Blank Profit And Loss Form

Key takeaways

Filling out and using a Profit and Loss form is crucial for understanding your business's financial health. Here are six key takeaways to keep in mind:

- Accuracy is Essential: Ensure that all figures are correct. Mistakes can lead to poor decision-making.

- Regular Updates: Update the form regularly, ideally monthly or quarterly, to reflect current financial status.

- Understand Revenue and Expenses: Clearly categorize all income and expenses. This clarity helps identify trends and areas for improvement.

- Use for Strategic Planning: Leverage the insights from your Profit and Loss form to make informed business decisions and set future goals.

- Consult a Professional: If you're unsure about filling it out, consider seeking help from an accountant or financial advisor.

- Review Periodically: Regularly review past forms to analyze performance over time and adjust strategies accordingly.

Common mistakes

Filling out a Profit and Loss form can be straightforward, but mistakes often occur. One common error is not including all sources of income. When individuals or businesses overlook certain revenue streams, they may present an inaccurate picture of their financial health. This can lead to poor decision-making based on incomplete data.

Another frequent mistake is misclassifying expenses. Some may categorize costs incorrectly, such as listing personal expenses as business expenses. This misclassification can lead to tax issues and skew the overall financial analysis. Accurate categorization is essential for understanding where money is being spent and for future budgeting.

Additionally, many people fail to update their Profit and Loss statements regularly. Relying on outdated information can result in missed opportunities for improvement. Regular updates allow for timely adjustments to spending and income strategies. Keeping the form current helps maintain a clear view of financial performance.

Lastly, not reconciling the Profit and Loss form with bank statements can be a significant oversight. Discrepancies may arise if transactions are not accurately reflected. This can lead to confusion and errors in financial reporting. Regular reconciliation ensures that all figures align and that the financial statements are reliable.

Misconceptions

Understanding the Profit and Loss (P&L) form is essential for anyone involved in managing a business's finances. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings about the P&L form.

- Misconception 1: The P&L form is only for large businesses.

- Misconception 2: The P&L only reflects cash transactions.

- Misconception 3: A P&L form shows the cash flow of a business.

- Misconception 4: The P&L form is the same as a balance sheet.

- Misconception 5: You only need to prepare a P&L form once a year.

- Misconception 6: All expenses are deductible on the P&L form.

- Misconception 7: The P&L form is only useful for tax purposes.

- Misconception 8: A positive net income means the business is financially healthy.

This is not true. Both small and large businesses use the P&L form to track their income and expenses. It's a valuable tool for any size business.

Many believe that the P&L form only includes cash-based transactions. In reality, it can also include credit transactions, providing a more comprehensive view of financial performance.

While the P&L form indicates profitability, it does not provide a complete picture of cash flow. For cash flow insights, a separate cash flow statement is necessary.

The P&L form and balance sheet serve different purposes. The P&L shows profitability over a specific period, while the balance sheet provides a snapshot of assets, liabilities, and equity at a given moment.

Some think an annual report suffices. However, preparing a P&L form quarterly or monthly helps businesses monitor performance and make timely adjustments.

Not all expenses can be deducted. Some costs may not be considered necessary for generating income, and understanding which expenses qualify is crucial for accurate reporting.

While it is important for tax reporting, the P&L form also aids in strategic decision-making, helping business owners assess profitability and identify trends.

A positive net income is a good sign, but it does not automatically indicate financial health. Other factors, like cash flow and debt levels, must also be considered.

Dos and Don'ts

When filling out the Profit and Loss form, it is important to follow certain guidelines to ensure accuracy and clarity. Here are five things you should and shouldn't do:

- Do double-check all figures for accuracy before submitting the form.

- Do use consistent categories for income and expenses throughout the form.

- Do include all sources of income, even if they seem minor.

- Do keep supporting documents organized in case they are needed later.

- Do review the completed form for any missing information.

- Don't leave any sections blank; if something does not apply, indicate that clearly.

- Don't use vague terms; be specific about income sources and expenses.

- Don't forget to update the form regularly to reflect current financial status.

- Don't rush through the process; take your time to ensure everything is accurate.

- Don't ignore instructions provided with the form; they are there for a reason.

Other PDF Forms

Roof Condition Certification Form - This certification protects the interests of all parties involved in the sale.

What Is a Form 8300 Used For? - Understanding Form 8300 can significantly simplify cash transaction management for businesses.

Flea Tick Certificate - It is essential for anyone involved in animal transportation to be familiar with this form.

