Blank Payroll Check Form

Key takeaways

When filling out and using the Payroll Check form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are some key takeaways:

- Always use the most current version of the Payroll Check form to avoid outdated information.

- Double-check employee details, including name, address, and Social Security number, for accuracy.

- Clearly specify the pay period to ensure that employees understand the time frame for their earnings.

- Calculate gross pay accurately, taking into account regular hours, overtime, and any bonuses.

- Deduct the appropriate taxes and other withholdings to reflect the correct net pay.

- Ensure that all signatures required for approval are obtained before issuing the checks.

- Keep a copy of each Payroll Check form for your records to maintain a clear audit trail.

- Review the completed form for any errors before distribution to prevent issues with payment.

Common mistakes

Filling out a Payroll Check form can seem straightforward, but many people make common mistakes that can lead to delays or issues with payment. One frequent error is incorrect employee information. This includes misspellings of names, wrong Social Security numbers, or incorrect addresses. Such mistakes can create significant complications, especially when it comes to tax reporting and compliance.

Another common mistake is failing to account for overtime hours correctly. Employees may not always track their hours accurately, leading to underpayment or overpayment. It’s essential to ensure that all hours worked, including overtime, are documented and calculated correctly before submitting the form.

Many individuals also overlook the importance of checking the pay period dates. Submitting a Payroll Check form with incorrect pay period dates can result in employees not receiving their checks on time. Always double-check that the dates correspond to the actual work period to avoid confusion.

Additionally, some people forget to include deductions such as taxes, health insurance, or retirement contributions. These deductions must be clearly indicated on the form. Neglecting to do so can lead to discrepancies in net pay and potential issues with tax compliance.

Another mistake involves signature requirements. Some Payroll Check forms require a supervisor's or manager's signature. Failing to obtain the necessary approvals can delay processing and payment. Always confirm that the form has been signed by the appropriate parties before submission.

Lastly, many individuals do not keep a copy of the submitted form. Having a record of what was submitted is crucial for tracking payments and resolving any future discrepancies. It’s a good practice to make a copy for your records, ensuring that you have all the information if questions arise later.

Misconceptions

Understanding the Payroll Check form can be tricky, and several misconceptions often arise. Here are four common misunderstandings that can lead to confusion:

- Misconception 1: The Payroll Check form is only for salaried employees.

- Misconception 2: The Payroll Check form is only needed at the end of the year.

- Misconception 3: Completing the Payroll Check form is a one-time task.

- Misconception 4: The Payroll Check form is not important for small businesses.

This is not true. The Payroll Check form is designed for all types of employees, including hourly workers, contractors, and freelancers. Regardless of how an employee is compensated, this form is essential for documenting payments accurately.

Many believe that the Payroll Check form is only relevant during tax season. However, it is crucial to maintain accurate records throughout the year. Regularly updating and filing this form ensures that payroll is processed smoothly and helps avoid any last-minute scrambles.

Some people think that once the Payroll Check form is filled out, it does not require further attention. In reality, this form may need to be updated frequently. Changes in employee status, tax withholding, or payment methods necessitate revisions to ensure accuracy.

This misconception can be particularly harmful. Small businesses often think they can bypass formal payroll processes. In truth, maintaining proper payroll documentation is vital, regardless of the business size. It helps avoid legal issues and ensures that employees are paid correctly and on time.

Dos and Don'ts

When filling out a Payroll Check form, attention to detail is crucial. Here’s a list of things you should and shouldn’t do to ensure accuracy and compliance.

- Do double-check employee information for accuracy.

- Do verify the pay period dates before submitting.

- Do calculate deductions correctly to avoid overpayment or underpayment.

- Do ensure that the signature is included where required.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; this can lead to delays.

- Don't use nicknames or abbreviations for employee names.

- Don't forget to check for any updates in tax regulations.

- Don't submit the form without reviewing it for errors.

By following these guidelines, you can help ensure a smooth payroll process. Taking the time to be thorough can save you and your employees from potential issues down the line.

Other PDF Forms

Why Would a Prosecutor Ask for a Continuance - Utilizing this form demonstrates your commitment to the legal process.

The Washington Employment Verification form is a vital resource for both employers and employees, ensuring that necessary job status and salary information are accurately confirmed. This procedure is essential for various applications, including loans and rentals, as it helps build trust and transparency. To familiarize yourself with this process and correctly complete the document, you can access the Employment Verification form now.

Sample Church Demographics Form - Provide your policy number for identification with insurance.

Void Check Citibank - This Citibank form allows for smooth and timely deposits directly to your bank account.

