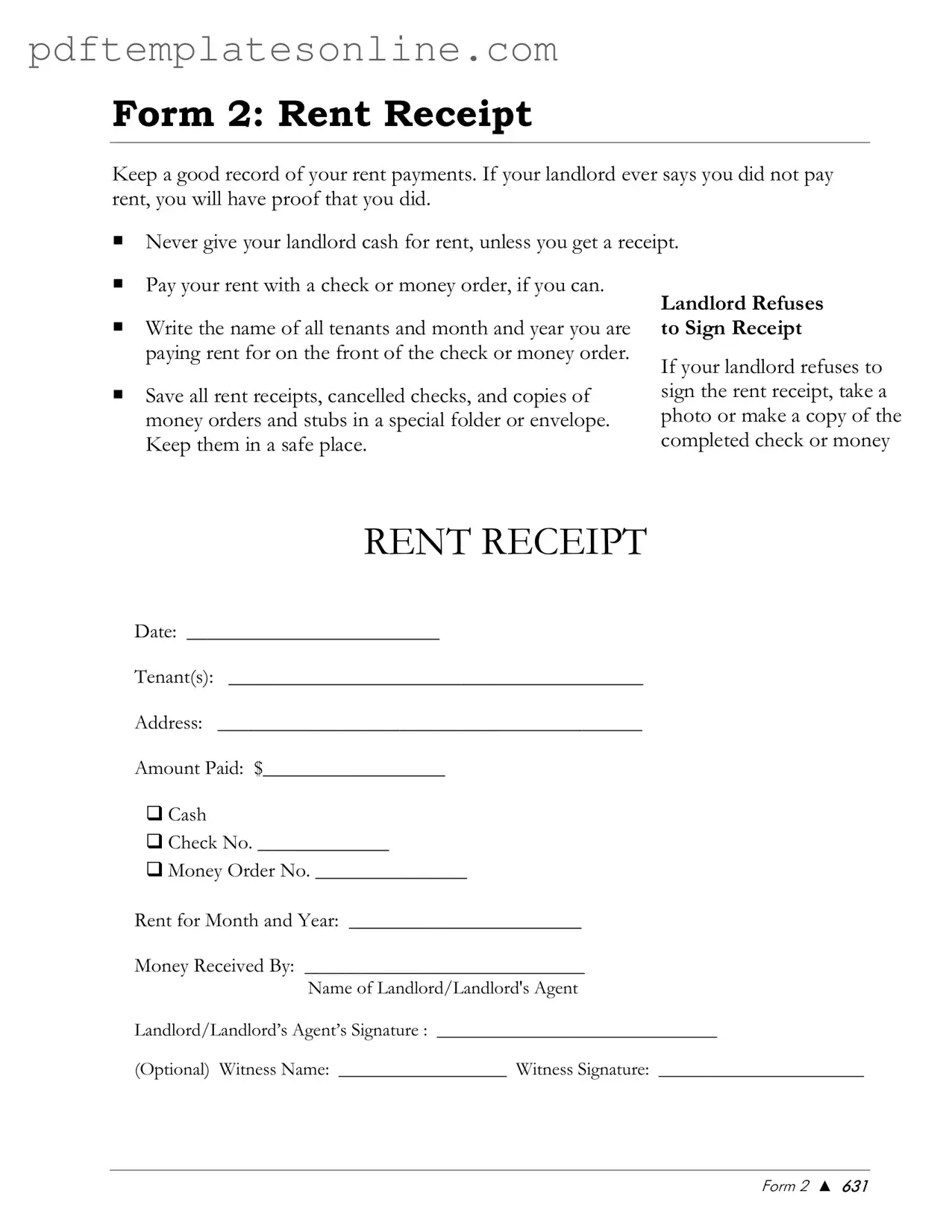

Blank Rental Receipt Form

Key takeaways

When filling out and using the Rental Receipt form, several key points should be considered to ensure clarity and compliance.

- Complete All Fields: Ensure that every section of the form is filled out accurately, including the date, tenant names, and address.

- Specify Payment Method: Clearly indicate the method of payment, whether it is cash, check, or money order.

- Record Amount Paid: Write the exact amount received in the designated space to avoid any confusion.

- Document Rent Period: Note the specific month and year for which the rent is being paid to establish a clear timeline.

- Landlord Information: Include the name of the landlord or the landlord's agent to identify the recipient of the payment.

- Signature Requirement: While optional, obtaining the landlord or agent's signature adds an extra layer of validation to the receipt.

- Witness Signature: Having a witness sign the receipt can provide additional credibility to the transaction.

- Keep Copies: Both the landlord and tenant should retain copies of the signed receipt for their records.

- Legal Compliance: Ensure that the receipt complies with local laws and regulations regarding rental transactions.

