Fillable Promissory Note for a Car Document

Key takeaways

When dealing with a Promissory Note for a Car, it’s essential to understand the key aspects of the form. Here are some important takeaways to keep in mind:

- Understand the Purpose: A promissory note is a legal document that outlines the borrower's promise to repay a loan. This specific note pertains to financing a vehicle.

- Identify the Parties: Clearly state the names and contact information of both the borrower and the lender. This ensures accountability.

- Specify the Loan Amount: Indicate the total amount being borrowed for the car. This figure is crucial for both parties.

- Outline the Interest Rate: Include the interest rate applicable to the loan. This affects the total amount to be repaid.

- Define the Payment Schedule: Detail how and when payments will be made. This can be monthly, bi-weekly, or another agreed-upon schedule.

- Include Late Fees: Specify any late fees that may apply if payments are not made on time. This encourages timely payments.

- State the Maturity Date: This is the date when the full loan amount is due. It’s important for planning repayment.

- Address Default Conditions: Clearly outline what happens if the borrower fails to make payments. This protects the lender’s interests.

- Signatures Required: Both parties must sign and date the document. This makes the agreement legally binding.

- Keep Copies: Each party should retain a copy of the signed promissory note for their records. This helps prevent disputes in the future.

By following these key points, you can effectively fill out and utilize a Promissory Note for a Car, ensuring a smooth borrowing process.

Common mistakes

When filling out a Promissory Note for a car, individuals often make several common mistakes that can lead to complications later on. One significant error is failing to include all necessary parties involved in the transaction. It's crucial to list both the borrower and the lender accurately. Omitting one party can create confusion and potential legal issues if disputes arise.

Another frequent mistake is neglecting to specify the loan amount clearly. While it may seem straightforward, some people write vague terms or forget to include the total sum borrowed. This lack of clarity can lead to misunderstandings regarding repayment expectations.

Additionally, individuals sometimes overlook the interest rate or fail to define it properly. A Promissory Note should clearly state whether the interest is fixed or variable, as well as the specific percentage. Ambiguities in this section can cause disputes over how much is owed over time.

People often forget to include the repayment schedule. This schedule should detail when payments are due and how much each payment will be. Without this information, it can be challenging for both parties to keep track of payments, leading to missed deadlines and possible penalties.

Another common oversight is not signing the document. A Promissory Note is not legally binding unless it is signed by both parties. Failing to obtain signatures can render the entire agreement unenforceable, leaving the lender without legal recourse if the borrower defaults.

Moreover, some individuals neglect to include the consequences of defaulting on the loan. This section should outline what happens if the borrower fails to make payments. Without this information, the lender may find it difficult to enforce their rights if issues arise.

Lastly, many people forget to keep a copy of the signed Promissory Note for their records. Having a copy is essential for both parties to reference in case of disputes or misunderstandings. Without it, proving the terms of the agreement can become challenging.

Misconceptions

Understanding the Promissory Note for a Car is essential for both buyers and sellers in a vehicle transaction. However, several misconceptions can lead to confusion and potential legal issues. Here are five common misconceptions:

- It is the same as a car loan agreement. Many people believe a promissory note is identical to a car loan agreement. While both documents involve borrowing money to purchase a vehicle, a promissory note is a simple promise to pay back the loan, whereas a loan agreement includes detailed terms and conditions.

- It does not require signatures. Some assume that a promissory note can be valid without signatures. In reality, both parties must sign the document for it to be legally binding. Without signatures, the note lacks enforceability.

- It only benefits the lender. This misconception overlooks the fact that a promissory note protects both parties. It outlines the repayment terms, which can help the borrower understand their obligations and avoid potential disputes.

- It cannot be modified. Many believe once a promissory note is signed, it cannot be changed. In truth, both parties can agree to modify the terms. However, any changes should be documented in writing and signed by both parties to remain enforceable.

- It is not necessary for private sales. Some individuals think a promissory note is only needed in dealership transactions. However, using a promissory note in private sales is highly recommended. It provides a clear record of the agreement and helps protect both parties in case of disputes.

Dos and Don'ts

When filling out the Promissory Note for a Car form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do provide accurate personal information, including your full name and address.

- Do clearly state the loan amount and the interest rate.

- Do include the payment schedule, specifying due dates and payment amounts.

- Do sign and date the document to validate it.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; all sections must be completed.

- Don't use vague language; be clear and specific in your terms.

- Don't falsify any information; honesty is crucial.

- Don't forget to review the document for errors before submission.

- Don't neglect to consult a financial advisor if you have questions.

Browse Common Types of Promissory Note for a Car Templates

Release of Promissory Note Template - Ensures clarity regarding the discharge of the borrower's debts.

When dealing with financial agreements, having access to the right forms is crucial, and a Georgia PDF can simplify the process of creating a legally binding Promissory Note that clearly defines the responsibilities of both the borrower and the lender.

