Fillable Quitclaim Deed Document

Key takeaways

Filling out and using a Quitclaim Deed form is a straightforward process, but it requires careful attention to detail. Here are ten key takeaways to consider:

- Understand the Purpose: A Quitclaim Deed is primarily used to transfer ownership of real estate from one party to another without guaranteeing that the title is clear.

- Identify the Parties: Clearly list the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide Property Description: Include a detailed description of the property being transferred. This should encompass the address and legal description.

- Check State Requirements: Each state has its own requirements for completing and filing a Quitclaim Deed. Ensure compliance with local laws.

- Signatures Required: The grantor must sign the document in the presence of a notary public. Some states may require the grantee’s signature as well.

- Notarization: Notarization is essential. It verifies the identities of the parties involved and the authenticity of the signatures.

- Filing the Deed: After completion, the Quitclaim Deed should be filed with the appropriate county recorder’s office to make the transfer official.

- Consider Tax Implications: Be aware of any potential tax consequences associated with the transfer of property. Consulting a tax professional may be beneficial.

- Keep Copies: Retain copies of the completed Quitclaim Deed for personal records. This can be important for future reference.

- Seek Legal Advice: If there are any uncertainties or complexities, consider seeking legal advice to ensure the process is handled correctly.

By following these guidelines, individuals can navigate the Quitclaim Deed process with confidence. Proper execution and understanding of the form will help facilitate a smooth property transfer.

Quitclaim Deed Forms for Particular States

Common mistakes

Filling out a Quitclaim Deed form can seem straightforward, but many people make common mistakes that can lead to significant issues later on. One frequent error is failing to include the correct legal description of the property. This description should be detailed enough to clearly identify the property being transferred. Without it, the deed may not be valid, and the transfer of ownership could be challenged.

Another mistake involves not properly identifying the grantor and grantee. The grantor is the person transferring the property, while the grantee is the one receiving it. It’s crucial to use full names and, when applicable, include marital status. Omitting this information can create confusion and complicate future transactions.

People often overlook the need for signatures. A Quitclaim Deed must be signed by the grantor to be effective. If the grantor is married, some states require both spouses to sign, even if only one spouse is transferring their interest. Failing to obtain the necessary signatures can render the deed invalid.

Another common error is neglecting to have the deed notarized. Many states require that the Quitclaim Deed be notarized to be legally binding. This adds an extra layer of verification to the transaction. Skipping this step can lead to complications when trying to record the deed with the county.

Some individuals forget to record the Quitclaim Deed after it has been completed. Recording the deed with the appropriate county office is essential for protecting the new owner's rights. If the deed is not recorded, it may be difficult to prove ownership in the future, especially if another claim arises.

Additionally, people sometimes fail to check for existing liens or encumbrances on the property before transferring it. A Quitclaim Deed does not eliminate any debts associated with the property. If there are liens, the new owner may inherit these financial burdens, which can lead to unexpected challenges.

Another mistake is using outdated forms. Laws and requirements can change, so it’s important to use the most current version of the Quitclaim Deed form. Using an outdated form may lead to legal issues or rejection by the county recorder’s office.

Finally, individuals may not seek legal advice when needed. While it’s possible to fill out a Quitclaim Deed without assistance, consulting with a legal expert can help avoid pitfalls. A lawyer can provide guidance tailored to specific circumstances and ensure that all legal requirements are met.

Misconceptions

Many people have misunderstandings about the Quitclaim Deed form. Here are ten common misconceptions, along with explanations to clarify them.

-

Quitclaim deeds transfer ownership completely.

This is not entirely true. A quitclaim deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor has any ownership interest at all.

-

Quitclaim deeds are only used in divorce cases.

While they are commonly used in divorce settlements, quitclaim deeds can also be used for other reasons, such as transferring property between family members or clearing up title issues.

-

Quitclaim deeds are the same as warranty deeds.

These two types of deeds are different. A warranty deed provides a guarantee of clear title, while a quitclaim deed does not offer any warranties or guarantees.

-

Once a quitclaim deed is signed, it cannot be revoked.

A quitclaim deed is generally irrevocable once recorded, but there may be some circumstances where a party can seek to reverse the transaction through legal means.

-

Quitclaim deeds are only for real estate.

While they are most commonly used for real estate, quitclaim deeds can also be used for other types of property, such as vehicles or personal items.

-

Using a quitclaim deed is always simple and straightforward.

While the process can be simple, complications may arise, especially if there are disputes over ownership or if the property has liens or other encumbrances.

-

A quitclaim deed eliminates all claims to the property.

This is misleading. A quitclaim deed transfers the grantor's interest, but it does not necessarily eliminate claims by other parties who may have rights to the property.

-

All states recognize quitclaim deeds in the same way.

State laws vary regarding quitclaim deeds. It is essential to understand the specific laws in your state to ensure proper use.

-

Quitclaim deeds can be used to avoid taxes.

This is a misconception. While some transfers may not trigger taxes, others can. It is important to consult a tax professional to understand any potential tax implications.

-

Once a quitclaim deed is filed, the property is automatically transferred.

The deed must be properly executed and recorded to effectuate the transfer. Until that happens, the ownership may still remain with the original owner.

Understanding these misconceptions can help you make informed decisions regarding property transfers. Always seek professional advice when dealing with legal documents.

Dos and Don'ts

When filling out a Quitclaim Deed form, certain practices can help ensure accuracy and legality. Here are six important dos and don'ts to consider:

- Do provide complete and accurate information about the property, including the legal description.

- Do ensure that the names of all parties involved are spelled correctly and match their legal documents.

- Do have the form notarized to validate the transfer of interest in the property.

- Do keep a copy of the completed Quitclaim Deed for your records.

- Don't leave any sections blank; incomplete forms can lead to legal issues.

