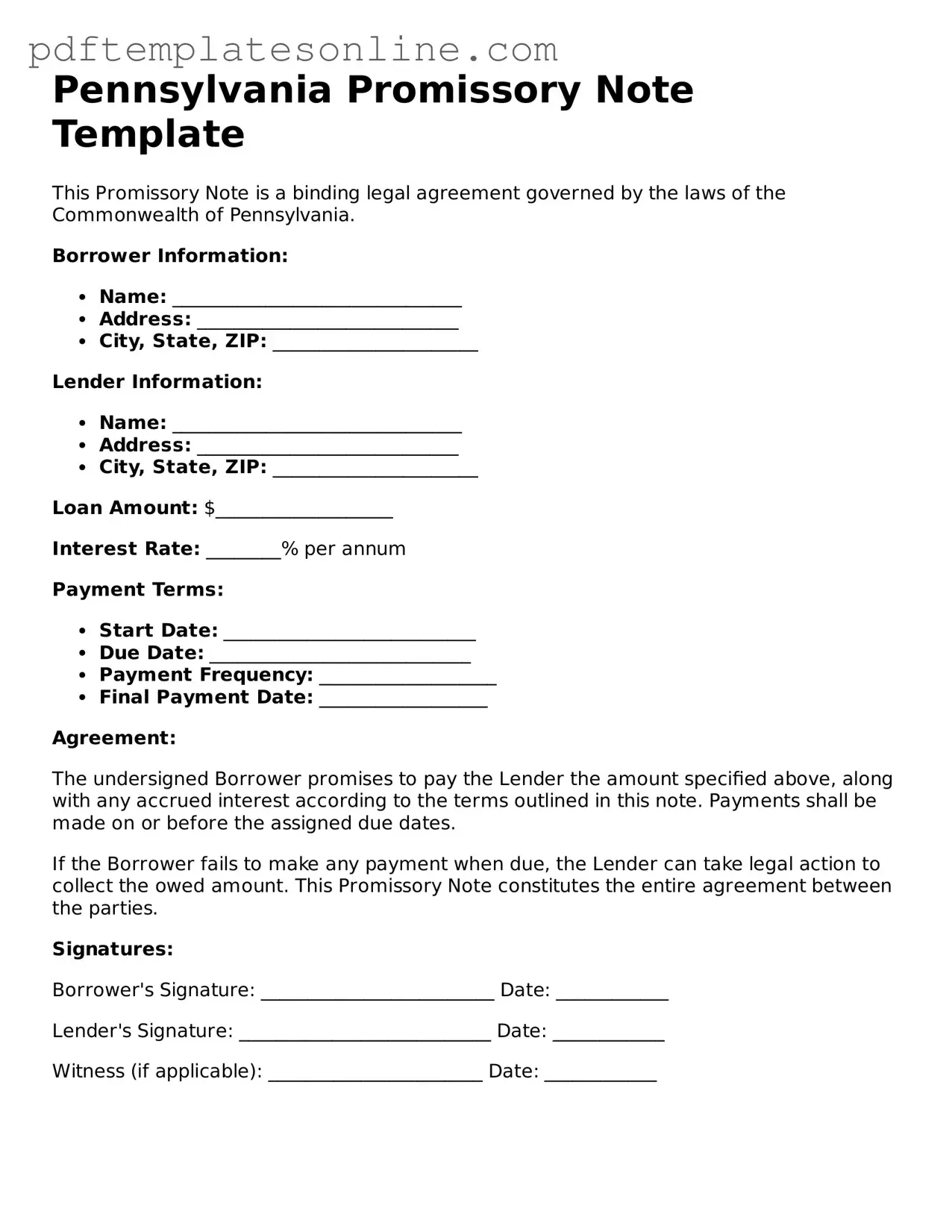

Official Pennsylvania Promissory Note Document

Key takeaways

When dealing with the Pennsylvania Promissory Note form, several important points should be kept in mind. Understanding these can help ensure that the document serves its intended purpose effectively.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This establishes who is responsible for repayment.

- Loan Amount: Specify the exact amount of money being borrowed. This figure is crucial for clarity and enforcement.

- Interest Rate: If applicable, include the interest rate. This can be fixed or variable, but it must be clearly defined.

- Payment Terms: Outline how and when payments will be made. This includes the frequency of payments and the due dates.

- Maturity Date: Indicate when the loan must be fully repaid. This date is essential for both parties to know.

- Default Terms: Describe what happens if the borrower fails to make payments. This section should outline the lender's rights in such cases.

- Governing Law: Mention that Pennsylvania law governs the agreement. This is important for any legal disputes that may arise.

- Signatures: Ensure both parties sign the document. Without signatures, the note may not be legally binding.

By following these key takeaways, individuals can better navigate the process of creating and using a promissory note in Pennsylvania.

Common mistakes

Filling out a Pennsylvania Promissory Note form can seem straightforward, but many people make common mistakes that can lead to complications down the road. One of the most frequent errors is failing to include all necessary details about the borrower and lender. Each party’s full name, address, and contact information should be clearly stated. Omitting any of this information can create confusion and may hinder the enforcement of the note if disputes arise.

Another mistake often made is neglecting to specify the interest rate. It is essential to clearly state whether the loan is interest-free or if interest will be charged. If interest is applicable, the rate must be indicated. Without this information, the terms of repayment may be unclear, leading to potential misunderstandings between the parties involved.

