Official Pennsylvania Transfer-on-Death Deed Document

Key takeaways

When considering the Pennsylvania Transfer-on-Death Deed form, it is essential to grasp its significance and the steps involved in its proper use. Below are key takeaways to keep in mind:

- The Transfer-on-Death Deed allows property owners to designate beneficiaries who will inherit their property upon their death, bypassing probate.

- To be valid, the deed must be completed and signed in accordance with Pennsylvania law, which requires the signatures of both the owner and a notary public.

- It is crucial to provide a clear legal description of the property to avoid any confusion regarding the assets being transferred.

- The deed must be recorded in the county where the property is located before the owner’s death to be effective.

- Beneficiaries can be individuals or entities, such as a trust, but they must be clearly identified in the deed.

- Property owners retain full control over the property during their lifetime; they can sell, mortgage, or change beneficiaries as desired.

- Filing a Transfer-on-Death Deed does not affect the owner’s property taxes or their eligibility for any government assistance programs.

- It is advisable to consult with a legal professional to ensure that the deed is filled out correctly and aligns with the owner’s estate planning goals.

- Upon the owner's death, the beneficiaries must provide a certified copy of the death certificate and the recorded deed to the county to complete the transfer of ownership.

Common mistakes

Filling out a Transfer-on-Death Deed (TODD) form in Pennsylvania can be a straightforward process, but many people make common mistakes that can lead to complications down the road. One of the most frequent errors is not properly identifying the property. It’s crucial to provide a complete and accurate legal description of the property being transferred. Omitting details or using vague language can create confusion and may invalidate the deed.

Another mistake often seen is failing to include all necessary signatures. In Pennsylvania, both the owner and the designated beneficiary must sign the deed. If one signature is missing, the deed may not be recognized. It’s essential to ensure that everyone involved understands their role and completes their part of the document.

People sometimes overlook the importance of having the deed notarized. A Transfer-on-Death Deed must be notarized to be legally binding. Without this step, the document may not hold up in court or during the transfer process. Always check that a notary public is present to witness the signing.

Additionally, many individuals neglect to record the deed with the county recorder of deeds. While completing the form is a significant step, failing to record it means that the transfer may not be recognized after the property owner’s death. Recording the deed ensures that the beneficiary's rights are protected and that the transfer is documented in public records.

Another common pitfall is not considering the implications of the TODD on estate taxes. Some people mistakenly believe that a Transfer-on-Death Deed avoids all tax implications. However, depending on the value of the property and other factors, taxes may still apply. Consulting with a tax professional can help clarify these potential issues.

People often forget to communicate their intentions with family members. Not discussing the existence of a Transfer-on-Death Deed can lead to confusion and disputes among heirs. Open communication can prevent misunderstandings and ensure that everyone is on the same page regarding property distribution.

Another mistake involves not updating the deed after significant life changes. If the beneficiary’s situation changes—such as marriage, divorce, or the birth of a child—the deed may need to be revised. Keeping the document current is essential to reflect the owner's wishes accurately.

Some individuals fail to consider the impact of joint ownership on the Transfer-on-Death Deed. If the property is jointly owned, the deed may not work as intended. Understanding how joint ownership affects the transfer is vital to avoid unintended consequences.

Lastly, many people underestimate the importance of seeking legal advice. While the form may seem simple, the implications of filling it out incorrectly can be significant. Consulting with a legal expert can provide clarity and ensure that the deed serves its intended purpose without complications.

Misconceptions

Understanding the Pennsylvania Transfer-on-Death Deed (TOD) can be challenging due to various misconceptions. Here are five common misunderstandings about this legal document:

-

Misconception 1: The TOD deed avoids probate entirely.

While a TOD deed allows for the direct transfer of property upon the owner's death, it does not eliminate the probate process for other assets. Only the property designated in the TOD deed bypasses probate.

-

Misconception 2: A TOD deed can be used for any type of property.

Not all properties qualify for a TOD deed. It is typically limited to real estate, such as residential homes or land, and does not apply to personal property like vehicles or bank accounts.

-

Misconception 3: A TOD deed is irrevocable once signed.

This is incorrect. The property owner can revoke or change the TOD deed at any time before their death. This flexibility allows for adjustments as circumstances change.

-

Misconception 4: A TOD deed affects the owner’s ability to sell the property.

While the TOD deed is in place, the owner retains full control of the property. They can sell, mortgage, or otherwise manage the property without restrictions from the TOD deed.

-

Misconception 5: The beneficiaries of a TOD deed have immediate rights to the property.

Beneficiaries do not gain any rights to the property until the owner passes away. Until that time, the owner maintains full ownership and control.

Dos and Don'ts

When filling out the Pennsylvania Transfer-on-Death Deed form, it's important to follow certain guidelines to ensure the process goes smoothly. Here are some dos and don'ts to keep in mind:

- Do provide accurate information about the property, including its legal description.

- Do include the names and addresses of the beneficiaries clearly.

- Do sign the deed in the presence of a notary public.

- Do ensure that the deed is recorded with the appropriate county office after signing.

- Don't leave any sections of the form blank; incomplete forms may be rejected.

- Don't forget to check for any local requirements that may apply.

- Don't use vague terms when describing the property; clarity is key.

- Don't assume that verbal agreements are enough; all details must be in writing.

Browse Popular Transfer-on-Death Deed Forms for US States

Transfer on Death Deed California Common Questions - Acts as a powerful statement of your wishes regarding property transfer.