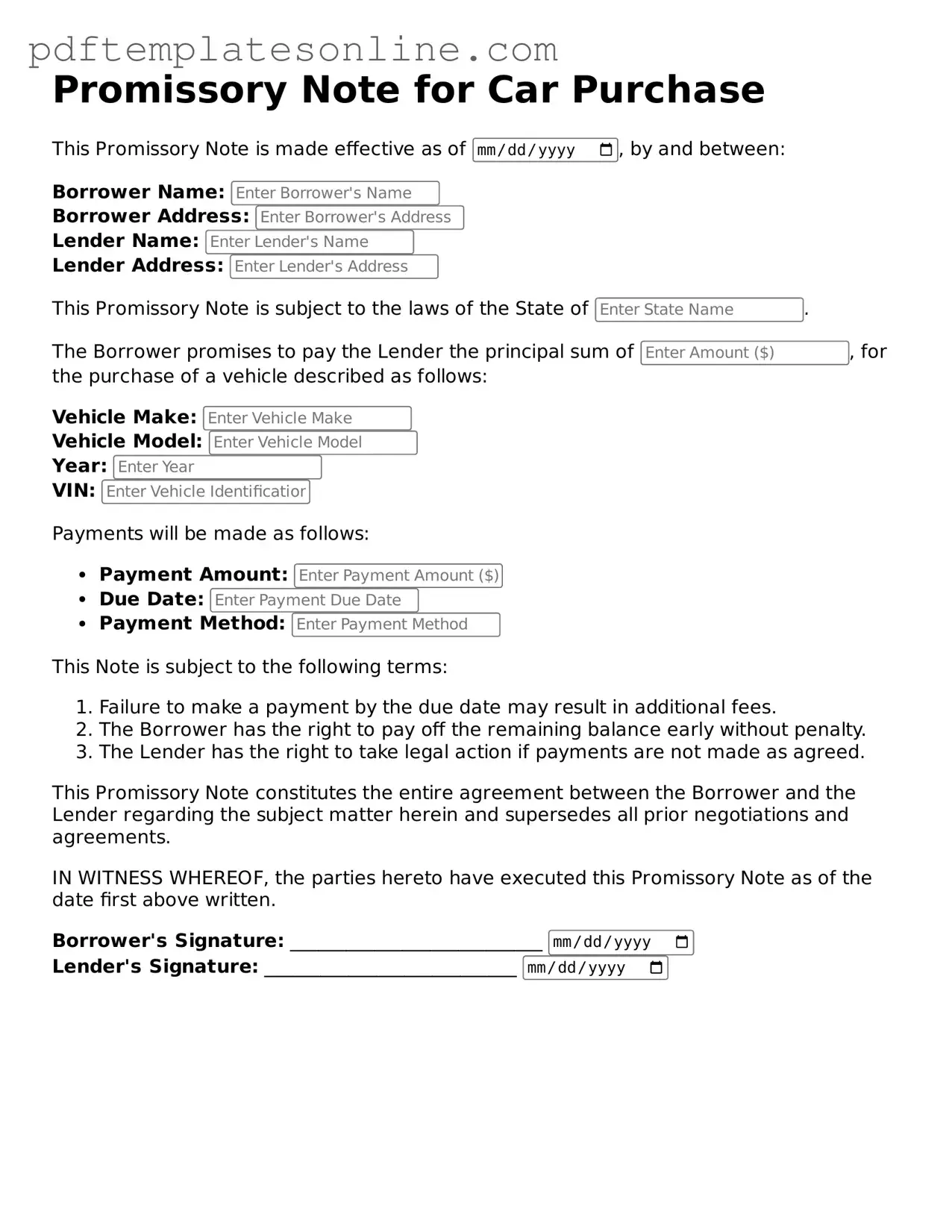

Detailed Guide for Writing Promissory Note for a Car

Filling out the Promissory Note for a Car is an important step in securing your loan agreement. Once completed, this document will serve as a formal record of the terms agreed upon between you and the lender. Follow the steps below to ensure that the form is filled out correctly.

- Begin with the date at the top of the form. Write the current date in the designated space.

- Enter your name as the borrower. This should be your full legal name.

- Provide your address. Include the street address, city, state, and zip code.

- Next, write the name of the lender. This could be a bank, credit union, or individual.

- Fill in the lender’s address, similar to how you provided your own.

- Specify the principal amount of the loan. This is the total amount you are borrowing to purchase the car.

- Indicate the interest rate. Write this as a percentage, ensuring it reflects the agreed-upon rate.

- State the repayment terms. Include how often payments will be made (monthly, bi-weekly, etc.) and the duration of the loan.

- Provide details about any collateral, if applicable. This typically includes the car’s make, model, year, and Vehicle Identification Number (VIN).

- Sign the form. Make sure to date your signature to confirm when you signed the document.

- If required, have a witness sign the document. This adds an extra layer of validation to the agreement.

After completing the form, review it carefully for any errors or omissions. Once confirmed, both you and the lender should keep a signed copy for your records. This will help ensure clarity and protect both parties involved in the transaction.