Detailed Guide for Writing Payroll Check

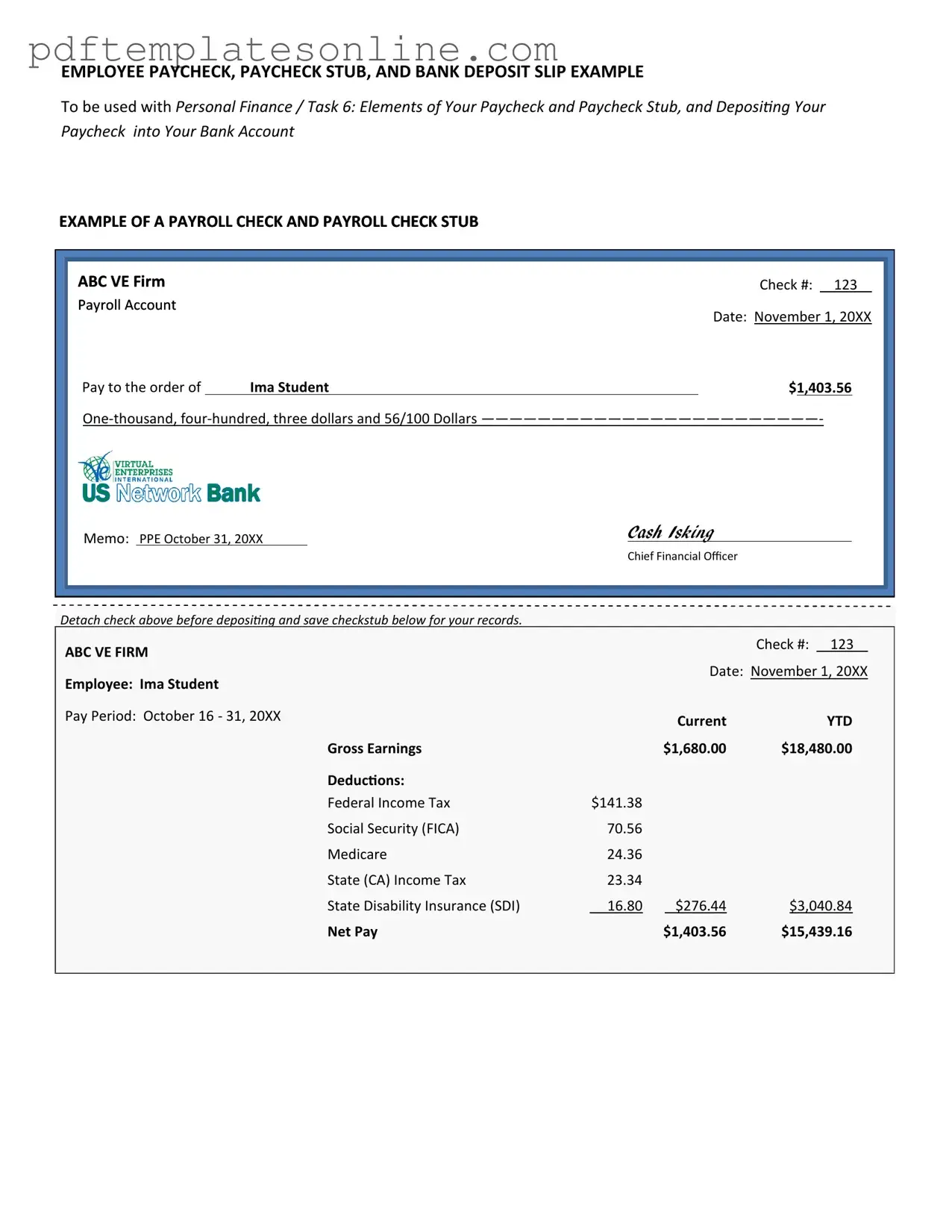

Filling out the Payroll Check form is a straightforward process, but it requires attention to detail to ensure accuracy. Once completed, this form will facilitate the timely processing of payroll for employees.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Next, write the employee's name in the designated space. Ensure the spelling is correct.

- Fill in the employee ID number or social security number, if applicable, to identify the employee accurately.

- Specify the pay period by indicating the start and end dates of the pay period for which the check is being issued.

- Enter the gross pay amount. This is the total earnings before any deductions.

- List any deductions that apply, such as taxes, benefits, or other withholdings. Provide the total amount of deductions.

- Calculate the net pay by subtracting the total deductions from the gross pay. Enter this amount in the appropriate space.

- Sign the form at the bottom to authorize the payroll check.

- Finally, make a copy of the completed form for your records before submitting it to the payroll department.