Fillable Personal Guarantee Document

Key takeaways

Filling out a Personal Guarantee form is an important step in many financial agreements. Here are some key takeaways to keep in mind:

- Understand Your Commitment: A Personal Guarantee means you are personally responsible for the debt if the primary borrower defaults.

- Read the Terms Carefully: Review all terms and conditions before signing. Know what you are agreeing to.

- Provide Accurate Information: Fill out your personal details accurately. This includes your name, address, and financial information.

- Consider the Risks: Think about the potential consequences. If the borrower fails to pay, your assets may be at risk.

- Seek Legal Advice: If unsure, consult a legal expert. They can help clarify your obligations and rights.

- Keep a Copy: After signing, keep a copy of the form for your records. This is important for future reference.

- Check for Co-Signers: If there are multiple guarantors, understand how liability is shared among you.

- Know the Duration: Be aware of how long the guarantee lasts. Some agreements may have a set time frame.

- Review Regularly: Revisit the agreement periodically. Changes in circumstances may affect your obligations.

Common mistakes

Filling out a Personal Guarantee form can be a straightforward process, but many individuals make common mistakes that can lead to complications later on. One frequent error is failing to provide complete and accurate personal information. This includes not only the name and address but also contact details. Omitting any of these can result in delays or even rejection of the guarantee.

Another mistake is neglecting to read the terms and conditions thoroughly. Many people sign the form without fully understanding their obligations. This can lead to unexpected liabilities down the road. It is crucial to comprehend what the guarantee entails before signing.

Some individuals also overlook the need for signatures from all required parties. If the form requires multiple signatures, failing to obtain them can invalidate the guarantee. Each signatory must understand their role and the implications of the guarantee.

In addition, many people do not keep a copy of the completed form for their records. This can create issues if there are disputes later regarding the terms of the guarantee. It is wise to retain a copy to refer back to in case of questions or misunderstandings.

Finally, a common oversight is not consulting with a legal professional when needed. While the form may seem simple, the consequences of a Personal Guarantee can be significant. Seeking advice can help clarify any uncertainties and ensure that the document is filled out correctly and comprehensively.

Misconceptions

When it comes to the Personal Guarantee form, there are several common misconceptions that can lead to confusion. Understanding these misconceptions can help individuals make informed decisions. Here are four key misunderstandings:

-

It only applies to business loans.

Many believe that a Personal Guarantee is only necessary for business-related loans. In reality, it can also apply to personal loans or leases, especially when a lender seeks additional security for repayment.

-

Signing a Personal Guarantee means you are liable for the entire debt.

This is not entirely accurate. While a Personal Guarantee does make you responsible for the debt if the primary borrower defaults, the amount you owe may depend on the terms of the guarantee and the specific agreement with the lender.

-

Once signed, a Personal Guarantee cannot be revoked.

This misconception overlooks the possibility of negotiating the terms. In some cases, it may be possible to modify or release a Personal Guarantee, but this typically requires agreement from the lender.

-

Personal Guarantees are only for individuals with poor credit.

This belief can be misleading. Even individuals with good credit may be asked to sign a Personal Guarantee, especially in business transactions where the lender wants additional assurance of repayment.

By clarifying these misconceptions, individuals can approach the Personal Guarantee form with a better understanding of its implications and requirements.

Dos and Don'ts

When filling out a Personal Guarantee form, attention to detail is crucial. Here are six important dos and don'ts to consider:

- Do read the entire form carefully before filling it out.

- Do provide accurate and complete information.

- Do sign and date the form where required.

- Do keep a copy of the completed form for your records.

- Don't rush through the process; take your time to ensure accuracy.

- Don't leave any sections blank unless instructed to do so.

Browse Common Types of Personal Guarantee Templates

Termination Agreement Real Estate - The termination can happen for a variety of reasons as stated in the form.

The key aspects of the Real Estate Purchase Agreement are crucial for ensuring a smooth transaction, as they set forth the obligations of both the buyer and the seller in a real estate deal.

Private Mortgage Contract - It’s wise for buyers to review the terms carefully, especially the interest rates and fees involved.

Purchase Agreement Addendum - An addendum provides a written record of negotiated changes.

