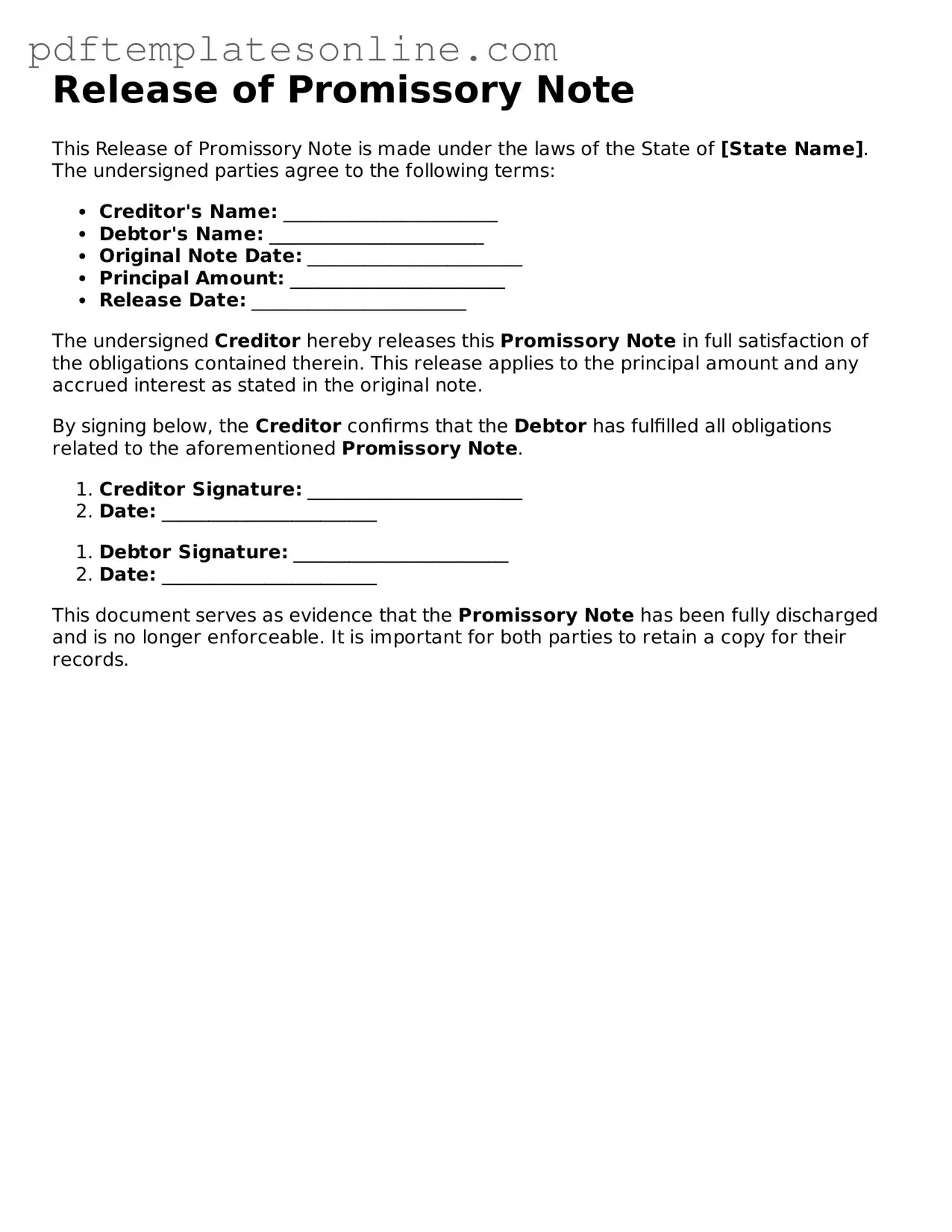

Fillable Release of Promissory Note Document

Key takeaways

When dealing with a Release of Promissory Note form, it is essential to understand its significance and how to complete it correctly. Here are some key takeaways to consider:

- Understand the Purpose: The form serves to formally release a borrower from their obligation to repay a loan documented by a promissory note.

- Identify the Parties: Clearly state the names of both the lender and the borrower to avoid any confusion.

- Include the Note Details: Reference the original promissory note by including details such as the date it was executed and the amount borrowed.

- Signatures Required: Both parties should sign the form to validate the release. This indicates mutual agreement.

- Notarization May Be Needed: Depending on state laws, notarizing the document may add an extra layer of authenticity.

- Retain Copies: Each party should keep a copy of the signed form for their records, ensuring that there is proof of the release.

- Consult Legal Counsel: Seeking advice from a legal expert can help clarify any uncertainties and ensure compliance with local laws.