Detailed Guide for Writing Profit And Loss

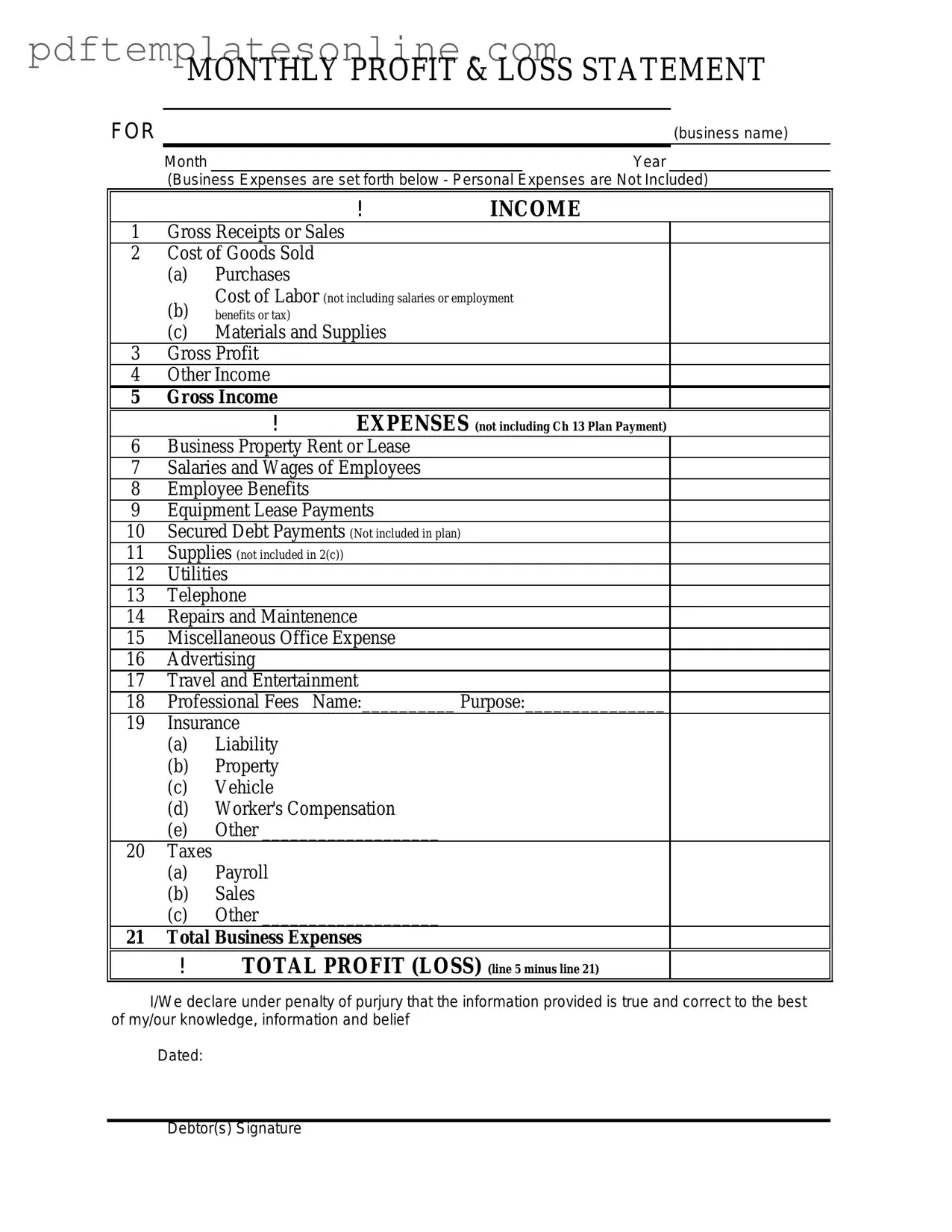

Completing the Profit and Loss form is an essential task for tracking your financial performance. This process involves gathering various financial details about your business operations. The following steps will guide you through filling out the form accurately and efficiently.

- Begin by collecting all relevant financial documents, such as income statements, receipts, and invoices.

- Open the Profit and Loss form on your computer or print a hard copy if you prefer to fill it out by hand.

- Start with the Revenue section. Enter your total sales or income for the specified period.

- Next, move to the Cost of Goods Sold (COGS). List the direct costs associated with producing your goods or services.

- Subtract the COGS from your total revenue to find your Gross Profit.

- Proceed to the Operating Expenses section. Record all expenses related to running your business, such as rent, utilities, and salaries.

- Calculate your Operating Income by subtracting total operating expenses from your gross profit.

- If applicable, include any Other Income or Expenses that may affect your overall profit.

- Finally, determine your Net Profit by adding other income and subtracting other expenses from your operating income.

- Review all entries for accuracy before submitting or saving the completed form.