Blank Release Of Lien Texas Form

Key takeaways

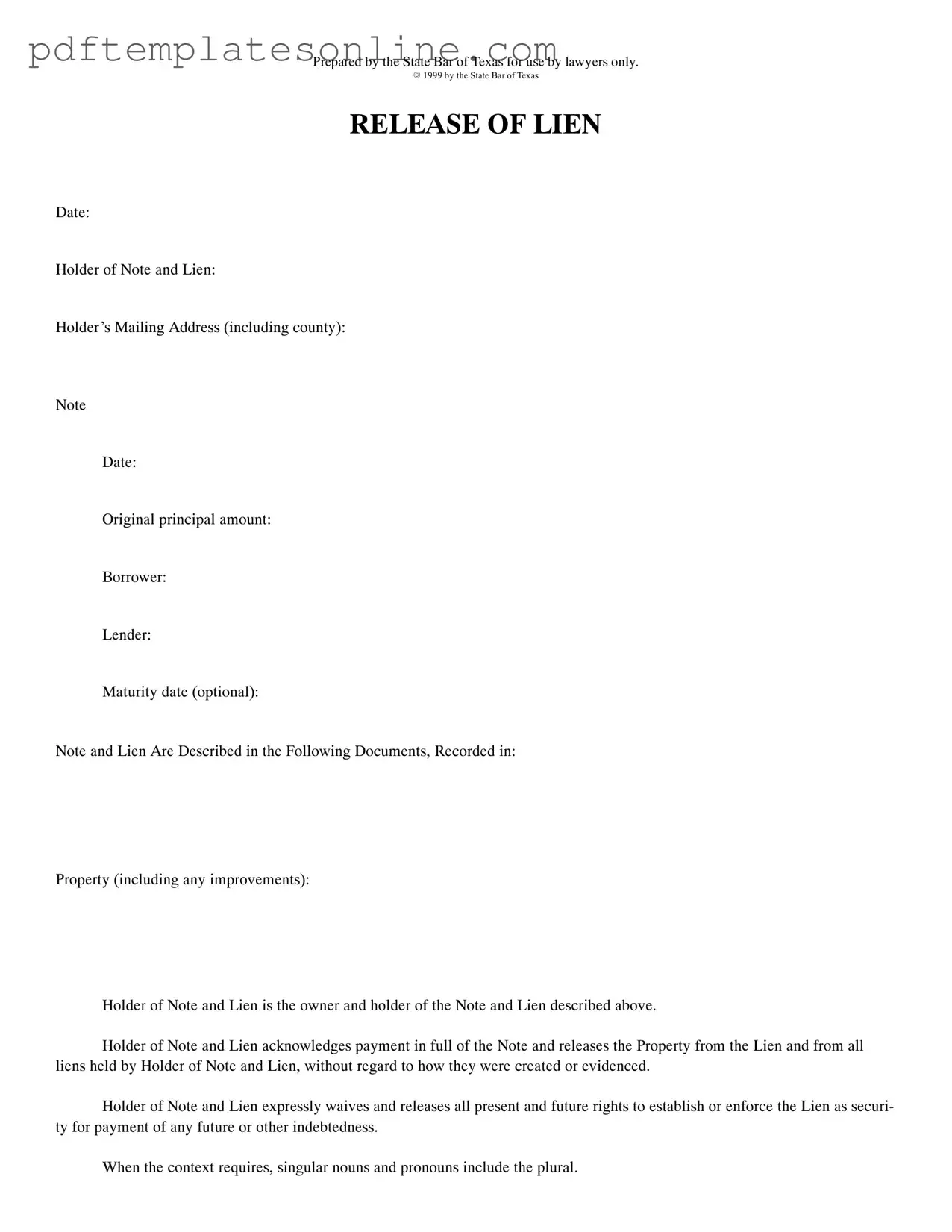

1. Purpose of the Form: The Release of Lien Texas form is used to officially release a lien on a property once the debt has been paid in full. This ensures that the property is free from any claims by the lienholder.

2. Information Required: When filling out the form, you must provide specific details such as the holder of the note and lien, the borrower's information, and the property description. Accuracy is crucial to avoid future disputes.

3. Acknowledgment Requirement: The form must be acknowledged before a notary public. This step confirms that the holder of the lien agrees to release the lien and helps prevent fraudulent claims.

4. Recording the Document: After completing the form, it should be recorded with the appropriate county office. This step is essential to make the release official and to inform the public that the lien has been lifted.

Common mistakes

Filling out the Release of Lien form in Texas can seem straightforward, but several common mistakes can lead to complications. One major error is failing to include the correct holder of the note and lien. This section must accurately reflect the individual or entity that holds the lien. If this information is incorrect, it can create confusion and may invalidate the release.

Another frequent mistake is neglecting to provide the holder's mailing address. This address is essential for any future correspondence or legal matters. Without it, you may face challenges in communication, which can lead to delays or disputes down the line.

People often overlook the importance of the note date. This date signifies when the original loan was made and is critical in establishing the timeline of the lien. If this date is missing or incorrect, it can complicate the legal standing of the release.