Many individuals also overlook the importance of detailing the repayment schedule. It is crucial to outline when payments are due, how much each payment will be, and the total duration of the loan. Without a clear repayment schedule, borrowers may struggle to meet their obligations, and lenders may face difficulties in tracking payments. Clarity in this section helps ensure that both parties are on the same page regarding expectations.

Finally, some people forget to sign and date the document. A Promissory Note is not legally binding without the signatures of both the borrower and lender. Additionally, dating the document is important as it establishes when the agreement was made. This can be vital for record-keeping and in case of any disputes. Ensuring that all parties have signed and dated the form can prevent unnecessary issues later on.

Misconceptions

Understanding the Pennsylvania Promissory Note form is essential for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings about this important document:

- All Promissory Notes are the Same: Many people believe that all promissory notes are identical. In reality, they can vary significantly in terms of terms, conditions, and legal requirements.

- A Promissory Note Must Be Notarized: Some think that notarization is mandatory for a promissory note to be valid. While notarization can add an extra layer of authenticity, it is not a legal requirement in Pennsylvania.

- Only Written Promissory Notes are Valid: A common misconception is that verbal agreements cannot be enforced. However, oral promissory notes can be legally binding, though they are harder to prove in court.

- Interest Rates are Unlimited: Some borrowers assume that lenders can charge any interest rate they choose. Pennsylvania law imposes limits on interest rates, especially for consumer loans.

- Promissory Notes are Only for Large Loans: Many believe these notes are only necessary for significant amounts. In truth, they can be used for any loan, regardless of size.

- Once Signed, a Promissory Note Cannot Be Changed: Some people think that modifications are impossible after signing. In fact, both parties can agree to amend the terms, provided it is documented properly.

- Promissory Notes are Only for Personal Loans: While they are commonly used in personal lending, promissory notes can also be utilized in business transactions and real estate deals.

- A Promissory Note Guarantees Payment: Many believe that signing a promissory note guarantees that payment will be made. However, if the borrower defaults, the lender must take legal action to recover the debt.

- All Promissory Notes Are Enforceable: Some assume that every promissory note is automatically enforceable. However, notes that lack essential elements or are not executed properly may not hold up in court.

- Only Lawyers Can Draft Promissory Notes: There is a misconception that only legal professionals can create these documents. In reality, individuals can prepare promissory notes themselves, as long as they understand the necessary components.

By clearing up these misconceptions, individuals can better navigate the lending process and ensure that their agreements are valid and enforceable.

Dos and Don'ts

When filling out the Pennsylvania Promissory Note form, it is essential to approach the task with care. This document serves as a written promise to repay a loan, and accuracy is crucial. Below is a list of things you should and shouldn't do to ensure the form is completed correctly.

- Do: Clearly state the names of both the borrower and the lender. Ensure that the names are spelled correctly to avoid any confusion later.

- Do: Specify the loan amount in both numerical and written form. This helps prevent any discrepancies regarding the amount owed.

- Do: Include the interest rate, if applicable. Be explicit about whether the rate is fixed or variable.

- Do: Outline the repayment schedule. Indicate when payments are due and the method of payment.

- Don't: Leave any sections blank. Every part of the form should be filled out to avoid misunderstandings.

- Don't: Use vague language. Be specific about the terms of the agreement to ensure clarity.

- Don't: Forget to date and sign the document. Both the borrower and lender should sign the note to make it legally binding.

- Don't: Ignore state-specific requirements. Make sure to adhere to any additional regulations that may apply in Pennsylvania.

By following these guidelines, you can create a clear and enforceable Promissory Note that protects the interests of both parties involved.

Browse Popular Promissory Note Forms for US States

Promissory Note for Personal Loan - A means for preventing misunderstandings regarding loan repayment expectations.

When applying for a job, it is important to have all necessary documents ready, including the Employment Application PDF form, which can be found at https://mypdfform.com/blank-employment-application-pdf/. This standardized document assists employers in gathering essential information about candidates, including personal details, work history, education, and references, ultimately aiding in the assessment of qualifications and suitability for the position.

Promissory Note Template California Word - Key elements include the names of the borrower and lender, the amount borrowed, and the repayment terms.

Georgia Promissory Note - The clear structure of a promissory note can also help in financial planning for the borrower.

Detailed Guide for Writing Pennsylvania Promissory Note

Filling out the Pennsylvania Promissory Note form is a straightforward process. Once completed, this document will outline the terms of the loan agreement between the lender and the borrower. It’s important to ensure that all information is accurate to avoid any misunderstandings later on.

- Obtain the Form: Download or print the Pennsylvania Promissory Note form from a reliable source.

- Fill in the Date: Write the date when the note is being created at the top of the form.

- Identify the Parties: Enter the names and addresses of both the borrower and the lender. Make sure the spelling is correct.

- Specify the Loan Amount: Clearly state the total amount of money being borrowed.

- Set the Interest Rate: If applicable, indicate the interest rate that will be charged on the loan.

- Define the Repayment Terms: Outline how and when the borrower will repay the loan. Include payment frequency and due dates.

- Include Late Fees: If there are any penalties for late payments, specify the amount and conditions for these fees.

- Signatures: Both the borrower and lender must sign the document. Include the date of signatures.

- Witness or Notary: Depending on your needs, you may want to have a witness or notary public sign the document to validate it.

After completing the form, make sure to keep a copy for your records. It’s also a good idea to provide a copy to the other party involved in the agreement. This ensures that everyone has the same understanding of the terms outlined in the note.