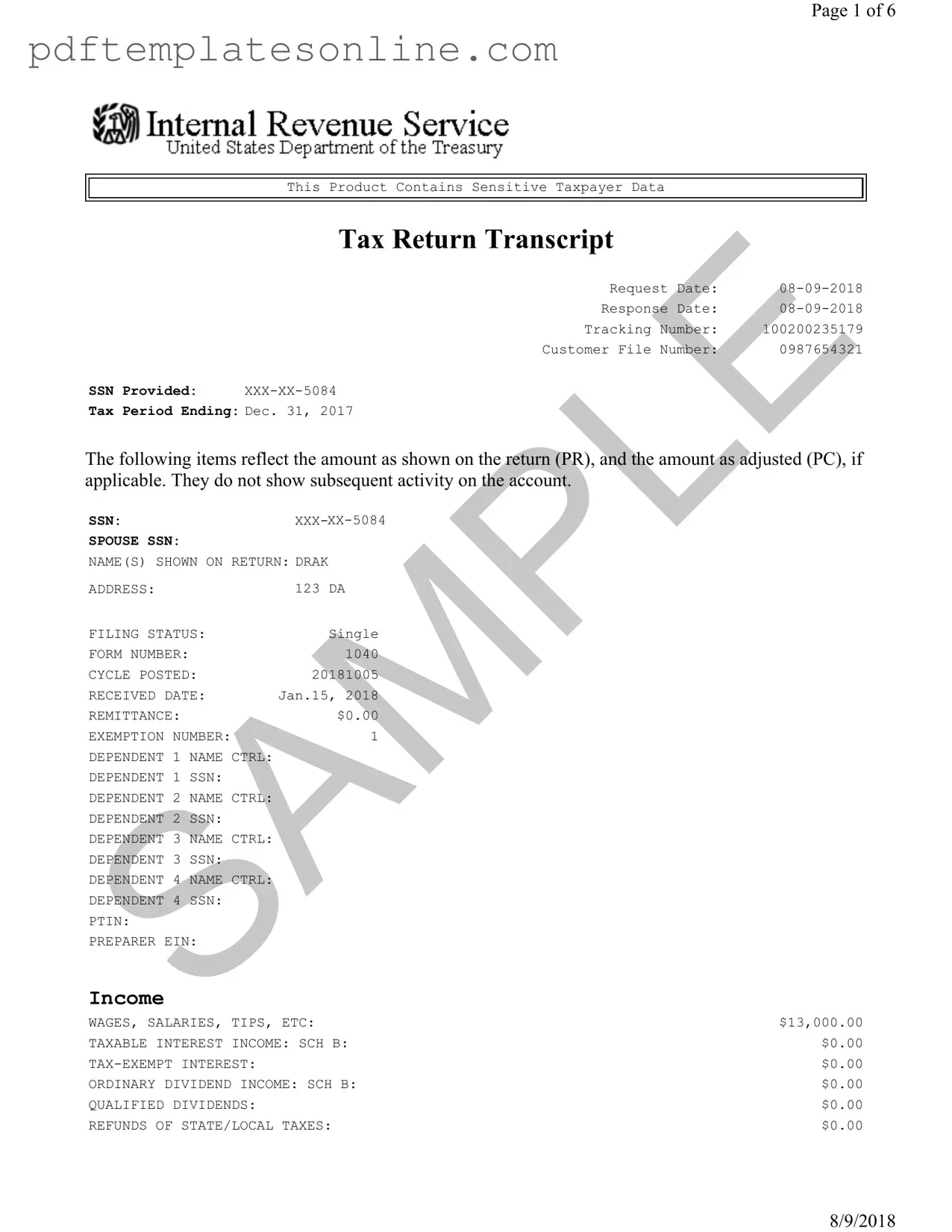

Filling out the Sample Tax Return Transcript form requires careful attention to detail. This form contains sensitive taxpayer data, and accuracy is crucial. Follow the steps below to ensure you complete the form correctly.

- Begin by entering the Request Date at the top of the form. Use the format MM-DD-YYYY.

- Next, fill in the Response Date using the same date format.

- Record the Tracking Number provided on the form.

- Input the Customer File Number as indicated.

- Enter the SSN Provided, ensuring to replace the last four digits with XXX-XX-XXXX.

- Fill in the Tax Period Ending date, which should match the year of the tax return.

- Complete the NAME(S) SHOWN ON RETURN section with the taxpayer's name.

- Provide the ADDRESS where the taxpayer resides.

- Indicate the FILING STATUS, selecting from options such as Single, Married Filing Jointly, etc.

- Enter the FORM NUMBER as 1040.

- Record the CYCLE POSTED date.

- Fill in the RECEIVED DATE of the tax return.

- Input the REMITTANCE amount, if applicable.

- Enter the EXEMPTION NUMBER based on the taxpayer's situation.

- List any dependents, if applicable, including their names and SSNs.

- Complete the income section, entering amounts for wages, interest, dividends, and any other relevant income sources.

- Fill in the adjustments to income, including educator expenses and self-employment tax deductions.

- Provide tax and credit information, including standard deduction amounts and any applicable credits.

- Complete the payments section, detailing federal income tax withheld and any other payments made.

- Lastly, calculate the AMOUNT YOU OWE or any refund due.

Once the form is filled out, review all entries for accuracy. Ensure that all sensitive information is handled securely. This form will be used for processing your tax information, so it is important to keep it confidential and protected.