Fillable Promissory Note Document

Key takeaways

When filling out and using a Promissory Note, it’s important to understand its purpose and structure. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Promissory Note is a written promise to pay a specific amount of money at a designated time.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This helps avoid confusion later.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This figure should be accurate and easy to find.

- Detail the Interest Rate: If applicable, include the interest rate. Specify whether it’s fixed or variable, as this affects repayment amounts.

- Set the Repayment Terms: Outline how and when the borrower will repay the loan. Include the payment schedule, such as monthly or quarterly payments.

- Include Late Fees: If there are penalties for late payments, state them clearly in the document. This encourages timely repayment.

- Signatures Are Essential: Both parties should sign the note. This signifies agreement to the terms laid out in the document.

- Keep Copies: After signing, both the borrower and lender should keep copies of the Promissory Note. This serves as a reference in case of disputes.

- Consult Legal Advice: If unsure about any terms or conditions, seeking legal advice can provide clarity and ensure the document is valid.

- Be Aware of State Laws: Different states may have specific regulations regarding Promissory Notes. Familiarizing yourself with local laws is beneficial.

By keeping these points in mind, you can ensure that your Promissory Note is clear, enforceable, and serves its intended purpose effectively.

Promissory Note Forms for Particular States

Common mistakes

Filling out a Promissory Note can seem straightforward, but many people make critical mistakes that can lead to complications down the line. One common error is failing to include all necessary details. This includes not specifying the loan amount, interest rate, or repayment schedule. Omitting these details can create confusion and disputes later.

Another frequent mistake is not clearly identifying the parties involved. The borrower and lender must be explicitly named, including their full legal names and contact information. If this information is incomplete or incorrect, it can complicate enforcement of the note.

Some individuals overlook the importance of signatures. A Promissory Note is not valid without the proper signatures from both parties. Additionally, failing to date the document can lead to issues regarding when the terms of the loan begin. A simple date can provide clarity and protect both parties.

People often neglect to include terms for default. Without clear consequences for missed payments, the lender may find it challenging to enforce the agreement. Clearly outlining what happens in the event of a default can help avoid disputes and ensure that both parties understand their obligations.

Another mistake is not considering state laws. Each state may have different requirements regarding Promissory Notes. Ignoring these regulations can render the document unenforceable. It's crucial to understand the laws that apply to your situation.

Lastly, many individuals fail to keep copies of the signed document. After the Promissory Note is executed, both parties should retain a copy for their records. This can be vital in case any disputes arise in the future. Keeping accurate records protects everyone's interests.

Misconceptions

Understanding promissory notes can be challenging, and several misconceptions often arise. Here are nine common misunderstandings about the promissory note form:

-

All promissory notes are the same. Many people believe that all promissory notes follow a one-size-fits-all format. In reality, they can vary significantly based on the terms, parties involved, and specific legal requirements.

-

Promissory notes do not need to be in writing. Some individuals think that verbal agreements are sufficient. However, for a promissory note to be enforceable, it generally needs to be in writing.

-

Only banks can issue promissory notes. This misconception suggests that only financial institutions can create these documents. In fact, anyone can issue a promissory note as long as they follow the necessary guidelines.

-

Promissory notes are always secured by collateral. While some promissory notes are secured, others are unsecured. An unsecured note does not require collateral, which can increase the risk for the lender.

-

Interest rates must be included in all promissory notes. Many assume that every promissory note must specify an interest rate. However, it is possible to create a note without interest, often referred to as a "zero-interest" promissory note.

-

Signing a promissory note is a guarantee of repayment. Some people believe that just because a note is signed, it guarantees repayment. While it is a legal obligation, various factors can affect the ability to repay.

-

Promissory notes are not legally binding. This misconception suggests that these documents lack legal weight. On the contrary, a properly executed promissory note is a legally binding contract.

-

All promissory notes require notarization. While notarization can add an extra layer of legitimacy, it is not always required for a promissory note to be valid. Requirements can vary by state.

-

Promissory notes can only be used for loans. Many think that these notes are exclusively for loan agreements. However, they can also be used in various transactions, such as the sale of goods or services.

By clearing up these misconceptions, individuals can better navigate the complexities of promissory notes and understand their rights and responsibilities.

Promissory Note Categories

Dos and Don'ts

When filling out a Promissory Note form, it's important to be thorough and accurate. Here are some guidelines to help you navigate the process.

- Do read the entire form carefully before starting. Understanding what is required will help prevent mistakes.

- Don't leave any sections blank. Every part of the form needs to be completed to ensure clarity and enforceability.

- Do use clear and legible handwriting or type the information. This ensures that all parties can easily read the document.

- Don't use vague language. Be specific about the loan amount, interest rate, and repayment terms.

- Do include the date when the note is signed. This establishes the timeline for the agreement.

- Don't forget to sign the document. Without signatures, the note may not be considered valid.

- Do keep a copy of the completed note for your records. This can be useful for future reference or in case of disputes.

Check out Popular Documents

Texas Temporary Tag - Being informed about the Texas Temporary Tag form can save time and potential legal issues.

