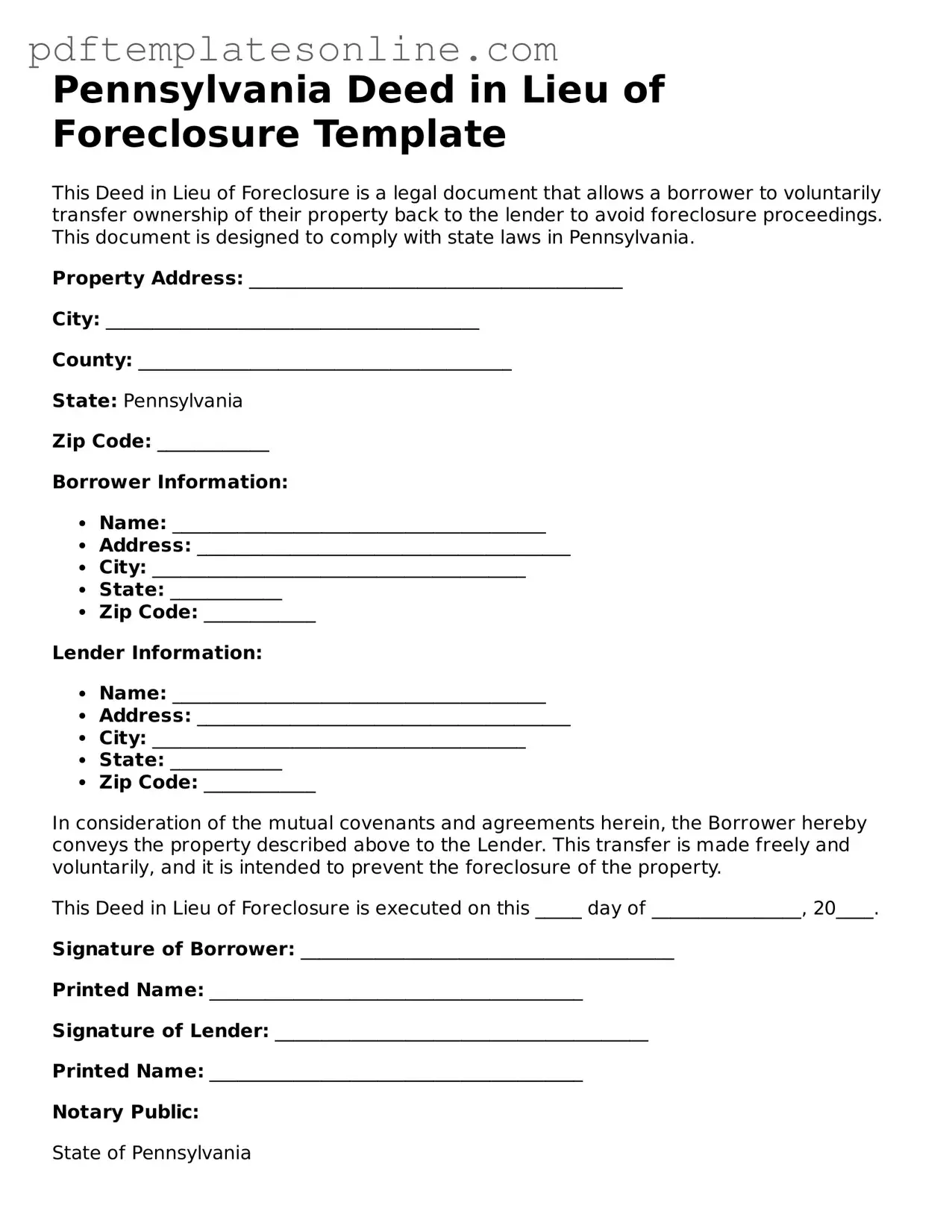

Official Pennsylvania Deed in Lieu of Foreclosure Document

Key takeaways

When dealing with the Pennsylvania Deed in Lieu of Foreclosure form, keep these key points in mind:

- Understand the purpose: A deed in lieu of foreclosure allows a homeowner to transfer property ownership to the lender to avoid foreclosure.

- Eligibility matters: Not all homeowners qualify. Lenders often require proof of financial hardship.

- Consult with professionals: It’s wise to talk to a real estate attorney or a financial advisor before proceeding.

- Review the terms: Carefully read the terms outlined in the deed to understand your rights and obligations.

- Document everything: Keep copies of all communications and documents related to the deed in lieu process.

- Tax implications: Be aware that transferring your property may have tax consequences. Consulting a tax professional can provide clarity.

- Impact on credit: A deed in lieu may affect your credit score, though it can be less damaging than a foreclosure.

Common mistakes

When filling out the Pennsylvania Deed in Lieu of Foreclosure form, many individuals make common mistakes that can complicate the process. One frequent error is failing to provide accurate property information. Ensure that the property address, parcel number, and legal description are correct. Inaccuracies can lead to delays or even rejection of the deed.

