Official Pennsylvania Deed Document

Key takeaways

Filling out and using the Pennsylvania Deed form is an important process for transferring property ownership. Here are some key takeaways to keep in mind:

- Understand the Types of Deeds: Familiarize yourself with the different types of deeds available in Pennsylvania, such as warranty deeds and quitclaim deeds, to choose the right one for your needs.

- Provide Accurate Information: Ensure that all information, including names, addresses, and property descriptions, is accurate and complete to avoid complications later.

- Include a Legal Description: The deed must contain a precise legal description of the property being transferred. This is often more detailed than just the street address.

- Signatures Matter: All parties involved in the transaction must sign the deed. If a party is unable to sign, a power of attorney may be needed.

- Notarization Required: The deed must be notarized to be valid. A notary public can verify the identities of the signers and witness the signing.

- Record the Deed: After signing and notarization, the deed should be recorded with the county recorder of deeds to protect your ownership rights.

- Pay Attention to Transfer Taxes: Be aware that Pennsylvania imposes a real estate transfer tax. Ensure you understand the tax implications before completing the transaction.

- Consult with Professionals: It may be beneficial to consult with a real estate attorney or a knowledgeable professional to navigate the process smoothly.

- Keep Copies: Always keep copies of the completed deed and any related documents for your records. This can be helpful for future reference.

By following these guidelines, individuals can ensure a smoother experience when filling out and using the Pennsylvania Deed form.

Common mistakes

When filling out the Pennsylvania Deed form, individuals often encounter several common pitfalls. One frequent mistake is failing to provide complete and accurate information about the property. This includes not listing the correct legal description, which is essential for identifying the property in question. Omitting this information can lead to confusion and potential disputes in the future.

Another mistake involves not properly identifying the parties involved in the transaction. Both the grantor and grantee must be clearly stated, including their full names and any relevant titles. Inaccuracies in naming can result in legal complications, especially if the names do not match official records.

Many people also overlook the importance of signatures. The Deed form requires the signature of the grantor, and in some cases, witnesses may also be necessary. Neglecting to sign the document or having it signed by the wrong person can invalidate the deed, making it unenforceable.

In addition, individuals often forget to include the date of the transaction. This date is crucial for establishing when the transfer of ownership takes place. Without it, the deed may lack clarity, leading to issues related to the timing of rights and responsibilities.

Lastly, many filers fail to consider the need for notarization. In Pennsylvania, a deed must be notarized to be legally binding. Skipping this step can render the document ineffective, which may complicate matters when attempting to transfer ownership or resolve disputes.

Misconceptions

Understanding the Pennsylvania Deed form is crucial for anyone involved in real estate transactions in the state. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings:

- All deeds are the same. Different types of deeds serve different purposes. For instance, a warranty deed offers more protection to the buyer than a quitclaim deed.

- You don’t need a lawyer. While it's not legally required to have a lawyer, having one can help navigate the complexities of real estate law and ensure your interests are protected.

- Only the seller signs the deed. Both the seller and the buyer must sign the deed for it to be valid. This is a critical step in the transfer of ownership.

- Notarization is optional. In Pennsylvania, a deed must be notarized to be legally recognized. This adds a layer of authenticity to the document.

- Deeds are filed automatically. After signing, it’s the responsibility of the seller or their agent to file the deed with the county recorder’s office. Failure to do so can lead to legal complications.

- All property transfers require a new deed. Some property transfers, such as those between family members, may not require a new deed, but it’s best to consult a professional to confirm.

- Once a deed is recorded, it can’t be changed. While changing a deed is difficult, it is possible through a legal process. This usually involves filing a corrective deed.

- You can use a deed from another state. Each state has its own requirements and forms. Using a deed from another state may not meet Pennsylvania's legal standards.

Being aware of these misconceptions can help ensure a smoother transaction and protect your investment in real estate.

Dos and Don'ts

When filling out the Pennsylvania Deed form, there are important guidelines to follow. Here are nine things you should and shouldn't do:

- Do ensure all information is accurate and complete.

- Do use clear and legible handwriting or type the form.

- Do include the correct legal description of the property.

- Do sign the deed in the presence of a notary public.

- Do check for any additional requirements specific to your county.

- Don't leave any sections blank unless instructed.

- Don't use abbreviations that may confuse the reader.

- Don't forget to include the names of all grantors and grantees.

- Don't submit the form without verifying all signatures.

Browse Popular Deed Forms for US States

How Do I Get a Copy of My House Title in California - A deed is effective once all parties have signed and dated it.

Quick Claim Deeds Georgia - File with the county recorder’s office to make it public record.

The California Motor Vehicle Power of Attorney form plays a vital role in facilitating vehicle transactions, especially when the owner is unable to attend to these duties in person. By authorizing a trusted individual to act on their behalf, owners can ensure that registration and ownership matters are handled efficiently. For those seeking assistance with this process, California PDF Forms provide invaluable resources to simplify the completion of necessary documents.