The Employment Application PDF form is crucial for streamlining the hiring process, as it enables employers to gather necessary information from potential candidates efficiently. By filling out this form, applicants can better present their qualifications, work history, and personal details, which are pivotal for recruitment decisions. For those interested in obtaining this form, it can be accessed at mypdfform.com/blank-employment-application-pdf/.

Dwi Assessment Nc - The tool directly supports enhancements to DWI services and monitoring protocols.

Detailed Guide for Writing Promissory Note

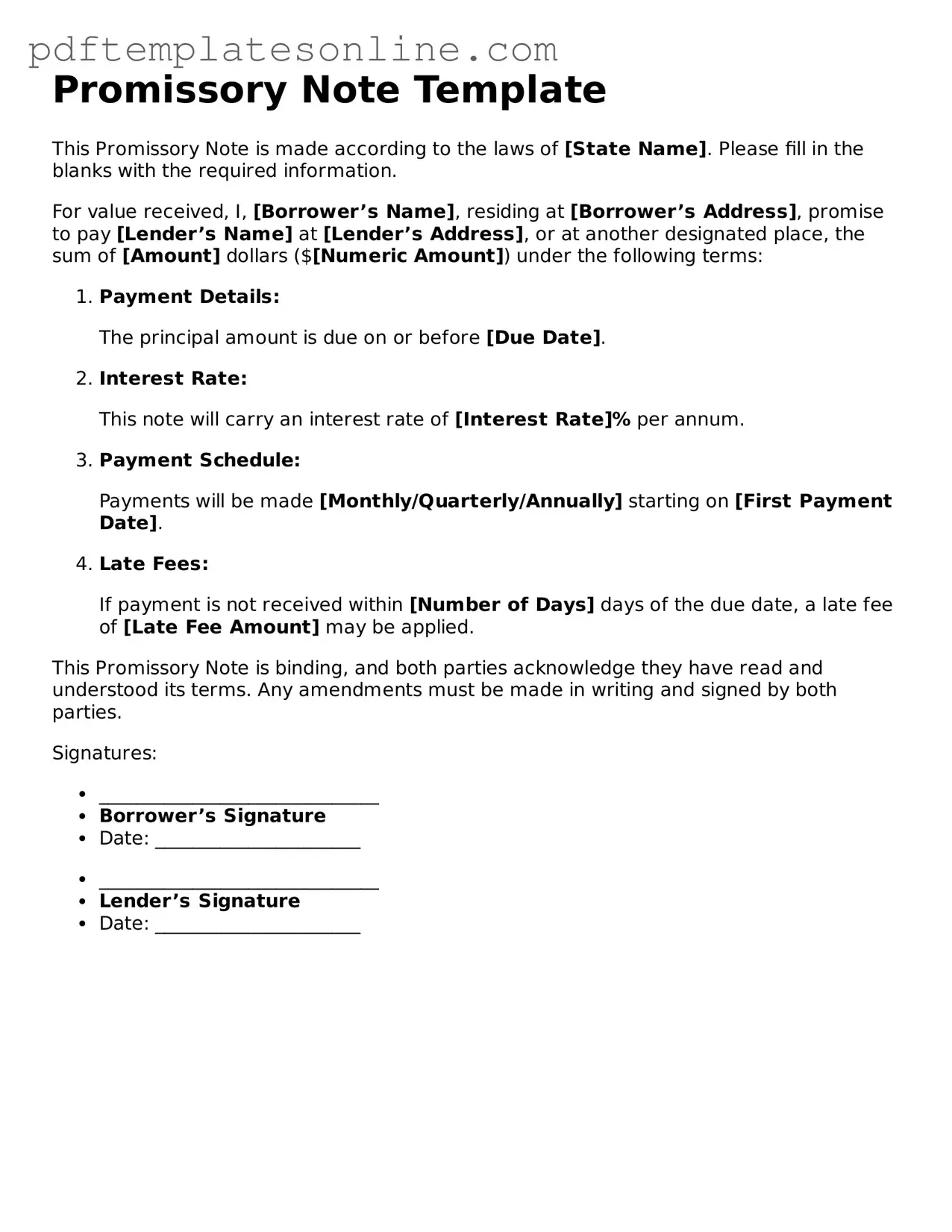

After you have gathered the necessary information, you are ready to fill out the Promissory Note form. This document is essential for formalizing a loan agreement between a borrower and a lender. Follow these steps carefully to ensure that all required information is accurately provided.

- Identify the Parties: At the top of the form, clearly state the names and addresses of both the borrower and the lender.

- Loan Amount: Enter the total amount of money being borrowed. This should be a clear and precise figure.

- Interest Rate: Specify the interest rate applicable to the loan. This can be expressed as a percentage.

- Payment Schedule: Outline the repayment terms. Indicate whether payments will be made monthly, quarterly, or annually, and include the due date for each payment.

- Loan Term: State the duration of the loan. This is the time period over which the borrower will repay the loan.

- Late Fees: If applicable, describe any late fees that will be incurred if payments are not made on time.

- Signatures: Both the borrower and lender must sign and date the form. This signifies their agreement to the terms outlined in the document.

Once you have completed the form, ensure that both parties retain a copy for their records. This will help prevent misunderstandings and provide a reference point in the future.