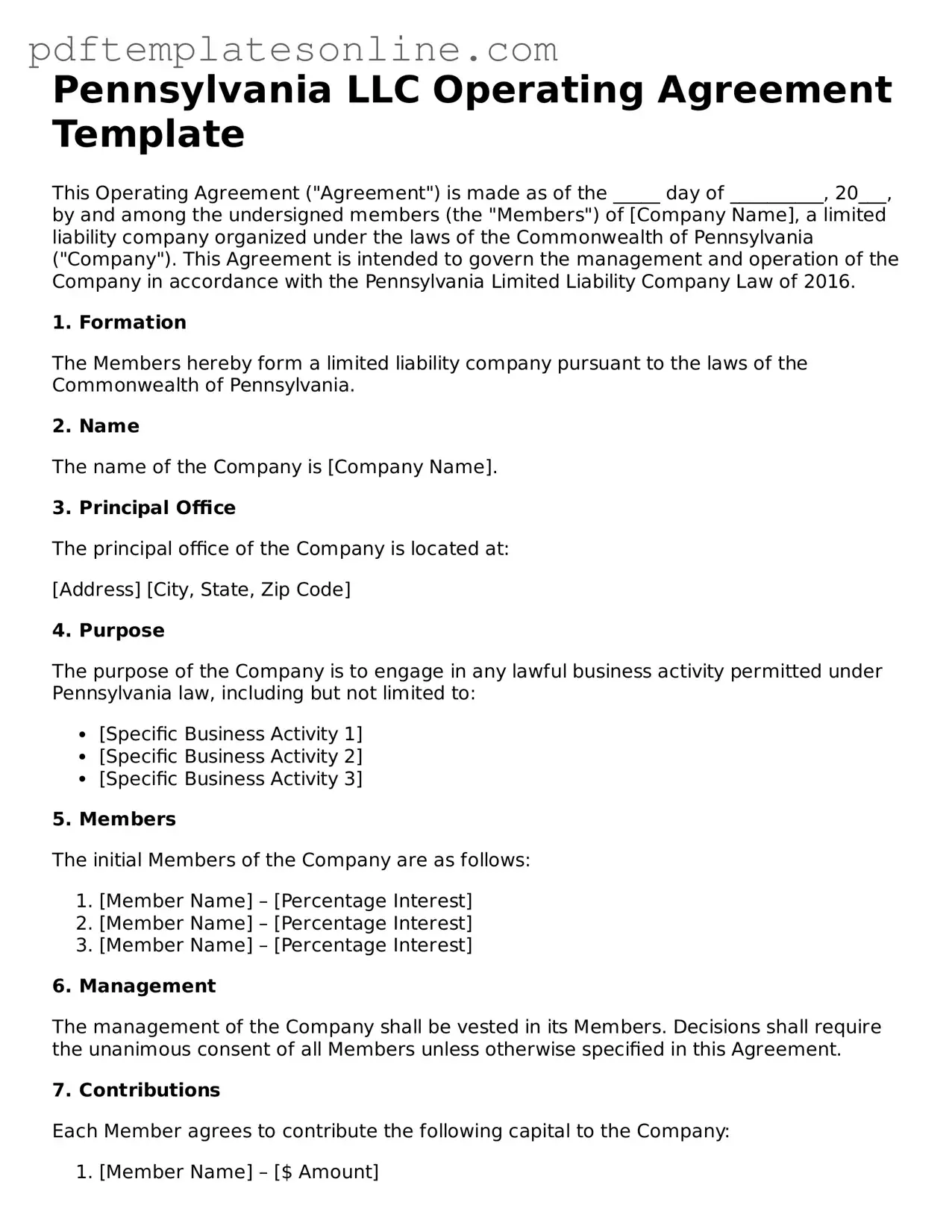

Official Pennsylvania Operating Agreement Document

Key takeaways

When it comes to forming a business in Pennsylvania, an Operating Agreement is a crucial document for Limited Liability Companies (LLCs). This agreement outlines the structure and operational guidelines of the business. Here are some key takeaways to keep in mind when filling out and using the Pennsylvania Operating Agreement form:

- Define the Purpose: Clearly state the purpose of your LLC. This helps in understanding the business's goals and objectives.

- Member Contributions: Specify the contributions of each member, whether they are in the form of cash, property, or services. This ensures transparency and fairness among members.

- Management Structure: Decide whether the LLC will be member-managed or manager-managed. This choice affects how decisions are made and who is responsible for daily operations.

- Profit Distribution: Outline how profits and losses will be distributed among members. This can be based on ownership percentages or another agreed-upon method.

- Dispute Resolution: Include a process for resolving disputes among members. This can prevent conflicts from escalating and provide a clear path to resolution.

- Amendments and Changes: Describe the process for making amendments to the Operating Agreement. Flexibility is key as your business evolves over time.

Understanding these elements can significantly enhance the functionality of your LLC and help maintain healthy relationships among members. A well-crafted Operating Agreement not only serves as a roadmap for your business but also provides legal protection and clarity.