Common mistakes

Filling out a rental receipt form might seem straightforward, but many individuals make common mistakes that can lead to confusion or disputes later. One frequent error is failing to include the date on the receipt. Without a clear date, it becomes challenging to track when the payment was made. This can create issues if there are questions about the timing of rent payments or if a tenant claims they paid on a different date.

Another mistake often made is incomplete tenant information. Many people forget to fill in the tenant's name or address. This omission can complicate matters if there are disputes over payment or if the receipt needs to be referenced later. Ensuring that all tenant details are accurately recorded is essential for maintaining clear records.

Additionally, individuals sometimes neglect to specify the payment method. While the form provides options like cash, check, or money order, failing to mark one of these can lead to uncertainty. If a tenant later claims they paid in cash, but the receipt does not reflect that, it may cause unnecessary disputes. It’s crucial to clearly indicate how the payment was made to avoid any misunderstandings.

Finally, not obtaining a signature from the landlord or landlord's agent can be a significant oversight. A signature serves as proof that the payment was received and acknowledged by the landlord. Without it, the tenant may find it difficult to prove that the payment was made, especially if issues arise in the future. Ensuring that all parties sign the receipt can provide peace of mind and protect everyone involved.

Misconceptions

Understanding the Rental Receipt form is essential for both landlords and tenants. However, several misconceptions can cloud its purpose and usage. Here are eight common misunderstandings:

- 1. A rental receipt is not necessary if a tenant pays in cash. Many believe that cash payments do not require a receipt. However, providing a receipt for cash transactions is crucial for record-keeping and proof of payment.

- 2. The landlord does not need to sign the receipt. Some think that a signature from the landlord or their agent is optional. In reality, a signature adds legitimacy to the receipt and confirms that the payment was received.

- 3. A rental receipt can be handwritten on any piece of paper. While it might seem convenient, using a formal rental receipt form ensures all necessary information is documented consistently and professionally.

- 4. The amount paid is not important if the tenant has a lease. This is a misconception. Documenting the exact amount paid is vital, regardless of the lease agreement, as it serves as proof of payment and can help resolve disputes.

- 5. A witness signature is always required. Many believe that a witness signature is mandatory for the receipt to be valid. In fact, while it can provide additional verification, it is not a requirement.

- 6. The receipt is only for the tenant's benefit. Some think that only tenants need the receipt. However, landlords also benefit, as it helps them maintain accurate financial records and can protect them in case of disputes.

- 7. Rental receipts are only needed for monthly payments. This misconception suggests that receipts are unnecessary for other types of payments. In reality, any payment related to the rental agreement should be documented, regardless of frequency.

- 8. Once a receipt is issued, it cannot be modified. Many assume that a receipt is final and unchangeable. However, if an error is found, it can be corrected, but both parties should acknowledge the change for clarity.

By addressing these misconceptions, both landlords and tenants can navigate rental agreements with greater confidence and clarity.

Dos and Don'ts

When filling out the Rental Receipt form, consider the following guidelines:

- Do write the date clearly at the top of the form.

- Do include all tenant names accurately.

- Do specify the address of the rental property.

- Don't leave the amount paid section blank.

- Don't forget to check the appropriate payment method.

- Don't skip the signature section for the landlord or agent.

Other PDF Forms

Act of Donation Form Louisiana - Once signed and notarized, the act of donation form marks the legal completion of the property transfer process.

The California Prenuptial Agreement form is a legal document designed to detail how a couple wishes to divide their assets and responsibilities should their marriage end. It provides a clear agreement on financial matters, safeguarding both parties' interests. By setting these terms before marriage, couples can ensure a measure of security and clarity for their future, making resources such as California PDF Forms invaluable in the process.

Gf Application Form - A connection worth cultivating starts with sharing your thoughts and wishes.

Detailed Guide for Writing Rental Receipt

Filling out the Rental Receipt form accurately is essential for record-keeping. This document serves as proof of payment for rent and should be completed carefully. Follow the steps below to ensure all necessary information is provided.

- Locate the Date field and enter the date the payment was received.

- In the Tenant(s) section, write the name(s) of the tenant(s) making the payment.

- Fill in the Address field with the rental property’s complete address.

- In the Amount Paid section, enter the total amount received for rent.

- Select the payment method by checking the appropriate box: Cash, Check, or Money Order. If you choose Check or Money Order, fill in the respective number.

- Indicate the Rent for Month and Year by specifying the month and year for which the rent is being paid.

- Write your name in the Money Received By field to identify who received the payment.

- Sign the form in the Landlord/Landlord’s Agent’s Signature section. This step is optional but recommended for verification.

- If applicable, fill in the Witness Name and Witness Signature fields to have an additional party verify the transaction.