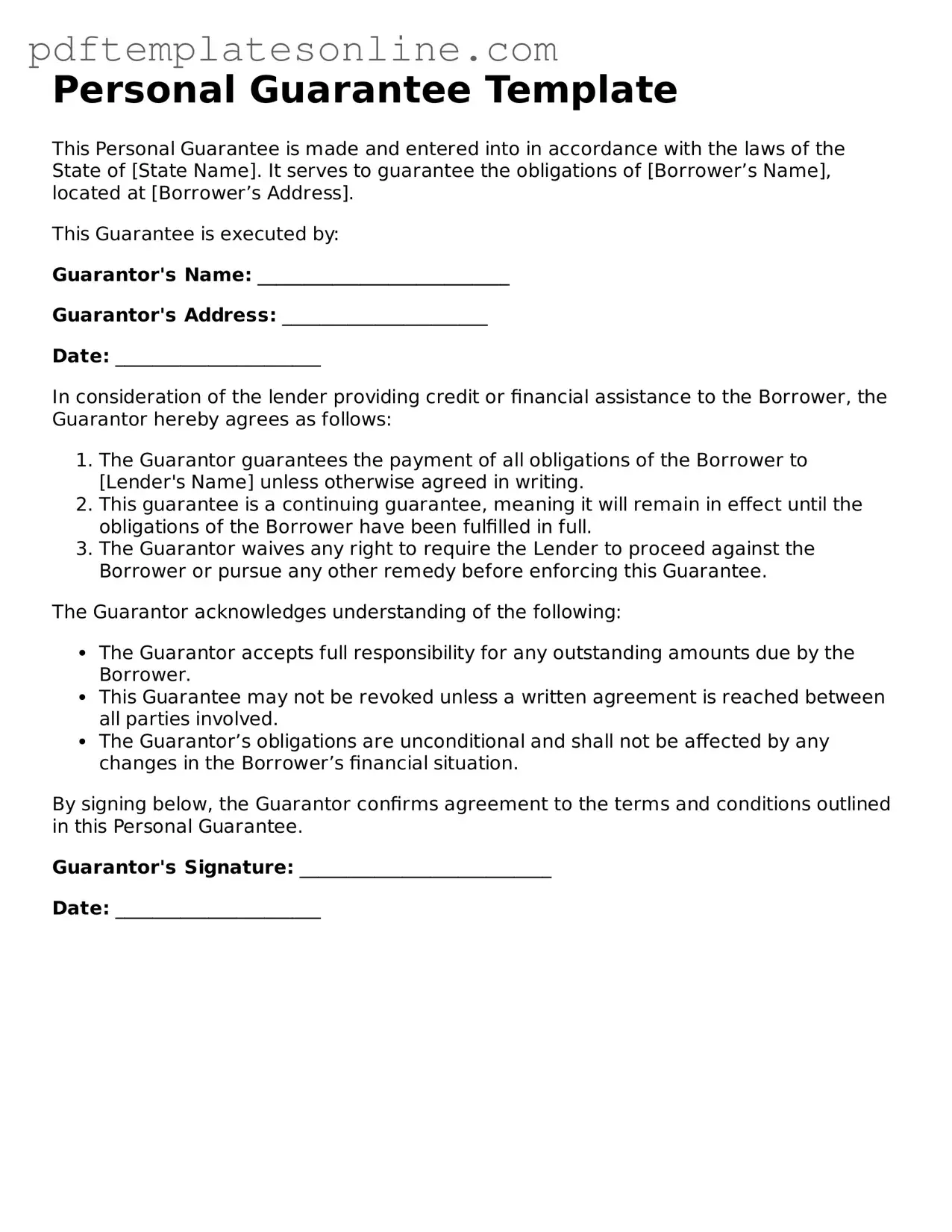

Detailed Guide for Writing Personal Guarantee

Completing the Personal Guarantee form is an important step in establishing your commitment to a financial agreement. After filling out the form, you will typically submit it alongside any required documentation to the relevant party, such as a lender or business partner. Ensure all information is accurate to avoid delays in processing.

- Begin by entering your full legal name in the designated field.

- Provide your current residential address, including city, state, and zip code.

- Fill in your date of birth in the specified format.

- List your Social Security number to verify your identity.

- Enter your phone number and email address for contact purposes.

- Indicate your relationship to the entity for which you are providing the guarantee.

- Specify the amount of the guarantee you are willing to provide.

- Read the terms and conditions carefully before signing.

- Sign and date the form to validate your commitment.