Official Pennsylvania Articles of Incorporation Document

Key takeaways

Filling out the Pennsylvania Articles of Incorporation form is an essential step for anyone looking to establish a corporation in the state. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Articles of Incorporation serve as the official document that establishes your corporation. It provides essential information about your business, including its name, purpose, and structure.

- Choose a Unique Name: Your corporation's name must be unique and not already in use by another entity in Pennsylvania. It’s wise to check the availability of your desired name through the Pennsylvania Department of State's online database.

- Designate a Registered Agent: Every corporation in Pennsylvania must have a registered agent. This individual or business entity is responsible for receiving legal documents on behalf of the corporation. Make sure your agent has a physical address in Pennsylvania.

- File with the Right Fees: When submitting your Articles of Incorporation, be prepared to pay the required filing fee. This fee can vary based on the type of corporation you are forming, so check the latest fee schedule to avoid any surprises.

Common mistakes

When filling out the Pennsylvania Articles of Incorporation form, many individuals encounter common pitfalls that can delay the incorporation process. One frequent mistake is providing incorrect or incomplete information. For example, failing to include the name of the corporation or using a name that is already taken can lead to rejection of the application. It is essential to conduct a thorough name search before submission to ensure the chosen name complies with state regulations.

Another common error involves the designation of the corporation's registered office. Some applicants forget to include a physical address, while others mistakenly use a P.O. Box. The registered office must be a physical location within Pennsylvania where legal documents can be served. This requirement is critical, as it ensures that the corporation can be reached for legal matters.

Many individuals also overlook the importance of the corporate purpose. The Articles of Incorporation form requires a clear statement outlining the nature of the business. A vague or overly broad description can lead to confusion and may not meet the state’s requirements. It’s best to be specific about the business activities to avoid complications down the line.

Additionally, failing to include the correct number of shares the corporation is authorized to issue is a mistake that can complicate future business dealings. Applicants sometimes either leave this section blank or enter an unrealistic number. It is crucial to determine the appropriate number of shares based on the business plan and future growth expectations.

Another area where mistakes often occur is in the selection of the incorporators. Some people mistakenly think they can list anyone as an incorporator, but there are specific requirements. Generally, at least one incorporator must be a person (not an entity) and at least 18 years old. Ensuring that the incorporators meet these criteria is vital for the validity of the incorporation.

Finally, individuals may neglect to sign and date the Articles of Incorporation. This oversight can result in delays, as the state will not process forms that are not properly signed. Taking the time to review the document for signatures and dates can save a lot of time and frustration.

Misconceptions

Understanding the Pennsylvania Articles of Incorporation form is essential for anyone looking to establish a business in the state. However, several misconceptions can lead to confusion. Here are seven common misconceptions:

- All businesses must file Articles of Incorporation. Not all businesses need to incorporate. Sole proprietorships and partnerships do not require this form.

- The Articles of Incorporation are the same as a business license. These are different documents. The Articles establish the business entity, while a business license allows you to operate legally.

- You can only incorporate in Pennsylvania if you are a resident. Non-residents can also incorporate in Pennsylvania, as long as they comply with state laws.

- Filing Articles of Incorporation guarantees your business will succeed. Incorporation does not ensure success. It provides legal protection but does not replace effective business practices.

- Once filed, the Articles of Incorporation cannot be changed. Amendments can be made to the Articles if necessary, allowing for adjustments as the business evolves.

- Incorporation is a quick and easy process. While it can be straightforward, it requires careful preparation and attention to detail to ensure compliance with state regulations.

- All corporations must have a board of directors. While most do, certain types of corporations, like single-member LLCs, may not require a board.

By clarifying these misconceptions, individuals can better navigate the incorporation process in Pennsylvania.

Dos and Don'ts

When filling out the Pennsylvania Articles of Incorporation form, it’s essential to follow certain guidelines to ensure a smooth process. Here are eight things to keep in mind:

- Do provide accurate information about your business name. Ensure it is unique and complies with Pennsylvania naming rules.

- Do include the purpose of your corporation. Be clear and concise about what your business will do.

- Do list the registered office address. This must be a physical address in Pennsylvania where official documents can be served.

- Do designate a registered agent. This person or entity will be responsible for receiving legal documents on behalf of the corporation.

- Don't leave sections blank. Every part of the form must be filled out to avoid delays in processing.

- Don't use abbreviations for the business name unless they are part of the official name. Clarity is crucial.

- Don't forget to sign and date the form. An unsigned form will be rejected.

- Don't overlook the filing fee. Ensure you include the correct payment to avoid processing delays.

By following these guidelines, you can help ensure that your Articles of Incorporation are filed correctly and efficiently.

Browse Popular Articles of Incorporation Forms for US States

How to Create an Llc in California - Filing the Articles of Incorporation formally establishes the corporation's legal existence.

Ga Corporation - Can include guidelines for share buybacks.

Obtaining a clear view of your financial situation is crucial for any business, and using the Profit and Loss form can greatly assist in this process. This comprehensive statement not only outlines the revenues and expenses but also provides a detailed look into your organization's profitability over a defined period. To start evaluating your financial performance effectively, utilize the Profit And Loss form and take the first step towards better financial management.

