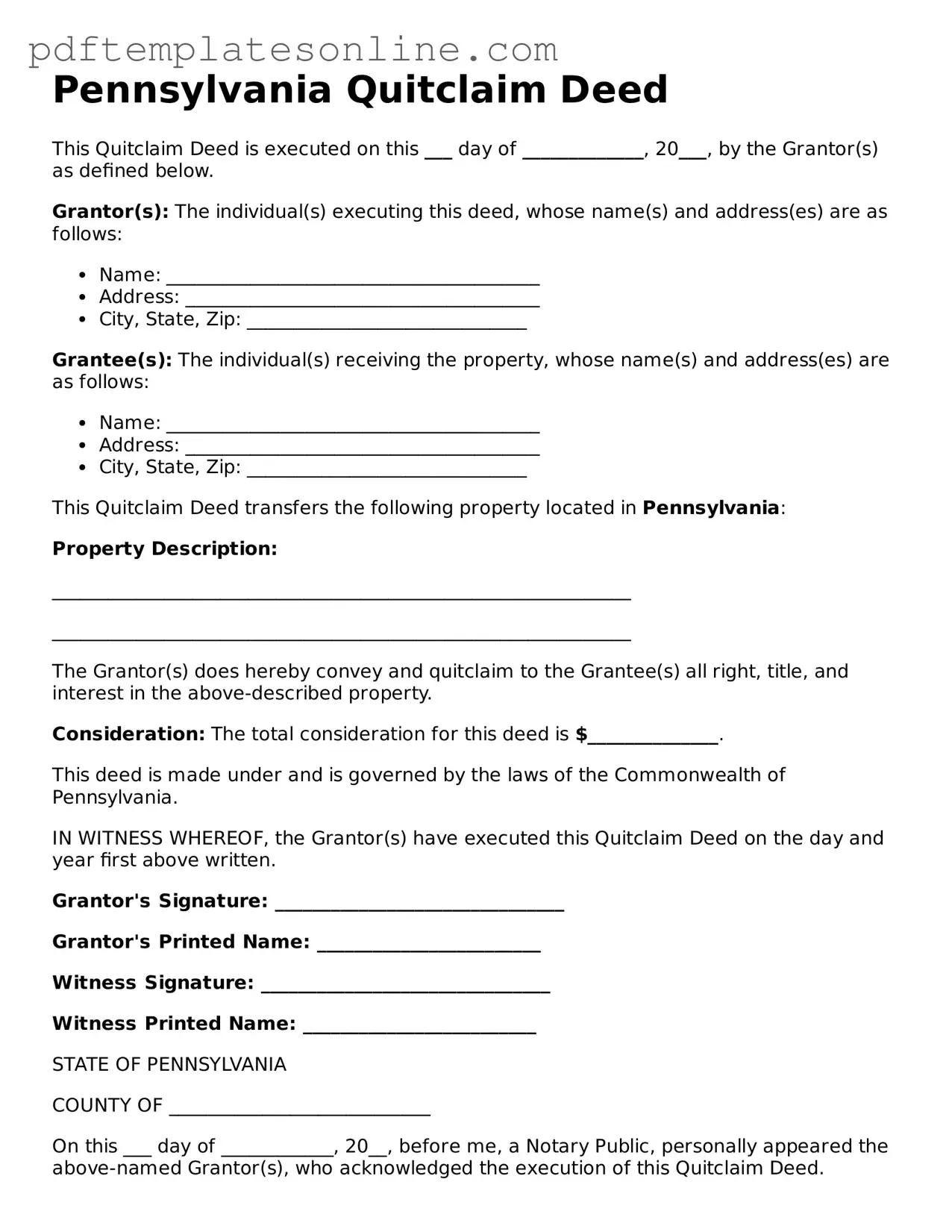

Official Pennsylvania Quitclaim Deed Document

Key takeaways

When considering the Pennsylvania Quitclaim Deed form, it is essential to understand its purpose and the proper procedures for filling it out. Here are ten key takeaways to keep in mind:

- Definition: A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties.

- Use Cases: This type of deed is commonly used among family members, in divorce settlements, or to clear up title issues.

- Filling Out the Form: Ensure all fields are completed accurately, including the names of both the grantor (seller) and grantee (buyer).

- Property Description: Provide a clear and precise description of the property being transferred, including the address and any relevant tax parcel numbers.

- Notarization Requirement: The quitclaim deed must be signed in the presence of a notary public to be legally valid.

- Recording the Deed: After notarization, the deed should be recorded at the county recorder of deeds office to provide public notice of the transfer.

- Transfer Taxes: Be aware that Pennsylvania may impose a transfer tax on the transaction, which varies by county.

- Legal Advice: Consider consulting with a real estate attorney to ensure that the deed is filled out correctly and that all legal implications are understood.

- Limitations: Understand that a quitclaim deed does not guarantee clear title; it merely transfers whatever interest the grantor has.

- Future Implications: After the transfer, the grantee assumes the risk associated with the property, including any liens or encumbrances.

Common mistakes

Filling out a Pennsylvania Quitclaim Deed form can be straightforward, but many people make common mistakes that can lead to problems later. One frequent error is not including the correct legal description of the property. This description must be precise. Without it, the deed may not be valid, and ownership could be challenged.

Another mistake involves failing to sign the deed properly. All grantors must sign the document, and if one signature is missing, the deed may be considered incomplete. Additionally, the signatures must be notarized. Neglecting this step can render the deed unenforceable.

