Fillable Prenuptial Agreement Document

Key takeaways

When considering a prenuptial agreement, it's essential to understand its implications and how to fill out the form correctly. Here are some key takeaways:

- Understand the Purpose: A prenuptial agreement outlines how assets will be divided in the event of a divorce or separation.

- Full Disclosure: Both parties must fully disclose their assets and debts. Transparency is crucial for the agreement to be enforceable.

- Consult an Attorney: Each party should have their own legal representation to ensure that their interests are protected.

- Timing Matters: Complete the agreement well in advance of the wedding date to avoid any claims of coercion.

- Be Clear and Specific: Clearly define all terms, including what is considered marital and separate property.

- Review State Laws: Prenuptial agreements are governed by state law, so be aware of the specific requirements in your state.

- Consider Future Changes: Address how future acquisitions will be handled and whether the agreement can be modified.

- Discuss with Your Partner: Open communication about the agreement can help prevent misunderstandings and build trust.

- Keep It Simple: Avoid overly complex language. The agreement should be straightforward and easy to understand.

- Sign Before Witnesses: Depending on state law, the agreement may need to be signed in front of witnesses or notarized.

Following these takeaways can help ensure that the prenuptial agreement serves its intended purpose effectively.

Prenuptial Agreement Forms for Particular States

Common mistakes

Filling out a prenuptial agreement form can be a daunting task for many couples. It’s essential to approach this process thoughtfully to avoid common pitfalls. One significant mistake people often make is failing to communicate openly with their partner. A prenuptial agreement is not just a legal document; it’s a reflection of your relationship. When both parties engage in honest discussions about their financial situations and future goals, the agreement can better serve both individuals.

Another frequent error involves overlooking the importance of full financial disclosure. Each partner should provide a comprehensive overview of their assets, debts, and income. Without complete transparency, the agreement may later be challenged in court. This lack of clarity can lead to misunderstandings and resentment, undermining the trust essential for a healthy marriage.

Many individuals also underestimate the necessity of legal counsel. While it may seem cost-effective to fill out the form without professional assistance, this decision can lead to serious consequences. A lawyer can ensure that the agreement complies with state laws and addresses all relevant issues. Their expertise can help navigate complex financial matters and avoid potential legal disputes in the future.

Additionally, some couples mistakenly believe that a prenuptial agreement is only for the wealthy. This misconception can be detrimental. Prenups can protect various assets, including businesses, retirement accounts, and even debts. Regardless of income level, having a clear agreement can provide peace of mind for both partners.

Another common mistake is failing to update the agreement as circumstances change. Life events such as the birth of children, significant career changes, or the acquisition of new assets can all impact the relevance of the prenuptial agreement. Regularly reviewing and amending the document ensures that it remains aligned with both partners' current situations and intentions.

Finally, some couples rush through the process, viewing it as a mere formality. Taking the time to thoughtfully consider each clause and its implications is crucial. A well-crafted prenuptial agreement reflects both partners' needs and desires, fostering a sense of security and understanding as they embark on their marital journey together.

Misconceptions

Many people have misconceptions about prenuptial agreements. Here are seven common misunderstandings:

-

Prenuptial agreements are only for the wealthy.

This is not true. Anyone can benefit from a prenuptial agreement, regardless of their financial status. It can help clarify financial responsibilities and protect individual assets.

-

Prenups are only for divorce.

While they are often associated with divorce, prenuptial agreements can also serve to outline financial expectations during the marriage. They can promote transparency and communication.

-

Prenuptial agreements are not enforceable.

This is a misconception. Prenups can be legally binding if they meet certain criteria, such as being fair, voluntary, and fully disclosed.

-

Prenups are a sign of distrust.

On the contrary, many couples view prenuptial agreements as a proactive way to address financial issues. They can foster open discussions about money, which can strengthen the relationship.

-

Prenups can include anything.

While prenuptial agreements can cover many financial matters, they cannot include provisions related to child custody or child support. Courts typically do not enforce these types of agreements.

-

Prenups are only necessary for second marriages.

First-time marriages can also benefit from a prenuptial agreement. It helps set clear expectations and protects both parties’ interests from the outset.

-

Prenups are complicated and expensive.

While they can be complex, the process can be straightforward with the right guidance. Investing in a prenuptial agreement can save money and stress in the long run.

Dos and Don'ts

When filling out a Prenuptial Agreement form, it is important to approach the process with care. Here are some essential dos and don'ts to consider.

- Do discuss your intentions with your partner openly.

- Do seek legal advice from a qualified attorney.

- Do ensure that both parties fully disclose their financial information.

- Do consider including provisions for future changes in circumstances.

- Don't rush the process; take your time to understand each section.

- Don't leave any blanks on the form; incomplete information can lead to issues.

- Don't ignore state laws that may affect the agreement.

- Don't pressure your partner into signing without their full understanding.

Check out Popular Documents

Printable Drivers Time Record Sheet - Use this form if the driver operates within a 100-air mile radius of their headquarters.

