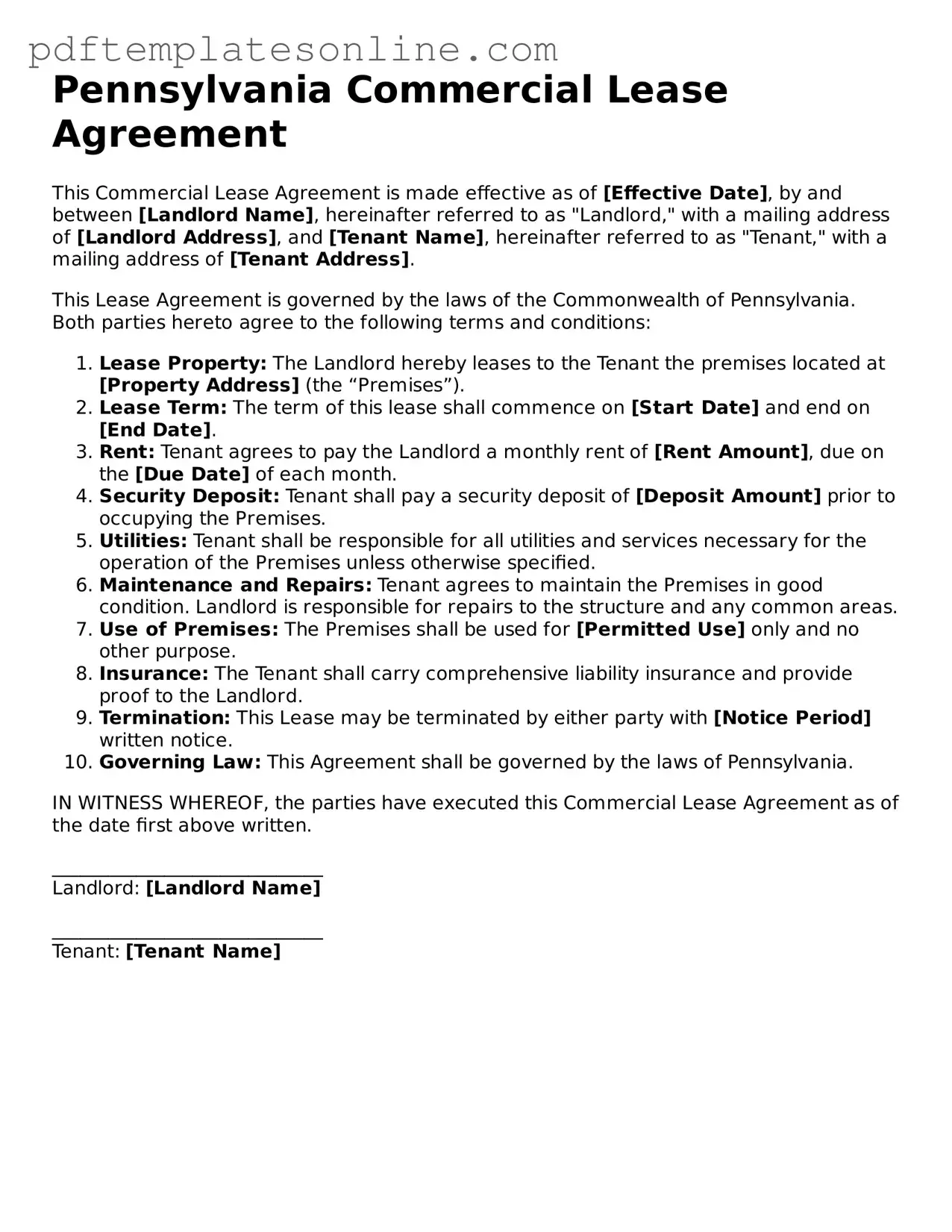

Official Pennsylvania Commercial Lease Agreement Document

Key takeaways

When filling out and using the Pennsylvania Commercial Lease Agreement form, several key points should be considered to ensure compliance and clarity for both parties involved.

- Understand the Lease Terms: Familiarize yourself with the specific terms of the lease, including the duration, rental amount, and payment schedule.

- Identify the Parties: Clearly state the names and contact information of both the landlord and the tenant to avoid any confusion.

- Property Description: Provide a detailed description of the commercial property being leased, including its address and any relevant features.

- Use Clause: Specify the permitted use of the property. This clause outlines what activities the tenant is allowed to conduct on the premises.

- Maintenance Responsibilities: Define the responsibilities for maintenance and repairs, indicating which party is responsible for specific tasks.

- Security Deposit: Clearly outline the amount of the security deposit, its purpose, and the conditions under which it may be withheld or returned.

- Termination Conditions: Include the conditions under which the lease can be terminated, including notice requirements and any penalties for early termination.

- Dispute Resolution: Consider including a clause detailing how disputes will be resolved, whether through mediation, arbitration, or litigation.

- Legal Compliance: Ensure that the lease complies with all local, state, and federal laws applicable to commercial leases in Pennsylvania.

These takeaways will assist in navigating the complexities of the Pennsylvania Commercial Lease Agreement, ensuring a smoother leasing process for both landlords and tenants.

Common mistakes

Filling out a Pennsylvania Commercial Lease Agreement can be a daunting task. Mistakes made during this process can lead to misunderstandings and potential legal issues down the line. One common error is failing to specify the exact terms of the lease, including the duration. Without clear start and end dates, both landlords and tenants may find themselves in disputes regarding lease termination or renewal.

