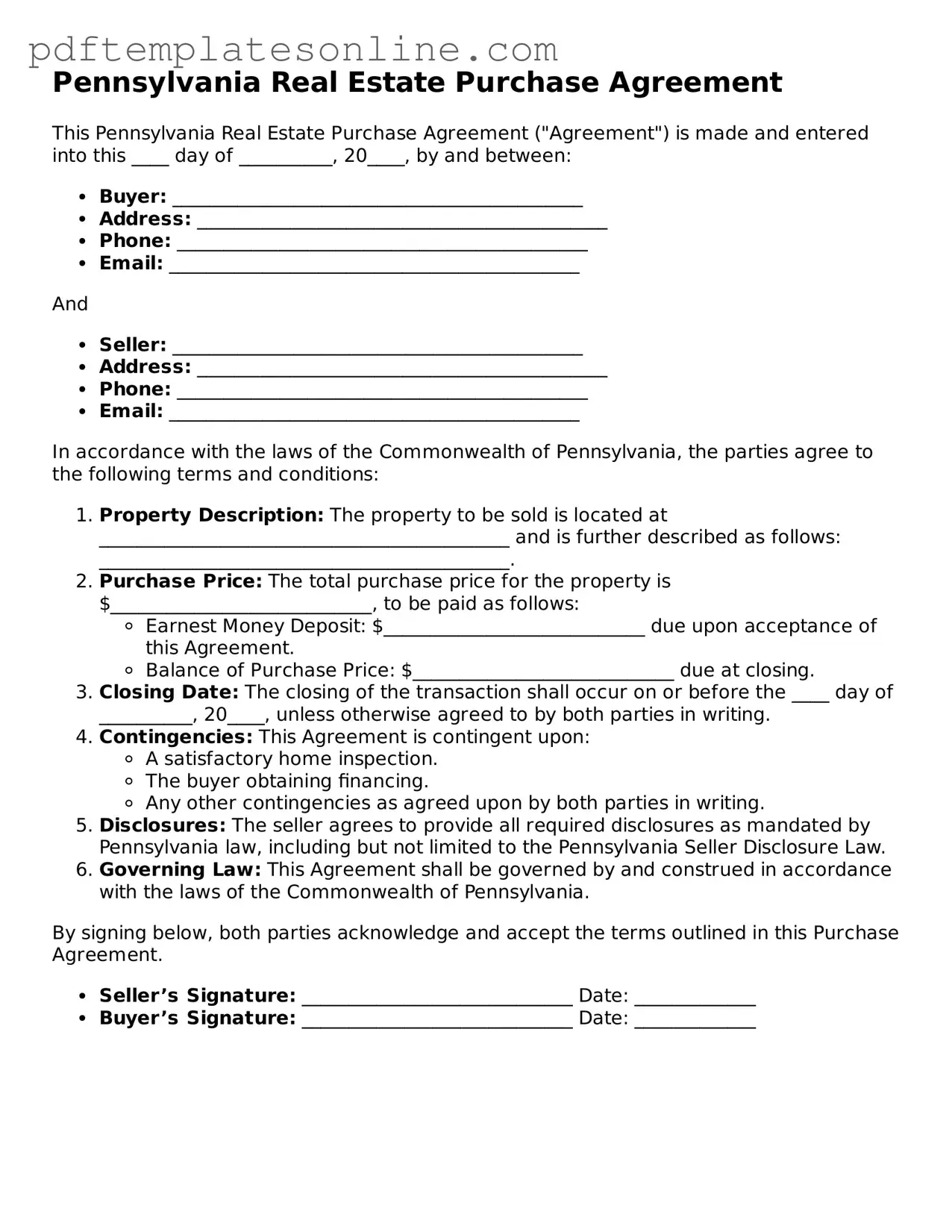

Official Pennsylvania Real Estate Purchase Agreement Document

Key takeaways

Understanding the Pennsylvania Real Estate Purchase Agreement is essential for both buyers and sellers in a real estate transaction. Here are some key takeaways regarding the use of this form:

- The agreement outlines the terms of the sale, including the purchase price, closing date, and any contingencies that may apply.

- All parties involved must review the document carefully to ensure that all details are accurate and reflect their intentions.

- It is advisable to seek legal advice or assistance from a real estate professional when completing the form to avoid potential pitfalls.

- Once signed, the agreement becomes a legally binding contract, and any changes should be documented in writing to maintain clarity and enforceability.

Common mistakes

Filling out the Pennsylvania Real Estate Purchase Agreement can be a daunting task. Many people, whether first-time buyers or seasoned investors, often make common mistakes that can lead to complications down the line. Understanding these pitfalls is crucial for a smooth transaction.

One frequent mistake is not providing accurate property details. Buyers sometimes overlook the importance of including the correct address, legal description, or parcel number. These details are essential for identifying the property and ensuring that the agreement is legally binding.

Another common error is failing to specify the purchase price clearly. While it may seem straightforward, ambiguities can arise if the price is not clearly stated. This can lead to misunderstandings and disputes later in the process.

Many individuals also neglect to include contingencies in the agreement. Contingencies protect buyers by allowing them to back out of the deal under certain conditions, such as failing a home inspection or securing financing. Without these clauses, buyers may find themselves locked into a purchase that isn't right for them.

Additionally, not understanding the earnest money deposit is a mistake that can have financial implications. Buyers should know how much to offer as earnest money and the conditions under which it may be forfeited. This deposit shows the seller that the buyer is serious, but it also requires careful consideration.