- Don't forget to check local laws, as requirements can vary by state or county.

Browse Common Types of Quitclaim Deed Templates

Deed in Lieu Meaning - In some jurisdictions, homeowners might be required to provide a financial hardship letter to facilitate the Deed in Lieu process.

Deed of Gift Property - The form helps clarify the giver’s wishes and intent for the gift.

A California Real Estate Purchase Agreement form is a crucial document used in the process of buying or selling real estate in California. It outlines the terms and conditions of the sale, including the purchase price, financing details, and inspection rights. To assist with this process, resources such as California PDF Forms can be invaluable, ensuring that both parties, the buyer and the seller, understand their rights and obligations.

Lady Bird Deed Form - The Lady Bird Deed can be a thoughtful gift for future generations, helping to secure a family's legacy.

Detailed Guide for Writing Quitclaim Deed

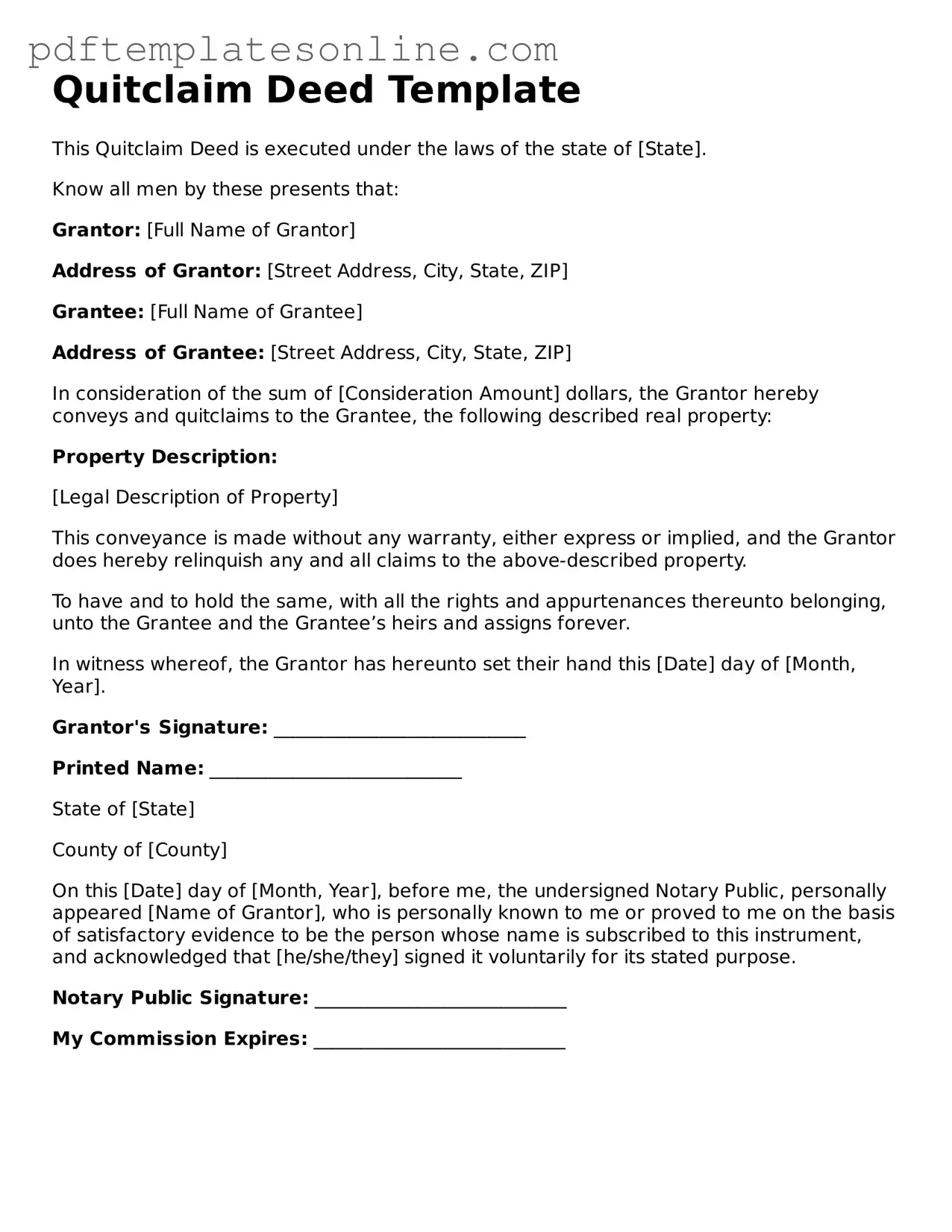

After you have gathered all necessary information and documents, it’s time to fill out the Quitclaim Deed form. This document is essential for transferring ownership of property. Follow these steps carefully to ensure accuracy and completeness.

- Obtain the Quitclaim Deed form. You can find this form online or at your local county recorder's office.

- Fill in the names of the grantor and grantee. The grantor is the person transferring the property, while the grantee is the person receiving it. Make sure to include their full legal names.

- Provide the property description. Include the address and legal description of the property being transferred. This may require a survey or reference to the property deed.

- Indicate the consideration. This is the amount of money or value exchanged for the property. If the transfer is a gift, you can state "for love and affection."

- Sign the form. The grantor must sign the deed in the presence of a notary public. Ensure that the signature is clear and matches the name provided.

- Notarize the document. A notary public will verify the identity of the grantor and witness the signing of the document.

- File the deed. Submit the completed Quitclaim Deed form to the appropriate county office for recording. There may be a filing fee, so check in advance.

Once you have completed these steps, you will have successfully filled out the Quitclaim Deed form. The next phase involves ensuring that the document is recorded properly, which will finalize the transfer of property ownership.