Official Pennsylvania Bill of Sale Document

Key takeaways

When dealing with the Pennsylvania Bill of Sale form, there are several important points to keep in mind. This document serves as a record of the transaction between a buyer and a seller. Here are some key takeaways:

- Purpose: The Bill of Sale acts as proof of ownership transfer for personal property.

- Details Required: Include names, addresses, and signatures of both the buyer and seller.

- Description of Item: Clearly describe the item being sold, including make, model, and identification numbers.

- Purchase Price: Clearly state the amount paid for the item to avoid future disputes.

- As-Is Condition: If applicable, indicate that the item is sold "as-is," meaning no warranties are provided.

- Witness or Notary: Although not always required, having a witness or notary can add an extra layer of validation.

- Multiple Copies: Create multiple copies of the Bill of Sale for both parties to keep for their records.

- Legal Compliance: Ensure that the form complies with Pennsylvania state laws regarding sales of personal property.

- Retain for Records: Keep the Bill of Sale in a safe place, as it may be needed for future reference.

- Tax Implications: Be aware of any tax obligations that may arise from the sale, such as sales tax.

Understanding these points can help ensure a smooth transaction and provide clarity for both the buyer and seller.

Common mistakes

Filling out the Pennsylvania Bill of Sale form is a straightforward process, yet many individuals encounter pitfalls that can lead to complications down the line. One common mistake is failing to provide complete information about the buyer and seller. Omitting details such as full names, addresses, or contact numbers can create confusion and hinder future communication. It's essential to ensure that all parties are accurately represented to avoid disputes.

Another frequent error is neglecting to include a thorough description of the item being sold. Whether it's a vehicle, a piece of equipment, or personal property, the description should be detailed. This includes the make, model, year, and, if applicable, the Vehicle Identification Number (VIN). A vague description may lead to misunderstandings regarding what was actually sold.

Some individuals overlook the importance of including the sale price. Leaving this section blank or writing an ambiguous amount can cause issues if questions arise about the transaction. It’s crucial to state the exact amount agreed upon to ensure transparency and clarity.

Additionally, many people fail to sign the document. A Bill of Sale is not legally binding without the signatures of both the buyer and seller. This oversight can render the entire document ineffective, leading to potential legal disputes. Always double-check that both parties have signed and dated the form.

Another mistake involves not having a witness present during the signing. While not always required, having a witness can provide an extra layer of security and validation to the transaction. In some cases, it may be beneficial to have the document notarized, especially for high-value items.

Some individuals mistakenly assume that a Bill of Sale is only necessary for vehicle transactions. This is not the case. A Bill of Sale is beneficial for any significant transfer of ownership, including boats, trailers, and even large appliances. Ignoring this can lead to issues with proving ownership later.

People often forget to keep copies of the Bill of Sale for their records. After the transaction, both the buyer and seller should retain a copy of the signed document. This serves as proof of the sale and can be crucial for future reference, particularly if questions about the transaction arise.

Another oversight is not checking local regulations. While the Pennsylvania Bill of Sale form is standardized, certain counties or municipalities may have specific requirements. Being unaware of these local laws can lead to complications that could have been easily avoided.

Some sellers may also make the mistake of not disclosing important information about the item being sold. For example, if there are known defects or issues, failing to mention them can lead to legal repercussions. Transparency is key in any sale to maintain trust and avoid disputes.

Lastly, individuals sometimes rush through the form without reviewing it thoroughly. Taking the time to double-check all information can prevent errors and ensure the Bill of Sale is valid and enforceable. A careful review can save time and potential headaches in the future.

Misconceptions

When it comes to the Pennsylvania Bill of Sale form, there are several common misconceptions that people may have. Here are four of them:

- It is not legally required. Many believe that a Bill of Sale is unnecessary for private sales. However, while not always required, it is highly recommended to protect both the buyer and seller.

- Only vehicles need a Bill of Sale. Some think this form is only for vehicle transactions. In reality, a Bill of Sale can be used for various items, including furniture, electronics, and other personal property.

- It must be notarized. There is a misconception that a Bill of Sale must be notarized to be valid. In Pennsylvania, notarization is not required, but it can add an extra layer of security.

- It is a complicated document. Many people assume that the Bill of Sale is a complex legal document. In fact, it is quite simple and straightforward, requiring only basic information about the buyer, seller, and item being sold.

Understanding these misconceptions can help ensure that your transactions go smoothly and that both parties are protected.

Dos and Don'ts

When filling out the Pennsylvania Bill of Sale form, it’s important to be careful and thorough. Here are some essential do's and don'ts to keep in mind:

- Do include accurate information about the buyer and seller.

- Do clearly describe the item being sold, including make, model, and VIN if applicable.

- Do specify the sale price to avoid any confusion later.

- Do sign and date the form to make it legally binding.

- Don't leave any fields blank; incomplete forms can lead to issues.

- Don't use vague language; be specific to prevent misunderstandings.

- Don't forget to keep a copy for your records after the transaction is complete.