- Consider Timing: File the release promptly after the debt has been settled to avoid future disputes.

- Use Clear Language: Avoid ambiguous terms in the document. Clear language helps prevent misunderstandings.

- Review Before Submission: Double-check all details for accuracy before finalizing the form to prevent any errors that could lead to complications.

Common mistakes

When filling out a Release of Promissory Note form, individuals often overlook critical details that can lead to complications down the line. One common mistake is failing to include all necessary parties involved in the agreement. If a borrower or co-signer is omitted, it can create confusion about who is responsible for the note and may lead to disputes later.

Another frequent error is neglecting to specify the date of release clearly. The date is essential because it marks when the obligations under the promissory note are officially terminated. Without this detail, there may be ambiguity regarding the effective date of the release, potentially affecting the rights of the parties involved.

Inaccurate or incomplete information about the promissory note itself is also a common pitfall. The form should reference the original note's amount, date, and any relevant terms. Omitting or misrepresenting these details can result in misunderstandings or legal challenges regarding the validity of the release.

Many people also fail to provide their signatures or the signatures of all relevant parties. A release form without the necessary signatures may not be considered valid, leaving the obligations of the promissory note intact. It is crucial to ensure that everyone involved reviews and signs the document to avoid any potential issues.

Lastly, individuals often underestimate the importance of keeping a copy of the completed form. After submitting the release, it is essential to retain a copy for personal records. Without documentation, proving that the note has been released could become challenging if disputes arise in the future.

Misconceptions

The Release of Promissory Note form is often misunderstood. Here are seven common misconceptions about this document:

- It is only necessary for large loans. Many believe that only significant financial transactions require a release. In reality, any promissory note, regardless of the amount, can benefit from a formal release to clarify that the debt has been satisfied.

- It is automatically issued when a loan is paid off. Some assume that a release will be generated automatically once the debt is settled. However, the borrower must request this document to ensure proper acknowledgment of payment.

- It serves as proof of payment. While the release indicates that the debt is cleared, it does not serve as proof of payment itself. Borrowers should retain payment records separately for their own documentation.

- It is a complex legal document. Many think that the release form is complicated and requires legal expertise to complete. In fact, it is a straightforward document that can be filled out with basic information.

- Once signed, it cannot be revoked. Some believe that signing the release is final and cannot be undone. However, if there was a mistake or misunderstanding, parties may negotiate a new agreement.

- It is only relevant to the lender. This misconception overlooks the borrower's rights. The release is equally important for borrowers, as it protects them from future claims on the same debt.

- It must be notarized to be valid. While notarization can add an extra layer of authenticity, it is not always a requirement for the release to be legally binding. The specifics can vary by state.

Dos and Don'ts

When filling out the Release of Promissory Note form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do provide accurate information regarding the parties involved.

- Do include the date of the release clearly.

- Do ensure that all signatures are present and legible.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless specified.

- Don't use correction fluid or erasers on the form.

By adhering to these guidelines, you can help ensure that the Release of Promissory Note is processed smoothly and without complications.

Browse Common Types of Release of Promissory Note Templates

How to Write a Promissory Note Example - This document can enhance the buying experience by providing clear terms of the sale.

For individuals engaged in lending or borrowing, acquiring a California Promissory Note form is essential to ensure that the terms of the agreement are clearly defined and legally enforceable. This form not only solidifies the commitment between parties but also details necessary elements such as interest rates and payment schedules. To access a customizable version of this important document, you can visit formcalifornia.com/editable-promissory-note-form/, which provides the tools needed for tailored financial agreements and enhances mutual understanding in transactions.

Detailed Guide for Writing Release of Promissory Note

Once you have the Release of Promissory Note form ready, it's important to fill it out accurately to ensure that all necessary details are captured. This will help in finalizing the release process smoothly.

- Begin by entering the date at the top of the form. This is typically the date when you are filling out the form.

- Next, write the name of the person or entity that is releasing the promissory note. This should be the lender or the individual who originally held the note.

- In the following section, provide the name of the borrower. This is the individual or entity that took out the loan and signed the promissory note.

- Include the original amount of the promissory note. This is the total sum that was borrowed, as stated in the original agreement.

- Clearly state the date when the promissory note was executed. This is the date when the borrower signed the note.

- Next, indicate the date when the promissory note was paid in full. This confirms that the borrower has fulfilled their obligation.

- Sign the form where indicated. This signature should be that of the lender or authorized representative.

- Finally, provide any additional information if required, such as contact details or a witness signature if necessary.

After completing the form, make sure to keep a copy for your records. You may need to send the original document to the relevant parties involved to finalize the release of the promissory note.