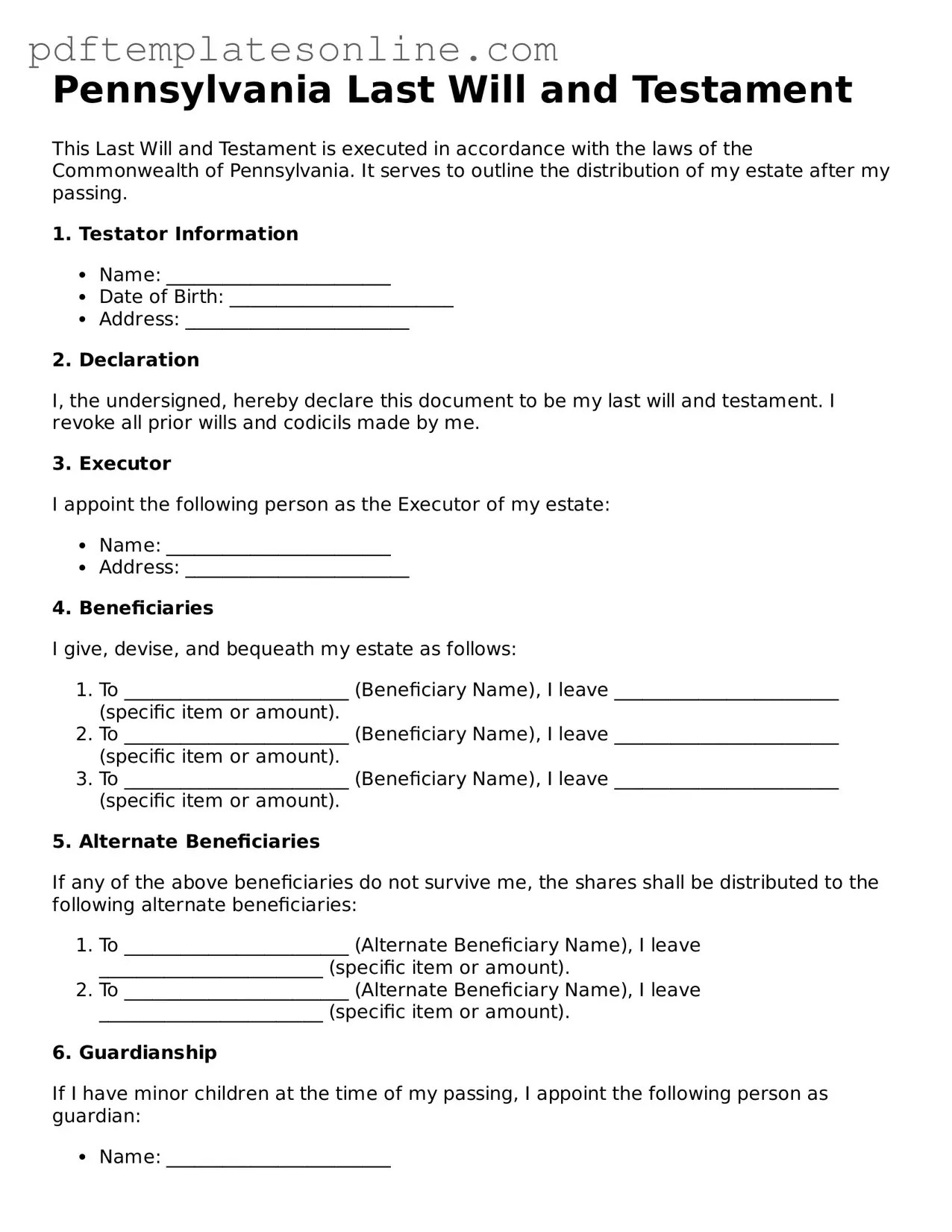

Official Pennsylvania Last Will and Testament Document

Key takeaways

When filling out and using the Pennsylvania Last Will and Testament form, it is important to consider several key factors to ensure that the document is valid and reflects your wishes accurately. Below are ten essential takeaways:

- The form must clearly state that it is your last will and testament.

- Include your full legal name and address to identify yourself.

- Designate an executor who will be responsible for carrying out the terms of the will.

- Clearly outline how you wish your assets to be distributed among your beneficiaries.

- It is advisable to name alternate beneficiaries in case your primary choices are unable to inherit.

- The will must be signed by you in the presence of at least two witnesses.

- Witnesses should not be beneficiaries of the will to avoid potential conflicts of interest.

- Consider having your will notarized, although it is not required in Pennsylvania.

- Keep the original document in a safe place and inform your executor of its location.

- Review and update your will periodically, especially after major life changes such as marriage, divorce, or the birth of a child.

Common mistakes

Filling out a Last Will and Testament form in Pennsylvania is a crucial step in ensuring that your wishes are honored after your passing. However, many individuals make common mistakes that can lead to confusion or even invalidate their wills. One frequent error is failing to sign the document properly. In Pennsylvania, a will must be signed by the testator, or the person making the will. If the signature is missing or not done correctly, the will may not be recognized as valid.

Another mistake involves not having the required witnesses. Pennsylvania law mandates that a will must be witnessed by at least two individuals who are not beneficiaries. If the witnesses do not sign the will, or if they are beneficiaries themselves, this can create complications in the future.

Many people also neglect to date their will. While Pennsylvania does not require a specific date for a will to be valid, including one helps clarify the timeline of your wishes. If multiple wills exist, the most recent one is typically considered valid, provided it is dated. Without a date, it may be challenging to determine which version of the will should be honored.