Another mistake is neglecting to include all necessary signatures. Both the borrower and any co-owners must sign the document. If a signature is missing, the deed may not be legally binding. It’s essential to double-check that everyone involved has signed before submission.

Some individuals overlook the importance of consulting with a legal or financial advisor. While the form may seem straightforward, professional guidance can help you understand the implications of signing over your property. This step can prevent future regrets and ensure that you are making an informed decision.

Additionally, people often forget to attach required documents. Supporting documentation, such as a copy of the mortgage and any correspondence with the lender, should accompany the deed. Missing documents can lead to confusion and potential issues down the line.

Another common oversight is not properly notarizing the deed. In Pennsylvania, the deed must be notarized to be valid. Failing to have it notarized means the deed could be challenged in the future.

Many also underestimate the importance of understanding the tax implications. A deed in lieu of foreclosure can have tax consequences, including potential liability for income tax on any forgiven debt. It's wise to consult a tax professional to fully grasp these implications.

Finally, some people rush the process without reviewing the deed thoroughly. Take the time to read through the entire document. Mistakes in wording or omissions can lead to significant issues. A careful review can save you from unnecessary complications.

Misconceptions

There are several misconceptions surrounding the Pennsylvania Deed in Lieu of Foreclosure form. Understanding these can help individuals make informed decisions regarding their real estate situations.

- It eliminates all debt obligations. Many believe that signing a Deed in Lieu of Foreclosure automatically cancels all debts associated with the mortgage. However, this is not always the case. Depending on the lender's policies and the specific terms of the agreement, some obligations may still remain.

- It is a quick and easy process. While a Deed in Lieu of Foreclosure can be faster than going through the foreclosure process, it still requires negotiation and approval from the lender. The timeline can vary significantly based on the lender's requirements and the circumstances of the property.

- It will not affect credit scores. Some individuals think that a Deed in Lieu of Foreclosure has no impact on their credit. In reality, it can still negatively affect credit scores, similar to a foreclosure, as it indicates to creditors that the borrower was unable to meet their mortgage obligations.

- It is available to everyone. Not all homeowners qualify for a Deed in Lieu of Foreclosure. Lenders typically require a thorough review of the borrower's financial situation, and some may only offer this option under specific circumstances.

- It absolves the borrower of all liability. There is a common belief that once a Deed in Lieu of Foreclosure is executed, the borrower is free from any further liability. However, if there are any second mortgages or liens on the property, the borrower may still be responsible for those debts.

Dos and Don'ts

When filling out the Pennsylvania Deed in Lieu of Foreclosure form, it's important to follow certain guidelines to ensure the process goes smoothly. Here are seven things to do and avoid:

- Do provide accurate property information, including the address and legal description.

- Do include the names of all parties involved in the transaction.

- Do sign the document in the presence of a notary public.

- Do check for any outstanding liens or encumbrances on the property.

- Don't leave any fields blank; complete all required sections of the form.

- Don't use incorrect or outdated forms; ensure you have the latest version.

- Don't forget to retain copies of the completed form for your records.

Browse Popular Deed in Lieu of Foreclosure Forms for US States

California Pre-foreclosure Property Transfer - The documentation may contain clauses that address the condition of the property and any potential liens that might exist.

For those needing to authorize someone to manage their vehicle-related affairs, the California Motor Vehicle Power of Attorney form serves as an essential resource. This legal document empowers a designated individual to oversee ownership or registration tasks when the vehicle owner is unavailable. To access this important form and for additional resources, visit California PDF Forms, ensuring that all vehicle transactions can proceed without delay.

Deed in Lieu Vs Foreclosure - This option typically requires all parties to agree on various terms, including condition assessments.

Deed in Lieu of Mortgage - This option is often favored for its simplicity and immediate effect in relieving a homeowner of further financial obligations.

Foreclosure Process in Georgia - This is an alternative to going through the formal foreclosure process.

Detailed Guide for Writing Pennsylvania Deed in Lieu of Foreclosure

After completing the Pennsylvania Deed in Lieu of Foreclosure form, you will need to submit it to the appropriate county office for recording. This process helps to ensure that the transfer of property ownership is officially recognized. Be prepared to provide any additional documents that may be required by the county.

- Obtain the Pennsylvania Deed in Lieu of Foreclosure form from a reliable source, such as a legal website or your lender.

- Begin by filling in the names of the parties involved. This includes the borrower (you) and the lender (the bank or financial institution).

- Next, provide a description of the property. Include the address and any relevant details that clearly identify the location.

- Indicate the date of the deed. This should be the date you are signing the document.

- Sign the form in the designated area. Make sure to do this in front of a notary public, as notarization is typically required.

- Have the notary public complete their section. This includes their signature and seal, which verifies that the document has been properly executed.

- Make copies of the signed and notarized form for your records.

- Submit the original form to the county recorder’s office where the property is located. Check for any specific requirements or fees associated with the recording process.