Nys Deed Form - With a deed, both buyers and sellers have a documented record of the property transaction.

House Deed Sample - Can include restrictions on future use of the property.

Detailed Guide for Writing Pennsylvania Deed

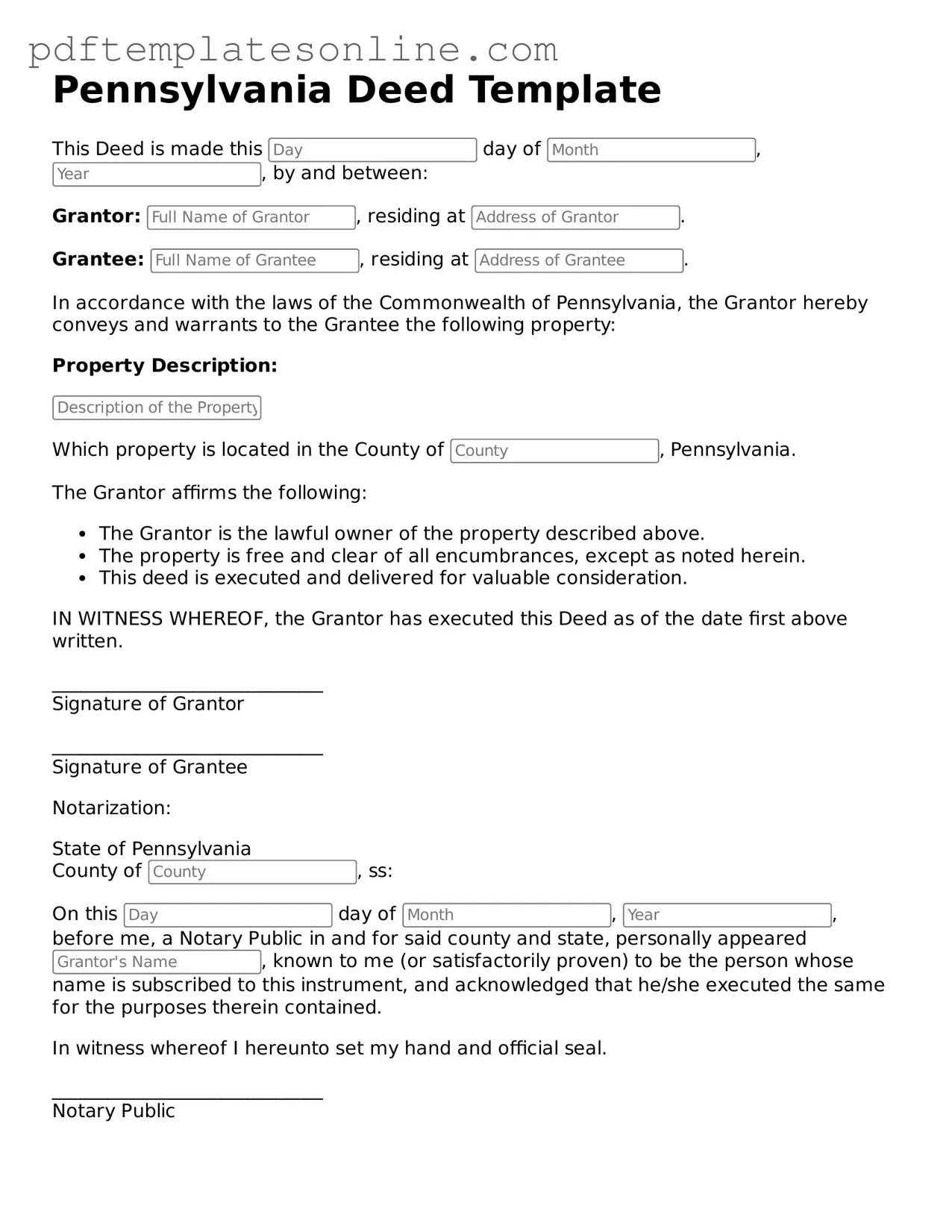

Once you have the Pennsylvania Deed form in hand, you’ll need to fill it out carefully to ensure all required information is included. This process is straightforward, but attention to detail is essential. After completing the form, it will need to be signed and notarized before it can be submitted for recording.

- Begin by entering the name of the grantor (the person transferring the property) at the top of the form.

- Next, write the name of the grantee (the person receiving the property) below the grantor’s name.

- Provide the complete address of the property being transferred, including street address, city, and zip code.

- Include a legal description of the property. This can often be found on the previous deed or property tax records.

- State the consideration amount, which is the value of the property or the price paid for the transfer.

- Indicate the date of the transaction.

- Sign the form where indicated, ensuring that the signature matches the name of the grantor.

- Have the form notarized. The notary will verify the identity of the grantor and witness the signature.

- Make copies of the completed and notarized deed for your records.

- Submit the original deed to the appropriate county office for recording.