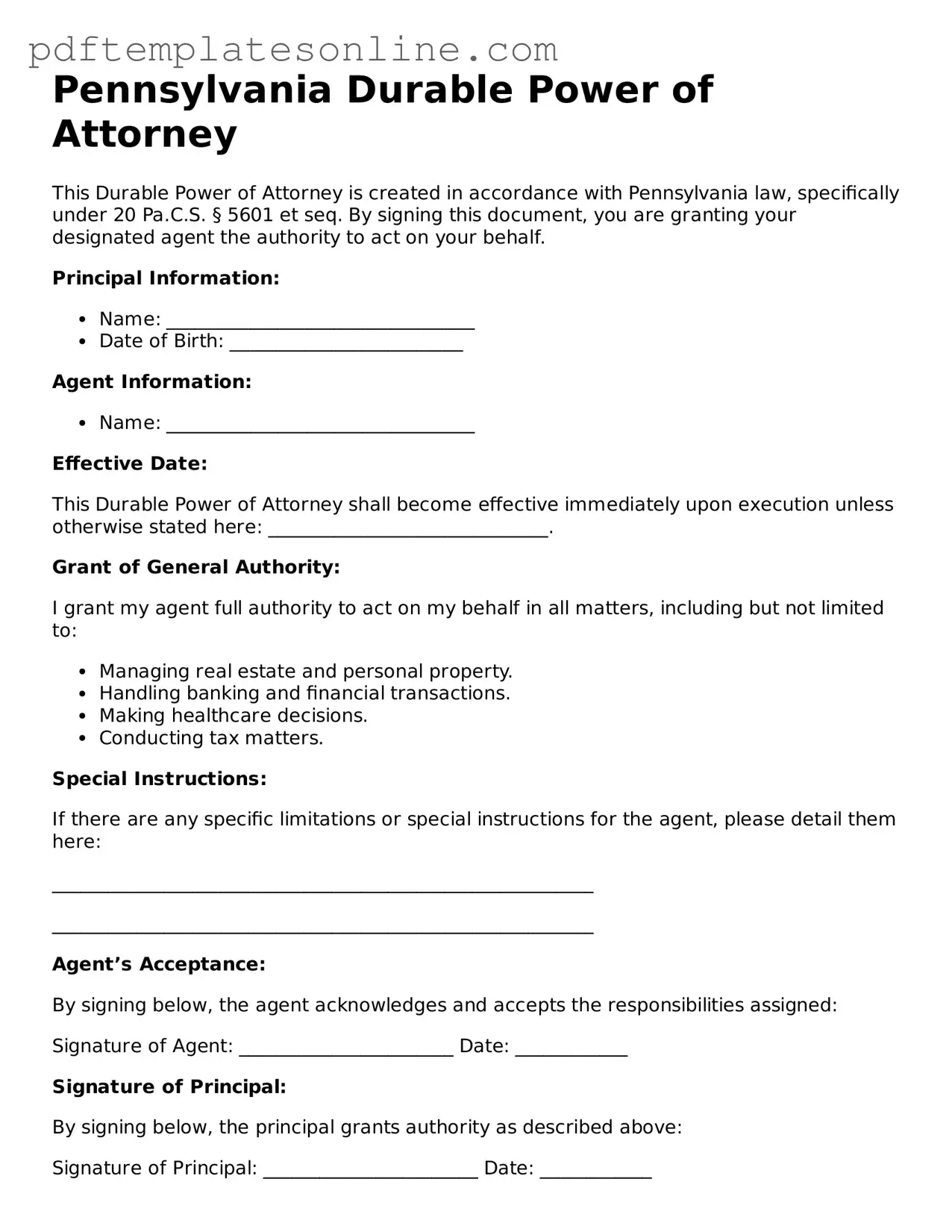

Official Pennsylvania Durable Power of Attorney Document

Key takeaways

When filling out and using the Pennsylvania Durable Power of Attorney form, keep the following key takeaways in mind:

- The form allows you to designate someone to act on your behalf in financial matters.

- It remains effective even if you become incapacitated.

- Choose an agent you trust, as they will have significant control over your financial decisions.

- Clearly specify the powers you are granting to your agent to avoid confusion later.

- Sign the form in front of a notary public to ensure it is legally binding.

- Provide copies of the completed form to your agent and any relevant financial institutions.

- Regularly review and update the document as your circumstances or preferences change.

- Understand that this document can be revoked at any time as long as you are still competent.

Common mistakes

Filling out a Pennsylvania Durable Power of Attorney form can be a straightforward process, but many people make common mistakes that can lead to complications down the line. One frequent error is failing to clearly identify the principal. The principal is the person granting authority, and it’s crucial to include their full name and address. Omitting this information can create confusion about who is actually giving the power.

Another common mistake is not specifying the powers granted to the agent. The form allows for a broad range of authorities, but if the powers are not clearly delineated, the agent may not be able to act as intended. It's important to take the time to outline specific powers, whether they involve financial decisions, healthcare choices, or other important matters.