Texas Corporation - Once filed, the Articles become part of the public record, ensuring transparency for stakeholders.

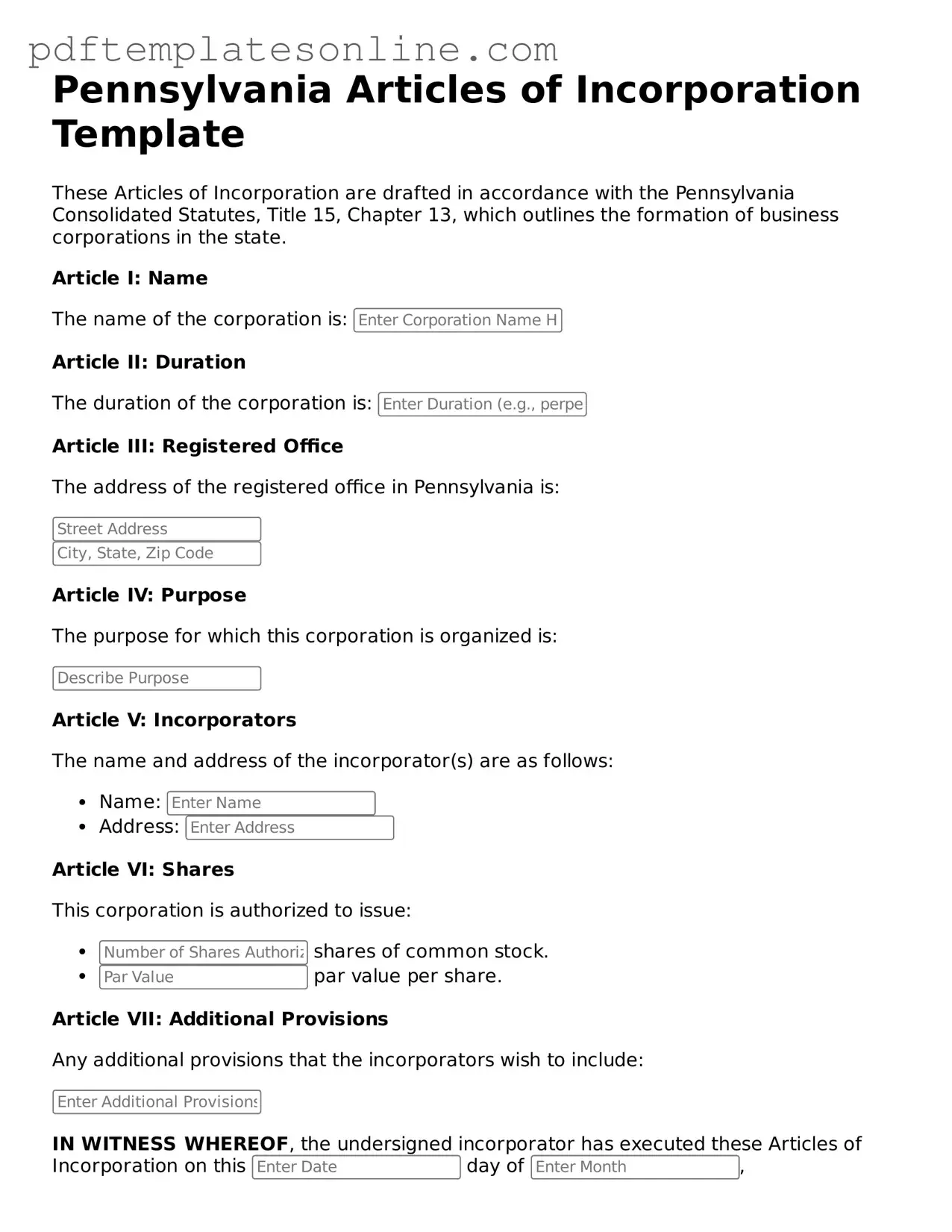

Detailed Guide for Writing Pennsylvania Articles of Incorporation

After obtaining the Pennsylvania Articles of Incorporation form, it is essential to complete it accurately to ensure proper filing with the state. Once the form is filled out, it will need to be submitted along with the required fee to the appropriate state office.

- Begin by entering the name of the corporation. Ensure that it complies with Pennsylvania naming requirements.

- Provide the registered office address. This must be a physical address in Pennsylvania where legal documents can be served.

- Include the name and address of the incorporator. This person is responsible for filing the Articles of Incorporation.

- Specify the purpose of the corporation. A brief description of the business activities should be included.

- Indicate the number of shares the corporation is authorized to issue. If applicable, include the classes of shares and their par value.

- Sign and date the form. The incorporator must sign the document to validate it.

- Review the completed form for accuracy. Check all entries to ensure there are no errors or omissions.

- Prepare the filing fee. Confirm the current fee amount and acceptable payment methods.

- Submit the completed form and payment to the Pennsylvania Department of State. This can often be done online or by mail.