Common mistakes

When individuals or groups form a business in Pennsylvania, an Operating Agreement is a crucial document that outlines the management structure and operational guidelines. However, many people make mistakes when filling out this form, which can lead to misunderstandings or disputes down the line. Here are five common errors to avoid.

One of the most frequent mistakes is failing to clearly define roles and responsibilities. It’s essential to specify who will manage the business and what each member's duties entail. Without this clarity, members may have different expectations, leading to conflicts. Clearly outlining roles helps ensure everyone is on the same page from the start.

Another common error is not including a detailed capital contribution section. Members should specify how much each person is investing in the business and the form of that investment, whether cash, property, or services. Omitting this information can create disputes about ownership percentages and profit sharing later on.

People often overlook the importance of establishing a process for decision-making. The Operating Agreement should outline how decisions will be made, including voting rights and procedures. Without this framework, members may struggle to reach consensus, leading to frustration and inefficiency.

Many individuals also forget to include provisions for handling disputes. It’s wise to plan for disagreements in advance. By including a clear dispute resolution process, such as mediation or arbitration, the Operating Agreement can help prevent conflicts from escalating and ensure a smoother resolution.

Finally, neglecting to update the Operating Agreement as the business evolves is a significant oversight. Changes in membership, business structure, or goals may necessitate revisions. Regularly reviewing and updating the agreement ensures it remains relevant and effective in guiding the business.

Misconceptions

When it comes to the Pennsylvania Operating Agreement form, several misconceptions can lead to confusion. Understanding these myths can help ensure that you have a clear grasp of what this document entails and how it can benefit your business.

- Myth 1: An Operating Agreement is only necessary for large businesses.

- Myth 2: The Operating Agreement is a public document.

- Myth 3: You can use a generic template for your Operating Agreement.

- Myth 4: Once the Operating Agreement is signed, it cannot be changed.

- Myth 5: An Operating Agreement is not legally binding.

This is not true. Even small businesses or single-member LLCs benefit from having an Operating Agreement. It sets clear guidelines and helps prevent misunderstandings among members.

In Pennsylvania, Operating Agreements are private documents. They do not need to be filed with the state, which means you can keep your business operations confidential.

While templates can be a good starting point, they often fail to address specific needs of your business. Customizing your Operating Agreement ensures it reflects your unique circumstances and complies with Pennsylvania laws.

This is a misconception. Operating Agreements can be amended as your business evolves. Regularly reviewing and updating the document is a best practice.

In fact, an Operating Agreement is legally binding among the members of the LLC. It provides a framework for how the business will be managed and can be enforced in court if necessary.

Dos and Don'ts

When filling out the Pennsylvania Operating Agreement form, it is important to approach the task with care and attention to detail. Here are four key actions to take and avoid:

- Do: Read the entire form carefully before you begin. Understanding what is required will help ensure that all necessary information is provided.

- Do: Provide accurate and complete information. Double-check all entries to minimize errors that could lead to complications later on.

- Do: Consult with a legal professional if you have questions. Getting expert advice can clarify any uncertainties you may have about the form.

- Do: Keep a copy of the completed form for your records. This will be useful for future reference and can help resolve any potential disputes.

- Don't: Rush through the form. Taking your time to fill it out thoughtfully can prevent mistakes that might require corrections.

- Don't: Leave any sections blank unless specifically instructed. Missing information can lead to delays or rejection of the agreement.

- Don't: Use vague or ambiguous language. Clear and precise wording is essential for ensuring that all parties understand their rights and responsibilities.

- Don't: Forget to sign and date the form. An unsigned document may not be considered valid, so ensure that all required signatures are included.

Browse Popular Operating Agreement Forms for US States

Operating Agreement Llc California Template - It can help new members understand the existing practices and assumptions of the business.

Texas Llc Operating Agreement - This document allows the customization of the LLC's operations beyond state law defaults.

Ohio Llc Operating Agreement - The Operating Agreement can clarify member voting rights.

To create a seamless and effective rental experience, landlords and tenants can utilize the California Room Rental Agreement form, which not only clarifies the terms of the rental but also addresses potential ambiguities. For those looking to tailor their agreements further, resources like California PDF Forms provide customizable options that can enhance the rental process.

What Is an Llc Business - It allows existing members to protect their interests when newcomers join the LLC.

Detailed Guide for Writing Pennsylvania Operating Agreement

Once you have the Pennsylvania Operating Agreement form in hand, you’re ready to begin the process of filling it out. This document is essential for outlining the management and operational structure of your business. Follow these steps carefully to ensure everything is completed correctly.

- Start with the basic information. Fill in the name of your LLC at the top of the form.

- Provide the principal address of your LLC. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the LLC. Make sure to include their roles if applicable.

- Specify the purpose of your LLC. This can be a simple statement about what your business will do.

- Outline the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Detail the voting rights of each member. This includes how decisions will be made within the company.

- Include provisions for profit and loss distribution. Clearly state how profits and losses will be shared among members.

- Provide information on how new members can be added to the LLC in the future.

- Include any additional clauses that are relevant to your business needs, such as buyout provisions or dispute resolution processes.

- Finally, have all members sign and date the agreement to make it official.