Some individuals neglect to date the form. A date is essential as it establishes when the document becomes effective. Without a date, there may be disputes regarding the timing of the authority granted, which could lead to unnecessary complications in critical situations.

Additionally, many people forget to have the document properly witnessed or notarized. In Pennsylvania, the Durable Power of Attorney must be signed in the presence of a notary public or two witnesses. Failing to meet these requirements can render the document invalid, leaving the principal without the intended protections.

Another mistake is not discussing the decision with the chosen agent beforehand. It’s vital to ensure that the agent is willing to accept the responsibility and understands the principal's wishes. An uninformed agent may not act in accordance with the principal's desires, which can lead to conflict and frustration.

People often overlook the importance of reviewing the form periodically. Life circumstances change, and so do the needs of the principal. Regularly reviewing and updating the Durable Power of Attorney ensures that it remains relevant and effective in light of any changes in personal circumstances or relationships.

Lastly, many individuals underestimate the significance of sharing the document with relevant parties. Simply having the form completed is not enough; it should be provided to the agent, family members, and any financial institutions or healthcare providers that may need it. This proactive step can help prevent confusion and ensure that the agent can act swiftly when necessary.

Misconceptions

Understanding the Pennsylvania Durable Power of Attorney (DPOA) form is crucial for anyone considering establishing this important legal document. However, several misconceptions can lead to confusion. Here are five common misconceptions about the Pennsylvania DPOA:

- It only takes effect when I become incapacitated. Many believe that a DPOA only activates when the individual is no longer able to make decisions. In Pennsylvania, a DPOA can be effective immediately upon signing, unless specified otherwise. This means the appointed agent can start acting on your behalf right away.

- My agent can do anything they want with my assets. While a DPOA grants your agent significant authority, it does not give them unrestricted power. The agent must act in your best interest and follow the guidelines you set forth in the document. They cannot use your assets for personal gain unless explicitly authorized.

- Once I sign a DPOA, I cannot change it. This is a common myth. You can revoke or modify your DPOA at any time, as long as you are mentally competent. It's important to communicate any changes to your agent and relevant institutions.

- A DPOA is only for financial matters. While many people associate DPOAs with financial decisions, they can also cover healthcare decisions. In Pennsylvania, a separate document called a Healthcare Power of Attorney is typically used for medical decisions. However, you can include healthcare provisions in your DPOA if you wish.

- My family will automatically make decisions for me if I can’t. This assumption can lead to complications. Without a DPOA in place, family members may face legal hurdles to make decisions on your behalf. A DPOA clearly outlines who you trust to act for you, ensuring your wishes are respected.

By clarifying these misconceptions, individuals can make informed decisions about their Durable Power of Attorney in Pennsylvania. Proper understanding of this document empowers individuals to protect their interests and ensure their wishes are honored.

Dos and Don'ts

When filling out the Pennsylvania Durable Power of Attorney form, it is important to approach the process with care. Here are seven things to consider, including actions to take and those to avoid.

- Do ensure you understand the powers you are granting to your agent.

- Do choose a trusted individual as your agent.

- Do clearly specify the effective date of the power of attorney.

- Do sign the document in the presence of a notary public.

- Don't leave any sections of the form incomplete.

- Don't select an agent who may have conflicting interests.

- Don't overlook the need to discuss your wishes with your agent.

Browse Popular Durable Power of Attorney Forms for US States

Texas Durable Power of Attorney - The document must be signed and notarized for it to be legally binding and recognized by institutions.

Ny Statutory Power of Attorney - Secure your future by granting authority to someone you trust with a Durable Power of Attorney.

Durable Power of Attorney California - In case of incapacity, this form helps manage your affairs without court intervention.

The Employment Application PDF form is a standardized document used by employers to collect essential information from job applicants. This form typically includes sections for personal details, work history, education, and references. Completing this form accurately is vital for candidates seeking employment, as it serves as a primary tool for assessing qualifications and suitability for available positions. To access a blank version of the form, visit https://mypdfform.com/blank-employment-application-pdf.

Financial Power of Attorney Georgia - This form remains effective even if you become incapacitated or unable to make decisions for yourself.

Detailed Guide for Writing Pennsylvania Durable Power of Attorney

To fill out the Pennsylvania Durable Power of Attorney form, it is essential to follow the steps carefully to ensure that all necessary information is accurately provided. This process will help designate an individual to manage your financial affairs when you are unable to do so.

- Obtain the Pennsylvania Durable Power of Attorney form. This can be found online or through legal offices.

- Begin with the principal's information. Fill in your full name, address, and date of birth in the designated sections.

- Identify the agent. Provide the full name, address, and contact information of the person you are appointing as your agent.

- Specify the powers granted. Clearly indicate the specific financial powers you wish to grant to your agent. You may choose to grant broad or limited powers.

- Include any limitations. If there are any restrictions on the powers you are granting, list them in this section.

- Sign and date the form. The principal must sign and date the document in the presence of a notary public.

- Have the document notarized. The notary public will verify your identity and witness your signature.

- Distribute copies. Provide copies of the completed form to your agent, any relevant financial institutions, and keep a copy for your records.