Following these guidelines can help ensure a smooth transaction and protect both parties involved.

Browse Popular Bill of Sale Forms for US States

Example of a Bill of Sale for a Car - A standard form used across various types of transactions.

Best Place to Sell Your Car Privately - The Bill of Sale may include information about warranties or guarantees.

Detailed Guide for Writing Pennsylvania Bill of Sale

Completing the Pennsylvania Bill of Sale form is an important step in documenting the transfer of ownership for personal property. After filling out the form, both the seller and buyer should keep a copy for their records. This ensures clarity and protection for both parties involved in the transaction.

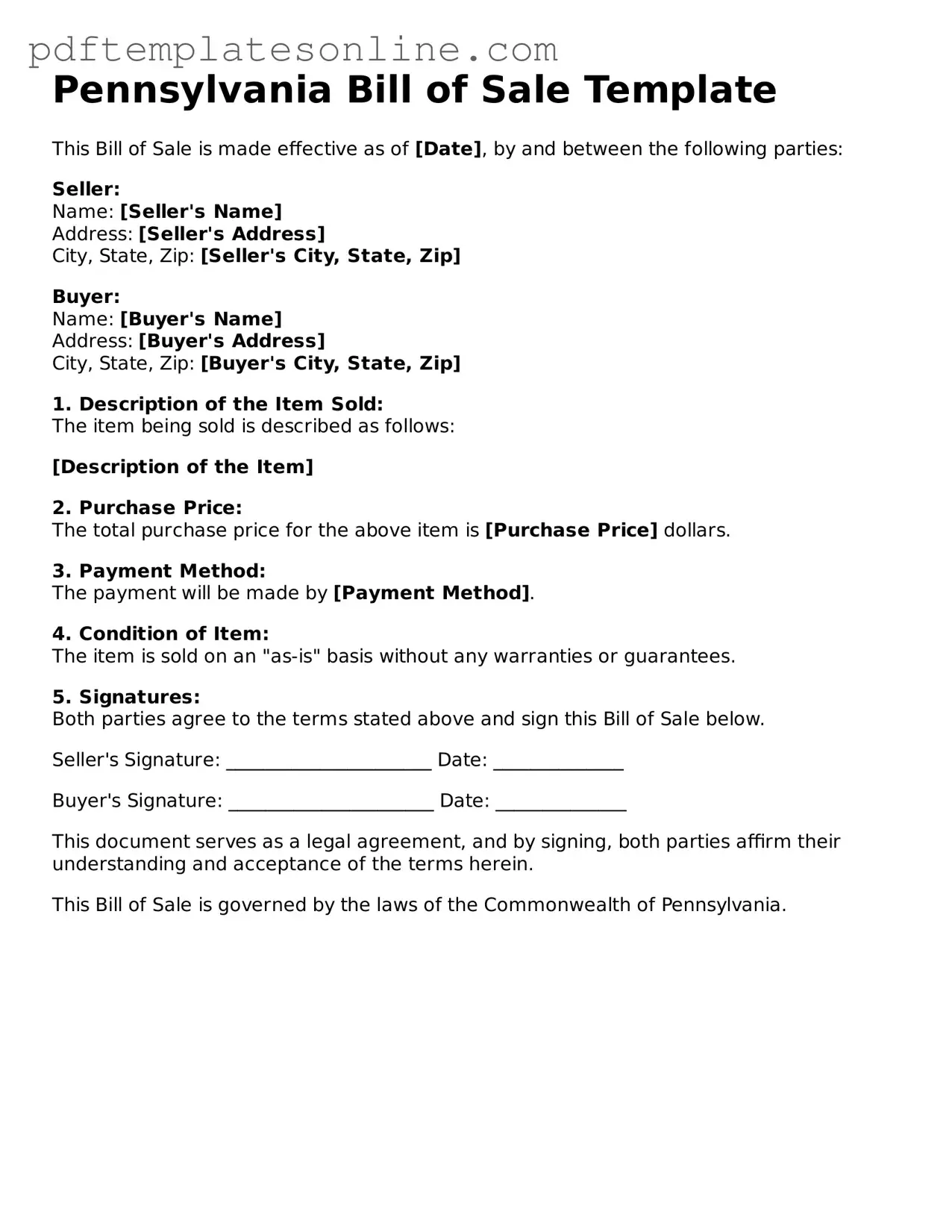

- Obtain the Pennsylvania Bill of Sale form. This can be found online or at local government offices.

- Fill in the date of the transaction at the top of the form.

- Provide the seller's full name and address. Ensure that the information is accurate and up-to-date.

- Enter the buyer's full name and address. Double-check for any typos.

- Describe the item being sold. Include details such as make, model, year, and any identification numbers.

- Indicate the sale price clearly. Specify the currency to avoid confusion.

- Include any terms or conditions of the sale if applicable. This may cover warranties or guarantees.

- Sign and date the form. Both the seller and buyer should sign it to validate the transaction.

- Make copies of the completed form for both parties to retain.