Ecomap Key - It can act as a guide for setting personal goals related to relationships.

In addition to the important details outlined in the California Room Rental Agreement form, landlords and tenants may find it beneficial to utilize resources such as California PDF Forms for creating and customizing their agreements, ensuring that all necessary terms are accurately captured and legally enforceable.

Work Application Form - Take time to think through your answers to provide thoughtful responses.

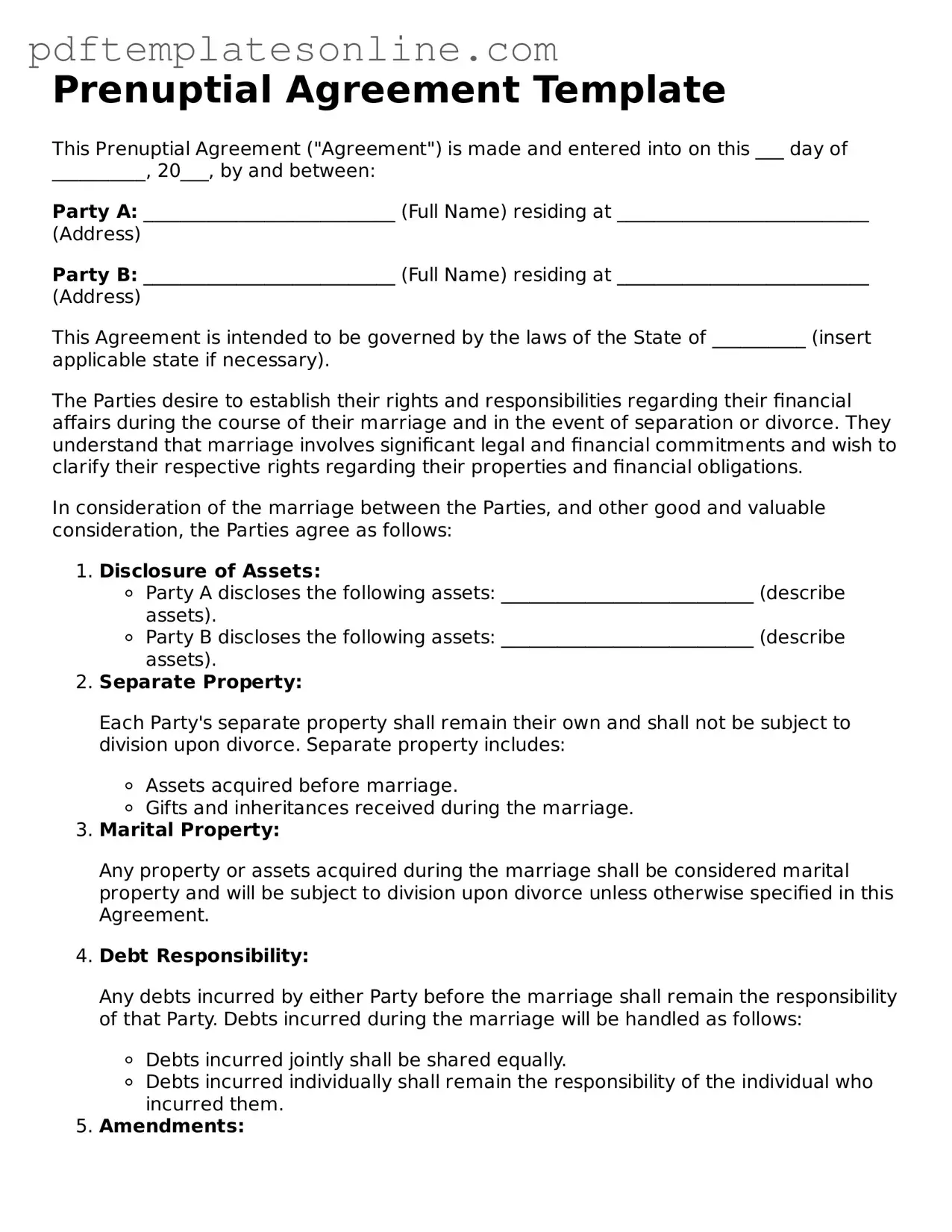

Detailed Guide for Writing Prenuptial Agreement

Filling out a Prenuptial Agreement form requires careful attention to detail. This process involves gathering personal information and discussing financial arrangements with your partner. Follow these steps to complete the form accurately.

- Gather Personal Information: Collect full names, addresses, and dates of birth for both parties.

- List Assets: Document all assets owned by each party, including real estate, bank accounts, investments, and personal property.

- Detail Liabilities: Outline any debts or financial obligations each party has, such as loans or credit card debt.

- Discuss Financial Arrangements: Agree on how assets and debts will be managed during the marriage and in the event of a divorce.

- Include Provisions: Specify any special terms or conditions, such as spousal support or inheritance rights.

- Review the Agreement: Both parties should review the completed form to ensure accuracy and clarity.

- Sign the Document: Both parties must sign the agreement in the presence of a notary public to make it legally binding.