Another frequent mistake is neglecting to detail the rent payment structure. It is essential to include not just the amount of rent but also the due date and acceptable payment methods. If this information is vague or missing, it could result in late payments or even eviction proceedings. Clarity in financial obligations helps maintain a healthy landlord-tenant relationship.

People often overlook the importance of defining maintenance responsibilities. In many cases, the lease should clearly outline who is responsible for repairs and upkeep of the property. When these responsibilities are not explicitly stated, disagreements may arise, leading to frustration and potential legal action.

Additionally, some individuals fail to read the fine print regarding additional costs. Commercial leases may include clauses about property taxes, insurance, and maintenance fees. If these costs are not addressed upfront, tenants may be blindsided by unexpected expenses, which can strain their budget and business operations.

Lastly, many people do not seek legal advice before signing the lease. While it may seem like an unnecessary expense, consulting with a legal expert can provide valuable insights. A professional can help identify potential pitfalls in the agreement and ensure that the lease aligns with the tenant's business needs and legal rights.

Misconceptions

When dealing with a Pennsylvania Commercial Lease Agreement, many individuals and businesses hold misconceptions that can lead to confusion or costly mistakes. Here are eight common misconceptions explained:

- All leases are the same. Many believe that all commercial leases are identical. In reality, each lease is unique and tailored to the specific needs of the landlord and tenant. Variations can include terms, conditions, and obligations.

- Verbal agreements are sufficient. Some people think that a verbal agreement is enough to establish a lease. However, in Pennsylvania, commercial leases should be in writing to be enforceable. Relying on verbal agreements can lead to misunderstandings.

- Only the rent amount matters. While rent is crucial, other factors like maintenance responsibilities, utilities, and renewal options are equally important. Neglecting these details can result in disputes later on.

- Lease terms are set in stone. Many assume that once a lease is signed, the terms cannot be changed. However, amendments can be made if both parties agree, allowing for flexibility in the agreement.

- Security deposits are non-refundable. A common belief is that security deposits cannot be returned. In Pennsylvania, landlords must provide a written explanation if they retain any portion of the deposit after the lease ends.

- Landlords can enter the property at any time. Some tenants think landlords have unrestricted access to the leased space. In reality, landlords must provide reasonable notice before entering, except in emergencies.

- All lease disputes must go to court. Many believe that any disagreement must be resolved through litigation. However, mediation and arbitration are often effective alternatives that can save time and money.

- Commercial leases do not require legal review. Some individuals think they can handle the lease without legal assistance. However, having a legal expert review the lease can help identify potential issues and protect your interests.

Understanding these misconceptions can help landlords and tenants navigate their agreements more effectively. It is crucial to approach a commercial lease with thorough knowledge and, when necessary, seek professional advice.

Dos and Don'ts

When filling out the Pennsylvania Commercial Lease Agreement form, it is important to approach the process with care and attention to detail. Below is a list of things to consider and avoid.

- Do read the entire lease agreement thoroughly before filling it out.

- Do provide accurate and complete information in all sections.

- Do clarify any terms or conditions that are unclear with the landlord or property manager.

- Do keep a copy of the completed lease for your records.

- Do ensure that all parties involved sign the agreement.

- Don't rush through the form; take your time to ensure accuracy.

- Don't leave any sections blank unless instructed to do so.

- Don't sign the lease without understanding all the terms and conditions.

- Don't ignore any additional documents that may need to be submitted with the lease.

- Don't forget to check for any required deposits or fees that need to be paid upfront.

By following these guidelines, you can help ensure a smoother leasing process and foster a positive relationship with your landlord or property manager.

Browse Popular Commercial Lease Agreement Forms for US States

Retail Space Lease Agreement - Clauses addressing personal guarantees can help secure the lease for the landlord.

Ca Commercial Lease Agreement - Specifies the termination notice period required by both parties.

The California Notary Acknowledgment form plays a crucial role in ensuring the legitimacy of legal documents by confirming the identity and signature of the signer. By utilizing this form, individuals and businesses can avoid ambiguities and potential fraud in their transactions. For those looking for more information or resources regarding these documents, you can visit California PDF Forms.

Printable Commercial Lease Agreement - The non-refundable deposit terms may be specified in the lease to protect landlord interests.

Detailed Guide for Writing Pennsylvania Commercial Lease Agreement

Filling out the Pennsylvania Commercial Lease Agreement form requires attention to detail. Each section must be completed accurately to ensure that both parties are protected and that the lease terms are clear. Follow these steps to complete the form properly.

- Begin by entering the date at the top of the form.

- Identify the parties involved. Fill in the landlord's name and address in the designated fields.

- Provide the tenant's name and address in the appropriate section.

- Describe the leased premises. Include the address and any specific details about the property being leased.

- Specify the lease term. Indicate the start date and end date of the lease period.

- Outline the rent amount. State how much rent is due, when it is due, and how it should be paid.

- Include security deposit information. Specify the amount of the security deposit and any conditions for its return.

- Detail the use of the premises. Describe what the tenant is allowed to do in the leased space.

- Address maintenance responsibilities. Clearly state who is responsible for maintenance and repairs.

- Fill in any additional terms or conditions that apply to the lease agreement.

- Both parties must sign and date the form at the end. Ensure that each party receives a copy of the signed agreement.