In addition, individuals sometimes forget to be clear about their intentions. Ambiguities in language can lead to disputes among heirs. Clearly stating who receives what can help prevent misunderstandings and conflicts down the line. A well-defined will leaves no room for interpretation.

Another common oversight is failing to update the will after major life changes. Events such as marriage, divorce, or the birth of a child can significantly affect your wishes. Regularly reviewing and updating your will ensures that it reflects your current situation and intentions.

Some individuals also overlook the importance of including a residuary clause. This clause addresses any assets not specifically mentioned in the will. Without it, any property not explicitly outlined may be distributed according to state law rather than your wishes.

Furthermore, many people do not consider the tax implications of their estate. Understanding how taxes may affect your heirs can help you make more informed decisions about asset distribution. Consulting with a financial advisor or estate planner can provide valuable insights.

Lastly, individuals sometimes fail to store their will in a safe and accessible location. A will that cannot be found after your passing can lead to delays and complications in the probate process. Keeping your will in a secure yet accessible place ensures that your wishes can be honored without unnecessary hurdles.

Misconceptions

When it comes to creating a Last Will and Testament in Pennsylvania, many people hold misconceptions that can lead to confusion or even legal issues. Here are seven common misunderstandings:

- Only wealthy individuals need a will. Many believe that only those with significant assets require a will. In reality, everyone can benefit from having a will, regardless of their financial status. A will ensures that your wishes are honored and can simplify the process for your loved ones.

- Handwritten wills are not valid. Some think that only typed and formally executed wills are acceptable. In Pennsylvania, handwritten wills, also known as holographic wills, can be valid if they meet certain criteria. However, it's essential to ensure that they comply with state laws.

- Verbal wills are legally binding. Many people mistakenly believe that simply expressing their wishes verbally constitutes a will. In Pennsylvania, a will must be in writing and signed to be legally binding. Relying on verbal statements can lead to disputes among heirs.

- Once a will is created, it cannot be changed. Some individuals think that a will is set in stone once it is signed. In fact, you can amend or revoke your will at any time, as long as you follow the proper legal procedures. This flexibility allows you to update your wishes as your life circumstances change.

- All debts must be paid before distributing assets. While it is true that debts are typically settled before assets are distributed, many people believe that this means heirs will receive nothing. In reality, the estate may still have assets left after debts are settled, which can be distributed according to the will.

- Wills avoid probate. A common misconception is that having a will allows your estate to bypass the probate process entirely. In Pennsylvania, a will must still go through probate, although having a will can help streamline the process and clarify your wishes.

- Beneficiaries can be changed without a new will. Some assume that simply naming beneficiaries in a will is sufficient and that they can be changed informally later. However, changes to beneficiaries should be made through a new will or an official amendment to ensure that your wishes are legally recognized.

Understanding these misconceptions can help individuals make informed decisions when creating their Last Will and Testament in Pennsylvania. It’s always wise to consult with a legal professional to ensure that your will accurately reflects your intentions and complies with state laws.

Dos and Don'ts

When filling out the Pennsylvania Last Will and Testament form, it's important to follow certain guidelines to ensure that your wishes are clearly expressed and legally valid. Here are nine essential do's and don'ts to consider:

- Do clearly identify yourself at the beginning of the document.

- Do specify your beneficiaries by full name and relationship.

- Do appoint an executor to manage your estate.

- Do sign the document in the presence of two witnesses.

- Do date the will to indicate when it was created.

- Don't use ambiguous language that could lead to confusion.

- Don't forget to revoke any previous wills if this is your latest version.

- Don't leave out important details about your assets.

- Don't sign the will without witnesses present.

Browse Popular Last Will and Testament Forms for US States

Sample of Last Will and Testament - An avenue to support loved ones in navigating the complexities of inheritance after your death.

Ohio Will Template - Facilitates an organized succession plan, especially for business owners.

Free Ny Will Template - Can be revised as life changes occur, keeping it aligned with your current situation.

To simplify the process of establishing a rental agreement, landlords and tenants can utilize the California PDF Forms tailored specifically for this purpose, ensuring that all necessary information is included to maintain a transparent and effective rental experience.

Simple Will Template Georgia - A Last Will can be witnessed to validate its authenticity.

Detailed Guide for Writing Pennsylvania Last Will and Testament

Completing the Pennsylvania Last Will and Testament form is an important step in ensuring your wishes are clearly communicated regarding your estate. After filling out the form, it is advisable to review it carefully and consider having it witnessed and notarized to ensure its validity.

- Begin by obtaining the Pennsylvania Last Will and Testament form. This can often be found online or at local legal offices.

- Clearly write your full name at the top of the form. Ensure that it matches your identification documents.

- State your address, including city, state, and zip code. This helps to establish your legal residence.

- Designate an executor. This is the person who will carry out your wishes as outlined in the will. Include their full name and address.

- List your beneficiaries. Specify who will inherit your assets, and include their full names and relationships to you.

- Detail the specific assets you wish to leave to each beneficiary. Be clear and precise to avoid confusion.

- Include any special instructions, such as guardianship for minor children or specific wishes for your funeral arrangements.

- Sign and date the form at the designated area. Your signature must be done in the presence of witnesses.

- Have at least two witnesses sign the document. They should also provide their addresses. Ensure they are not beneficiaries.

- If desired, consider having the will notarized to add an extra layer of authenticity.