Another oversight is not reviewing the timeline for closing. Buyers often forget to clarify key dates, such as when the closing will take place or how long the seller has to respond to offers. A clear timeline helps keep everyone on track and prevents delays.

Buyers may also fail to read the fine print. Important clauses regarding repairs, closing costs, and other obligations can be hidden in the details. Taking the time to read and understand these sections can save a lot of headaches later.

Some individuals make the mistake of not consulting a real estate professional. While it might seem like a cost-saving measure to go it alone, having an expert can provide valuable insights and help avoid costly errors.

Lastly, neglecting to sign and date the agreement is a simple yet critical mistake. An unsigned contract is not legally binding. Ensuring that all parties have signed and dated the document is essential for its validity.

By being aware of these common mistakes, buyers can approach the Pennsylvania Real Estate Purchase Agreement with confidence. A little attention to detail can make a significant difference in the home-buying experience.

Misconceptions

When it comes to the Pennsylvania Real Estate Purchase Agreement form, several misconceptions often arise. Understanding these can help buyers and sellers navigate the real estate process more effectively. Here are seven common misconceptions:

- 1. The form is the same for all real estate transactions. Many believe that the Pennsylvania Real Estate Purchase Agreement is a one-size-fits-all document. In reality, the specifics can vary based on the type of property and the unique circumstances of the transaction.

- 2. The agreement is not legally binding. Some individuals think that because the form is a standard template, it lacks legal weight. However, once signed by both parties, it becomes a legally binding contract, enforceable in court.

- 3. Only the buyer needs to sign the agreement. A common misconception is that only the buyer’s signature is necessary for the agreement to be valid. Both the buyer and seller must sign the document for it to take effect.

- 4. The agreement covers all aspects of the sale. Many assume that the Real Estate Purchase Agreement includes every detail of the transaction. While it addresses key terms, additional agreements may be needed for specific contingencies or conditions.

- 5. It cannot be modified. Some people think that once the Pennsylvania Real Estate Purchase Agreement is filled out, it cannot be changed. In fact, parties can negotiate and amend the agreement as long as both sides agree to the modifications.

- 6. It is only necessary for residential transactions. There is a belief that this form is applicable only to residential real estate. However, it can also be used for commercial properties, although additional clauses may be necessary.

- 7. Once signed, the agreement cannot be canceled. Some individuals fear that signing the agreement locks them into the deal permanently. In certain circumstances, such as a breach of contract or specific contingencies, it is possible to cancel the agreement legally.

By clearing up these misconceptions, buyers and sellers can approach the Pennsylvania Real Estate Purchase Agreement with a better understanding, ensuring a smoother transaction process.

Dos and Don'ts

When filling out the Pennsylvania Real Estate Purchase Agreement form, attention to detail is crucial. Here are ten important dos and don'ts to consider:

- Do read the entire agreement thoroughly before filling it out.

- Do ensure all names are spelled correctly and match identification documents.

- Do specify the purchase price clearly, including any contingencies.

- Do include all relevant property details, such as the address and legal description.

- Do consult with a real estate professional if you have questions about any section.

- Don't leave any sections blank; this can lead to misunderstandings later.

- Don't use vague language; be specific about terms and conditions.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to sign and date the agreement where required.

- Don't overlook the importance of including any agreed-upon repairs or concessions.

Browse Popular Real Estate Purchase Agreement Forms for US States

How to Make a Purchase Agreement - The agreement specifies the closing date for the transaction.

When engaging in the sale or purchase of a mobile home, it is important to utilize the proper documentation to ensure a smooth transaction. The California Mobile Home Bill of Sale form serves as an essential legal tool in this process, and for additional resources regarding such forms, you can visit California PDF Forms. This document not only establishes proof of sale but also confirms compliance with state regulations.

Home Purchase Contract - Securing all relevant signatures is vital for ensuring the document's enforceability.

Real Estate Contract Georgia - The Real Estate Purchase Agreement should be thoroughly vetted to prevent any future legal issues.

Simple Real Estate Sales Contract - All verbal agreements should be included in writing in this document.

Detailed Guide for Writing Pennsylvania Real Estate Purchase Agreement

Completing the Pennsylvania Real Estate Purchase Agreement form is a crucial step in the home buying process. Accurate and thorough completion of this form helps ensure that all parties understand their rights and obligations. Follow these steps to fill out the form correctly.

- Identify the Parties: Enter the full names and addresses of the buyer(s) and seller(s). Ensure that all parties involved are clearly identified.

- Property Description: Provide a detailed description of the property being purchased. Include the address, lot number, and any relevant legal descriptions.

- Purchase Price: Specify the total purchase price of the property. This should be a clear figure, stated in both numerical and written form.

- Deposit Information: Indicate the amount of the earnest money deposit. State how this deposit will be handled and where it will be held.

- Financing Contingency: If applicable, outline the terms of any financing contingencies. Include details about the type of loan and the lender.

- Closing Date: Specify the anticipated closing date. This is the date when the transaction will be finalized.

- Inspection Rights: Indicate if the buyer has the right to conduct inspections. Include any specific terms related to inspections.

- Additional Terms: List any additional terms or conditions that both parties have agreed upon. Be as specific as possible.

- Signatures: Ensure that all parties sign and date the agreement. Each signature should be accompanied by the printed name of the signatory.

Once the form is completed, both parties should review it carefully. This ensures that all information is accurate and that there are no misunderstandings. After verification, the agreement can be executed, leading to the next steps in the real estate transaction process.