People often overlook the importance of including the consideration amount. This is the value exchanged for the property. Even if the transfer is a gift, stating a nominal amount is necessary. Leaving this blank can lead to confusion or disputes in the future.

Some individuals mistakenly use outdated forms or versions of the Quitclaim Deed. Laws and requirements can change, so it's crucial to use the most current version. Using an old form may lead to complications or rejections when filing.

Another common error is not providing the grantee's full name and address. The grantee is the person receiving the property, and their information must be accurate and complete. Incomplete information can delay the processing of the deed.

People sometimes forget to check for any liens or encumbrances on the property before transferring ownership. If there are existing debts tied to the property, the new owner could inherit these issues. It's essential to conduct a title search to avoid surprises.

Finally, many individuals fail to record the Quitclaim Deed with the appropriate county office. Recording the deed is crucial for establishing legal ownership. Without this step, the transfer may not be recognized by the state, leaving the new owner vulnerable to claims from others.

Misconceptions

Understanding the Pennsylvania Quitclaim Deed form is essential for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings regarding this important legal document.

- Quitclaim deeds transfer ownership completely. Many believe that a quitclaim deed fully transfers ownership rights. While it does convey whatever interest the grantor has, it does not guarantee that the grantor has any interest at all.

- Quitclaim deeds are only for family members. Some think that quitclaim deeds are exclusively used between family members. In reality, they can be used for any transfer of property, regardless of the relationship between the parties.

- Quitclaim deeds eliminate all liabilities. It's a common myth that using a quitclaim deed removes all liabilities associated with the property. However, any existing liens or debts tied to the property remain, even after the transfer.

- Quitclaim deeds are complicated legal documents. Many people perceive quitclaim deeds as complex. In truth, they are relatively straightforward and can often be completed without the need for extensive legal assistance.

- All quitclaim deeds must be notarized. Some individuals believe that notarization is mandatory for all quitclaim deeds. While notarization is recommended for validity and to avoid disputes, it is not a strict requirement in Pennsylvania.

- Quitclaim deeds can be used to transfer property without a title search. There is a misconception that a quitclaim deed can be executed without a title search. However, it is wise to conduct a title search to uncover any potential issues before transferring property.

- Quitclaim deeds are the same as warranty deeds. Many confuse quitclaim deeds with warranty deeds. Unlike warranty deeds, which provide guarantees about the title, quitclaim deeds come with no such assurances.

- Using a quitclaim deed is always the best option. Some people think that quitclaim deeds are the best choice for all property transfers. However, this may not be the case, especially when the parties need more legal protection.

- Quitclaim deeds are only for real estate. A common misunderstanding is that quitclaim deeds are limited to real estate. They can also be used to transfer other types of property interests, such as personal property.

- Once a quitclaim deed is executed, it cannot be changed. Finally, some believe that quitclaim deeds are irrevocable. While they do represent a transfer of interest, the grantor can often create a new deed to reverse or modify the transaction.

By clarifying these misconceptions, individuals can make informed decisions regarding property transfers in Pennsylvania. Understanding the nuances of quitclaim deeds can help avoid potential pitfalls and ensure a smoother transaction process.

Dos and Don'ts

When filling out the Pennsylvania Quitclaim Deed form, it is essential to approach the process with care and attention to detail. Below are some important dos and don'ts to consider.

- Do ensure that all names are spelled correctly. Accurate spelling prevents future disputes.

- Do provide a complete legal description of the property. This description should clearly identify the boundaries and location.

- Do include the date of the transfer. This helps establish a clear timeline for the transaction.

- Do sign the deed in the presence of a notary public. Notarization adds legitimacy to the document.

- Don't leave any sections blank. Incomplete forms can lead to delays or rejections.

- Don't use vague terms when describing the property. Clarity is key to avoid confusion.

- Don't forget to check local recording requirements. Each county may have specific rules for filing.

- Don't assume that a Quitclaim Deed is the same as a warranty deed. Understand the differences to protect your interests.

By following these guidelines, individuals can navigate the Quitclaim Deed process more effectively and ensure a smoother transfer of property rights.

Browse Popular Quitclaim Deed Forms for US States

Quit Claim Deed Form Georgia - It does not require you to conduct a title search, which can save time.

In order to facilitate a smooth transaction, it is important for both parties to utilize a comprehensive document, such as the Florida PDF Forms, which can help ensure that all necessary information is accurately captured and that the ownership transfer complies with state laws.

Quick Claim Deeds Ohio - For joint owners, a Quitclaim Deed can clarify respective ownership stakes.

Detailed Guide for Writing Pennsylvania Quitclaim Deed

After completing the Pennsylvania Quitclaim Deed form, the next step involves submitting the document to the appropriate county office for recording. This process ensures that the transfer of property ownership is officially recognized and documented.

- Obtain the Pennsylvania Quitclaim Deed form from a reliable source, such as the county recorder's office or an official website.

- Fill in the name of the grantor (the person transferring the property) at the top of the form.

- Provide the name of the grantee (the person receiving the property) in the designated section.

- Include the full legal description of the property being transferred. This information can typically be found on the property deed or tax assessment records.

- Enter the address of the property in the appropriate field.

- Specify the date of the transfer in the designated area.

- Have the grantor sign the form in the presence of a notary public to ensure the signature is valid.

- Complete any additional required fields, such as the notary’s information and seal.

- Review the completed form for accuracy and completeness before submission.

- Submit the signed and notarized Quitclaim Deed to the county recorder's office along with any required fees for recording.