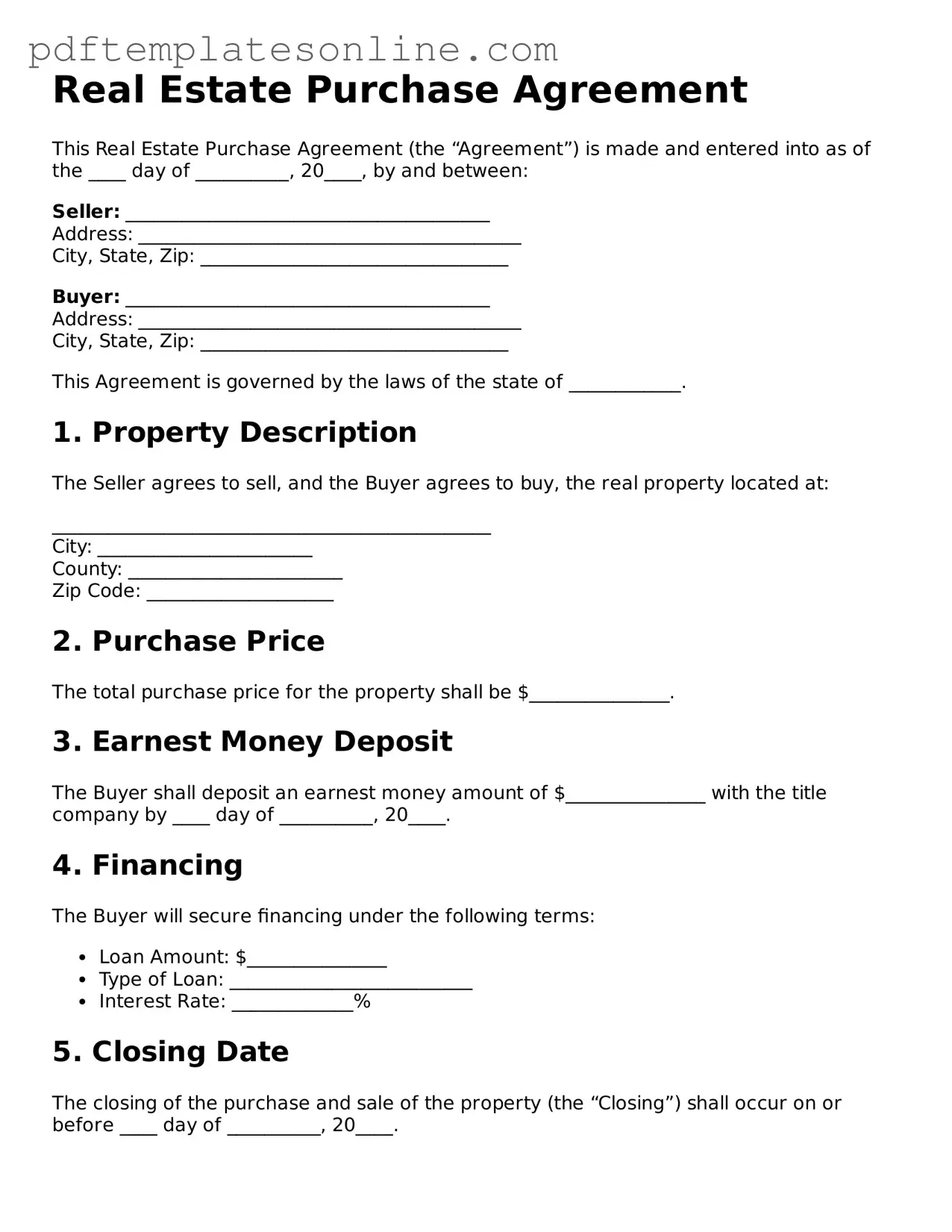

Fillable Real Estate Purchase Agreement Document

Key takeaways

The Real Estate Purchase Agreement is a legal document that outlines the terms and conditions of a property sale. It serves as a binding contract between the buyer and the seller.

Both parties must provide accurate information about the property, including its address, legal description, and any fixtures or personal property included in the sale.

It is essential to clearly state the purchase price and the method of payment, whether it be cash, financing, or a combination of both.

Contingencies can be included in the agreement. Common contingencies involve inspections, financing, and the sale of the buyer's current home.

All parties should review the agreement carefully before signing to ensure that all terms are understood and agreed upon.

Once signed, the agreement becomes legally binding. Therefore, it is advisable to consult with a real estate professional or attorney if there are any questions or concerns.

Real Estate Purchase Agreement Forms for Particular States

Common mistakes

Filling out a Real Estate Purchase Agreement can be a daunting task, and mistakes can lead to delays or complications in the transaction. One common error is failing to provide accurate property descriptions. Buyers and sellers must ensure that the property address, legal description, and any included fixtures are clearly outlined. Omitting details can create confusion and potential disputes.