Texas Deed Transfer Form - Though the deed helps transfer property outside of probate, it does not eliminate taxes owed at death.

To facilitate a smooth transaction, it's important to utilize the proper documentation, such as the California Mobile Home Bill of Sale, which can be found through resources like California PDF Forms. This ensures that all legal requirements are met and provides both parties with the necessary proof of sale.

Where Can I Get a Tod Form - Many states have adopted Transfer-on-Death Deeds, reflecting their growing popularity in estate planning.

Transfer on Death Affidavit Ohio - Property owners should consider their entire estate plan before deciding on a Transfer-on-Death Deed.

Detailed Guide for Writing Pennsylvania Transfer-on-Death Deed

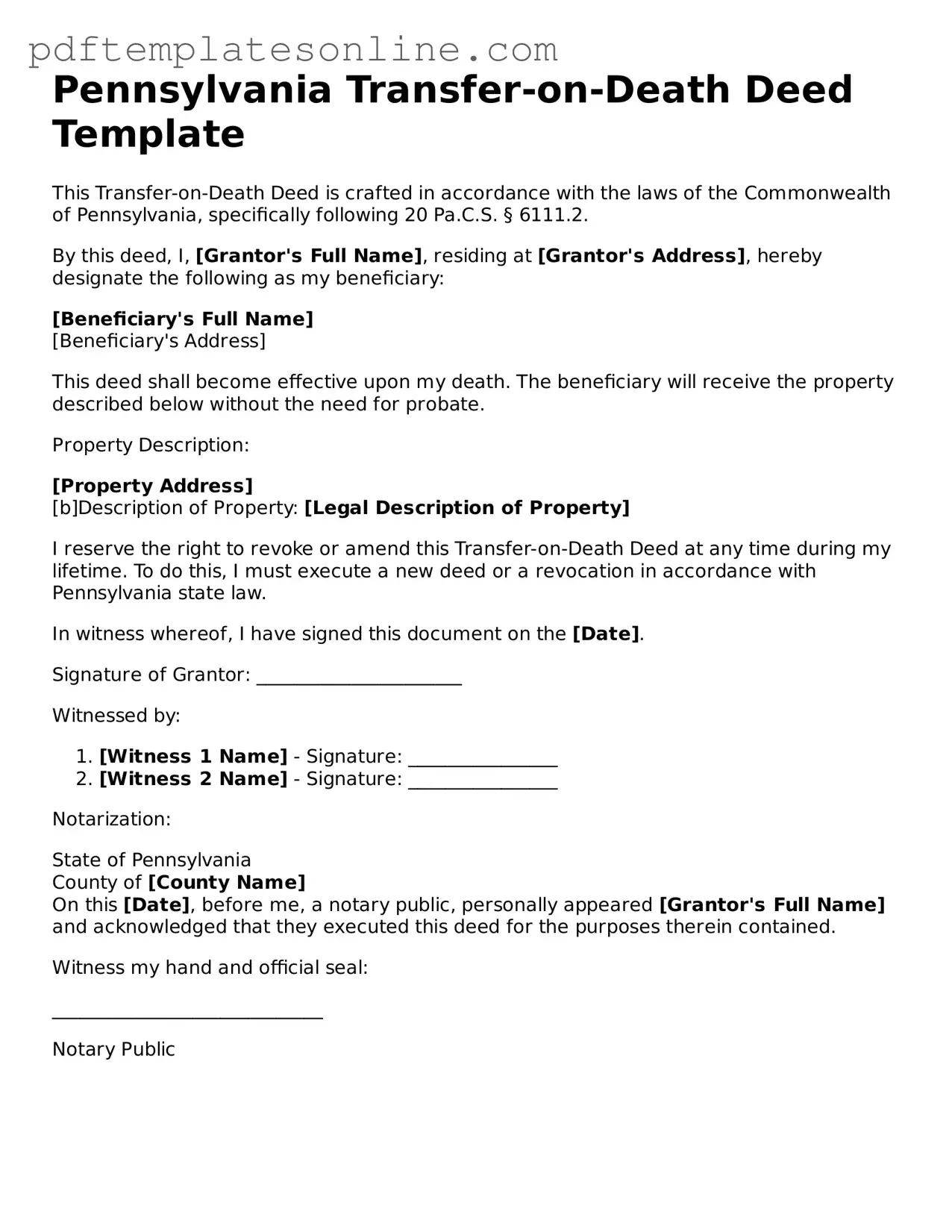

Once you have the Pennsylvania Transfer-on-Death Deed form in hand, it’s time to fill it out carefully. This deed allows you to designate a beneficiary who will receive your property upon your death, without going through probate. Follow these steps to ensure you complete the form correctly.

- Gather necessary information. Collect details about the property you want to transfer, including the address and legal description.

- Identify yourself. In the designated section, write your full name and address as the current owner of the property.

- List the beneficiary. Clearly state the name and address of the person you wish to inherit the property after your death.

- Include additional beneficiaries. If you want to name more than one beneficiary, provide their names and addresses as well.

- Sign the form. As the owner, you must sign the deed in the presence of a notary public. This step is crucial for the deed to be valid.

- Notarization. Have the notary public sign and seal the document, confirming your identity and signature.

- Record the deed. Take the completed and notarized form to your local county recorder’s office to officially record it.

After completing these steps, your Transfer-on-Death Deed will be ready for recording. Make sure to keep a copy for your records. This deed will take effect upon your passing, ensuring a smooth transition of your property to your chosen beneficiary.