In addition, the original principal amount must be filled out accurately. This amount represents the total borrowed and is crucial for confirming that the lien has been satisfied. An error here could raise questions about whether the debt was fully paid.

Another common oversight is failing to properly describe the property involved. This includes not only the address but also any improvements made to the property. A vague or incomplete description can lead to issues in enforcing the release, as it may not clearly identify what is being released from the lien.

People sometimes forget to include the maturity date, even though it is optional. While it may not seem necessary, including this date can provide additional clarity regarding the timeline of the loan and its repayment, which can be beneficial in future dealings.

Additionally, some individuals do not ensure that the acknowledgment section is completed correctly. This part verifies that the document was signed in front of a notary public. If this step is neglected, the release may not hold up in court, leading to potential legal issues.

Lastly, failing to return the form to the correct address after recording is a common mistake. This step is vital to ensure that all parties have the necessary documentation on file. Not following through with this can lead to confusion and potential disputes regarding the lien's status.

Misconceptions

Understanding the Release of Lien form in Texas is crucial for property owners and lenders. However, there are several misconceptions that can lead to confusion. Here are nine common misconceptions:

- Only lawyers can use the Release of Lien form. Many believe that only licensed attorneys can fill out this form. In reality, property owners and lenders can use it as long as they understand the requirements.

- The form is only for unpaid debts. Some think the Release of Lien is only relevant when a debt remains unpaid. In fact, it is used to release a lien once the debt has been fully paid.

- All liens are automatically released once a debt is paid. It's a common belief that paying off a loan automatically removes the lien. However, a formal Release of Lien must be filed to officially remove it from public records.

- Notary acknowledgment is optional. Many assume that notarizing the document is not necessary. However, a notary's acknowledgment is typically required to validate the Release of Lien.

- The form must be filed in person. Some people think they must file the Release of Lien in person at the courthouse. In many cases, it can be mailed or submitted electronically, depending on local rules.

- Only the original lender can file the Release of Lien. There is a misconception that only the original lender has the authority to file this document. Any holder of the note can file it once the debt is satisfied.

- The Release of Lien is the same as a satisfaction of mortgage. Many confuse these two terms. While both serve to release a lien, a satisfaction of mortgage specifically pertains to mortgages, while the Release of Lien can apply to various types of liens.

- Once filed, the Release of Lien cannot be revoked. Some believe that once the form is filed, it cannot be undone. However, if there was an error or if it was filed inappropriately, it can sometimes be contested.

- The form is not necessary for personal property. There is a misconception that the Release of Lien only applies to real estate. In fact, it can also pertain to personal property, depending on the situation.

Being aware of these misconceptions can help ensure that property transactions go smoothly and that all parties understand their rights and responsibilities.

Dos and Don'ts

When filling out the Release of Lien Texas form, it's important to follow specific guidelines to ensure accuracy and compliance. Here are some key do's and don'ts:

- Do provide complete and accurate information for all required fields.

- Do double-check the spelling of names and addresses to avoid any issues.

- Do ensure that the date of acknowledgment is filled in correctly.

- Do have the form notarized to validate the release.

- Don't leave any fields blank; fill in all necessary details.

- Don't forget to include the property description accurately.

- Don't submit the form without verifying that payment has been made in full.

Other PDF Forms

What Does a Dog Need to Travel - Some airlines may have additional requirements beyond the veterinary certificate.

In order to facilitate vehicle-related transactions when the owner is unavailable, the California Motor Vehicle Power of Attorney form allows a trusted individual to manage crucial matters pertaining to vehicle ownership and registration. For those seeking this essential legal document, resources such as California PDF Forms can provide the necessary templates and guidance to complete it properly.

Counseling Army - Leaders can use the DA 4856 to identify and address soldier concerns.

Detailed Guide for Writing Release Of Lien Texas

Once the Release of Lien form is completed, it should be submitted to the appropriate county office for recording. This process will officially document the release of the lien on the property. Follow these steps to fill out the form accurately.

- Date: Enter the current date at the top of the form.

- Holder of Note and Lien: Write the name of the individual or entity that holds the note and lien.

- Holder’s Mailing Address: Provide the complete mailing address of the holder, including the county.

- Note Date: Fill in the date when the note was originally executed.

- Original Principal Amount: State the original amount of the loan or obligation.

- Borrower: Enter the name of the borrower associated with the lien.

- Lender: Specify the name of the lender who provided the loan.

- Maturity Date (optional): If applicable, include the date when the loan is due.

- Note and Lien Are Described in the Following Documents, Recorded in: Indicate the details of the documents that describe the lien.

- Property: Describe the property that is subject to the lien, including any improvements.

- Holder of Note and Lien Acknowledgment: Confirm that the holder acknowledges payment in full and releases the property from the lien.

- Acknowledgment Section: Complete the acknowledgment section, including the state and county, the date of acknowledgment, and the name of the person acknowledging.

- Notary Public: Leave space for the notary public’s name and commission expiration date.

- Corporate Acknowledgment (if applicable): If the holder is a corporation, complete this section with the necessary details.

- Return Address: Write the address to which the recorded document should be returned after processing.