Another frequent mistake is neglecting to specify the purchase price. This is a critical element of the agreement. If the price is left blank or incorrectly stated, it can lead to misunderstandings. Always double-check that the amount reflects what both parties have agreed upon.

Many individuals also overlook the importance of including contingencies. Contingencies are conditions that must be met for the sale to proceed. Common examples include financing, inspections, and appraisals. Failing to include these can leave buyers vulnerable and unprotected.

Inaccurate dates can also pose a significant problem. Buyers should ensure that the closing date and any deadlines for contingencies are clearly stated. Missing or incorrect dates can lead to missed opportunities or legal issues.

Another mistake is not including all necessary signatures. Each party involved in the transaction must sign the agreement for it to be legally binding. If a signature is missing, it can invalidate the entire contract.

Buyers and sellers sometimes forget to clarify who is responsible for closing costs. This can lead to unexpected expenses and disputes later on. Clearly outlining these responsibilities in the agreement helps prevent misunderstandings.

In addition, failing to review the financing terms can create complications. Buyers should ensure that the agreement reflects their financing arrangements accurately. This includes the type of loan, interest rate, and any specific lender requirements.

Another common oversight is neglecting to include any special requests or agreements. If there are specific terms that both parties have discussed, such as repairs or included appliances, these should be documented in the agreement to avoid confusion later.

Moreover, not consulting with a real estate professional can lead to numerous mistakes. Having an experienced agent or attorney review the agreement can help catch errors and ensure that all necessary elements are included.

Lastly, individuals often fail to keep a copy of the signed agreement. It is essential to retain a copy for personal records and to refer back to if any issues arise. Keeping organized documentation helps ensure a smoother transaction process.

Misconceptions

Understanding the Real Estate Purchase Agreement (REPA) is crucial for anyone involved in buying or selling property. However, several misconceptions can lead to confusion. Here are six common misunderstandings about this important document:

- The REPA is a legally binding contract only when signed by both parties. While it is true that a signed REPA is binding, the agreement can also be enforceable if one party has acted on the terms, even if the other has not signed.

- All REPA forms are the same. This is not accurate. Different states and localities may have specific requirements or variations in their REPA forms. It's important to use the correct form for your jurisdiction.

- The REPA guarantees that the sale will go through. A signed agreement does not guarantee that the sale will be completed. Various conditions, such as financing or inspections, must be satisfied for the transaction to proceed.

- You cannot change the terms of the REPA once it is signed. While it is generally advisable to finalize the terms before signing, parties can negotiate changes after signing. This requires mutual consent and often a written amendment.

- The REPA only covers the sale price of the property. In reality, the REPA includes various terms beyond the sale price, such as contingencies, closing dates, and responsibilities for repairs, which are essential for a smooth transaction.

- Using a REPA is optional in real estate transactions. In most cases, a written agreement is necessary to protect both parties. Verbal agreements are difficult to enforce and can lead to misunderstandings.

By clarifying these misconceptions, buyers and sellers can better navigate the complexities of real estate transactions and make informed decisions.

Real Estate Purchase Agreement Categories

Dos and Don'ts

When filling out a Real Estate Purchase Agreement form, it's essential to approach the task with care. Here are some key points to consider:

- Do read the entire document thoroughly before filling it out. Understanding each section is crucial.

- Do provide accurate information. Double-check names, addresses, and financial details to avoid complications later.

- Do consult with a real estate professional if you have questions. Their expertise can guide you through the process.

- Don't leave any sections blank. Incomplete forms can lead to delays or misunderstandings.

- Don't rush the process. Take your time to ensure that everything is filled out correctly and completely.

Check out Popular Documents

Roof Inspection Report Template - Ensure your roofing installation complies with all local codes.

Vics Bol - Features instructions to ensure proper handling of each package.

Cease and Desist Letter Sample - It may include a request for a written response.

Detailed Guide for Writing Real Estate Purchase Agreement

Filling out a Real Estate Purchase Agreement form is a crucial step in the property buying process. This document outlines the terms and conditions of the sale, ensuring that both the buyer and seller have a clear understanding of their obligations. Below are the steps to complete the form accurately.

- Begin by entering the date on which the agreement is being executed.

- Provide the names and contact information of both the buyer and the seller. Ensure all details are accurate.

- Identify the property being purchased. Include the full address and any relevant legal descriptions.

- Specify the purchase price of the property. This should reflect the agreed-upon amount between the buyer and seller.

- Outline the terms of the deposit. Indicate the amount and the timeline for payment.

- Detail any contingencies. This may include financing, inspections, or other conditions that must be met before the sale is finalized.

- State the closing date. This is the date when the transaction will be completed and ownership will be transferred.

- Include any additional terms or conditions that are specific to the sale. This could cover repairs, appliances, or other considerations.

- Both parties should sign and date the agreement to indicate their acceptance of the terms.

Once the form is filled out and signed, it is advisable to keep copies for both parties. This ensures that everyone has access to the agreed-upon terms as the transaction moves forward.